BTC! CME Futures - when are going to close the gap?What Is a Gap?

A gap is an area discontinuity in a security's chart where its price either rises or falls from the previous day’s close with no trading occurring in between. Gaps are common when news causes market fundamentals to change during hours when markets are typically closed, for instance an earnings call after-hours.

KEY TAKEAWAYS

-A gap is a discontinuous space in the price chart of an asset or security, often occurring between trading hours.

-There four different types of gaps – Common Gaps, Breakaway Gaps, Runaway Gaps, and Exhaustion Gaps - each with its own signal to traders.

-Gaps are easy to spot, but determining the type of gap is much harder to figure out.

What Does A Gap Tell You?

Gaps typically occur when a piece of news or an event causes a flood of buyers or sellers into the security. It results in the price opening significantly higher or lower than the previous day’s closing price. Depending on the kind of gap, it could indicate either the start of a new trend or a reversal of a previous trend.

Gapping occurs when the price of a security or asset opens well above or below the previous day’s close with no trading activity in between. Partial gapping occurs when the opening price is higher or lower than the previous day’s close but within the previous day’s price range. Full gapping occurs when the open is outside of the previous day’s range. Gapping, especially a full gap, shows a strong shift in sentiment occurred overnight.

Cmegroup

CME Cheat Sheet 2021CME Group Futures Dates:

Dec 2020 BTCZ20 16 Dec 2019 > 24 Dec 2020 Settlement: 28 Dec 2020 -

Jan 2021 BTCF21 03 Aug 2020 > 29 Jan 2021 Settlement: 01 Feb 2021 -

Feb 2021 BTCG21 31 Aug 2020 > 26 Feb 2021 Settlement: 01 Mar 2021 -

Mar 2021 BTCH21 28 Sep 2020 > 26 Mar 2021 Settlement: 29 Mar 2021 -

Apr 2021 BTCJ21 02 Nov 2020 > 30 Apr 2021 Settlement: 03 May 2021 -

May 2021 BTCK21 30 Nov 2020 > 28 May 2021 Settlement: 01 Jun 2021 -

Jun 2021 BTCM21 28 Dec 2020 > 25 Jun 2021 Settlement: 28 Jun 2021 -

Dec 2021 BTCZ21 30 Dec 2019 > 31 Dec 2021 Settlement: 03 Jan 2022 -

Dec 2022 BTCZ22 28 Dec 2020 > 30 Dec 2022 Settlement: 03 Jan 2023 -

Source:

www.cmegroup.com

CME Bitcoin Gaps Study:

marketsscience.com

CME Futures Info:

www.cmegroup.com

CME Futures Open Interest Info:

www.cmegroup.com

Indicator To Track CME Sunday Opens:

BTC1! FUTUROS DE BITCOIN CME - GAPBuenos días!

*Esta idea a través de Tradingview no es sinónimo para entrar posiciones en corto* primero debemos hacerle un seguimiento a la debilidad en la tendencia actual.... para un retroceso fuerte como lo vemos en el patrón de barras proyectado. no debería superar el máximo anterior $12.635. Para empezar a caer con fuerza en primera instancia, rellenar GAP, ubicado entre los ($9.665 - $9.925). una vez alli un rebote de gato muerto y seguir la tendencia bajista. finales 2020 e inicios 2021

BTC1!: CME TD 9 Bear Trap Buy SignalCautious shorting the current 4hr candle on BTCUSD, currently looking at a bear trap on the CME futures chart with a TD buy signal on the 4hr. Bears are also failing to move price strength into oversold conditions, signalling signs of bearish exhaustion, as CMF returns to positive.

S&P is finding support (for now) from the 200 Day MA that could confirm with a candle close by end of day.

Remaining cautious, could turn bullish. Might as well fill the little weekend gap at $9,175 - $9,220 that's closeby before falling lower at least.

Courtesy of Tone Vays TI Indicator: tonevays.com

Inverse Head & Shoulders Fracta - Deadcat to $9.4K?

A few possible scenarios:

Extremely Bullish BTC Price Expectation after Massive CME GapBTC Has a very bullish price movement ahead of itself after observing a massive CME gap of 15%. The futures contracts from the Chicago Mercantile Exchange (CME) have something special to them; they don't open 24/7.

Gaps occur when the price of BTC moves during the time (the weekend) when CME is closed and other exchanges are open. For example, the Binance futures and Coinbase futures are opened 24/7.

These gaps tend to fill themselves, meaning the price moves into the opposite direction of the gap and continuing trading around the level where the CME futures market stopped.

In my previous gap analysis I showed that indeed 8 out of the 10 gaps were filled within 7 days:

This one of the largest gaps we have observed so far, showing a very bullish price expectation for BTC. Given the fact that the price dropped a lot recently, this might be a great moment to pick up some sats at a discount.

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

Bitcoin CME Futures Daily Chart AnalysisHello everybody,

First please give me your support by following & put a like thanks !

Here is my daily chart analysis for the Bitcoin Futures since the beginning of January 2020 till today.

Bitcoin was in a bullish channel and broke it around 10 000 price level.

Then on the 7 & 8 March 2020 Bitcoin did a Daily Gap about 1000 points & extended till 5000 price level.

This price level in the futur could be a good support in a bearish scenario.

But actually, my chart analysis shows a small bullish scenario.

Indeed, Bitcoin broke the triangle & the VWAP with a " Powerful " bullish Hollow Candle.

The goal is that Bitcoin reach to the

10 500 price level which was also by the past the end of our bullish channel by price break.

But we have to pay attention because the volume divergence line was broken by two important volume bars.

The " problem " is actually the second bar which is bigger than the first one.

It's why it's better if we wait till the next bar to see what's happening.

You can also watch that the actual Hollow Candle did a wick.

Not a big wick but enough important to say that sellers are in the place.

9000 price level could be a good resistance if sellers push more tomorrow & also because 9000 was the GAP level.

So, Bitcoin could reach next week the 10 500 price level but we have to pay attention for a possible pullback tomorrow on the VWAP.

It's all for this chart analysis & i really hope you'll like it !

Don't forget to support me by following & like !

Thanks & see you !

Bitcoin | Rising Wedge & CME GAP..!!BTC/USD (Update)

In 4hr Chart, #Bitcoin Forming Rising Wedge Pattern & Almost Ready for Big Move.

If Wedge Broken Upside, Then Bulls Might fill the $800 Unfilled gap in Coming Days.

If Wedge Broken Downside, then It Might Test the 5.8k Area.

BTW Rising Wedge is Bearish Pattern.(70/30)

In 8h Chart, Still Bulls trying to Clear the Important Resistance (6840-6960) but Bears Defending it.

Waiting for Strong Confirmations i.e RSI, MACD, Volume & EMA50 & 100!!

Please like the idea for Support & Subscribe for More ideas like this and share your ideas and charts in Comments Section..!!

Thanks for Your Love & Support..!

Brace Yourselves | Consolidation Coming to an EndSo, this past week was rather flat for Bitcoin in comparison to the previous ones. We saw the market consolidate further up but essentially become flat due to the very important resistance level of 6900. We saw it retest the resistance MULTIPLE times on the lower time frames, and yet, failed to breakout of it every, single, time. Despite the positivity coming from the global markets this week, Bitcoin didn't seem to correlate much within their volatility as it did before. Sellers are still in charge and they are refusing to be fooled by the news trying to say "everything is alright, the collapse is over". No, it is not over, it is merely a pullback before another upcoming dump and Bitcoin investors are well aware of it. Should we see a possible chance of breaking above our consolidating wedge, then we will instantly see a huge wave of FOMO buying power coming into play, which will ultimately boost Bitcoins price higher...but do you really think this will be the case?

CME futures are going to be closing in the next 8 hours of the time of writing this and Bitcoin is circulating around their major resistance area as well for now. A lot of volatility usually comes in before closure time, where we will see huge moves being made by either sellers or buyers, giving us a better perspective of which direction the volatility will head onwards. My bias remains bearish (as stated within the previous posts), and I'll be looking to take further shorts if we manage to reach our resistance levels of 6800-6900 again. Should we see a clear breakout of the ascending trendline and the current level of support around 6400, then I'm afraid it's all going to be downhill from there FAST. Sunday will definitely open up with a huge gap on the CME futures, the question is, are you ready for it?

The mining industry is also looking interesting for Bitcoin at the moment. As soon as the mining difficulty dropped by 16%, we instantly saw the BTC hash rate pump up from 75m TH/s, all the way to 113m TH/s. I guess everybody turned on their farms again once they saw how much lower the difficulty dropped. Normally this is a positive sign for the Crypto markets, but we didn't see it react to that point as much, which further gives me these bearish insights.

Either way though, let's see how we close off this week. I will keep this post updated if anything changes.

If you found this post useful in any way, feel free to leave a 'Like', it will be highly appreciated!

This is NOT a financial advice, trade at your own risk!

BITCOIN GOING 4% DOWN THIS WEEK?This weekend bitcoin pumped and created another gap on the CME chart.

In 35 minutes CME should open the week and I do suppose it would be the right time for CME to fill that gap.

Just something to be aware of as its possible this will start the next bigger retracement.

My target is $9600, what's yours?

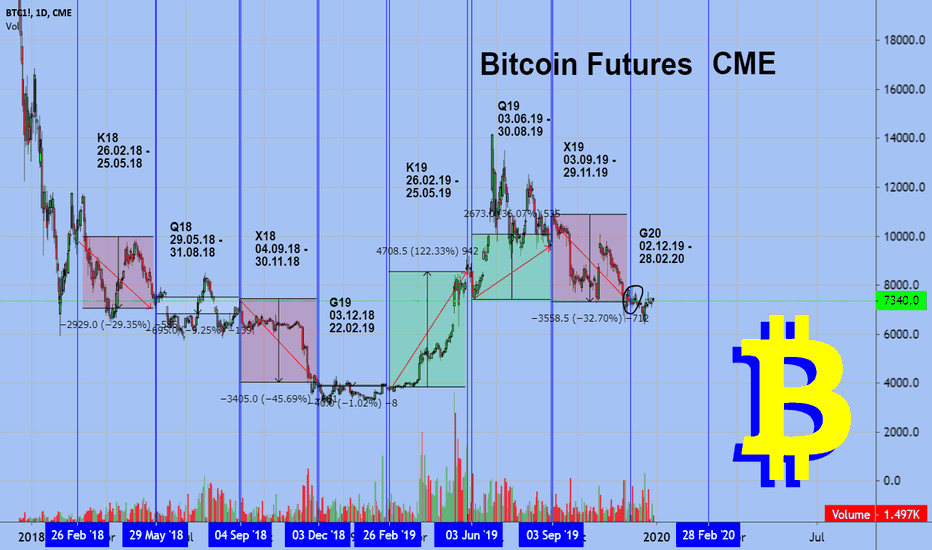

Bitcoin Futures CMEOn December 15, two years ago, the largest American company CME Group launched Bitcoin futures.

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

CME futures are one of the most manipulative instrument on the cryptocurrency market.

And the opening and closing of their futures suggests when the bottom will be.

December 15, 2017. two contracts were opened

3 months until March 29 - opening price 20631 - closing price 7070

6 months until June 29 - opening price 20631 - closing price 5800

Before bitcoin futures, large players did not have a high-quality tool for the global short market - and the Chicago exchange provided this opportunity

After 3 months, bitcoin fell by 67%

The market go up a little, but by the close of the 6-month contract, the market fell by 71%

On July 2, another 6-month contract was opened and closed on December 28

40%

detailed table of the start and end dates of all contracts.

CME does not save this data, for this you can like it under the chart

docs.google.com

And the most interesting

I think you remember the growth of November 25-26 at $ 3000 up

If you look a little in the table, then you can see the contract F20 from 10.28.19 to 01.31.20 - the conclusion from this until January 31 we will not see a price above 9200

On December 16, the first annual price contracts were opened in the $ 6,600 zone and I am sure this factor will push the price up

But already today, December 30 will be open semi-annual contracts M20 12/30/19 - 06/29/20

And today, a two-year contract opens and this fact will also push the price up.

Perhaps someone doubts that the price of bitcoin in 2 years will be lower than 7000? write a comment

Best regards EXCAVO

Could we fill the CME Gap ?Since this massive spike it seems the bullish sentiment is expanding quickly. Which is excellent. Bullish sentiment is something that we need in order to continue the run up.

However, when taking a closer look at the recent leg on larger time frames. It appears to be nothing other than a simple retest of the major resistance line down, and the bottom of the daily pennant that was broken down from just a few weeks back.. Until these lines are broken it will be very difficult for me to add leverage positions with confidence.

Demonstrating the retest and major resistance:

Since I not leveraged, I am doing my best to search for major support. At the moment, it seems that 8700 could be that level .

Here's why:

1. At 8700 we have the 50% retracement from the recent top. Which is also the same retracement level that we hit this last bounce from the top.

2. Based on the range that we created the first weeks of October, 8700 should provide decent horizontal support.

3. Last but not least, 8700 also marks the bottom of the CME gap that was created over the weekend!

Now I have never been a gap trader, however with the additional technical support, it seems like a good place for me to put my money.

Also note: We have yet to break back above major resistance. Trade carefully.

I hope you all enjoyed this article and maybe even found it a bit interesting!

Wish you all the best of luck!

bitcoin manipulationdo you need any more info than this chart?

pomp- tone vays- all refuse to see that bitcoin grew because futures are invloved and used that it was world interest.

the intrest was big money men buying and buying and selling then shorting on launch of futures,

bitcoin made them very rich while the hodlers search twitter and youtube for fomo....

Another Descending Triangle for Ethereum.Or maybe a bear flag / bull flag.

Keep in mind that looking for bull patterns in a short term bearish trend with the backing of the federal reserve is not an easy task.

Also, in one of my previous posts I spoke about the CME futures that have launched on Ethereum that are similar to the ones launched in late 2017 for Bitcoin, and we all seen what happened there.

Time will tell per usual

RBOB Gasoline Futures (Jan 2020) - Rectangle in formationNYMEX:RBF2020

Clear rectangle on the January Futures of the RBOB Gasoline.

A breakout could lead to an interesting trend to ride.

When trading commodities and futures contracts you should always take into account the specifications of each contract to calculate exactly how many contracts to buy or sell short on the basis of your risk management and position sizing.

www.cmegroup.com

CME Bitcoin Futures downswing Fibonacci retraceContinuing from my previous chart. Fibonacci downswing retrace is always 61.8%

All vertical lines are the CME Bitcoin Futures expiry dates

Each orange vertical line, shows a CME date that was preceded by a bounce

Following those dates (orange), there is a short retest of the recent high

The price then drops all the way back down to test the start of that bounce

After testing the lower trendline, the downswing Fibonacci retrace is always 61.8% (to meet the upper trendline)

This cycle repeats until the price breaks down to a lower plateau trendline

Nasdaq 100 - If you're a BULL, this might be how it plays outNQ1! - Plenty of opportunity to capture points up and down. However, if your bias is to the upside, here is how it may end up playing out. In my opinion, what will be a last leg up before new LO's.

Yellow lines are areas of targets for resistance and support (as high as 6870). We may have already seen the support (6245) for higher moves put in on Friday, otherwise, a sightly lower level for support below (6170).

With that road-map in mind, I will look for entry patterns as opportunities to get in trades. As of late, taking 35-50 pts a clip. After I collect my profits, any continued move only serves as psychological compensation for being correct with the trade's direction. No FOMO here. Plenty of volatility to go around.