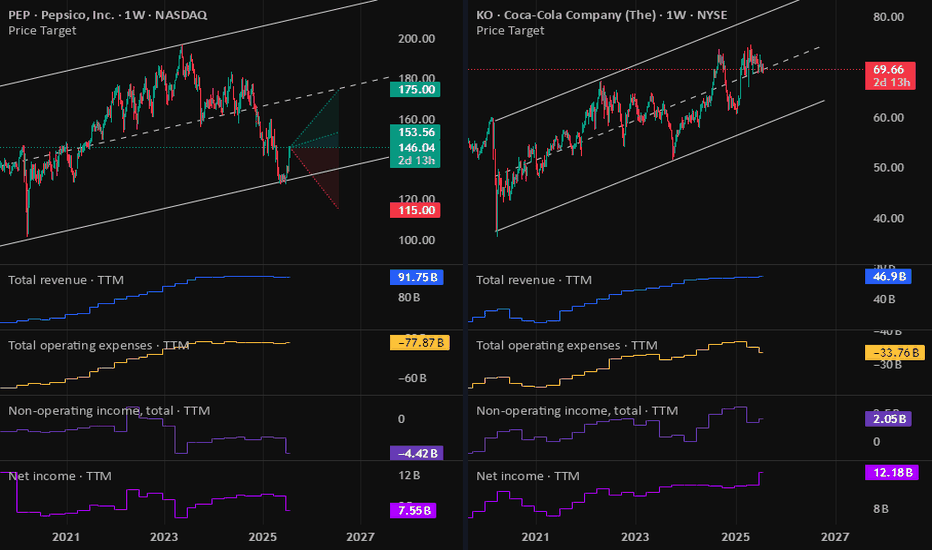

KO: Coca-Cola (CFD) Earnings 23-07-2025Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Coca-cola

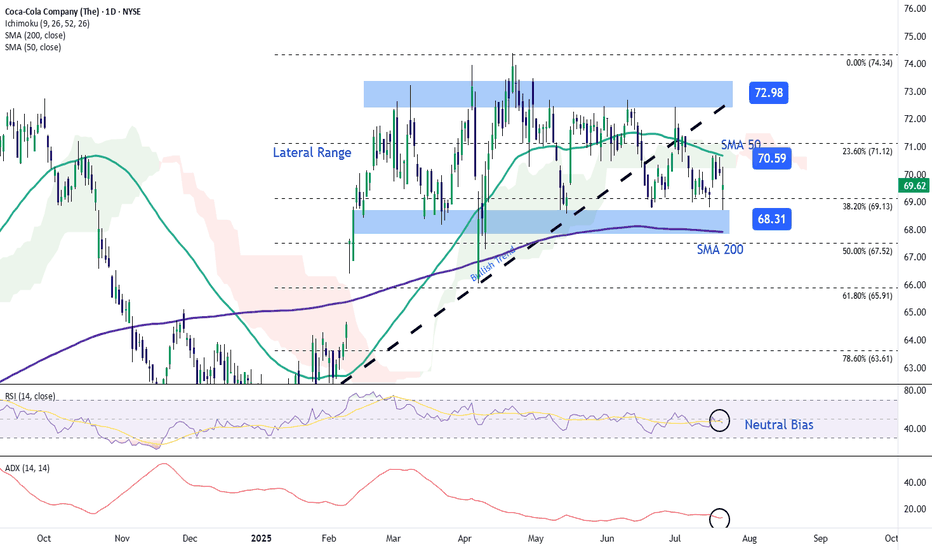

Coca-Cola Stock Falls Despite Strong EarningsDuring the latest trading session, Coca-Cola stock maintained a clear neutral bias after a nearly 1% decline, falling below the $70 per share level. This movement came despite the company reporting better-than-expected results, with earnings per share (EPS) of $0.87, above the $0.83 expected, and total revenue of $12.62 billion, exceeding market estimates of $12.54 billion.

Despite these solid results, the company noted that it expects a possible decline in sales volume over the coming months and also anticipates higher costs due to a new commercial strategy. Additionally, there is growing uncertainty around demand for sugary beverages, which could be impacted by the current economic backdrop. These factors have limited short-term upside potential, leaving the stock in a state of technical neutrality.

Sideways Range Holds

Since late February, the stock has been trading within a steady sideways range, with a ceiling at $73 and a floor at $68. The current price remains near the midpoint of that range, reflecting a lack of clear long-term direction. As long as this indecision continues, range-bound behavior is likely to dominate in the sessions ahead.

Technical Indicators

RSI: The Relative Strength Index remains close to the neutral level of 50, indicating a balance between buying and selling pressures. Without a clear directional shift, the sideways range may continue in the short term.

ADX: The ADX line has been fluctuating below the 20 level, indicating low average volatility and a persistent consolidation phase. Unless this indicator sees a meaningful uptick, the current range is likely to remain in play.

Key Levels to Watch:

$73 – Major Resistance: Marks the upper boundary of the range. A strong move toward this level could initiate a new bullish trend.

$70 – Immediate Resistance: Aligns with the 50-period simple moving average and the 23.6% Fibonacci retracement level. A breakout here could signal a short-term bullish bias.

$68 – Key Support: Aligned with the 200-period simple moving average, this level represents a critical technical floor. A break below it could activate a relevant bearish bias and potentially lead to a longer-term downtrend.

Written by Julian Pineda, CFA – Market Analyst

Coca-Cola: Nearing Final Wave III HighDespite recent sell-offs, we still expect Coca-Cola to reach a final high of magenta wave within our beige Target Zone between $76.58 and $81.51, which should also mark the completion of the broader beige wave III. However, an alternative scenario—with a 38% probability—remains in play: in this case, the top of beige alt.III would have already occurred, and a direct decline below $60.62 would likely follow. In either scenario, once the high of beige wave III is established, we anticipate a significant correction.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Coca-Cola: IndecisiveCoca-Cola continues to trade sideways, still failing to confirm either of our scenarios definitively. The primary scenario envisions that wave III in beige will post another high within the beige Target Zone ($76.58–$81.51), which offers a potential setup for short positions. Following that, wave IV in beige should begin a substantial correction. However, if the stock fails to overcome resistance at $74.38, it could indicate that the top of wave alt.III in beige is already in. A decline below the $66.05 support level would activate the alternative scenario (35% probability), implying a drop below $60.62.

COCA-COLA: This is a +43% wave, aiming at $82.Coca-Cola is about to turn bullish on its 1D technical outlook (RSI = 53.500, MACD = -0.130, ADX = 31.368), trading on a flat 1M candle, coming off another flat candle before it (April). This neutrality has historically been a re accumulation period for the stock. Given that its most recent low was on the 0.382 of its multi year Channel Up and the rebound took place on the 1M MA50, we expect at least a +43.22% rise from there. On this pattern, all rallies that started on the 1M MA50, grew by at least +43.22% and touched the 0.786 Fibonacci level of the Channel. Our TP = 82.00 and we expect to get there by the end of the year.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Shares of Coca-cola Set For Breakout Amid Golden Cross Pattern The Coca-Cola Company (NYSE: NYSE:KO ) on Tuesday reported first-quarter sales below analysts' estimates but profit that topped expectations, as the beverage giant navigates tariff uncertainty.

Earnings Overview

The company said its "comparable," or adjusted, earnings per share came in at $0.73 on revenue that declined 2% YoY to $11.1 billion. Analysts expected $0.72 and $11.22 billion, respectively.

CEO James Quincey said:

"Despite some pressure in key developed markets, the power of our global footprint allowed us to successfully navigate a complex external environment."

Coca-Cola Says Operations 'Subject to Global Trade Dynamics'

In an update to its full-year outlook, Coca-Cola said that its "operations are primarily local, however, it is subject to global trade dynamics which may impact certain components of the company’s cost structure across its markets. At this time, the company expects the impact to be manageable."

Technical Outlook

Shares of Coca-Cola ( NYSE:KO ) were down about 1% shortly after the market opened Tuesday. They entered the day up about 15% since the start of the year. As of the time of writing, the stock is up 0.49%.

Albeit earnings missed estimate, the 4 hour price of Coca-Cola shares (NYSE: NYSE:KO ) depicts a golden cross pattern- this is a metric that is generally seen as a bullish reversal with its counterpart known as "Death cross". With the RSI at 51 and the Golden cross pattern, NYSE:KO might be on the cusp of a bullish campaign.

Coca-Cola Company (KO) Shares Trade Near All-Time HighCoca-Cola Company (KO) Shares Trade Near All-Time High

Stock market charts indicate that from the start of last week’s trading through to its close:

→ The S&P 500 Index (US SPX 500 mini on FXOpen) declined by approximately 3%;

→ Pepsico (PEP) shares dropped by more than 1%;

→ Coca-Cola Company (KO) shares rose by around 2.4%.

Why Aren’t Coca-Cola Shares Falling?

The relatively strong performance of Coca-Cola (KO) shares compared to the broader market and its main competitor may be attributed to the fact that Coca-Cola operates a concentrate production facility in Atlanta, USA. In contrast, Pepsico’s equivalent production is based in Ireland. This gives Coca-Cola a potential advantage under the tariff policies pursued by the Trump administration.

Incidentally, according to media reports, Diet Coke is the favourite drink of the US President.

Technical Analysis of KO Stock Chart

In 2025, KO stock has been forming an upward channel, though the current price is approaching key resistance levels:

→ the upper boundary of this ascending channel;

→ the $73 level, above which several successive all-time highs have been formed. However, price action suggests that bulls have so far struggled to establish a foothold above this mark.

It is possible that the upcoming quarterly earnings report, scheduled for 29 April, could provide a positive catalyst for KO’s share price.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coca-Cola: As PlannedAs primarily anticipated, Coca-Cola has recently established the peak of wave in magenta just below the resistance at $73.53. The stock then dropped by approximately 5%. We now expect the low of wave in magenta to occur soon, and afterward, wave should bring significant gains, thus completing the large wave III in beige. Our Target Zone for this wave III top lies between $75.42 and $78.88. It provides opportunities to either close existing long positions or to open new short trades.

Coca-Cola: High in Sight?!Coca-Cola has gained around 9% over the past two weeks and should now be approaching the high of the turquoise wave 4. As soon as this top is established (below the resistance at $70.74), we expect sell-offs down to the forecast low of wave (A) in magenta below the support at $60.62. However, if the stock breaks above the resistances at $70.74 and $73.53 during its current upward move, we will consider wave alt.(A) in magenta as complete. In this scenario, the subsequent wave alt.(B) would already be underway, aiming for a high within our beige Target Zone between $75.32 and $80.36 (probability: 39%).

Coca-Cola (KO) Stock Surges Nearly 5% in a DayCoca-Cola (KO) Stock Surges Nearly 5% in a Day

Yesterday, shares of The Coca-Cola Company (KO) saw a significant rally, climbing nearly 5% and reaching a yearly high above $67. The last time KO stock traded at this level was in late October 2024. Investor optimism was fueled by the release of the company’s Q4 financial report, which exceeded expectations:

→ Reported earnings per share: $0.55 vs. expected $0.52

→ Gross revenue: $11.5 billion vs. forecasted $10.7 billion

Additionally, Coca-Cola announced:

→ A substantial market share increase in the non-alcoholic beverage sector and $10.8 billion in free cash flow.

→ Projections for 5–6% organic revenue growth in 2025, highlighting the company’s resilience amid economic uncertainty.

Technical Analysis of Coca-Cola (KO) Stock

At yesterday’s market open, KO formed a large bullish gap, which may act as future support. Meanwhile, price extremes outline an ascending channel pattern.

If optimism persists:

→ The price may move towards the channel median, where supply and demand tend to balance (similar to early 2025).

→ Bears might become active around $69.25, a level that has previously influenced price movements (indicated by arrows).

Analysts' Price Forecast for Coca-Cola (KO) Stock

Following the earnings report, analysts from leading investment firms have acknowledged Coca-Cola’s strong performance, either reaffirming or raising their price targets for KO stock:

→ Citi maintained a "Buy" rating with a $85 price target.

→ Jefferies reiterated its "Buy" rating with a target of $75.

→ UBS kept its "Buy" rating, setting a $72 target.

According to TipRanks:

→ 12 out of 13 surveyed analysts recommend buying KO stock.

→ The 12-month average price target for KO is $72.4.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coca-Cola To Report Q4 Earnings Today Ahead of Market OpenCan the Beverage Giant Sustain Its Momentum?

Coca-Cola (NYSE: KO) is set to report its fourth-quarter earnings results on Tuesday, February 11,2025 ahead of the market open. Investors and traders are closely watching the stock, which has already shown premarket strength, rising 0.20% early Tuesday morning. With the Relative Strength Index (RSI) at 60.84, market participants are anticipating a potential bullish continuation, provided earnings results meet or exceed expectations.

Strong Performance in 2023

Coca-Cola, a global leader in the beverage industry, has continued to demonstrate resilience despite economic uncertainties. In 2023, the company reported $45.75 billion in revenue, marking a 6.39% increase from the previous year’s $43 billion. Earnings also saw an impressive 12.28% growth, reaching $10.71 billion. This performance underscores Coca-Cola’s ability to maintain steady growth through product diversification and strategic market positioning.

Analysts remain optimistic about the stock, with 17 analysts giving KO a consensus rating of "Strong Buy." The 12-month price target of $72.18 suggests a potential 11.82% upside from its latest price, reinforcing bullish sentiment ahead of the earnings report.

Technical Analysis

As of Tuesday’s premarket session, NYSE:KO is trending upwards, with its price hovering near $65, a key pivot and resistance level. Breaking this barrier could trigger a bullish rally, potentially pushing KO toward higher price targets in the coming weeks.

However, if earnings disappoint, a retracement may be in play, with immediate support aligning with the 38.2% Fibonacci retracement level at $63. This level could serve as a critical point for a potential rebound, should selling pressure emerge following the earnings announcement.

What to Expect Post-Earnings

A strong earnings beat could propel KO further into bullish territory, confirming its upward trajectory and attracting more institutional interest. On the flip side, weaker-than-expected results may lead to a temporary pullback, offering a potential buying opportunity at key support levels.

COCA-COLA: bottomed and started the 2025 rally to $82.The Coca-Cola company just turned bullish on its 1D technical outlook (RSI = 56.409, MACD = 0.210, ADX = 24.907) as it crossed over the 1D MA50 following a clean HL at the bottom of the long term Channel Up. The 1D RSI is already on a bullish divergence and this validates technically the start of the new bullish wave. The previous one increased by +42.18% so a target significantly below it (TP = 82.00) is more than justified long term.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The Fizz is Back: Coca-Cola's Stock on the Rebound● The price had encountered several resistance points around the $62 mark in the past.

● Once it broke through this barrier, the stock surged to reach a record high of $72.5.

● However, it then faced a significant pullback, dropping approximately 16% before finding support at the breakout area.

● Recently, the price has begun to climb once more, setting its sights on the previous all-time high, with expectations of surpassing it.

Coca Cola $KO Fibonacci Re-tracement Coca Cola NYSE:KO Fibonacci Re-tracement

👀 NYSE:KO 📈📉 Analyzing potential price action in Coca-Cola using Fibonacci Retracements. Identifying key support and resistance levels for potential entry and exit points. 💰 #TechnicalAnalysis #TradingView #Fibonacci #SupportResistance #RiskManagement"

Long Position Idea on Coca-Cola - $62 Support ZoneFirst, the $62 zone has proven to be a strong support level historically. Every time the price has approached this area, buyers have stepped in, and we’ve seen a reversal to the upside. Right now, the price is also testing the ascending trendline support that has been holding since 2022. If this trendline holds again, it could lead to another strong move upward.

What makes this trade even more interesting is the risk/reward ratio. My target is at $77.45, which represents a 24.86% upside, while the stop loss is set at $57.51, or about 7.29% downside. That gives this trade a very attractive 3.41 risk/reward ratio, meaning the potential reward far outweighs the risk.

Additionally, the RSI is near oversold territory, sitting in the 30–40 range. This typically signals that sellers are exhausted and a reversal might be coming. I’m also seeing volume starting to stabilize, which indicates that selling pressure is easing. If buyers step in here, we could see volume increase alongside price, further supporting the move upward.

Finally, the target at $77.45 aligns perfectly with the upper boundary of the ascending channel, which has been respected for quite some time. This makes the upside not only achievable but also consistent with the broader trend.

Coca Cola - A Clear Trading Setup!Coca Cola ( NYSE:KO ) will provide a textbook setup soon:

Click chart above to see the detailed analysis👆🏻

Coca Cola is one of these "under the radar" stocks which is just trending higher and higher but nobody is really paying attention. However currently Coca Cola is retesting a resistance trendline of the governing rising channel pattern so a short term retracement is quite likely.

Levels to watch: $72, $65

Keep your long term vision,

Philip (BasicTrading)

Technical Analysis of Coca-Cola (KO)The stock ( KO ) is currently in a retracement phase from its all-time highs reached in September 2024, having momentarily paused at previous relative highs.

Given Coca-Cola’s long-term uptrend, we can identify several key support levels where the retracement may halt and resume its upward trajectory:

SUP 1 : The first support area could be the current level, marked as SUP 1.

SUP 2 : The second area is around $64, labeled as SUP 2. Analyzing the Volume Profile, we notice significantly higher volume levels here.

POC : Just below SUP 2, we find the POC (Point of Control) area in the Volume Profile, located around $60.

SUP 3 : Another support level, marked as SUP 3, is around $57.

In the worst-case scenario, a drop down to SUP 3 would represent a drawdown of around 20%. Historically, Coca-Cola has seen similar drawdowns of 15%-20% and even as much as 40% at times.

The final potential support area is between $54-$53, corresponding to a secondary peak in the Volume Profile and an area where the stock has previously found resistance. This scenario would reflect a drawdown of about 30%

An additional note: the SUP 2 and POC levels align precisely with the 0.382 and 0.618 levels of the Fibonacci Retracement indicator.

Coca-Cola’s Q3 Report:Strong Revenue Growth and Bullish OutlookCoca-Cola reported its third-quarter earnings on October 23, 2024, showcasing both resilience and the ongoing challenges posed by global economic conditions. Despite a slight decline in reported net revenue, the beverage giant managed to achieve growth in key areas, reflecting its ability to adapt to external pressures.

Key Takeaways from Q3 2024 Earnings

Revenue & Earnings Performance

Organic Revenue: Rose by 9%, showing strong core performance.

Reported Net Revenue: Fell by 1% to $11.9 billion, down from $11.95 billion a year ago, primarily due to currency fluctuations and increased operational costs.

Adjusted EPS: Increased by 5% to $0.77, driven by effective pricing strategies.

Reported EPS: Dropped by 7% to $0.66 due to currency headwinds and rising operational expenses.

Despite currency-related challenges, Coca-Cola’s strategic pricing adjustments helped offset inflationary pressures, leading to gains in adjusted earnings. However, operating income was negatively impacted by a 23% decline, attributed to restructuring costs and currency movements.

Regional Highlights

North America: Revenue surged by 12%, with smart pricing strategies effectively managing inflationary pressures. This region remained the strongest contributor to Coca-Cola's overall performance.

Latin America: Saw a remarkable 24% rise in organic revenue. However, severe currency devaluation caused a 20% negative impact on reported revenue, highlighting the global challenges the company continues to face.

Asia-Pacific: Reported revenues fell by 4%, though a 3% organic recovery signaled underlying demand despite regional economic difficulties.

China & Turkey: Sales volumes struggled, with ongoing economic pressures leading to a contraction in these markets.

Strategic Moves & Financial Challenges

One of the biggest hurdles this quarter was the impact of a $6 billion tax deposit related to litigation with the IRS, which significantly strained Coca-Cola’s cash flow. Despite this, Coca-Cola remains financially resilient, leveraging its strong foundation to withstand such pressures better than many other corporations.

Driving Growth Through Innovation & Partnerships

Coca-Cola continues to push forward with digital innovation and strategic partnerships:

2024 Summer Olympics: Coca-Cola’s collaboration generated over 42 million impressions for its smartwater brand, part of its broader strategy to integrate digital technologies.

AI & Data Analytics: Coca-Cola is increasingly using AI to optimize pricing, enhance operational efficiencies, and better target consumers, helping to manage costs and shape future strategies.

Future Outlook

Looking ahead, Coca-Cola is projecting a 10% growth in organic revenue for the full year of 2024. Despite ongoing currency headwinds expected to reduce EPS growth by 5%, the company is confident in its ability to navigate these challenges. Investments in digital transformation, brand expansion, and strategic adaptability are seen as key drivers for long-term success.

Technical Analysis: Potential Bullish Reversal

From a technical standpoint, the chart indicates a potential bullish seasonality ahead. A possible demand area has been identified, where large speculators may begin building long positions. Patience is essential, as traders wait for a confirmed reversal signal within this demand zone, potentially setting up for a long entry.

Conclusion

Coca-Cola’s Q3 performance underscores its ability to manage economic headwinds while pursuing growth opportunities. As it continues to invest in digital innovation, strategic partnerships, and product adaptability, the company remains well-positioned for sustained long-term growth. Traders and investors should keep an eye on the upcoming demand area for a potential bullish setup, aligning with the broader market's favorable seasonality.

✅ Please share your thoughts about KO in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Coca-Cola (KO) Share Price Drops Sharply After Earnings ReportCoca-Cola (KO) Share Price Drops Sharply After Earnings Report

On 23 October, Coca-Cola (KO) released its third-quarter earnings, which exceeded forecasts:

→ Earnings per share (EPS): Actual = $0.77; Expected = $0.74

→ Gross revenue: Actual = $11.95 billion; Expected = $11.69 billion

Despite these positive results, KO's share price saw a sharp decline, likely due to market concerns about fourth-quarter sales forecasts, which face risks associated with currency fluctuations.

Technical Analysis of Coca-Cola (KO) Stock Chart:

→ In 2024, price fluctuations formed an upward channel (shown in blue), with a notable surge in early August (marked by a black arrow), even as broader markets were under pressure from recession fears and the decline of the Japanese stock market. This suggests that buyer interest around the $66 level remains strong.

→ Since then, the price has oscillated between $69 and $70.50, with these levels alternately serving as support and resistance (marked by blue arrows), as well as testing the upper boundary of the blue channel.

→ Currently, KO’s price sits near the midpoint of the blue channel, indicating potential support at this level, which could significantly slow the downward momentum observed post-earnings.

Furthermore, bulls may attempt to resume the upward trend within the blue channel, with $69 acting as a key level to test the strength of demand.

Analysts remain optimistic. According to TipRanks data:

→ 11 of 15 analysts recommend buying KO stock;

→ The average KO price target is $75.46 over the next 12 months.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

COCA COLA bottomed. Get ready for a +20% rally.Last time we looked at the Coca-Cola Company (KO) was at the end of the previous year (December 07 2023, see chart below), giving a buy signal, which eventually hit our $62.00 Target, even though it had to take longer than we expected:

This time, the price action is giving us yet again a very strong buy signal as the price rebounded yesterday exactly on the 0.236 Fibonacci retracement level of the 1-year Channel. At the same time, so did the 1W RSI, reversing upwards below its MA level, consistent with the previous two bottoms of April 12 2024 and October 06 2023.

Based on the lowest rally we had within this Channel, we expect Coca Cola to rise by at least +19.45%, setting our Target at $79.70.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇