“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

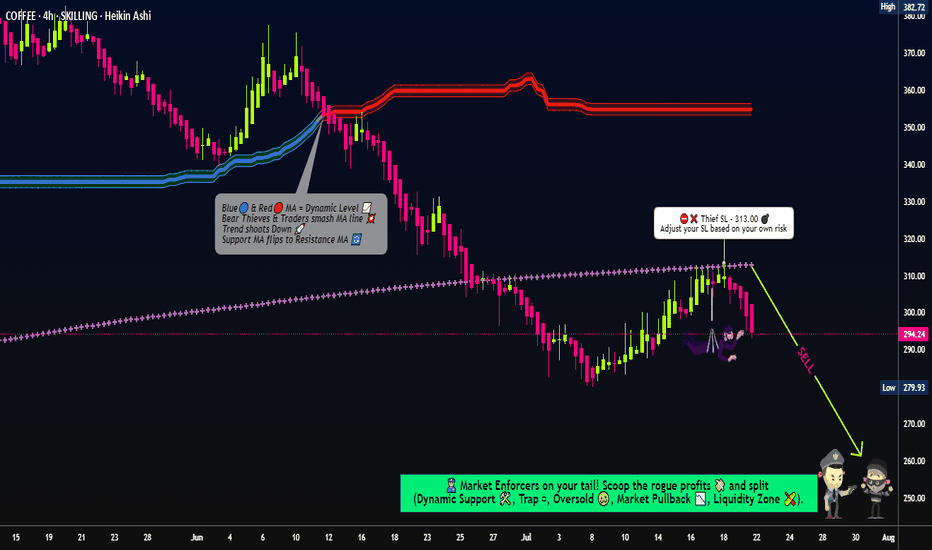

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee_analysis

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

The Coffee Code: A Short Opportunity Hidden in Plain SightThere is a difference between seeing the market and truly understanding it. Most traders react. The enlightened anticipate.

This week, the COT strategy has illuminated a setup so clear, yet so overlooked, that only those who understand the deeper language of the markets will act. Coffeewhispers a warning, and few are listening.

The Codes Have Been Revealed:

🔻 Code 1: Commercials' COT Index – The real insiders, the ones who move markets, are at a bearish extreme. The last time we saw this setup? A major reversal followed.

🔻 Code 2: Positioning Extremes – Large specs are at an all-time high in longs. When the herd rushes in, exits become crowded.

🔻 Code 3: Advisor Sentiment – The so-called “experts” are euphoric. When advisors scream bullishness while commercials quietly stack shorts, it’s a sign. A big one.

🔻 Code 4: Valuation – Coffee is severely overvalued relative to Gold, Treasuries, and the Dollar. The weight of reality will soon press down.

🔻 Code 5: ADX Over 60 – A high ADX signals a trend’s climax. The moment it rolls over is the key to this code triggering the move.

🔻 Code 6: Seasonality – Mid-February to March? Historically, a time of decline. The cycle repeats for those who see it.

🔻 Code 7: Cycles Colliding – Multi-timeframe cyclical pressure is now aligned against coffee.

The rarest and most powerful force in motion.

Additional indicators confirm it. Distribution. Divergences. Ultimate Oscillator. Williams ProGo. %R sell zones. Every signal is flashing red.

And yet, most will hesitate. Most will ignore the signs. They will wait until it's too late.

The question is not whether the opportunity exists. It’s whether you can see it.

If you understand what’s written here, you already know what comes next.

If you don’t... then perhaps it’s time we talked.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

Acknowledgment

The strategies and concepts taught in this class draw significant inspiration from the works and teachings of Larry Williams, a pioneer in trading and market analysis. His groundbreaking research and methodologies have shaped the foundation of modern trading education.

While this class incorporates Larry Williams’ principles, the content has been adapted and presented to reflect my own understanding and application of these ideas. Full credit is given to Larry Williams for his original contributions to the field of trading.

COFFEE - UniverseMetta - Signal#COFFEE - UniverseMetta - Signal

D1 - Formation of potential 3rd wave.

H4 - Securing behind the channel line + possible retest of the level, through the 3rd wave. You can try to enter from these levels or wait for the breakout of the 1st wave. Stop behind the maximum of the 1st wave.

Entry: 328.66 - *320.11

TP: 307.55 - 293.16 - 279.62 - 257.96

Stop: 344.60

Arabica Coffee Futures. The Canary in the Coal MineWith nearly 60 percent up path performance in 2024, Arabica coffee futures rose above $3.00 a pound, the highest mark since May 2011, as traders assess potential problems with next year’s crop in top producer - Brazil.

Despite recent rains, soil moisture levels remain low, leading to limited fruit development and excessive leaf growth, local traders said.

U.S. and European coffee lovers are getting ready to tighten their belts as natural disasters have hit the world’s two largest coffee-producing countries, causing commodity prices to more than double in the past five years.

Droughts in Brazil, the world’s largest coffee producer, and severe typhoons in Vietnam, the second-largest producer, have severely disrupted the global coffee supply chain, driving up production costs that are increasingly being passed on to consumers.

In addition, there are reports that Brazilian coffee farmers are holding back shipments of coffee to the market in hopes of higher prices, leading to further shortages, tighter supplies of coffee on the spot market, and higher prices.

Coffee is literally the “Canary in the coal mine,” signaling climate change, the ecological crisis, and its impact on agriculture.

The idiom originated within the Industrial Revolution in England (back to late XVIII century), when coal miners, lacking modern gas-monitoring equipment, would take canaries (birds) into the coal mine with them. And when dangerous gases like carbon monoxide (which is odorless) accumulated in excess in the mine, they stopped the birds chirping and killed the canaries before killing the miners, thus providing a warning to leave the tunnels immediately.

As some of the world’s largest coffee-consuming regions, coffee lovers in the United States and Europe will find the price hikes particularly hard to stomach.

According to German consumer data company Statista, Europeans consume about 3.2 million tons of coffee a year, accounting for nearly 33 percent of the world’s total coffee consumption, while Americans drink 400 million cups of coffee daily (which equates to 146 billion cups of coffee consumed in the United States each year, or nearly four cups a day for every American adult).

In fact, coffee is more than just a morning ritual in the United States; it has become a cultural and business driver.

But understanding the depth of America’s love affair with coffee may be as complex as the drink itself, and of course, more complex than the current coffee prices.

Natural disasters have taken a heavy toll.

Brazil, which accounts for about 40% of the world’s coffee production, is battling one of its worst droughts in decades. Dry conditions have severely impacted Arabica-growing regions, reducing yields.

The 2023–24 crop cycle is already seeing a sharp drop in production, with some estimates suggesting output could fall by as much as a fifth (20%).

The impact is being felt most acutely in Minas Gerais, Brazil’s largest coffee-producing state and home to high-quality Arabica, which has seen months of lower-than-normal rainfall.

Brazil’s farmers are battling the country’s worst drought in seven decades and above-average temperatures.

While Brazil dominates the Arabica market, Vietnam is the world’s leading producer of the cheaper Robusta beans used in instant coffee. Earlier this fall, Typhoon Yagi devastated the country’s main coffee-growing regions in the Central Highlands, killing at least 60 people and injuring hundreds more.

Thousands of hectares of coffee plantations were estimated to have been damaged, leading to significant losses in both the current crop and future production potential, as the damaged trees will take years to recover.

A perfect storm of environmental concerns has driven prices to all-time highs, above US$3.00 per pound of coffee beans.

The combined impact of drought in Brazil and the typhoon in Vietnam has sent global coffee prices soaring. The International Coffee Organization (ICO), an intergovernmental body made up of coffee-exporting and -importing countries, reported that prices rose nearly 20% in the third quarter of 2024, reaching their highest level in nearly a decade.

The ongoing effects of climate change make a quick return to stability difficult. The sector remains vulnerable to extreme weather conditions, which could further disrupt future harvests. In addition, growing global demand, particularly in emerging markets such as Asia, could continue to put upward pressure on prices, further slowing recovery efforts.

As the world’s two largest coffee producers struggle to recover from the crisis, the outlook for the global coffee market remains uncertain.

Climate change is reducing the area of land suitable for growing coffee crops, and extreme weather events are becoming more frequent, creating a range of challenges for the sector and coffee drinkers in the US and Europe.

In technical terms, the main 12-month graph of coffee prices indicates another buyers attempt to storm the round, 250-cent mark.

Since the price is near to consolidate by the end of the year above this round number, it can contribute to a further rally and multiple price growth in the foreseeable future.

The Enigma of Robusta: Why is Coffee's Unsung Hero So Valuable?Robusta coffee, a resilient and versatile bean, has played a pivotal role in the global coffee market. Despite its often overlooked status, Robusta has experienced a significant surge in value in recent years. This article explores the factors driving the rising prices of Robusta coffee, including increased demand, supply chain disruptions, and climate change. By understanding the challenges and opportunities facing Robusta, we can better appreciate its enduring significance in the global coffee industry.

Introduction

The global coffee market has witnessed a steady rise in demand, leading to a corresponding increase in prices for both Arabica and Robusta beans. While Arabica often takes center stage, Robusta, a less celebrated but equally essential bean, has also experienced a notable appreciation in value. This article delves into the reasons behind Robusta's ascent, examining the factors that have contributed to its growing prominence.

Factors Driving Robusta Coffee Prices

Several key factors have converged to push Robusta coffee prices upward:

Increased Demand: The global appetite for coffee has expanded significantly, particularly in emerging markets. This rising demand, coupled with a limited supply, has created upward pressure on prices.

Supply Chain Disruptions: Weather-related challenges, geopolitical tensions, and logistical constraints have disrupted supply chains, leading to shortages and higher costs.

Climate Change: Climate change has exacerbated weather-related events, such as droughts and floods, impacting coffee production and driving up prices.

Shifting Cultivation Patterns: Some farmers have shifted their focus to more profitable crops, reducing the overall supply of Robusta coffee.

The Enduring Value of Robusta

Despite the challenges it faces, Robusta Coffee continues to hold significant value. Its resilience, versatility, and unique flavor profile make it a sought-after commodity. As a cornerstone of the global coffee market, Robusta plays a crucial role in meeting consumer demand and supporting the livelihoods of millions of farmers.

Conclusion

The rising prices of Robusta coffee can be attributed to a combination of factors, including increased demand, supply chain disruptions, and climate change. While the future of coffee production faces challenges, Robusta's enduring value and adaptability position it as a resilient force in the global coffee market. By understanding the factors driving price increases and exploring innovative solutions, we can ensure the continued sustainability and enjoyment of this beloved beverage.

Coffee - Is price going to drop from supply zone of feb 2022???Hey traders coffee is at highs of feb 2022, it does tend to drop in August to September time, and now were at this high commercials are selling coffee and id rather be on there side than retailers who are still buying.

So I am going to sell....

Please like comment and follow cheers

This chart material is for education purposes only / Demo account should be traded only

Not So Little Brother ? NYSE:BROS +3.85%on 05/06/24 is a powerful contender for Starbucks customers. Living in southern California, I've started seeing DutchBros popping up around town (are they any good?). One thing for sure they've gotten right is their amplified focus on delivering the best customer experience. One thing that the NASDAQ:SBUX Starbucks former CEO Howard Schultz asked his former company to refocus on. It's so good that Tiktokers started making videos poking fun at the friendly nature of the Dutchbros employees.

With all of that being said, it's working for them and very well. They've opened 159 new shops in 2023, and according to Placer.AI, "While the growth of Starbucks' foot traffic has been shrinking since last year, Dutch Bros' growth in traffic has been accelerating." also, Earnest Analytics reports, Dutch Bros. accounted for 6% of U.S. consumer spending on coffee and other premium drinks. Up from 4% at the end of 2020. Last year's revenue was up about 31%

This is my Strategy:

Using Bollinger Bands and Fibonacci Retracement, we see increased trade volume and volatility as the price rises above the SMA and towards the upper band. The price is currently $28.34. We can expect it to reach a price target of $31.16 (test strategy here) before retracement or reversal, as the shares may be near overbought status.

This will give us a $2.82 profit per share. If sold

Enter at price targets: $27.33 (low) and $29.92 (max)

Hold for the price to cross $32.90 for uptrend confirmation.

(FYI, analyst target maintains $33.00/share)

It is one of my favorite stocks, and I'll watch its performance closely this year.

Something Brewing?

NASDAQ:SBUX Has had a tough week (dropping -17.7%), topped with a demand from the former CEO Howard Schultz to shift focus from the current data-driven business model to a customer-centric business.

With the above being said, I believe the coffee giant will recover amid rising competition from Dtchbros $NYSE: BROS and Dunkin Donuts $FINRA: DNKN_SHORT_VOLUME.

This is my strategy:

Using Bollinger Bands and Fibonacci Retracement, we see a large trade volume and volatility increase as the price drops below the SMA and lower band. The price is currently $73.11. We can expect it to reach a price target of $84.68 (test strategy here) before retracement or reversal, as the shares may be near overbought status.

This will give us a nice $11.50 profit per share.

Enter at price targets: $70.31 and $72.92

Hold for the price to cross $87.46 for uptrend confirmation.

US Coffee - Clear Buy with S/L 186; Big move aheadEntry Level: $190

Stop Loss: $186

Target: $195-$199.00

Analysis:

The current entry level for initiating a short-term long position in US Coffee stands at $190. A prudent risk management strategy suggests setting a stop loss at $186 to mitigate potential losses in case of adverse price movements.

The target range for this long position is set between $195 and $199.00. This target zone reflects the anticipated price movement based on technical analysis indicators and market dynamics.

Traders should closely monitor price action and key support/resistance levels to assess the validity of this trading opportunity and adjust their positions accordingly.

Coffee completes wave 1The coffee futures were spotted completing a five-wave advance beginning in Oct.2023 and ending in Nov.

The coffee price is now in a wave 2 corrective phase. The 158 and 155 levels shall be the crucial support levels going forward since they are the 50% and 61.8% retracement levels of the wave 1 rise respectively.

The 3rd wave price target is projected around the 190 zone.

Note*- This post is for educational purpose only

Robusta hit the target after 2 years at $28.00I don't know about you but I prefer Arabica Coffee to Robusta.

It's sweeter, it's fuller and it's not that bitter.

Anyways, I sent out this trade idea in September 2021!

The price broke above the Falling Wedge and there were strong signs of upside.

This trade idea was a slow pace and anyone who held onto this trade, most likely would have made very little money due to the daily interest expense charges.

It really does add up. And unfortunately, we traders can't treat these markets like medium to long term investors who deal with derivatives.

Anyways, the target hit at $28.00 and the price looks to be consolidating here before further upside. Hopefully, a new pattern forms and we can get wired back into the trade.

INTERESTING FACTS ABOUT THE ROBUSTA COFFEE COMMODITY

Second Most Traded Coffee:

Robusta is the second most traded type of coffee, following Arabica, in terms of global market demand and trade activity.

Price Determination:

Robusta coffee prices are influenced by factors such as weather conditions, crop yields, global supply and demand dynamics, currency exchange rates, and geopolitical events.

Use in Blends:

Robusta coffee is often used in coffee blends, alongside Arabica, to provide a stronger and more full-bodied flavor profile.

Coffee Exporter Revenue:

Robusta coffee exports contribute to the revenue of major coffee-producing countries such as Vietnam, Brazil, Indonesia, and Uganda, driving economic activity and foreign exchange earnings.