“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

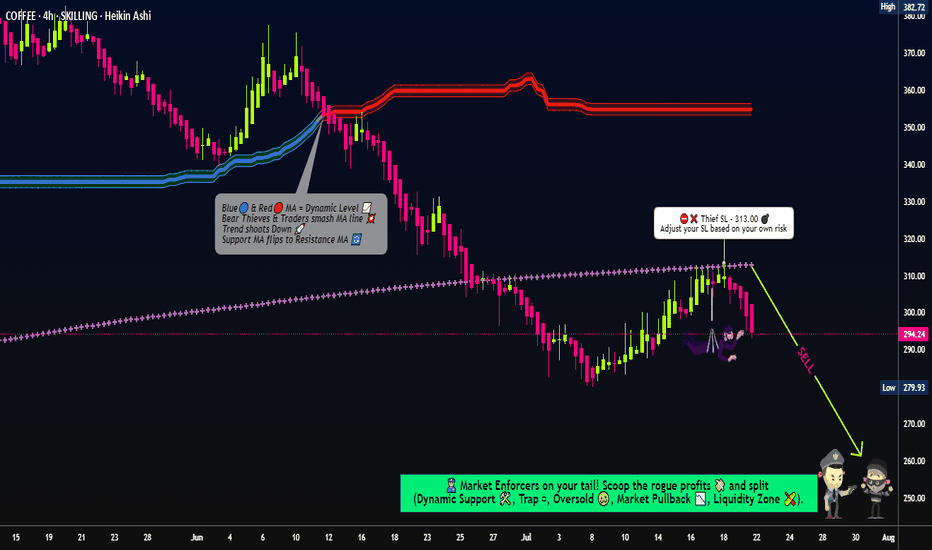

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee_futures

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

COFFEE Brewing upwardsBull case for Coffee is already well understood and price action confirms string upward trend.

Technicals: Broken above channel, on supprt, bull pennant forming, declining volume. All bullish signals. Gap at $359 possible target on downwards break. Target $500-600. Possible squeeze higher if big players caught short. Price action indicating possible parabolic blow off.

Fundamentals: Much already priced in. Current dryness in Brazil and damage to 2025 and 2026 crops not fully proceed, market hopeful rains will come and save crop. Harvest beginning approx May 2025 will possibly give some selling pressure, but until then stocks are tight and physical market showing no signs of further weakness.

Arabica Coffee Futures. The Canary in the Coal MineWith nearly 60 percent up path performance in 2024, Arabica coffee futures rose above $3.00 a pound, the highest mark since May 2011, as traders assess potential problems with next year’s crop in top producer - Brazil.

Despite recent rains, soil moisture levels remain low, leading to limited fruit development and excessive leaf growth, local traders said.

U.S. and European coffee lovers are getting ready to tighten their belts as natural disasters have hit the world’s two largest coffee-producing countries, causing commodity prices to more than double in the past five years.

Droughts in Brazil, the world’s largest coffee producer, and severe typhoons in Vietnam, the second-largest producer, have severely disrupted the global coffee supply chain, driving up production costs that are increasingly being passed on to consumers.

In addition, there are reports that Brazilian coffee farmers are holding back shipments of coffee to the market in hopes of higher prices, leading to further shortages, tighter supplies of coffee on the spot market, and higher prices.

Coffee is literally the “Canary in the coal mine,” signaling climate change, the ecological crisis, and its impact on agriculture.

The idiom originated within the Industrial Revolution in England (back to late XVIII century), when coal miners, lacking modern gas-monitoring equipment, would take canaries (birds) into the coal mine with them. And when dangerous gases like carbon monoxide (which is odorless) accumulated in excess in the mine, they stopped the birds chirping and killed the canaries before killing the miners, thus providing a warning to leave the tunnels immediately.

As some of the world’s largest coffee-consuming regions, coffee lovers in the United States and Europe will find the price hikes particularly hard to stomach.

According to German consumer data company Statista, Europeans consume about 3.2 million tons of coffee a year, accounting for nearly 33 percent of the world’s total coffee consumption, while Americans drink 400 million cups of coffee daily (which equates to 146 billion cups of coffee consumed in the United States each year, or nearly four cups a day for every American adult).

In fact, coffee is more than just a morning ritual in the United States; it has become a cultural and business driver.

But understanding the depth of America’s love affair with coffee may be as complex as the drink itself, and of course, more complex than the current coffee prices.

Natural disasters have taken a heavy toll.

Brazil, which accounts for about 40% of the world’s coffee production, is battling one of its worst droughts in decades. Dry conditions have severely impacted Arabica-growing regions, reducing yields.

The 2023–24 crop cycle is already seeing a sharp drop in production, with some estimates suggesting output could fall by as much as a fifth (20%).

The impact is being felt most acutely in Minas Gerais, Brazil’s largest coffee-producing state and home to high-quality Arabica, which has seen months of lower-than-normal rainfall.

Brazil’s farmers are battling the country’s worst drought in seven decades and above-average temperatures.

While Brazil dominates the Arabica market, Vietnam is the world’s leading producer of the cheaper Robusta beans used in instant coffee. Earlier this fall, Typhoon Yagi devastated the country’s main coffee-growing regions in the Central Highlands, killing at least 60 people and injuring hundreds more.

Thousands of hectares of coffee plantations were estimated to have been damaged, leading to significant losses in both the current crop and future production potential, as the damaged trees will take years to recover.

A perfect storm of environmental concerns has driven prices to all-time highs, above US$3.00 per pound of coffee beans.

The combined impact of drought in Brazil and the typhoon in Vietnam has sent global coffee prices soaring. The International Coffee Organization (ICO), an intergovernmental body made up of coffee-exporting and -importing countries, reported that prices rose nearly 20% in the third quarter of 2024, reaching their highest level in nearly a decade.

The ongoing effects of climate change make a quick return to stability difficult. The sector remains vulnerable to extreme weather conditions, which could further disrupt future harvests. In addition, growing global demand, particularly in emerging markets such as Asia, could continue to put upward pressure on prices, further slowing recovery efforts.

As the world’s two largest coffee producers struggle to recover from the crisis, the outlook for the global coffee market remains uncertain.

Climate change is reducing the area of land suitable for growing coffee crops, and extreme weather events are becoming more frequent, creating a range of challenges for the sector and coffee drinkers in the US and Europe.

In technical terms, the main 12-month graph of coffee prices indicates another buyers attempt to storm the round, 250-cent mark.

Since the price is near to consolidate by the end of the year above this round number, it can contribute to a further rally and multiple price growth in the foreseeable future.

Coffee - SHORTSeasonal tendencies are working against this, paired with U$D pressures as those continue to build.

Beyond that, world production is in steady decline with visible crisis levels looming on the horizon (within a decade). This is mostly due to radically increased UV levels in coffee growing regions, paired with a rapidly declining global work force.

Coffee price keeps the negativity – AnalysisCoffee price provided more negative closings by consolidating below 178.00 resistance, to start reacting to the major indicators by declining towards 159.40, expecting to continue forming negative crawl and attempt to touch 154.00, while breaking this obstacle will extend trades towards 147.10 to face the historical support that appears on the chart, assuring the importance of monitoring its behavior to manage to detect the next main trend.

COFFEE (Continuation) LONG - Update; Just a USD/Real Short ...... and nothing more.

Coffee remains a pure currency play on the USD/Real. - And with the Central Bank of Brazil hiking rates faster than any other central bank, this is mostly a one-way trade going into the seasonal peak.

Fundamentally, there is no evidence (0, zilch, nada) that there would be any supply issues at present - despite popular misconceptions to the contrary.

COFFEE - LONG (for now); Free coffee for your Great Depression!Could Coffee drop to $0 (or even go negative), much like crude oil did not too long ago??... You be the judge.

While currently long (a generational speculative bubble and all), this is likely the one to watch for one of the greatest Short Setups in ages!

Here is the Monthly. See it, yet?...

No?!

The Quarterly;

How about now?

Still no?! Let me zoom in for you.

Coffee Future is getting closer to pick a direction...KC=F has been in a vicious bear market just like many agricultural commodities. There is a down trend line since May, 2011. It is getting close to the apex of the symmetrical triangle as well. If it breaks up, it will be pretty bullish and it may be the start of new bull market in Coffee.

COFFEE - Possible "coffee break" aheadCoffee is back around the price of the beginning of the month.

Since OCT 2 we have a shy uptrend forming for coffee’s standards, in the 4h time frame (TF).

The price went up from its lowest of the current month and $104.90 to $113.35 (+8.04%) on OCT 12 and $111.70 (+6.45%) today so far.

The trend on the Higher TFs is still bearish and technically this is where are now.

We have some indications suggesting that we might be in front of a total reversal for the price of Coffee.

There are:

1) Higher lows since OCT 2

2) at the 4h TF since OCT 9 from the 10 bars 8 of them are above the 50MA

3) we had two major tests (and rejections) for price to break above two week resistance

4) we expect the price to reach at some point soon the monthly Fib 0.382 level

Against the above are the latest data from the COT report of OCT 6 where hedge funds closed 3.207 positions and opened 4.219 bringing the Net Long positions to 47.505 from 54.931 the previous week. Of course we still don’t know what their positions are for the current week.

So what we make out of all this.

To put it in simple terms with what I know so far the longer the price remains above the 50MA the more the chances of it breaking the $112 and move towards the Fib 0.382. The “Decision lvl” is where the two weeks resistance meets the blue trendline. Break it and we buy.

If on the other hand price breaks below the green trend line and the 20MA then we might be looking for more to the down.

Good luck traders

Note: I'm no trading expert nor have the ambition to become one! The above is just an idea that I share with the intention of attracting comments and perhaps become a better trader.

COFFEE - Turning the tide ?Coffee after a 3 week structure and battle seems to be making a break towards the Fib 0.382.

The higher time frames still point down.

The ADX indicator shows uptrend but no strength yet (it usually has a delay on that).

The COT of Sep 29 shows a lot of long orders closed (-3745) and more short open (+3065) with net long positions to 54931 compared to 61741 of the week before that.

So hudge funds expect more to the down.

We might have a turn of tide for coffee if this is not a false breakout, at least up to the Fib 0.382 area.

I will start engaging buy orders just after the decision level (green line) is broken to the upside by solid moves, maybe wait for the day to close.

Good luck traders.

Note: I'm no trading expert nor have the ambition to become one! The above is just an idea that I share with the intention of attracting comments and perhaps become a better trader.

COFFEE FUTURES - Wake up and smell the coffeeCOFFEE holded the support area of ~109.20-109.50 and made a pullback breaking the trendline (marked green on chart).

However the bulls seem to be sleepy so I believe the trend continues to be bearish and we have to monitor how price will react to make our decision.

Personally I'm considering a short position around the area marked on the chart.

Potential profit to blue line which is the next support area.

So as mentioned on the chart we monitor price and have our finger on the trigger.

Good luck traders.

Note: I'm no trading expert nor have the ambition to become one! The above is just an idea that I share with the intention of attracting comments and perhaps become better at trading commodities.

Coffee (KC) analysisAfter the strong bullish speculation on sugar finally ended, with the price is returning to more realistic values, my attention shifted to coffee.

Coffee, which was also heavily speculated upwards, reaching an absurd price of $ 140, has returned to the $ 100 area and then rebounded. At the end of the bounce, as you can see from the chart below, a distribution phase has begun, what in the candlestick analysis is called "checkmate."

Coffee, if there is no particularly positive news and data, will fall again in the coming weeks. Both because of the coronavirus effect, and because Brazilian production has grown a lot (also helped by the favourable climate), which will bring the price down.

Also (confidential news), a well-known Italian coffee company is still waiting to fix the price of the next deliveries, as it is sure that the contango will drop, as well as the prices.

Next short targets: $ 106.50/108.00 - $ 101.00 - $ 97.50/99.00 - $ 94.00.