“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

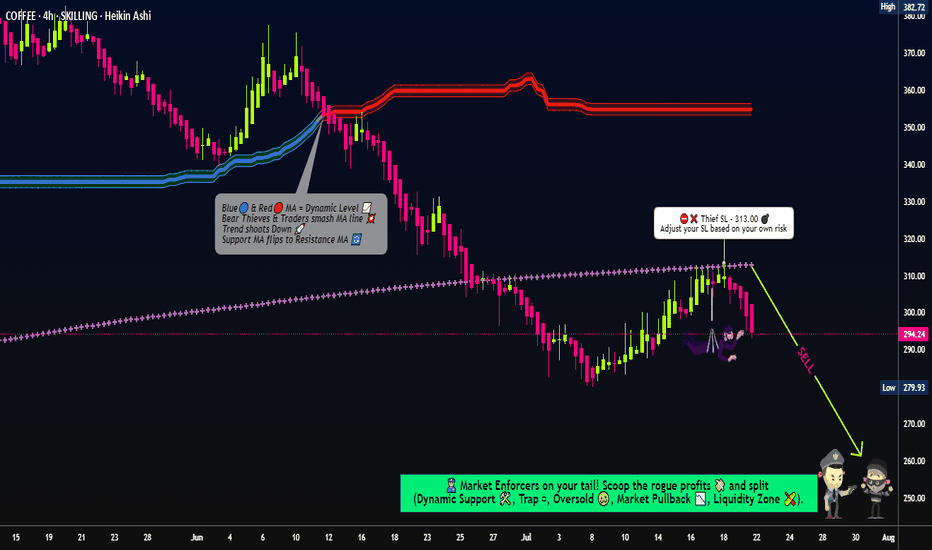

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee_setup

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Coffee - Is price going to drop from supply zone of feb 2022???Hey traders coffee is at highs of feb 2022, it does tend to drop in August to September time, and now were at this high commercials are selling coffee and id rather be on there side than retailers who are still buying.

So I am going to sell....

Please like comment and follow cheers

This chart material is for education purposes only / Demo account should be traded only

US Coffee - Clear Buy with S/L 186; Big move aheadEntry Level: $190

Stop Loss: $186

Target: $195-$199.00

Analysis:

The current entry level for initiating a short-term long position in US Coffee stands at $190. A prudent risk management strategy suggests setting a stop loss at $186 to mitigate potential losses in case of adverse price movements.

The target range for this long position is set between $195 and $199.00. This target zone reflects the anticipated price movement based on technical analysis indicators and market dynamics.

Traders should closely monitor price action and key support/resistance levels to assess the validity of this trading opportunity and adjust their positions accordingly.

Coffee Futures getting an uncommon sign of over extension.KC is hitting some fibs and speculators have been getting heavily long over the past 3 weeks as per COT data.

PMARP showing a good sign of over exuberance.

From what I can tell the consensus on it is that there's a big shortage and it cant go down, which is common across a few other commodities at the moment (CL etc). Consensus is rarely correct.

Much of the rally on this seems to have been supported by the "Bid everything, muh fed saving the economy" narrative that popped up last month.

A similar thing happened in 2008, Bear Sterns went under and JPM "saved the world", VIX got crushed to 16 (VIX is at 16.38 as of writing this) in the 4 weeks following, then we all know what happened from there.

Beware of big institutions saving the world narratives.

Coffee Short - Seasonal weakness starting For my coffee drinkers - Both Arabica and Robusta had a strong start to the year. However, seasonally a bearish phase starts from 22 Feb to 31 Mar. The technical price target was also reached yesterday. In the last 17 years we can observe a negative trend between 22 Feb to 1 Mar. Only in 5 out of 17 years did the coffee price rise during this period. On average, coffee loses around -3.75% in this period with a standard deviation of 6.92%.

What’s brewing with coffee futures?Like most commodities, London coffee futures saw a massive price uptrend in 2021. However, since the beginning of 2022, it's finally cooled off to an eight and half month low. As a silver lining, perhaps more interesting price action is currently heading our way.

With a very sharp fall during the last two weeks of February it's since consolidated, trading between $2,000 and $2,200 per metric tonne. As of writing, London robusta coffee futures (LRC) are trading at $2,099 per metric tonne.

For London coffee futures, May is typically a ranging month with price starting to pick up towards the second half of June. More often than not, highs of the year are made during the June and July months. However, seasonal trends will be butting up against the possibility that coffee prices are still overextended from 2021’s price hike.

Where could coffee prices reasonably head?

Looking at the daily chart with the Awesome Oscillator indicator, we can see some slight divergence. In spite of its undescriptive name, the Awesome Oscillator details trends and shifts in momentum. On the chart above, can see that the indicator is showing signs of a shifting momentum since the first week of March. With price consolidating, the indicator has slowly crept back up to its zero line, failing to keep correlation to the actual price and trend of the price chart. This could be a suggestion that price may make its way towards June and July highs. If so, the bigger question is if it will actually create the yearly high as well before making its way back down.

In respect to fundamentals, it has been noted that Brazil is currently harvesting a record setting yield of robusta coffee beans. However, the risk of frost hitting Brazil’s crop might not have been priced into its current trading price.

Start trading coffee futures with live and demo accounts today

Technical Outlook for the Coffee Market, backed by fundamentals.Fundamentals: The coffee Market has been in a strong bullish trend ever since a frost hit the brazil coffee belt in July / August 2021, followed by a period of drought. This left the world´s biggest producer of Arabica coffee with huge productivity losses for the 2021/2022 crop. That results in a really tight Arabica balance sheet for 2022, which could get worse through re-openings of coffee-to-go shops after Covid-19 lockdowns. The tense global logistic situation with low vessel space, exploding freight rates and shortage of containers and truckers is fuel to the already burning fire of less coffee supply than demand.

What can be examined from this is, that roasters tap into certified coffee inventories drowning them to 10-year lows, an extremely bullish factor ever since.

Technicals: Prices stay in an uptrend channel, that can be divided into a major channel and two minor ones. The structure stayed between those two lines while completing several Elliott-Waves. After a new ABC correction from the 160,00 cts high, prices could start a new 5-Wave up to test the upper line of the major channel at ~175,50 cts. The certified inventories sliding below the magical number of 1 million bags would support this move.

Certified Coffee Inventory

bilderupload.org

Chart

LKNCY Repeating MA patternIt can be seen after the MA arrives and makes a small turn towards the upside, price immediately follows

This can be observed on the latest MA (yellow)

The price is within a Rising Wedge (a bearish pattern) but this observation of the MA's give me hope for a bull breakout, as can be seen with each MA in the past

Coffee (KC); Let's get ready to break out those SHORTs ...... Again. Wait for it, tough! Let the U$D bottom vs. the Real, first, this being a pure currency play on the USD/BRL. (Fundamentals don't matter here; The market is balanced, nothing is happening - despite the occasional make-belief news flashes to the contrary.)

Made an awful lot of money on the way up here ;-) and now, it's time to cash in on the upcoming sell-off.

COFFEE - LONG (for now); Free coffee for your Great Depression!Could Coffee drop to $0 (or even go negative), much like crude oil did not too long ago??... You be the judge.

While currently long (a generational speculative bubble and all), this is likely the one to watch for one of the greatest Short Setups in ages!

Here is the Monthly. See it, yet?...

No?!

The Quarterly;

How about now?

Still no?! Let me zoom in for you.