“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

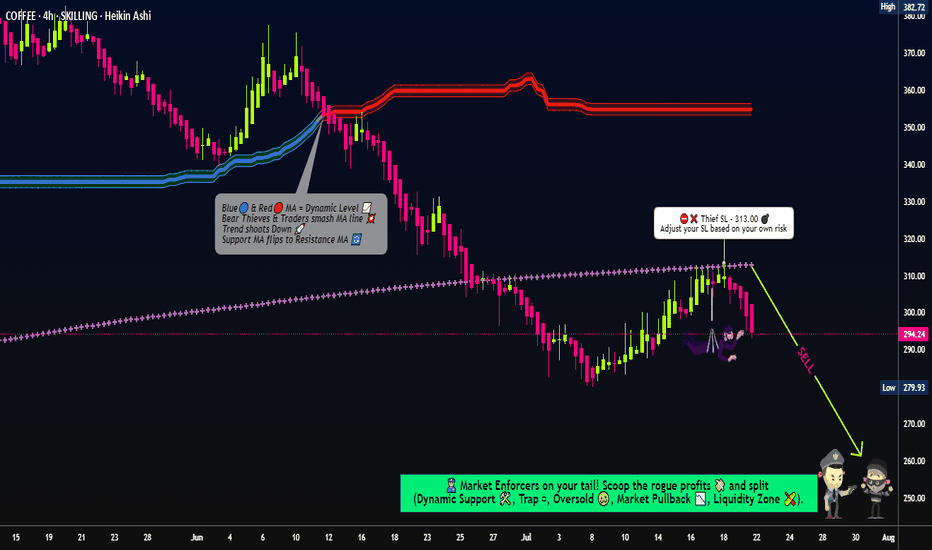

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee_trading

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Coffee - Is price going to drop from supply zone of feb 2022???Hey traders coffee is at highs of feb 2022, it does tend to drop in August to September time, and now were at this high commercials are selling coffee and id rather be on there side than retailers who are still buying.

So I am going to sell....

Please like comment and follow cheers

This chart material is for education purposes only / Demo account should be traded only

Not So Little Brother ? NYSE:BROS +3.85%on 05/06/24 is a powerful contender for Starbucks customers. Living in southern California, I've started seeing DutchBros popping up around town (are they any good?). One thing for sure they've gotten right is their amplified focus on delivering the best customer experience. One thing that the NASDAQ:SBUX Starbucks former CEO Howard Schultz asked his former company to refocus on. It's so good that Tiktokers started making videos poking fun at the friendly nature of the Dutchbros employees.

With all of that being said, it's working for them and very well. They've opened 159 new shops in 2023, and according to Placer.AI, "While the growth of Starbucks' foot traffic has been shrinking since last year, Dutch Bros' growth in traffic has been accelerating." also, Earnest Analytics reports, Dutch Bros. accounted for 6% of U.S. consumer spending on coffee and other premium drinks. Up from 4% at the end of 2020. Last year's revenue was up about 31%

This is my Strategy:

Using Bollinger Bands and Fibonacci Retracement, we see increased trade volume and volatility as the price rises above the SMA and towards the upper band. The price is currently $28.34. We can expect it to reach a price target of $31.16 (test strategy here) before retracement or reversal, as the shares may be near overbought status.

This will give us a $2.82 profit per share. If sold

Enter at price targets: $27.33 (low) and $29.92 (max)

Hold for the price to cross $32.90 for uptrend confirmation.

(FYI, analyst target maintains $33.00/share)

It is one of my favorite stocks, and I'll watch its performance closely this year.

US Coffee - Clear Buy with S/L 186; Big move aheadEntry Level: $190

Stop Loss: $186

Target: $195-$199.00

Analysis:

The current entry level for initiating a short-term long position in US Coffee stands at $190. A prudent risk management strategy suggests setting a stop loss at $186 to mitigate potential losses in case of adverse price movements.

The target range for this long position is set between $195 and $199.00. This target zone reflects the anticipated price movement based on technical analysis indicators and market dynamics.

Traders should closely monitor price action and key support/resistance levels to assess the validity of this trading opportunity and adjust their positions accordingly.

Coffee - SHORTSeasonal tendencies are working against this, paired with U$D pressures as those continue to build.

Beyond that, world production is in steady decline with visible crisis levels looming on the horizon (within a decade). This is mostly due to radically increased UV levels in coffee growing regions, paired with a rapidly declining global work force.

Coffee getting cheap!markets looking weak here long way down, good for coffee shops bad for farmers.

Coffee Short - Seasonal weakness starting For my coffee drinkers - Both Arabica and Robusta had a strong start to the year. However, seasonally a bearish phase starts from 22 Feb to 31 Mar. The technical price target was also reached yesterday. In the last 17 years we can observe a negative trend between 22 Feb to 1 Mar. Only in 5 out of 17 years did the coffee price rise during this period. On average, coffee loses around -3.75% in this period with a standard deviation of 6.92%.

Coffee price keeps the negativity – AnalysisCoffee price provided more negative closings by consolidating below 178.00 resistance, to start reacting to the major indicators by declining towards 159.40, expecting to continue forming negative crawl and attempt to touch 154.00, while breaking this obstacle will extend trades towards 147.10 to face the historical support that appears on the chart, assuring the importance of monitoring its behavior to manage to detect the next main trend.

#COFEE- SHORT OPPORTUNITYIn anticipation of the recession, coffe begins to lose value as smart money is moved from these commodities to safer places.

Meanwhile, an upward breakout was attempted on the descending pattern, but the deviation was apparently a fake-out, which means that we will soon have a retest of the support and if it is broken, we can go on short until the next . support.