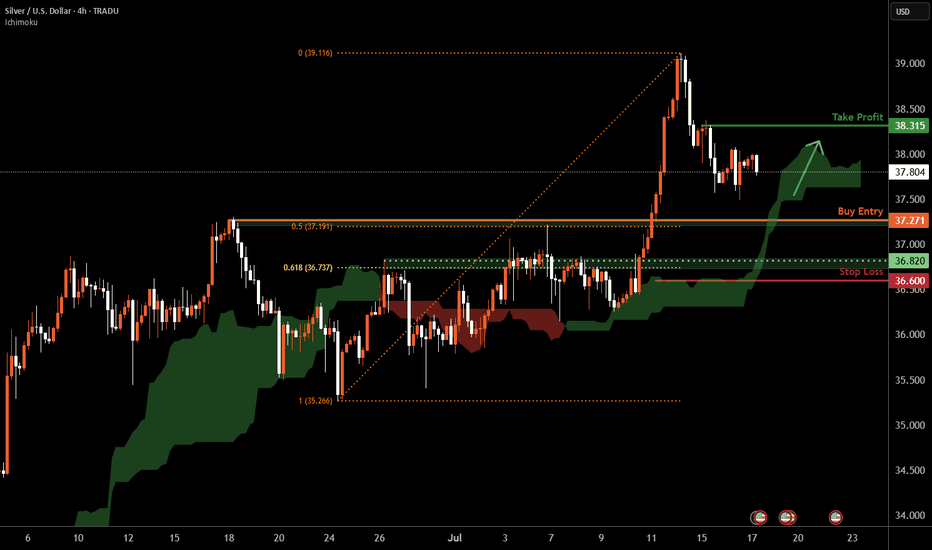

Silver H4 | Falling toward a pullback supportSilver (XAG/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 37.27 which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss is at 36.60 which is a level that lies underneath a pullback support and the 61.8% Fibonacci retracement.

Take profit is at 38.31 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Commodites

Levels to watch out I’ve exited my long positions and am staying on the sidelines for now. I won’t be selling into the current strength just yet, as there’s still room for exhaustion around the 2850 level. I’ll consider entering shorts if the market closes below 2725, with targets closer to 2000.

History is likely to repeat itself, with retailers jumping into the FOMO at 3000.

Silver H4 | Approaching overlap resistanceSilver (XAG/USD) is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 30.67 which is an overlap resistance that aligns close to the 50.0% Fibonacci retracement level.

Stop loss is at 31.10 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 29.79 which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Silver H4 | Rising into pullback resistanceSilver (XAG/USD) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 29.79 which is a pullback resistance that aligns close to the 23.6% Fibonacci retracement level.

Stop loss is at 30.90 which is a level that sits above the 50.0% Fibonacci retracement level and an overlap resistance.

Take profit is at 28.86 which is an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Silver H4 | Potential bearish reversalSilver (XAG/USD) has reversed off a resistance zone identified by the 38.2% Fibonacci retracement and the red Ichimoku Cloud, and could potentially drop lower from here.

Sell entry is at 31.17 (at market).

Stop loss is at 32.25 which is a level that sits above the 50.0% Fibonacci retracement level and a swing-high resistance.

Take profit is at 29.79 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

stock drop was forewarned by goldStocks to gold ratio had dropped weeks before the spx in dollars had turned.

Was the gold buying a signal that safe haven collateral was in demand?

In a panic, both stocks and gold can be sold as investors need more and more liquidity in falling markets. So gold is not necessarily an inverse asset to stock, keep this in mind.

In most major sell offs, gold tends to outperform as central banks react to restimulate after a crisis, so the gold move could be implying some weakness coming and a move to safety. Dollar devaluation down the road or more debt is the reason gold later rises.

Its good practice to look at stock indices compared to other commodities to get a better big picture view of what is happening.

EU faces pressure to defuse mounting anger as farmers protest aGiven the mounting anger and protests by farmers across Europe, there appears to be a significant challenge stemming from contradictory and potentially detrimental agricultural policies. The grievances include increased costs for agricultural diesel, additional fees for water consumption, complex regulations, and objections to bans on pesticides and herbicides mandated by the EU's Green Deal. The farmers are also concerned about the import of beef from countries like Brazil and Argentina, which they argue have laxer rules on animal welfare, making competition difficult.

This unrest, originating in France but spreading to neighboring countries, signals a broader issue with unpredictable government decisions affecting agriculture. In the Netherlands and Germany, similar protests have arisen over regulations to cut nitrogen emissions and phase out fuel subsidies, respectively. In Germany, there is also resentment over what is perceived as the unfair application of environmental policies.

With protests extending to Poland, Romania, Slovakia, Hungary, and Bulgaria, concerns range from unfair competition from cut-price cereals to high taxes and tight regulations. The impact of droughts, floods, and wildfires, combined with the squeeze from green policies, has fueled discontent.

For investors, this could be a pivotal moment to consider commodities such as cereals, soybeans, and copper. The disruptions in European agriculture may create fluctuations in the market, making these commodities potentially attractive for investment. However, it is crucial to monitor developments closely as tensions continue to grow, and the agricultural sector shapes up to be a major issue in the upcoming European Parliament elections in June.

GS Commodity Index ChartLooking at the Goldman Sachs Commodity Index and how the prices went up dramatically from the Covid lockdown, i would say that there is still room for a final rally, before a major correction in 2024.

The chart is self-explanatory.

Looking forward to read your opinion about this.

XAUUSD 1:13 RR Swing Trade capturedHello Everyone. Lamda team recently captured a beautiful high probability swing trade after tapping on the extreme order block. As soon as the price mitigated it, we switched to M5 for CHoCH based entry. Please pay careful attentions to the markups on the chart.

Happy trading

Team Lamda

DXY - wide scenarioThe shallowness in the market corresponds to the movements of the dollar, which keeps valuations from mainly consolidating templates.

Due to the current situations in European countries and the increasing turmoil in the US. It may introduce a slight mix in the currency, crypto and commodity markets.

In the event that the US maintains its position and the rest of the mid-sized countries fall into economic problems then we could see relative to the scenarios presented on the chart an exit at the top and gain dollar dominance in the global market.

The second option is to carry this forward in time, consolidate the current movement beforehand and then build a formation that will kick this upward.

Follow the trend and react accordingly. The market could be crazy by the end of the year....

UPDATE: MEDIUM TERM OUTLOOK ON THE DOLLARWhat's up trading world! Hope you have been well & taking care of yourself in these uncertain economic times! I am back with another DOLLAR INDEX update, now I did say I would update at the end of June however, with 1st July being a Friday, I wanted to observe how the market plays out so I could give a move comprehensive update!

UPDATE:

1. Bearing my previous post in mind, we saw the dollar shoot upwards and this was due to the biggest interest rate hike by the Fed since 1994. Monkeypox cases have also remained small in number which has only boosted the dollar even more.

2. As a result of the above, we saw pattern ABC play out in June (see previous post) where point 'B' illustrated opportunities for optimal buy-entries and these signals were shared with my private community and we were able to have a lovely 1:4 risk-reward trade (+420pips) that smashed through relevant targets!

MOVING FORWARD:

1. The dollar doesn't plan on slowing down anytime soon, we will definitely be expecting a rate hike again in July, it is the only way to crumb the inflation and do a hard reset on the debt the US has accumulated.

2. Barring covid & monkeypox cases remaining below 10K per/day, the dollar will continue to soar as commodities continue their much-needed reset.

3. Unemployment (NFP) numbers coming this week will also be a key indicator and although we expect it to be higher than last month, should there be a drop, I don't believe the drop will be extensive enough to stop the dollar's rally.

Technical analysis:

1. For optimal BUY-entry opportunities moving forward, wait for pattern ABC to play out, with point-B signalling entry point for buy-trades however, given the strength of the dollar, it might not even retest our daily support but rather continue going up due to strong fundamentals & key institutional traders trade-positions that are pushing the market right now.

2. Whether there is a RETEST or not of our daily-support zone, should the above 'moving forward' conditions happen, expect the DOLLAR index to make its way to $108, a price level it hasn't reached in almost 20 years!!

Thanks for reading! Let's take advantage of the markets together! These are generational wealth times that we are living in, don't let them pass you by! :))

Oil to dropFor more daily detailed analysis, don’t forget to click on the follow button. Also, please ask any questions you may have and I will be happy to answer them.

We are still looking short on OIL. some traders asked should we be shorting higher...

The answer is YES but you must have correct risk management, allowing you to trade profitably over and over.

Short zone is noted and exit is too by annotated chart arrows + symbols.

Crude and Oil Stocks -

It's here, the massive collapse few experts warned about. Today, was proof that demand is much smaller than mainstream economists thought. Sure, June contracts are $21, but, that can change like it did today.

From here, what can we expect with oil being at $1 a barrel? Simple. Massive closures of oil fields and oil producers going bust. Remember that oil producers barely make it by on $40 a barrel oil, so, at -35 or $1 oil, it's a dead end.

Sell your stock in oil companies, wait to see what transpires from here and go into safe havens for now. I foresee another massive selling coming soon unless the Fed and PPT start buying and manipulating.

Next level of investment - It's Robinhood Gold, but free and FAR better. Tick by Tick updates and so much more plus 1 free stock.

act.webull.com