Bullish bounce off 50% Fibonacci support?USOUSD is falling towards the support levle which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 68.20

Why we like it:

There is a pullback support that lines up with the 50% Fibonacci retracement.

Stop loss: 65.68

Why we like it:

There is a multi swing low support.

Take profit: 71.06

Why we like it:

There is a swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Commodities

PROP - Riding the Cycle? The Next Wave May Just Be Starting!Markets move in cycles; and PROP is no exception.

If you’ve been following our previous analyses, you’ll recognize the accumulation zone we highlighted earlier. Well, this updated chart adds another layer: the cyclical rhythm of price action.

🔁As shown, PROP has been moving in clearly defined waves, bouncing between key zones with consistency. The current cycle appears to have bottomed — once again — inside the lower bound, where strong demand continues to hold.

We’re now in the early phase of what could be a fresh bullish cycle. If the rhythm plays out as before, the path of least resistance could take us toward the median zone ($6.5 - $7.5) and possibly all the way back to the upper bound ($15 - $17) by late 2025 or early 2026.

🔍 Supporting Fundamentals

While the chart speaks volumes, the fundamentals back it up:

Energy demand is surging globally, fueled by AI, data centers, and electric infrastructure — all of which require massive power capacity.

Oil and gas remain essential in this transition phase, especially with renewable infrastructure still years away from matching base-load demand.

PROP (Prairie Operating Co.) controls 65,000 acres in the DJ Basin — one of the most productive oil regions in the U.S. With advanced drilling tech and low-cost operations, PROP is well-positioned to ride out volatility and capitalize on rising demand.

🎯 Key Zones to Watch

- Support: $2.5–$3

- Median target: $6.5–$7.5

- Macro resistance: $15–$17

📌 We’re not just seeing structure — we’re seeing rhythm, confluence, and timing align.

If this cycle continues to play out, PROP might just be preparing for its next major wave.

Are you ready to catch it?

🧠 Previous posts and technical breakdowns are attached for full context.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

GOLD ROUTE MAP UPDATEHey Everyone,

Quick follow up on our 1H chart route map:

What can I say.....pure perfection on our chart analysis as everything played out exactly as expected.

Yesterday, we identified the first level of the swing range at 3289, which delivered a clean full swing into 3305.

Today, we hit Level 2 of the swing range at 3267, and once again, it played out flawlessly with another full swing up to 3305.

A perfect finish to the day. Great work all around!

We are now looking for support above the swing range and a break above 3305 to track the movement up or further retest and break below the 1st level of the swing range may open the the 2nd level at 3267 again.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267 - DONE

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD Local Short! Sell!

Hello,Traders!

GOLD made a retest

Of the horizontal resistance

Of 3313$ and we are already

Seeing a bearish reaction and

We will be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD → Retest of resistance within a bearish runFX:XAUUSD breaks through the upward trend support amid a rallying dollar. Since the opening of the session, the price has been testing the zone of interest, but bears are quite aggressive...

Gold is partially recovering after falling to $3,268, a monthly low caused by the Fed's hawkish tone. The Central Bank kept its rate at 4.25–4.5% (9 votes to 2), highlighting uncertainty due to Trump's tariffs. Markets now estimate the probability of the rate remaining unchanged in September at 58% (previously 35%). The dollar's rise slowed amid concerns about the extension of the US-China trade truce and profit-taking ahead of key US employment data (after strong ADP and GDP reports). The nearest drivers are labor market statistics and trade news, while the technical picture for gold remains bearish.

Technically, on D1, the price is breaking key support zones, including the trend line, which overall only increases selling pressure on the metals market...

Resistance levels: 3310, 3320, 3334

Support levels: 3287, 3267, 3255

As part of the correction, the price has exhausted the entire daily ATR, forming a retest of the liquidity and interest zone. If the bears keep the price below 3320-3310, gold may head towards support...

Best regards, R. Linda!

SILVER: Will Go Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 36.490 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 36.231..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Is Wheat ZW1 Ready for a Long Trade? Key Demand Area InsightsThe futures of Wheat ZW1! are reaching a weekly demand zone, where we observe non-commercials going long and retail traders holding short positions. This could present a potential setup for a long trade. Note: There is another demand area below, but the positions of commercials are less clear compared to non-commercials and retail traders.

Always manage your risk carefully if you agree with my analysis, and be sure to develop your own trading plan.

✅ Please share your thoughts about ZW1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GOLD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 3,296.556 will confirm the new direction upwards with the target being the next key level of 3,310.375 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Gold Struggles at Resistance – Indicates Lower Lows AheadGold has been in a clear downtrend after facing a strong rejection around the 3,438 level (main resistance zone). Price is currently moving within a descending channel, confirming the formation of lower highs and lower lows – a classic bearish market structure.

Currently, Gold is trading near 3,306, facing resistance at 3,339 (marked as a possible lower high). If price fails to break above this level and sustain, there is a strong probability of continuation towards 3,249 and even 3,216.

Key Technical Highlights

- Immediate Resistance: 3,339 – 3,353

- Support Levels: 3,301 (short-term), 3,249, and 3,216

A rejection near 3,339 can lead to another leg down targeting 3,249 and 3,216. However, a strong breakout above 3,339–3,353 could temporarily shift momentum towards 3,394.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold Sell Setup - M15PEPPERSTONE:XAUUSD

Timeframe: m15

Risk Level: Medium

🔹 Setup:

Price is testing the upper boundary of the descending channel.

📈 Entry:

Current price zone: 3302.5

🎯 Targets (TP):

TP1: 3393

TP2: 3283

TP4: 3264

TP6: 3244

⛔ Stop Loss (SL):

3312.2

#XAUUSD #GOLD #SELL #Signal #MJTrading

Psychology Always Matters:

Gold Crashing After Hot U.S. Data – More Pain Ahead?Minutes ago, important indices were released from the US , which catalyzed the continuation of gold's downward trend .

Key U.S. Economic Data Just Dropped!

ADP Employment: 104K

GDP q/q: 3.0%

Both came in stronger than expected , signaling that the U.S. economy is holding up better than many thought!

Strong job growth

Solid economic expansion

The result? A stronger U.S. dollar ( TVC:DXY ) and potential downward pressure on Gold .

All eyes are now on FOMC meeting .

Will the Fed still hint at future rate cuts despite the solid data? Or is the easing cycle officially on hold? What is your idea!?

----------------------

Gold ( OANDA:XAUUSD ) has already managed to break the Support zone($3,350-$3,326) , Monthly Pivot Point , 50_EMA(Daily) , Support lines , and the lower line of the ascending channel . Also, Gold trading below $3,333 plays an important role for me, which can increase the possibility of a continuation of the downtrend .

I expect Gold to drop to at least the Potential Reversal Zone(PRZ) before the FOMO meeting and if the Support zone($3,307-$3,272) is broken, we can expect further declines to $3,253(Second Target) .

--------------------------------

Information we need to know:

How should the Federal Funds Rate be announced to cause a deeper drop in Gold ?

The Fed needs to take a hawkish stance — meaning:

They keep rates unchanged, but make it clear they intend to keep them elevated for a prolonged period.

They emphasize strong economic data like today's solid ADP and GDP numbers .

They express concern that inflationary risks remain, and cutting rates isn’t on the table anytime soon.

In this case, markets get disappointed, rate cut hopes fade, and gold drops as real yields( TVC:US10Y ) rise and the U.S. dollar strengthens.

--------------------------------

Note: Stop Loss (SL) = $3,340

Gold Analyze (XAUUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Is the surge in crude oil bulls here a comeback?The news-driven support for crude oil's recent rally is almost exhausted, so we'll continue to adopt a buy-low-sell-high strategy today, using a small stop-loss to maximize profits.

Short at $71.20, with a stop-loss at $71.70 and a take-profit at $69.20. (For aggressive shorting, try shorting at $70.95).

The above strategy is Charlie's personal opinion and is for reference only. If you follow suit, please be cautious and use a stop-loss to protect your position. TVC:USOIL FOREXCOM:USOIL TRADU:USOIL TRADU:USOIL

Gold Spot / U.S. Dollar Analysis (15-Minute Chart)Key Levels

Support Levels:

Immediate: 3,294.000 (S/L level)

Next: 3,280.000

Resistance Levels:

Immediate: 3,304.000 (Entry level)

Next: 3,308.000, 3,316.250, 3,320.000

Profit Targets:

Tiered levels up to 3,328.000 (highest target).

Price Action & Trends

Current Trend:

The price is bullish (+0.84% today) but hovering near the entry level (3,299.000) and testing 3,302.700.

The presence of multiple profit targets above suggests a bullish bias in the trade setup.

Critical Observations:

Price recently dipped to 3,294.000 (S/L) but rebounded, indicating buying interest at support.

The 3,304.000 level (entry) now acts as resistance. A breakout above could target 3,308.000+.

Volume & Momentum:

Not visible in the screenshot, but the upward movement suggests moderate bullish momentum.

Trade Setup Analysis

Entry: 3,299.000

Stop-Loss: 3,294.000 (5 USD below entry)

Profit Targets:

3,304.000 (Breakeven+)

3,308.000 → 3,328.000 (Scalping opportunities).

Risk-Reward Ratio:

If targeting 3,328.000, the RR is ~5:1 (29 USD profit vs. 5 USD risk).

Actionable Insights

Bullish Scenario:

Hold if price sustains above 3,304.000 (entry resistance).

Next target: 3,308.000.

Bearish Caution:

If price falls below 3,294.000 (S/L), exit to limit losses.

Watch for rejection at 3,304.000 (potential reversal).

Market Context:

Gold is sensitive to USD strength and geopolitical events. Monitor broader trends for confirmation.

GLD – Why Gold Is a Clear Short to MePrice moved from the Lower Median Line (L-MLH) up to the Centerline, fulfilling the 80% rule.

Then we had two Hagopians, which sent price right back to the Centerline.

After the breakout above the Centerline, the next target was the Upper Median Line Parallel (U-MLH), which was reached rather quickly.

Finally, price broke above the U-MLH and was pulled up toward the Warning Line (WL).

Is this the end of the happy story?

I think so—because Gold has now reached its 2nd standard deviation, and there’s probably no more gas left in the tank.

The Trade:

- A logical target is the U-MLH.

- A secondary target is the Centerline.

At the very least, if you're long, this might be a good time to take some profits—because no tree grows to the moon.

For further details, I will follow-up with a Video explanation - See my Signature.

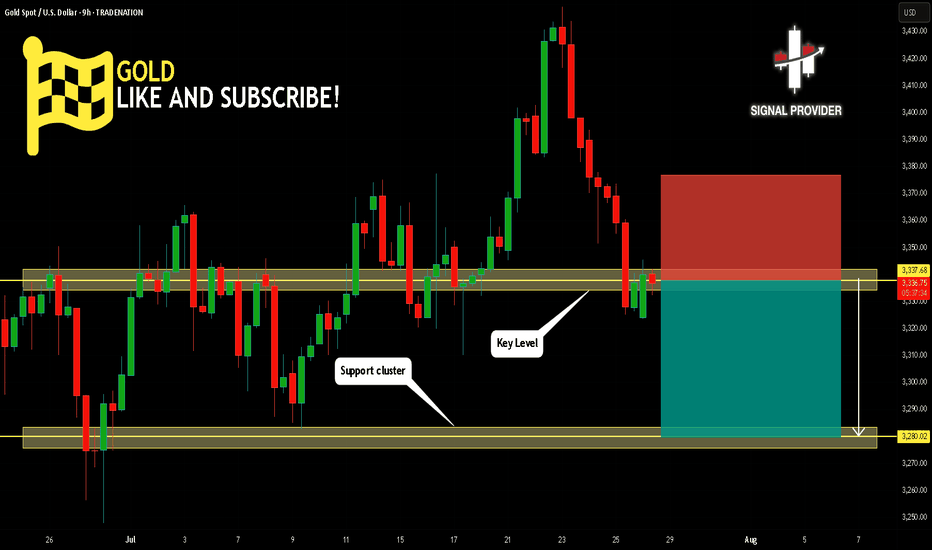

GOLD Will Move Lower! Sell!

Here is our detailed technical review for GOLD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 3,337.68.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,280.02 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DeGRAM | GOLD reached the $3300 level📊 Technical Analysis

● XAUUSD remains capped below a broken trendline retest near 3,355, while price forms a lower-high inside a descending channel.

● The repeated rejection of the 3,357.83 resistance level, coupled with failed bullish continuation, points to renewed downside toward 3,300 and 3,262.

💡 Fundamental Analysis

● A rebound in the DXY after strong US consumer sentiment and pending home sales adds pressure to gold, reaffirming real-yield strength.

● Traders are reducing long exposure ahead of upcoming NFP data and Powell’s next statement, shifting bias away from risk hedges.

✨ Summary

Short bias below 3,355. Break under 3,320 eyes 3,300 → 3,262. Key breakdown risk if lower trendline fails.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

USOIL IS GOING BULLISH. FOR HOW LONG?USOIL IS GOING BULLISH. FOR HOW LONG?

Brent has started this week with a strong bullish momentum and holds near 6-week high on supply fears. President Trump announced plans to impose tariffs on Indian exports and penalize its Russian oil imports. In a parallel move, the US introduced its most extensive sanctions on Iran in seven years. The United States has even offered its oil to the world in exchange for Iranian and Russian oil, but there is evidence that the US production capacity is now at historic highs and is unlikely to grow in the near future.

However, technically oil shows us bearish divergence on RSI and bearish wedge here. The price may reverse towards 6,900.00 as a first target. EIA data showed US crude inventories jumped by 7.7 million barrels last week—the largest increase in six months and defying forecasts for a decline. Market participants are waiting for the OPEC+ meeting this week, expecting a significant output hike.

Short selling remains the main themeGold hit a low of around 3267 yesterday and fluctuated until closing at 3274. Gold fluctuated upward at the opening today. Currently, gold is fluctuating around yesterday's rebound point of 3305. This is the resistance we need to pay attention to in the short term.

From the 4H analysis, today's short-term resistance is around 3305-3315. If gold wants to rise, it needs to stabilize above 3315. Focus on the 3335 first-line pressure, and rebound to the 3305-3315 resistance area during the day. You can consider shorting and follow the trend to see the decline unchanged, looking towards 3290-3280. Rely on this range to maintain the main tone of high-altitude participation. For the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

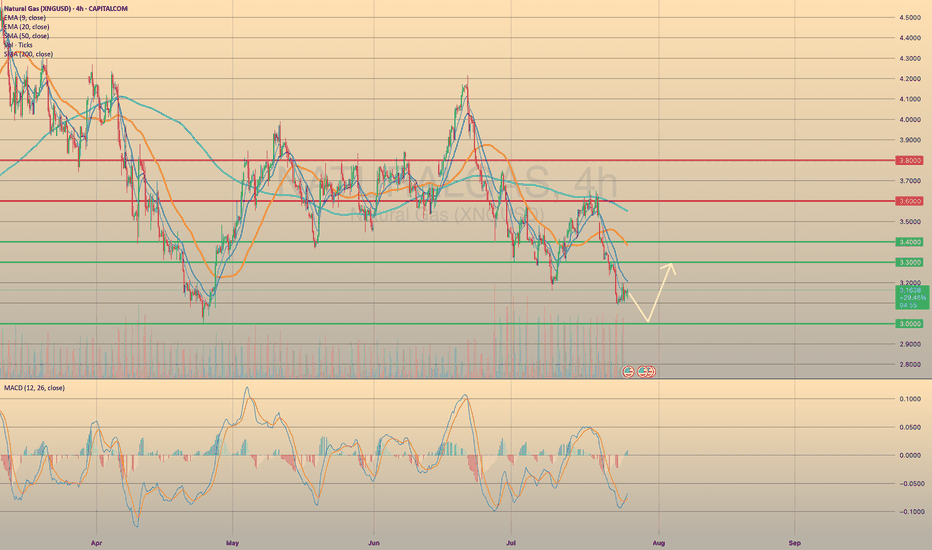

XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?

Recent bearish impulse started at the beginning of this week may come to an end soon. Yesterday the U.S. Natural Gas Storage report came out. Numbers appeared to be lower than expected and lower than previous. (23b vs 28b vs 46b). This is bullish signal for the market participants. Minutes after the report came out, market reacted bullish, however, soon price went sideways.

Right now gas prices continue to decline. Still, the opportunity for short-sellers here is quite limited. Not so far below there is a level of 3.0000, form where I expect the price to rebound, supposedly to a 3.3000.

Gold 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3318

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.