Gold Eyes Breakout From 3-Month Consolidation After reaching its record high of 3500 in April 2025, Gold entered a contracting consolidation phase for more than 3 months now, bounded between the 3500 resistance and 3100 support. This structure sets the stage for a breakout, with price action tracing five waves—raising the probability of another leg higher.

• Bullish Scenario: A close above the 3450 level could open the door to 3780 and even 4000, aligning with the broader monthly cup-and-handle formation target.

• Bearish Scenario: A close below 3300 could expose the market to downside risks, with potential retracements to 3280, 3250, 3200, and 3130.

Written by Razan Hilal, CMT

Commodities

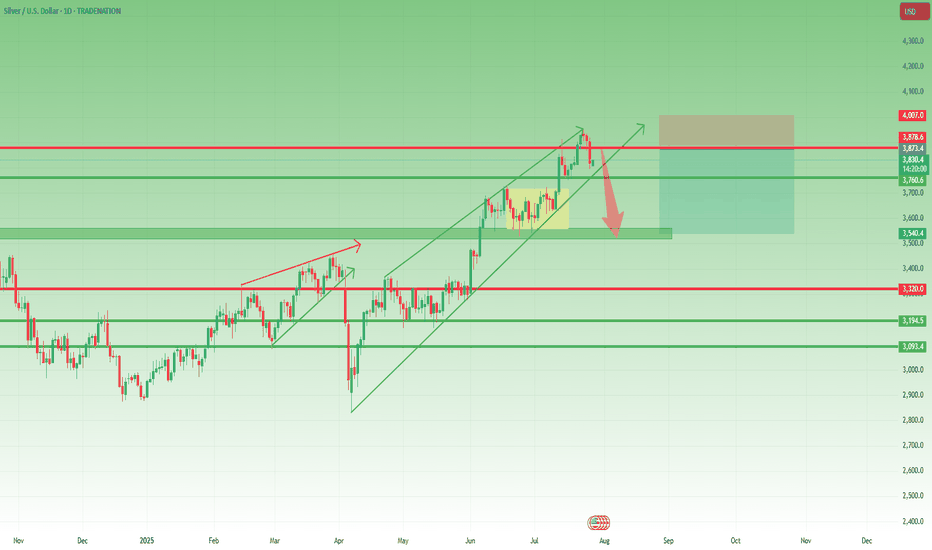

Silver Signals Pullback Risks From $40 BarrierFrom a fundamental standpoint, the strength seen in both tech and silver markets in 2025 may be supported by the structural integration of AI and innovation into global economic agendas. As AI and technology increasingly become the backbone of global infrastructure and development, demand is likely to remain strong.

Silver is currently retreating from the $40 psychological zone, the 39.50 high, which aligns with the target of an inverted head and shoulders pattern formed between August 2020 and March 2024.

• Pullback Scenario: In line with weekly overbought momentum as per the RSI indicator, a retracement may target support levels at $37, $36.20, and $35.20 before resuming its broader bullish trend.

• Breakout Scenario: A confirmed close above $40 may open the door to $42, $46, and potentially a move beyond $50.

Written by Razan Hilal, CMT

XAGUSD – Reversal Signs After the Run Toward $40Lately, I’ve been a strong advocate for a Silver rally toward $40, and indeed, we got a solid move, with price reaching as high as $39.50, not touching 40 though...

Just like with Gold, the last 3 days of last week turned bearish, and now it looks like we may be entering the early stage of a correction.

📉 Current Setup:

- The rejection from $39.50, right below the psychological $40 level, is significant

- I’ll be monitoring for a possible short entry if we get a rebound into the $38.80–$39.00 zone

- A new high above $39.50 would invalidate this setup

📌 On the downside, if price breaks below the confluence support at $37.70–$38.00, that would confirm the reversal and could lead to an acceleration toward $35.50 support

Conclusion:

The bullish narrative on Silver is pausing here. Until a new high is made, I’m looking to sell the bounce and follow the momentum if the breakdown under support is confirmed.

Let’s see how this plays out this week. 🧭

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

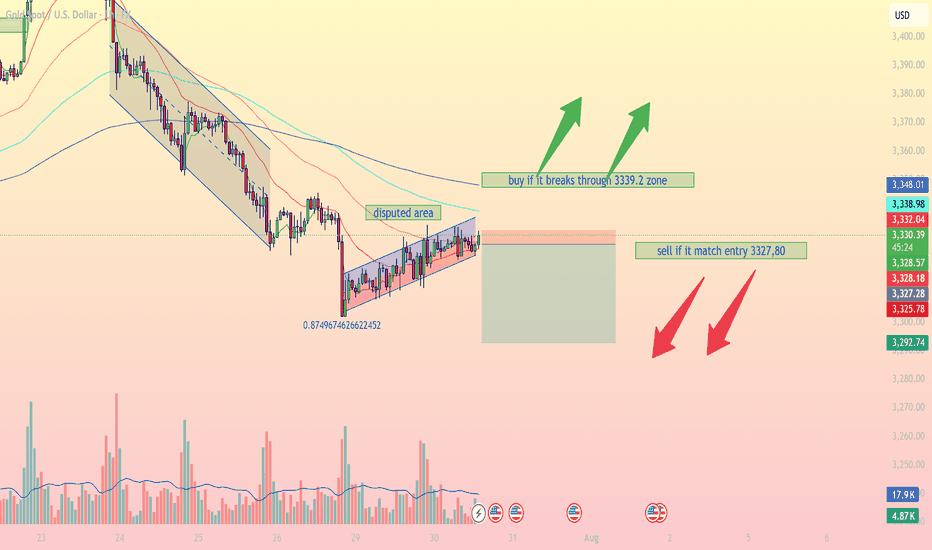

[XAUUSD – Intraday Price Action Outlook | 30 July 2025Gold (XAUUSD) is currently trading around 3,329 USD and is consolidating within a narrow rising channel after completing a significant downtrend. The market is showing signs of a potential breakout, either to continue a short-term bullish correction or resume the dominant bearish momentum.

Key Technical Zones:

Resistance zone: 3,339.2 – 3,348

This is a critical zone where bullish breakout confirmation is likely to attract momentum buyers. The zone aligns with upper trendline resistance and previous consolidation highs.

Support zone: 3,325.6 – 3,292.7

This range acts as a short-term support base, marked by multiple rejections and aligned with the lower boundary of the current rising wedge formation. A breakdown here could trigger strong bearish continuation.

Indicators & Confluences:

EMA200 (blue): Acting as dynamic resistance, slightly above current price.

EMA50 & EMA100: Compressing toward current price action, indicating price equilibrium and coiling volatility.

RSI (not shown): Likely hovering near 50 – signaling market indecision.

Fibonacci 0.874 has been tagged – often a zone where false breakouts or liquidity grabs occur, demanding caution.

Trading Strategy Suggestions:

Bullish Scenario (Breakout Strategy)

Entry: Buy only if price closes above 3,339.2 (confirmed breakout of wedge).

Stop-loss: Below 3,328.1 (previous supply turned demand).

Target: 3,370 – 3,392 zone (aligned with EMA200 breakout & prior structure).

Note: This setup relies on confirmation and should not be anticipated early. Wait for candle close above 3,339.2 to invalidate current wedge structure.

Bearish Scenario (Rejection & Breakdown Strategy)

Entry: Sell if price rejects 3,330–3,332 area and returns below 3,327.80 (as marked).

Stop-loss: Above 3,332.04 (above trendline and EMA cross).

Target: 3,292.74 (volume node + base of channel).

Risk/Reward: >7.0 (based on current tool parameters shown in chart).

This is a favorable setup if price respects current wedge resistance and fails to breakout convincingly.

Conclusion:

Gold is at a decisive point. The formation of a rising wedge in a prior downtrend signals potential bearish continuation, but a breakout above 3,339.2 could trigger a reversal short-term. Both bulls and bears need confirmation before entering. Monitor volume closely — rising volume on breakout/breakdown will validate either scenario.

XAUUSD H4 | Heading into pullback resistanceBased on the H4 chart analysis, the price is rising towards the sell entry, which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop to the take profit.

Sell entry is at 3,354.73, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 3,383.55, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

Take profit is at 3,311.79, which is a multi-swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Gold Price Analysis July 30Gold (XAUUSD) Consolidating in a Triangle Pattern – Preparing for a Big Breakout

Currently, gold is moving within a triangle consolidation pattern, reflecting the market’s indecision as investors await a series of important economic data from the US this week. This hesitation suggests that a breakout from the triangle pattern could trigger a strong FOMO effect, creating a significant price movement in either direction.

The current price action is similar to a “bull flag” or “pennant” pattern, where a breakout could lead to a clearer and more decisive trend. If the support zone in the pattern fails to hold, the possibility of a sell-off is high.

Trading scenario:

🔻 Activate SELL order:

When price breaks the triangle bottom around 3324

Downside target: 3285, further is the strong support zone at 3250

🔺 Activate BUY order:

When price breaks and holds above the resistance zone 3333

Or: when there is a bearish rejection signal and candle confirmation at the area 3385

Gold - Powerful RunAfter its powerful run, gold has shown signs of fatigue, stalling near technical resistance between $3,330–$3,350 per ounce in late July. Analysts warn that while the bullish trend remains intact on a structural level, daily volatility is high and some profit-taking or consolidation could continue unless new destabilizing events emerge.

Will the Rally Continue?

The Bull Case

Structural Demand: Multiple sources, including J.P. Morgan and other major forecast groups, predict gold’s structural bull case remains strong with average prices of $3,220–$3,675 per ounce likely through the end of 2025, and even $4,000 possible by 2026.

Ongoing Uncertainty: Persistent geopolitical risks, trade disputes, and fiscal pressures are expected to maintain robust safe haven flows into gold.

Central Bank and Asian Demand: Sustained buying by central banks and consumers in Asia could provide a solid floor below current levels.

The Bear Case

Interest Rate Dynamics: If central banks, especially the US Federal Reserve, hold or increase interest rates, gold could lose momentum, higher rates increase the opportunity cost of holding non yielding bullion.

Diminishing New Risks: Unless fresh economic or geopolitical shocks appear, further upside may be capped in the near term. Several experts predict gold may consolidate or trade sideways pending new catalysts.

Speculator Flows: Rapid speculative bets could lead to sharp corrections, particularly on technical breakdowns after such a strong rally.

Conclusion

The gold rally of 2025 has been driven by an unusual mix of global volatility, central bank behavior, and shifting investor psychology. While prices could pause or pull back in the coming months, the fundamental supports structural demand, central bank buying, and persistent global risks, suggest that the broader gold bull cycle is not yet over, with $3,000+ likely forming the new base for gold as we look toward 2026.

*NOT INVESTMENT ADVICE*

#gold #safehaven #uncertainty #economy #finance #trading #indicator

XAU/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, using a combination of trend lines, EMA, RSI, and price structure.

---

Technical Breakdown:

1. Price Structure:

Gold is forming a rising channel (black trend lines) within a short-term uptrend, but this is happening below the 200 EMA, which generally indicates bearish momentum.

A resistance zone is highlighted near the top of the channel, suggesting sellers might defend this level.

2. Key Level:

Resistance Level: Around 3,330–3,335 zone.

Target Point: Price is expected to break down from the channel and reach support levels near 3,284.35 and 3,282.51.

3. Moving Average (EMA 200):

Current price is below the 200 EMA (3,348.42), reinforcing a bearish bias.

4. RSI (14):

RSI is near 52.58, indicating neutral-to-slightly-overbought territory. No strong divergence is visible, but RSI is not confirming a bullish trend either.

5. Projection (Hand-drawn Path):

The drawn path shows a potential breakdown from the channel with a bearish impulse targeting lower support zones.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Confirmation Needed: Break below channel support

Entry Zone: Near the resistance of the rising channel (~3,330–3,335)

Target Zone: 3,284.35 – 3,282.51

Invalidation: Sustained break above 3,348 (above EMA 200)

plesse support boost 🚀 this analysis)

XUA/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 1-hour timeframe, targeting a move toward the $3,310–$3,315 support zone. Here's the full breakdown:

---

Technical Analysis – Gold (1H)

1. Fair Value Gap (FVG) Supply Zones

Two FVG supply zones are marked where price previously dropped sharply:

Upper FVG zone near $3,385.49 (with red arrow: expected rejection point)

Lower FVG zone near $3,352.47

Price is expected to reject from either zone, resuming the bearish move.

2. Market Structure: Lower Highs, Lower Lows

The chart shows a clear bearish structure, with consistent lower highs and lower lows.

The current price action suggests a potential pullback into FVG, followed by another leg down.

3. Key Support Zone (Target Area)

The yellow box between $3,315.22–$3,310.99 represents a strong demand/support zone and is marked as the target point.

This level has acted as a prior accumulation zone and is likely to attract buying interest again.

4. EMA 200 Resistance

Price is trading below the 200 EMA (currently at $3,365.87) — indicating a bearish bias.

EMA also aligns near the lower FVG zone, reinforcing the area as a potential reversal point.

5. RSI Indicator

RSI at 35.38 is nearing oversold territory but still shows downward pressure.

No divergence or reversal signal yet — supports the continuation view.

Mr SMC Trading point

---

Summary

Bias: Bearish

Current Price: $3,337.02

Supply Zones (FVG):

$3,385.49 (stronger supply)

$3,352.47 (minor supply)

Support Target: $3,315.22–$3,310.99

Structure: Bearish (LL-LH formation)

EMA: 200 EMA acting as dynamic resistance

RSI: 35.38 – still bearish momentum

---

Please support boost 🚀 this analysis)

Crude oil: Sell around 70.20, target 65.00-64.00Crude Oil Market Analysis:

Yesterday's crude oil market was very strong, with buying driving the market higher. The daily chart ultimately closed with a clear bullish candlestick. Buying on the daily chart is testing the resistance level between 70.00 and 70.60. After two consecutive days of bullish closes, and with clear bullish candlesticks, I predict another surge today. Let's look at the daily chart. The daily chart shows a significant rebound after a significant drop. Today, focus on selling opportunities between 70.00 and 70.60. A break of this level will change the overall selling trend. The strategy remains to sell high and be bearish.

Fundamental Analysis:

Today, focus on the ADP employment data and the EIA crude oil inventory data. The key news will be the interest rate results during the US trading session, along with speeches.

Trading Recommendations:

Crude oil: Sell around 70.20, target 65.00-64.00

Gold Contract Rolled!Now that the contract rolled We might get a bit more movement. Yesterday was nothing but a giant flag. I want to see price go sweep levels before turning full on bullish. We must keep in mind that we are at the end of the month as well. so price can end up stalling till next week. but tomorrow there is a lot of News pending. So that can really shake things up.

Bullish bounce off?The Gold (XAU/USD) has bounced off the pivot, which acts as a multi-swing low support and could rise to the 1st resistance, which is slightly below the 50% Fibonacci retracement.

Pivot: 3,310.45

1st Support: 3,288.74

1st Resistance: 3,362.86

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Crude oil starts to rise, are you ready?

💡Message Strategy

Oil prices continued their upward trend amid rising geopolitical risks. US President Trump recently issued a tough statement, demanding Russia end the conflict with Ukraine within 10 to 12 days or face secondary sanctions.

Fears that Russian crude oil exports might be disrupted pushed Brent crude oil prices close to $70 per barrel, marking their largest single-day gain in two weeks at 2.3%. Meanwhile, US West Texas Intermediate (WTI) crude oil prices also remained stable around $67.

The intertwined uncertainties of geopolitics and trade policy have complicated market sentiment. Besides the situation between Russia and Ukraine, investors are closely watching the August 1st trade policy deadline set by the United States and the upcoming OPEC+ meeting in early August, which will determine its September crude oil production increase plan.

The industry generally expects that despite tight crude oil inventories in some parts of the world and strong peak season consumption in the Northern Hemisphere, if OPEC+ continues to increase production, oversupply pressure will gradually emerge by the end of the year.

📊Technical aspects

From a technical perspective, the daily chart of US crude oil (WTI) shows a modest upward trend. The current price is trading steadily above its 100-day moving average, indicating continued bullish momentum.

The Relative Strength Index (RSI) remains between 55 and 60, remaining within overbought territory, suggesting further upside potential. A successful break above the key resistance level of $68.50 would open up opportunities towards $70.

💰Strategy Package

Long Position:66.50-67.00,SL:65.50,Target:68.50-69.00

Gold Bear Flag Forming After Trendline Break – Short Setup BelowGold (XAUUSD) recently broke a major ascending trendline that had held since late June, leading to an aggressive sell-off from the $3,440s down to the $3,270 zone.

Following that, price is now consolidating just beneath the previous support trendline, forming what appears to be a bear flag or rising channel inside a corrective structure.

The $3,330–$3,340 zone is now acting as resistance, and price is struggling to close above this level.

The current structure suggests continuation to the downside, with clean space to revisit the $3,271 liquidity pool and potentially even sweep that low.

Watch for bearish confirmation below the current flag – especially if price prints a rejection wick or engulfing candle at the upper edge of the box.

⸻

Key Levels:

• Resistance: $3,330 – $3,340 (flag top + previous support turned resistance)

• Support: $3,271 zone, followed by $3,248 sweep potential

⸻

Trigger Criteria:

• Bearish rejection inside the flag (e.g. pin bar or engulfing)

• Break and retest of the flag bottom or horizontal support

⸻

Risk Note:

A clean break back above $3,350 and reclaim of the previous trendline would invalidate this idea short term and shift bias back to neutral/bullish.

Gold - Short Setup Off Major Trendline Rejection📉 Gold - Short Setup Off Major Trendline Rejection

Gold has broken down through the rising trendline and is now retesting it — the moment of truth! 🧐

🔻 Short Entry: 3,336

🎯 Target: 3,236 (Fib 1.0 + HVN gap fill)

🛑 Stop: 3,346 (Above trendline retest)

⚖️ Risk/Reward: ~1:10

📊 Bonus: High volume node above adds resistance. Bearish volume profile structure confirms the breakdown bias.

Watching for volume to pick up on the move down. Let's see if GC bleeds into August. 🩸📆

GOLD BEARISH BIAS|SHORT|

✅GOLD broke the rising

Support line which is now

A resistance and the price

Is retesting the line now so

We are locally bearish biased

And we will be expecting a

Local move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY 30Min Engaged ( BULLISH & Bearish Break Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Break- 148.750

🩸Bearish Break- 148.370

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

SILVER Is About to Collapse? Watch This Critical Supply Zone!Price recently tapped a high near 39.20 before sharply rejecting from the 38.80–39.20 supply zone, confirming strong selling pressure. The current structure shows:

- Supply zone tested and rejected

- Likely return to the previous demand zone (36.50–36.00)

- RSI is turning down, confirming loss of momentum

A pullback toward 38.30–38.50, followed by a bearish continuation toward the 36.50 area, which acts as a key structural and institutional support.

🗓️ Seasonality

Historically, July is bullish for silver:

Last 5Y average: +0.89%

Last 2Y average: +2.18%

However, August–September are bearish months:

August: mildly positive, but weak

September: consistently negative across all time frames (-0.86% to -1.10%)

This increases the probability of a downward move starting in early August, in line with current price action rejection.

🪙 Commitment of Traders (COT) – July 22

Non-Commercials (speculators):

Longs: +656

Shorts: -516

Commercials (hedging):

Longs: +1,337

Shorts: +916

➡️ Commercials are increasing both long and short exposure, while non-commercials remain net long — a sign of moderate optimism.

However, long positioning is slowing down compared to previous weeks. A potential exhaustion in bullish momentum is forming.

📉 Sentiment

52% short vs 48% long

Volume: more lots on the short side (492 vs 454)

Sentiment remains neutral to slightly contrarian bullish, but not extreme. This may allow for a fake breakout before a deeper move down.

🧩 Operational Summary

Main bias: Bearish short to mid-term (starting August), supported by:

- Technical rejection at supply

- Negative seasonal tendencies ahead

- RSI showing momentum loss

- COT showing stabilization, not accumulation