Commodities

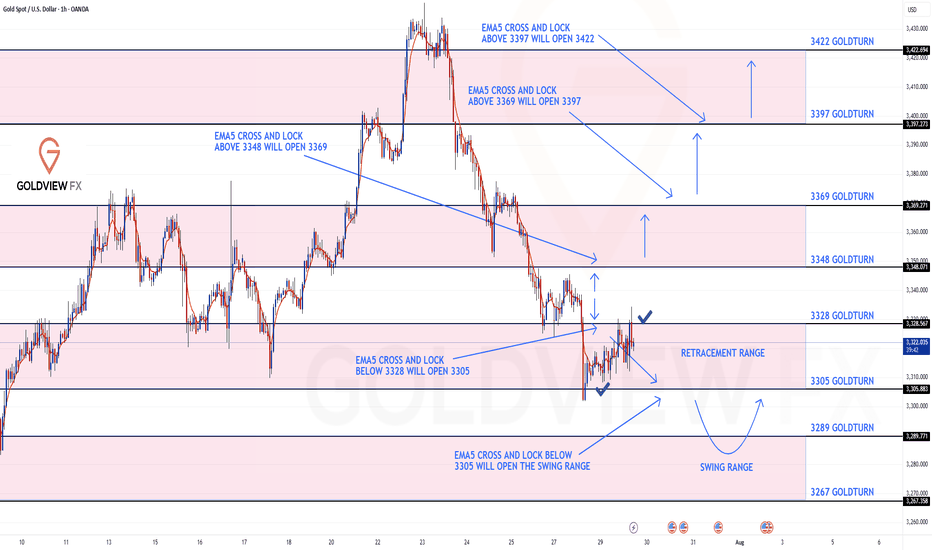

GOLD ROUTE MAP UPDATEHey Everyone,

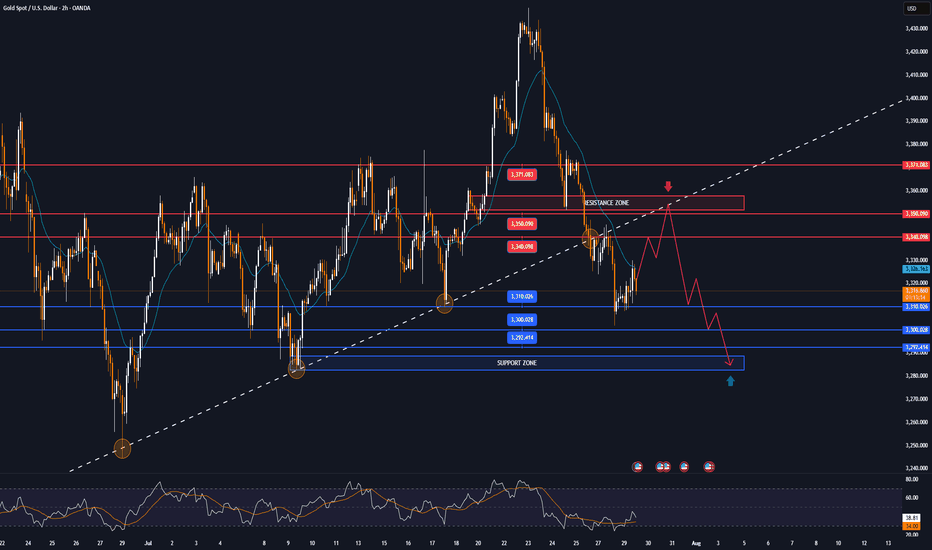

Following yesterday’s move into the 3305 retracement range, we got the expected reaction without an EMA5 lock, which further confirmed the rejection from that level and led to a clean bounce into 3228 just like we analysed.

From here, we anticipate price to range between 3328 and 3305. EMA5 cross and lock above 3328 or below 3305 will be key to confirming the next directional move.

We’ll continue to monitor for that confirmation and adjust accordingly.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3348

EMA5 CROSS AND LOCK ABOVE 3348 WILL OPEN THE FOLLOWING BULLISH TARGETS

3369

EMA5 CROSS AND LOCK ABOVE 3369 WILL OPEN THE FOLLOWING BULLISH TARGET

3397

EMA5 CROSS AND LOCK ABOVE 3397 WILL OPEN THE FOLLOWING BULLISH TARGET

3422

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289

3267

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

#XAGUSD: A Strong Bullish Move, Possible Target at $45?Silver is currently experiencing a correction, but the overall price remains bullish. Analysing the data, we can see a potential price reversal in our area of interest. Following the recent higher high, price is poised to create another record high. We should closely monitor volume and price behaviour. A strong volume signal would indicate a potential bullish move in the future.

Good luck and trade safely.

Like and comment for more!

Team Setupsfx_

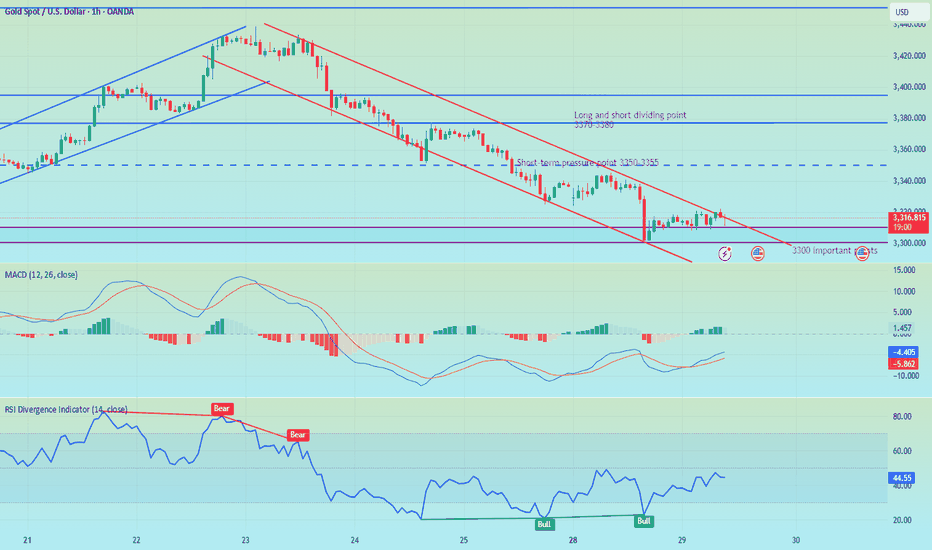

European session under pressure 3321 continue to shortI reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in the short term. Judging from the hourly chart, gold is still in a downward trend, and the hourly line is blocked near 3321. In the short term, if it cannot break through 3320-3330, gold will continue to fall. You can consider shorting, with the target at 3310-3300. If the European session is still volatile, maintain high shorts and low longs to participate in the cycle.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

Gold Price Analysis (GC1! or XAU/USD): Challenges and OutlookSince reaching a historic high of $3,509 on April 22, 2025, gold has struggled to maintain its upward momentum. On the daily timeframe, the price experienced a sharp rejection spike after touching that peak, prompting a sideways range as the market seeks a clearer direction.

From a technical perspective, a stronger US dollar typically puts downward pressure on gold, making it a more expensive investment for holders. However, examining the chart of GC1! * alongside the DXY shows that even during periods of a robust dollar, gold has continued to rise. Additionally, recent years have seen seasonality effects on gold largely ignored, with the yellow metal persistently climbing. The underlying reasons are multifaceted, but a key factor is gold’s status as a safe-haven asset—investors prefer to hold gold during times of uncertainty and economic turmoil.

* GOLD and DXY correlation

Looking ahead, investors are awaiting the Federal Reserve’s upcoming monetary policy announcement scheduled for Wednesday. According to the CME FedWatch tool, the consensus is that the Fed will keep interest rates steady at 4.25%-4.50%, marking the fifth consecutive meeting with unchanged rates.

From both fundamental and technical viewpoints, recent data suggest a cautious outlook. Notably, non-commercial traders added nearly 40,000 long contracts last week, indicating bullish sentiment. Conversely, retail traders have reduced their positions, which could signal a potential shift in market dynamics.

The key question remains: where might be a strategic entry point if gold resumes its upward trend?

In the chart, I’ve highlighted two daily demand zones and a strong weekly demand area. There’s a possibility that the price may not revisit the weekly demand zone to accommodate new longs, instead triggering entry signals from one of the daily demand zones. I recommend adding these zones to your watchlist as potential entry points.

What are your thoughts? I look forward to your insights!

✅ Please share your thoughts about GC1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

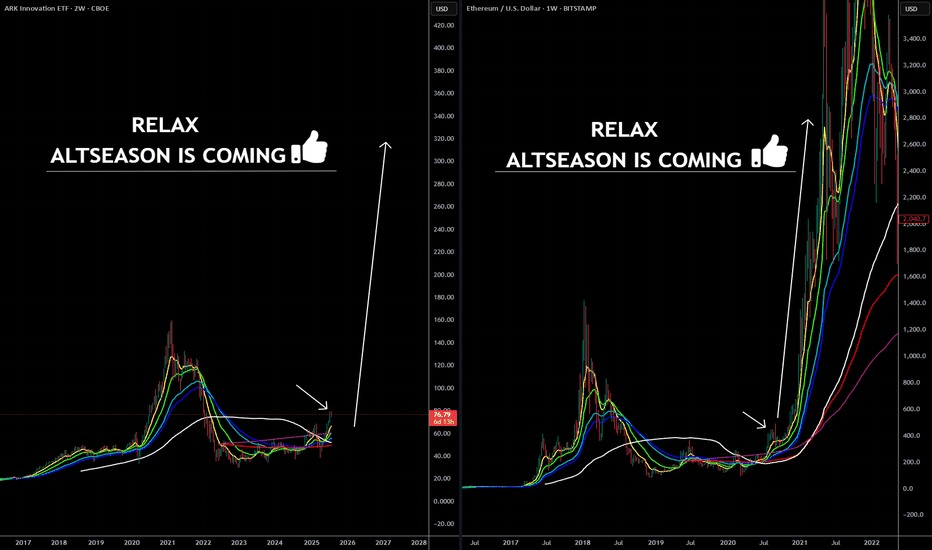

ARKK: The Calm Before the Innovation Storm -ALTSEASON Is COMING🚀 ARKK: The Calm Before the Innovation Storm 🌪️

The markets are shifting, and disruption is about to go vertical. ARK Innovation ETF (ARKK) is quietly positioning itself for what could be the most explosive move of this decade. With high-conviction bets in AI, Bitcoin, genomics, and next-gen tech, this isn’t just a fund—it’s a launchpad for exponential growth.

This post breaks down exactly why ARKK could go parabolic—and why the smart money is already moving in. 👇

Explosive upside in 2026

ARKK is already up over 24% YTD , showing strong momentum compared to broader markets and signaling early stages of a potential parabolic move .

High-conviction concentration in game-changers

Top 10 holdings include Tesla, Roku, Zoom, Coinbase, UiPath, Block, Crispr Therapeutics, DraftKings, Shopify, and Exact Sciences. These are leaders in innovation sectors with massive upside potential .

Deep exposure to Bitcoin and digital assets

Heavy allocation to Coinbase and Block gives indirect exposure to Bitcoin . If BTC breaks into a new cycle high , ARKK stands to benefit significantly.

Positioned in exponential growth sectors

Focus on AI, genomics, EVs, fintech, robotics, and blockchain , all of which are entering accelerating adoption phases globally.

Aggressive smart-money accumulation

Cathie Wood’s team continues buying aggressively during dips, reinforcing institutional confidence in the fund’s long-term trajectory.

Technical breakout structures forming

Ascending triangle and multi-month consolidation breakouts suggest a technical setup primed for explosive upside .

Innovation supercycle aligning

ARKK's themes are aligned with major global shifts like de-dollarization, decentralized finance, and AI convergence .

High beta = massive upside leverage

With a beta above 2 , ARKK tends to outperform in bull runs , offering leveraged exposure to innovation without the need for margin.

Resurgence of top holdings

Names like Coinbase, Tesla, Shopify, and Roku are up 50%–100% YTD , driving ARKK’s NAV growth and fueling bullish sentiment .

Long-term vision with short-term catalysts

The fund projects 5x returns over the next five years , while Bitcoin halving cycles, tech innovation, and regulatory clarity serve as short-term ignition points .

Marty Boots | 17-Year Trader — smash that 👍👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

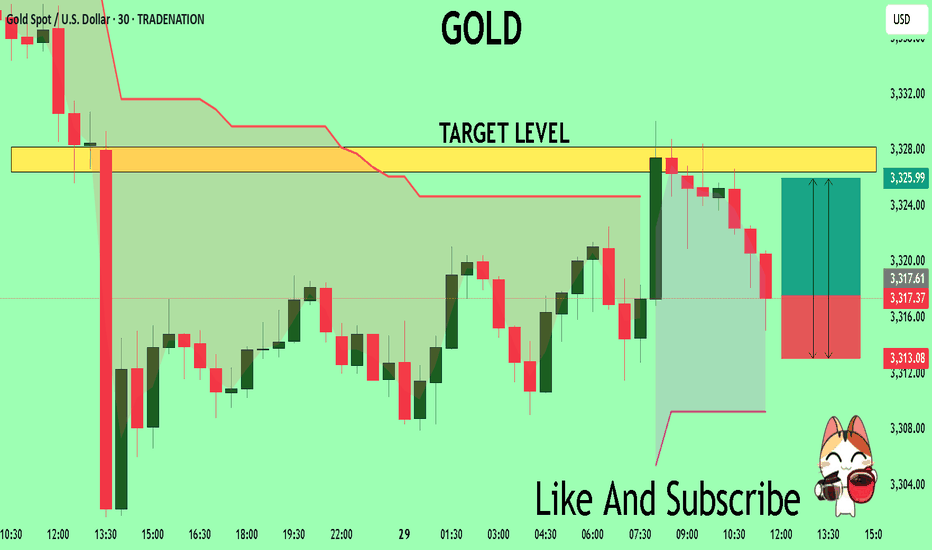

GOLD The Target Is UP! BUY!

My dear subscribers,

This is my opinion on the GOLD next move:

The instrument tests an important psychological level 3317.7

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3326.4

My Stop Loss - 3313.0

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD trades in narrow range after 4 sessions of sharp declineOn Tuesday (July 29), in the Asian market, the spot OANDA:XAUUSD traded in a narrow range after yesterday's sharp decline, and the current gold price is around 3,315 USD/ounce.

The OANDA:XAUUSD fell to its lowest level in nearly 3 weeks on Monday, mainly due to the trade agreement reached between the United States and the European Union over the weekend, which boosted the Dollar and risk sentiment.

The previous report released by the US Bureau of Labor Statistics showed that the number of US JOLTS jobs unexpectedly increased in May, reaching the highest level since November last year.

The number of JOLTS job vacancies in the US in May was 7.769 million, far exceeding the forecast of all economists surveyed.

Looking back at the data in April, the number of JOLTS job vacancies also showed an unexpected increase.

The JOLTS jobs report is a closely watched labor market data by the Federal Reserve.

In addition, the Conference Board of America's Consumer Confidence Index for July is scheduled to be released on the same day and is expected to be 95.8, compared to the previous value of 93.0.

The fundamental pressure that gold is under

OANDA:XAUUSD came under pressure yesterday and fell to a near three-week low, mainly due to the trade deal between the United States and the European Union (EU) over the weekend, which boosted the Dollar and risk sentiment. Moreover, US President Trump announced “global tariffs” of 15% to 20% on most countries, a change from his previous statement last week.

The deal reached by U.S. President Donald Trump and the European Union late last week will impose a 15% tariff on EU goods, half the rate Trump had threatened, easing fears of a wider trade war.

The U.S. and Japan also reached a deal last week, and U.S. and Chinese officials resumed talks in Stockholm, Sweden, this week with the goal of extending the tariff deadline by 90 days.

Technical Outlook Analysis OANDA:XAUUSD

Gold has been on a four-day losing streak, a decline that threatens bullish expectations as its current position gradually deprives it of any room for further upside.

Specifically, gold has recovered from the psychological level of $3,300 but the actual recovery is not significant, while it is under pressure from the EMA21 which is currently the closest resistance.

On the other hand, gold has fallen below both the long-term and short-term trend channels. If it continues to sell below the 0.382% Fibonacci retracement level, this will confirm a break below the psychological level of $3,300, then the downside target will be around $3,246 in the short term, rather than $3,228.

RSI is pointing down, below 50 and still far from the 20-0 area, also showing that in terms of momentum, gold is also under pressure and there is still a lot of room for decline ahead.

For gold to be eligible for an increase, it needs to at least bring price activity back above the EMA21, back inside the price channels. On the current daily chart, the technical conditions are more inclined towards the possibility of a decrease.

Notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,340 - 3,350 - 3,371 USD

SELL XAUUSD PRICE 3355 - 3353⚡️

↠↠ Stop Loss 3359

→Take Profit 1 3347

↨

→Take Profit 2 3341

BUY XAUUSD PRICE 3285 - 3287⚡️

↠↠ Stop Loss 3281

→Take Profit 1 3293

↨

→Take Profit 2 3299

GOLD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,321.22 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 3,329.97.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

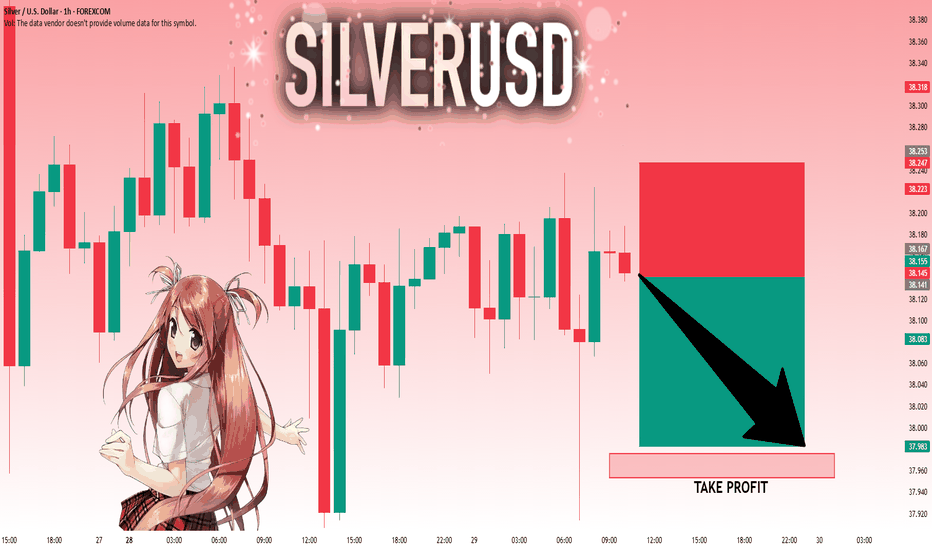

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.167 will confirm the new direction downwards with the target being the next key level of 37.976 .and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

XAUUSD: Market Analysis and Strategy for July 29Gold Technical Analysis:

Daily chart resistance: 3345, support: 3285

4-hour chart resistance: 3340, support: 3300

1-hour chart resistance: 3330, support: 3308.

After last week's sharp decline, gold continued its decline yesterday, breaking below its opening low and continuing its downward trend, reaching a low near 3300. In the short term, selling pressure is strong, but the rebound is weak, with a rebound high of 3330.

In terms of intraday trading, yesterday's low of 3301 was followed by a rebound. Focus on the resistance range of 3330-3338. Selling is recommended if the price is trading sideways between 3330-3338, with a defense of 3340. If it falls below 3300, the next target will be 3285.

Sell: 3338

Buy: 3302

Sell: 3300

EUR/USD | Sweeps Liquidity and Rebounds – Eyes on 1.16700!By analyzing the EURUSD chart on the 4-hour timeframe, we can see that after our previous analysis, the price continued its decline and eventually swept the liquidity below 1.15580. Following that, strong demand kicked in, and the pair is currently trading around 1.15810. If the price can hold above this level, we can expect further bullish movement. The next potential targets are 1.1600, 1.16280, 1.16430, and 1.16700.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

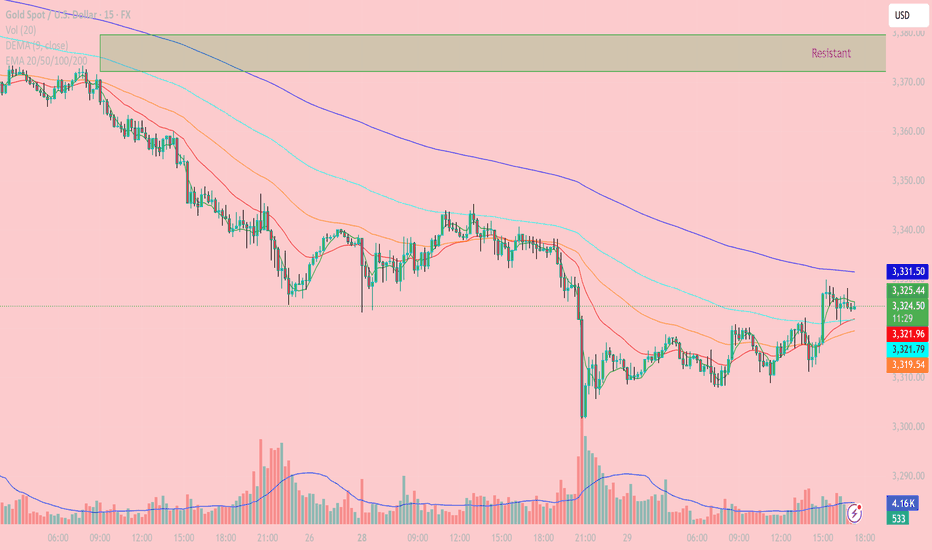

XAUUSD – Gold Intraday Technical Analysis (15-Min Chart) - July Current Price: 3,323.93 USD

Timeframe: 15 minutes

Last update: 17:14 UTC+7

- Trend Overview:

The 15-minute chart shows a minor recovery after a sharp drop in gold prices. However, overall pressure remains bearish as price continues to trade below all key EMAs (50–100–200), and the bulls have yet to break through significant resistance above.

- Key Technical Zones:

Nearby Resistance:

3,331.57 (EMA200): dynamic resistance, repeatedly tested but not broken

3,340 – 3,350: supply zone + 0.618 Fibonacci retracement

3,360 – 3,375: strong resistance zone (purple box), previous major rejection area

Nearby Support:

3,321.70 – 3,319.34 (EMA50 – EMA100): also aligns with 0.382 Fibonacci support

3,309 – 3,310: previous low, potential demand zone on deeper pullback

- Technical Analysis:

EMA & Structure:

Price is testing EMA200 (3,331.57) – a key level to watch for confirmation of any trend reversal. However, the larger trend remains bearish as long as this resistance holds.

EMA9 and EMA20 have crossed above EMA50, suggesting short-term bullish momentum, though not yet strong enough to confirm a full reversal.

Volume Analysis:

Recent bullish candles were supported by higher volume, but the current rally is weakening in volume – a sign of fading buying pressure.

RSI (not shown but recommended):

Watch for RSI break above 60 to signal potential continuation toward higher resistance levels.

- Trading Strategies:

Scenario 1 – Sell at Resistance (Sell on Rally):

Entry zone: around 3,330 – 3,335

Stop loss: above 3,340

Targets: 3,320 → 3,310

Rationale: Price is testing EMA200 and resistance; no confirmed breakout yet

Scenario 2 – Short-Term Buy on Dip:

Entry zone: 3,319 – 3,321 (EMA50/100 confluence)

Stop loss: below 3,308

Targets: 3,330 – 3,335

Rationale: Minor support holding, potential short bounce if price stabilizes

- Conclusion:

Gold is attempting a short-term rebound, but the broader trend remains bearish unless price breaks above 3,340 – 3,350 resistance. For now, focus on short setups at resistance and scalping small bounces from strong support zones.

Follow to receive more daily strategies – and don’t forget to save this if you find it useful.

Got a different view on gold today? Let’s discuss it in the comments!

GOLD Slips as Dollar Gains on Trade Deal – Bearish Below 3349

Gold Pares Gains as USD Strengthens on Trade Deal Ahead of Fed

Gold gave up early gains, pressured by a stronger U.S. dollar after the announcement of the US–EU trade agreement.

Meanwhile, attention shifts to upcoming U.S.–China negotiations later today, as both sides aim to extend the current trade truce and avoid new tariffs.

Investors are also closely watching the Federal Reserve’s policy decision on Wednesday, seeking signals on future interest rate moves.

TECHNICAL OUTLOOK:

Gold maintains a bearish trend while trading below 3349, with potential downside toward 3320.

A 1H candle close below 3320 – 3312 would confirm extended bearish pressure targeting 3285, driven in part by ongoing geopolitical risks.

⚠️ To shift back to a bullish structure, the price must stabilize above 3349.

Key Levels:

• Support: 3320 – 3285 – 3256

• Resistance: 3365 – 3375

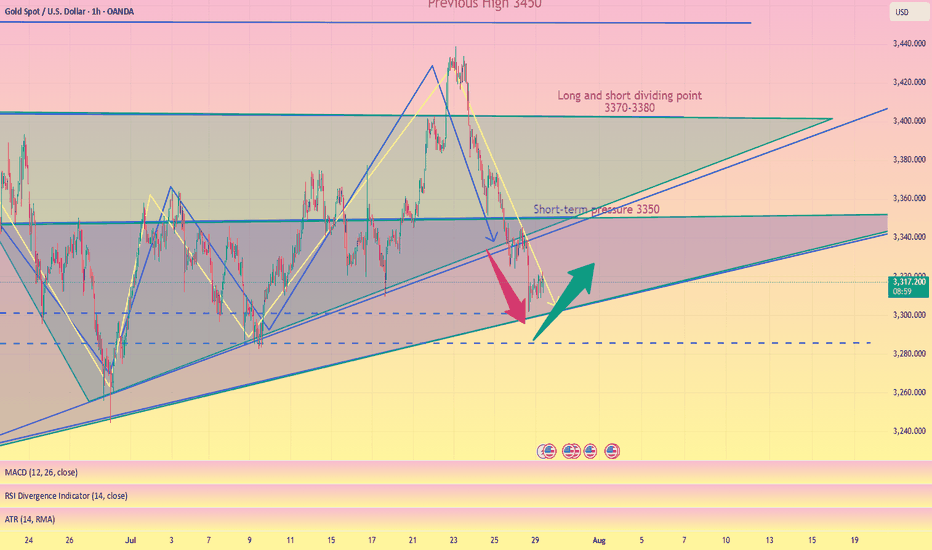

The latest trend analysis and layout of the day,flexible adoptio#XAUUSD

⚠️News focus on the Sino-US trade talks, which may affect the gold trend.

Since the opening of the market today, gold has been fluctuating in a narrow range in the short term, without giving a clear trading direction🤔, and the short-term trend has not changed much.📊

🚦It remains constrained by resistance and a downward trend. In the short term, we need to pay attention to the 3300 mark below and the support of 3295-3285📈. On the upside, we should pay attention to the short-term suppression level of 3321-3333 and yesterday's high of 3345-3350.📉

In the short term, as long as it does not break through yesterday's high point, the volatile downward trend will not change. 🐂Once it breaks through, the short-term decline will stop, and the market will continue the bull rebound to test 3370~3380 or even 3400 before falling again.

Therefore, short-term trading focuses on the 3300 mark below and the long trading opportunities at 3295-3285. On the upside, defend the 3345-3350 highs and establish short positions.🎯

🚀 BUY 3310-3330

🚀 TP 3321-3333

🚀 BUY 3295-3285

🚀 TP 3310-3330

🚀 SELL 3320-3330

🚀 TP 3310-3300

🚀 SELL 3345-3350

🚀 TP 3330-3285

SILVER Will Grow! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,817.6.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,930.1 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Silver Near $40: Deficits and Demand Fuel the RallySilver prices surged to multi-year highs in July 2025, driven by an extraordinary convergence of bullish factors, pushing prices above $39 per ounce, levels last seen in 2011.

Silver’s rally, supported by robust industrial demand and safe-haven inflows, aligns with traditional patterns as the U.S. dollar has weakened over 2.3% over the recent period.

Macroeconomic Drivers and the U.S. Dollar

Silver's rally is unfolding around shifting macro conditions. The Federal Reserve has kept interest rates at a restrictive 4.25-4.50% throughout 2025 due to persistently high inflation (2.7% YoY). However, expectations for more rate cuts are growing, with the CME FedWatch tool showing a 59.8% probability of a cut at the September meeting as of July 28.

Adding to the complexity, U.S. trade policies have triggered significant market volatility and raised concerns over a potential supply shock. The U.S. administration has imposed steep 30% tariffs on imports from Mexico, set to resume on August 1. This has heightened fears, as Mexico is the world’s largest silver producer and supplies over half of U.S. silver imports.

But macro drivers aren’t the full story. The real force behind silver’s rally lies in the physical market itself. A structural supply deficit, escalating industrial demand, and growing investor appetite from Asia and North America, are proving to be far more pivotal than shifting rates or a softer dollar.

Physical Market Dislocation and Industrial Demand

The year 2025 marks the fifth consecutive year of a structural deficit in the global silver market, and the imbalance between supply and demand shows no sign of easing.

With minimal new mining capacity expected to come online and lengthy lead times for project development, supply constraints are structural rather than temporary.

Since 2021, the cumulative shortfall has reached nearly 800 million ounces (25,000 tons), steadily drawing down available inventories and tightening the market.

Industrial demand remains the central pillar of silver’s bull market. Forecasts for 2025 project record consumption of roughly 700 million ounces, driven by rapid adoption in green technologies and digital infrastructure. The electrical and electronics sector, which includes solar photovoltaics (PV), consumer electronics, automotive electronics, power grids, and 5G networks, has increased its silver usage by 51% since 2016.

Solar PV alone consumed approximately 197.6 million ounces in 2024, a record largely driven by China’s 45% expansion in solar capacity. With global EV production expected to approach 20 million units in 2025, automotive silver demand alone could exceed 90 million ounces.

Together, persistent deficits, accelerating industrial consumption, and capital flowing into physically backed investment vehicles are creating a market where available silver is increasingly scarce, amplifying upside pressure on prices regardless of short-term macroeconomic shifts.

COMEX silver inventories peaked at 504.72 million ounces on May 11 but have since eased back to levels last seen on April 24, indicating a recovery in demand following the large accumulation in US inventories post-tariff shock.

Positioning and Ratios Favour Gains

With net inflows of 95 million ounces in the first half of 2025, silver ETP investment has already surpassed the total for all of last year. By June 30, global silver ETP holdings reached 1.13 billion ounces, just 7% below their highest level since the peak of 1.21 billion ounces in February 2021

Futures positioning has also surged , with long positions up 163% over six months. These factors have helped propel silver prices over 35% higher year-to-date, building on a 21% gain in 2024.

The iShares SLV ETF netted inflows of $1,467.5 million over the past 3 months.

Physical silver investment demand remains robust, with significant buying from Asian markets. India, the world’s leading silver importer, saw record purchases of physical bullion and silver-backed ETFs during the first six months of 2025.

The gold-to-silver ratio, currently in the late 80s, remains historically elevated, suggesting silver remains significantly undervalued compared to gold. This indicates substantial upside potential for silver, especially given persistent market deficits, rising industrial and investment demand, and gold rising at the same time.

Hypothetical Trade Set-up

The silver market’s bullish fundamentals appear increasingly robust. Investors may consider accumulating silver positions, viewing short-term consolidations as attractive buying opportunities amid the compelling long-term outlook.

Options open interest for the September contract shows a bullish bias with a put/call ratio of 0.82 and high call interest at the far out-of-the-money call strike of $45 per ounce.

To express a bullish view on silver, investors can deploy a long position in CME Silver futures expiring in September. A hypothetical trade setup for this view is described below.

● Entry: $38.00 per ounce

● Target 1: $40.00 per ounce

● Target 2 (extension): $42.00 per ounce (if Fed easing in September coincides with physical tightness)

● Stop Loss: $36.70 per ounce

● Profit at Target 1: $10,000

● Profit at Target 2: $20,000

● Loss at Stop: $6,500

● Reward-to-risk ratio: 1.54 (Target 1) and 3.08 (Target 2)

Alternatively, investors can exercise the same view using CME Micro Silver futures, which offer smaller notional positions and more flexibility. Each Micro contract is priced in USD per ounce and represents 1,000 ounces of silver, compared to 5,000 ounces for the standard contract.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

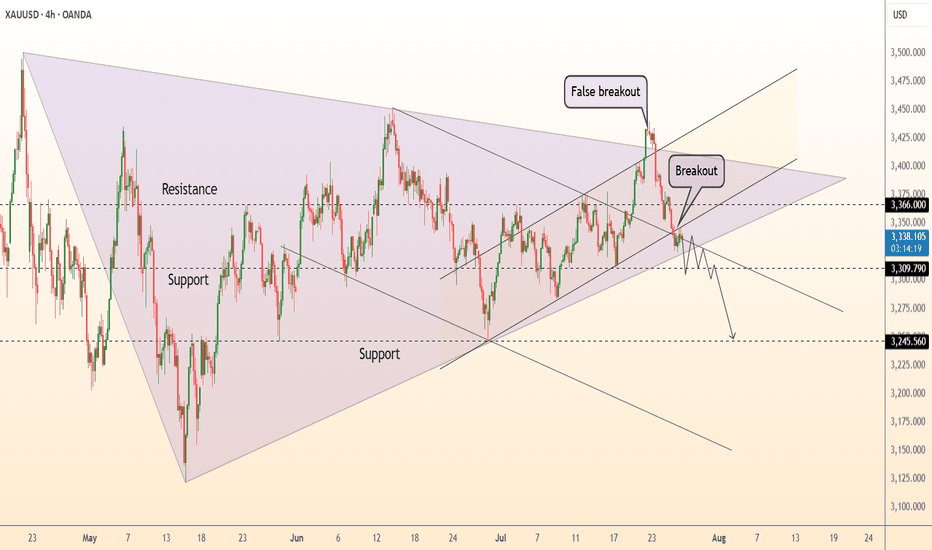

DeGRAM | GOLD broke the rising channel📊 Technical Analysis

● XAU printed a false break above the 3 400 wedge roof, then sliced back through the rising mid-channel, closing under the wedge base at 3 309 - a classic bull-trap that flips that band into resistance.

● Momentum has rolled over, and the break of July’s micro up-trend opens room to the broad triangle floor/May trend-pivot near 3 246; successive lower-highs since 24 Jul confirm bearish control.

💡 Fundamental Analysis

● Hot US Q2-GDP and sticky core-PCE lifted 2-yr yields to one-month highs, reviving the dollar bid, while cautious ECB guidance tempers euro gold demand.

✨ Summary

Sell 3 309-3 335; hold below 3 309 targets 3 246 ▶ 3 200. Invalidate on an H4 close above 3 366.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

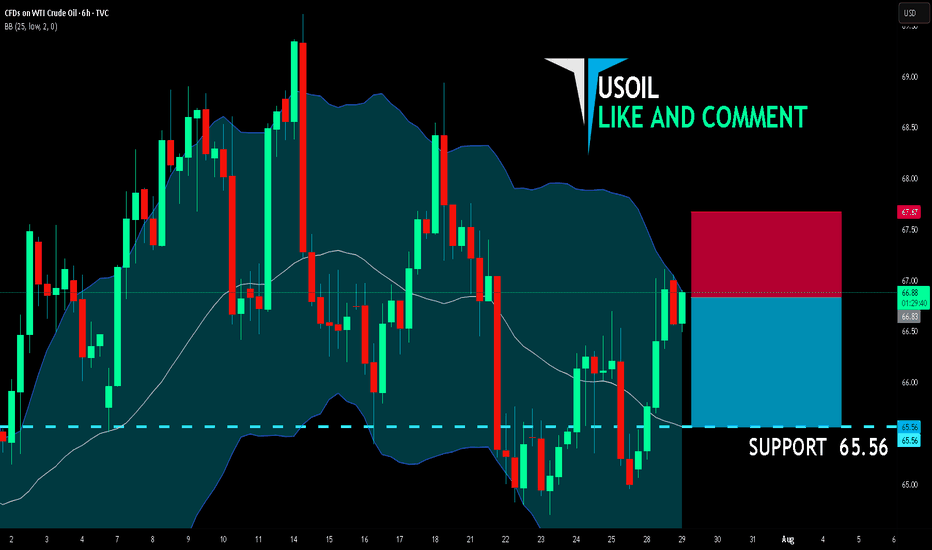

USOIL BEST PLACE TO SELL FROM|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 66.83

Target Level: 65.56

Stop Loss: 67.67

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

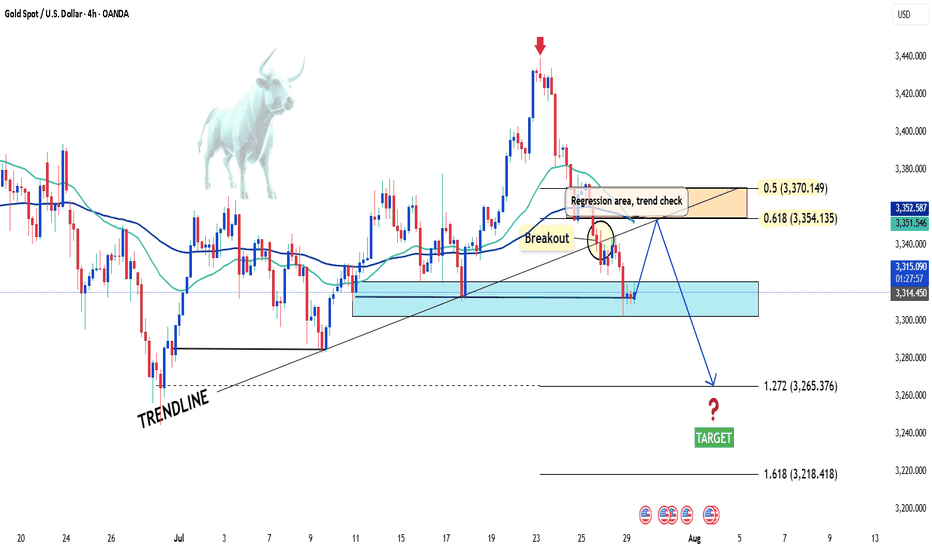

XAUUSD under pressure – Is the downtrend just beginning?Hello everyone! What do you think about XAUUSD right now?

Yesterday, XAUUSD extended its decline and is currently trading around 3,315 USD.

The recent drop in gold prices was mainly triggered by a stronger US dollar, following a trade agreement between the US and the European Union (EU).

From a technical perspective, the short-term outlook shows the beginning of a new downtrend. Notably, we see a bearish crossover in the EMA 34 and 89, along with a break of the previous upward trendline—both reinforcing the current bearish momentum.

If there’s a pullback before the next leg down, the 0.5–0.618 Fibonacci retracement zone (which also aligns with resistance and the EMAs) will be a key area to watch. This could be an ideal level for potential trade setups.

Looking ahead, the next support target is around 3,300 USD. If that level breaks, gold might aim for the 32XX region.

Do you think XAUUSD will continue to fall? Drop your thoughts in the comments!

Wishing you successful and profitable trades!

XAUUSD: Demand Rejection or Breakdown? All Eyes on 3,300 ZoneChart Analysis Breakdown (30m TF – Gold/USD)

1. Market Structure Overview

Bearish Trend Dominance:

The price has shifted into a bearish structure after a Break of Structure (BOS) to the downside, indicating bearish control after failing to sustain higher highs.

Lower Highs & Lower Lows:

A consistent formation of LHs and LLs confirms bearish momentum.

2. Key Zones & Reactions

🟩 Demand Zone (~3,300–3,310):

Current price is reacting from a clearly defined demand zone.

Strong buying wick indicates interest and potential short-term bounce.

This zone has historical significance — previous reversal point.

🟥 Supply Zone (~3,420–3,445):

Price reversed sharply from here.

This is a key liquidity zone; expect heavy resistance if price retraces.

🔵 BOS Areas Marked:

Confirmed transitions in structure:

Bullish BOS followed by a bearish BOS — great illustration of shift in control.

🟨 Consolidation Blocks:

Highlighted ranging periods show distribution/accumulation phases before breakouts.

3. Trendlines & Channel Patterns

📉 Descending Trendline:

Acts as dynamic resistance.

If price retraces to this level (around 3,330–3,340), expect potential rejection unless broken cleanly.

📈 Previous Bullish Channel (Broken):

Price moved out of a bullish ascending channel, confirming bearish intent.

4. Ichimoku Cloud Context

Price is below the Kumo cloud, suggesting bearish bias remains intact.

Future cloud is bearish.

However, short-term pullback into cloud possible (especially if demand zone holds).

📊 Forecast & Trade Idea

Scenario 1: Bullish Rejection from Demand

Price may bounce towards 3,340 (previous S/R + trendline retest).

Watch for reaction at this level.

Scenario 2: Clean Break of Demand Zone

Opens path toward deeper downside (e.g., 3,280 or even lower).

Could trigger liquidity grab before reversal.

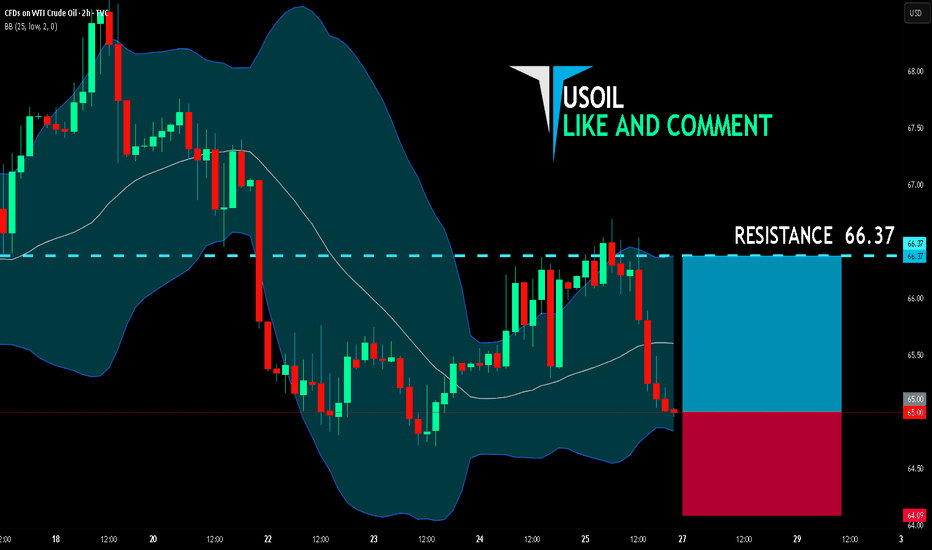

USOIL LONG FROM SUPPORT

USOIL SIGNAL

Trade Direction: long

Entry Level: 65.00

Target Level: 66.37

Stop Loss: 64.09

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅