COMPUSDT in a Strong Demand Zone! Reversal Potential / Breakdown🔍 In-Depth Analysis (Timeframe: Weekly / 1W)

The COMP/USDT pair is currently hovering above a long-term demand zone that has held strong since mid-2022. Price is sitting around $44.90, just above the key support area of $32 – $45 (highlighted in yellow), which has acted as a major accumulation zone for over 2 years.

🧱 Critical Zone: Smart Money Accumulation or Exhaustion?

The $32–$45 demand zone has been tested multiple times, indicating smart money interest and hidden buying pressure.

Price action in this range forms a clear base structure or horizontal accumulation pattern, a classic setup before a large directional move.

However, the prolonged sideways consolidation hints at an imminent breakout or breakdown — momentum is building.

---

📊 Key Technical Pattern:

🟨 Rectangle Range (Accumulation Structure)

Price has been ranging between $32 and $63.28 with no clear breakout.

Strong rejections every time price dips below $35 indicate consistent buyer defense.

🔃 Mean Reversion Behavior

Repeated moves back to the mid-range reflect an indecisive market (equilibrium phase), often seen before expansion.

---

📈 Bullish Scenario (Potential Reversal):

If price breaks above major resistance at $63.28:

1. Upside Targets:

🎯 $90.84 (key resistance zone)

🎯 $119.13 (prior distribution zone)

🎯 $165.94 (macro target if sentiment turns highly bullish)

2. Confirmation needed via weekly close above $63 with strong volume.

3. A bullish breakout may form a new Higher Low and Higher High structure on both daily and weekly timeframes.

🟢 Bullish confirmation: Weekly bullish engulfing + volume breakout above $63.

---

📉 Bearish Scenario (Potential Breakdown):

If price closes below the $32 support:

1. Possible downside targets:

⚠️ $22.76 (next logical support)

🚨 $16 (last consolidation base pre-2021 rally)

2. A break below this long-term support could trigger a final capitulation flush before a potential macro reversal.

🔴 Bearish confirmation: Weekly close below $32 with increased volume and sustained selling.

---

⚖️ Strategic Takeaway:

COMP/USDT is currently at a pivotal decision zone — a crossroads between massive upside potential and deeper downside risk.

This is not just another support area, it’s a macro-level demand zone that will likely dictate trend direction in the coming months.

⏳ A major move is brewing — whether breakout or breakdown, be ready.

#COMPUSDT #CryptoOutlook #TechnicalAnalysis #AltcoinSeason #DeFi #CryptoTrading #AccumulationZone #BreakoutSetup #BearishScenario #BullishSetup #CryptoAnalysis

COMPUSDT

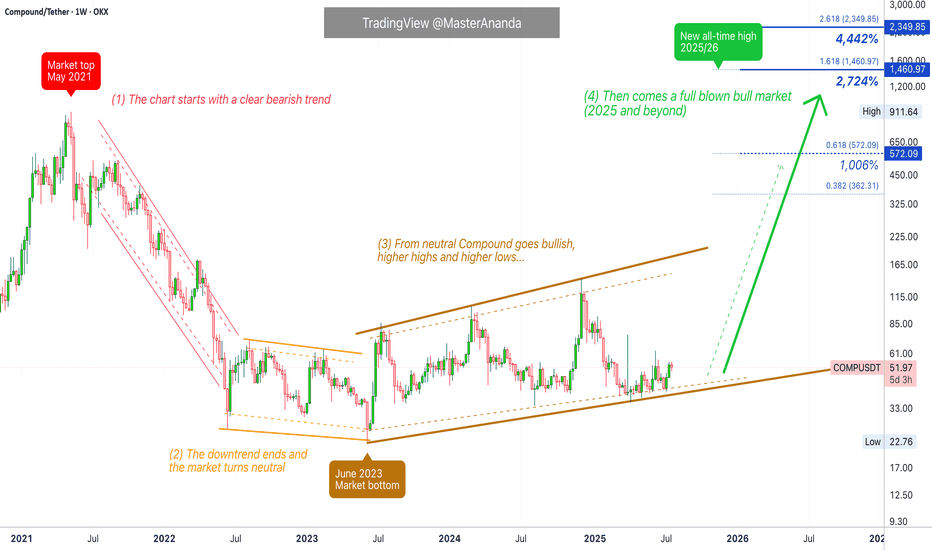

Compound Full Market Cycle · 1, 2, 3 & 4 (PP: 2,700% - 4,442%)This is the full long-term Compound (COMPUSDT) chart.

1) The market top happened May 2021. Notice how the bull market in 2021 ended early compared to 2025. While May signaled the start of a bear market, in 2025 we are already in July while trading at bottom prices.

High prices, a new all-time high, signals the start of a descent and bear market. COMPUSDT dropped from May 2021 until June 2022, more than a year. A shy lower low happened next around June 2023, a technical double-bottom.

2) Between June 2022 and June 2023 we have a neutral period, sideways. This is a "lost year."

3) Market dynamics change after June 2023. COMPUSDT stops producing lower lows and instead starts a bullish consolidation phase. Higher highs but still sideways. No major uptrend. This period lasts from June 2023 until present day, July 2025.

The pattern will break with a strong close above $150 followed by a sustained uptrend.

4) This is the 2025 bull market which can extend beyond this year into 2026, hopefully. Here instead of neutral or sideways, we should see a major uptrend as the mirror image of the 2021 downtrend. Also, a new all-time high is needed and expected to end this cycle. When the new all-time high hits, bearish conditions develop and the next bear market starts.

Potential for growth is huge, between 28 and 45X.

Thank you for reading.

Namaste.

COMPUSDT Accumulation Ending? Massive Bullish Reversal Ahead!

🧠 Weekly Analysis

After peaking near $911 in 2021, COMPUSDT experienced a prolonged downtrend, followed by a wide sideways accumulation phase around the $33–$41 range.

📉 This consolidation has formed a classic Wyckoff Accumulation structure, often seen before strong bullish reversals.

🟨 Key Support & Demand Zone:

🔻 Accumulation Zone: $33–$41

This range has acted as a strong floor since mid-2022.

Multiple rejections from this zone hint at smart money accumulation.

Recent long wicks and bullish rejections from this zone signal a potential reversal brewing.

🔮 Bullish Scenario:

If the price holds above the accumulation zone and breaks key resistance, the bullish case unfolds as follows:

📈 Bullish Price Targets:

1. ✅ $62.64 — First breakout confirmation.

2. ✅ $89.03 — Minor resistance and psychological level.

3. ✅ $117.27 — Major historical resistance.

4. ✅ $173.11 — Medium-term target.

5. ✅ $246.03 — Potential full target from pattern projection.

6. 🚀 Extension Targets: $363–$516 in case of a strong altcoin rally.

🔥 Breakout Confirmation: Weekly candle close above $62.64 with volume surge.

🧨 Bearish Scenario:

If the $33 support zone breaks and closes below:

⚠️ Possible downside:

Drop toward $23.27 (2022 low)

Extreme scenario: retest of $17 zone

This invalidates the current bullish structure and resumes macro downtrend

📊 Patterns Observed:

🔹 Extended Accumulation Range

🔹 Potential Inverse Head & Shoulders (in development)

🔹 Double Bottom Structure (awaiting neckline breakout)

These patterns suggest a market gearing up for a major shift — but volume and breakout confirmation remain crucial.

📅 Summary & Strategy:

🟢 Entry Zone: $35–$42 (low-risk accumulation)

🟡 Breakout Zone: Above $62.64

🔴 Stop Loss: Weekly close below $33

➡️ Favorable risk-to-reward setup for mid- to long-term swing traders and investors.

💡 Watch for breakout volume and BTC’s direction for confluence.

#COMPUSDT #CryptoBreakout #AltcoinSeason #WyckoffAccumulation #SwingTrading #CryptoTechnicalAnalysis #COMP #BreakoutSetup #CryptoAnalysis #BullishStructure

#COMP/USDT#COMP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 48, acting as strong support from which the price can rebound.

Entry price 53

First target 56

Second target 60

Third target 64

Compound 4X Lev. Full PREMIUM Trade-Numbers (PP: 2428%)This is a very, very easy set of targets that I am setting up here for Compound (COMPUSDT). And this trade setup with 4X leverage is low risk, very low risk. High potential for reward (more than 2,000%).

After June 2023, the dynamics changed from lower highs and lower lows, to higher highs and higher lows.

Late March produced the highest (buy)volume ever for this pair on this exchange. Someone in the background knows what is about to happen. Someone big. Now you know too thanks to this chart and trade-numbers.

The stop-loss is not meant for your liquidation nor for any trading, it is meant to indicate when the chart setup goes bad. Leveraged trading is for advanced traders.

If the stop-loss conditions are met, maybe monthly rather than weekly, the chart setup and market conditions are lost. Obviously, the stop-loss conditions can be activated and yet, growth still happens within weeks or months. Stop-losses should be ignored. Only advanced traders should use those.

This is a high probability trade setup. High risk vs a high potential for reward.

The numbers are meant for illustration only. Some people can use them to make predictions, others to decide where to buy as simply Cryptocurrency investors, while still others can use them to trade.

How you use these numbers is to you. I am not responsible for any loses, for how the market behaves nor any of your mistakes. Trading is a game for adults. A game, truly. This game can produce money as well as losses.

Trade at your own risk. I am wishing you success and great profits. You can do this. Just keep trying, work hard, study... Focus.

Full trade-numbers below:

_____

LONG COMPUSDT

Leverage: 4X

Entry levels:

1) $46

2) $43

3) $41

4) $36

Targets:

1) $50

2) $55

3) $60

4) $75

5) $88

6) $100

7) $122

8) $140

9) $165

10) $180

11) $205

12) $245

13) $274

14) $311

Stop-loss:

Close weekly below $35

Potential profits: 2428%

Capital allocation: 3%

_____

Don't mind my disclaimer on these trades. Some people can't face the fact of a losing trade. It is for those.

Responsible people like you and me know how the game works. We are happy to accept our winnings as well as any loss. We do not blame others for our mistakes. Life is full of challenges, we use these challenges as learning experiences. Trying circumstances are what made us into who we are today.

When you are going through something hard, it can be tough to face this reality with a smile in your face. When you look back to the past, in retrospect after all is great, you might even laugh and wear a badge of honor for the hard times you were able to overcome.

Think about it, a challenge that was once a nightmare, is now only a story that you can share and enjoy while you continue to grow.

Trading can help you improve your life, if you are honest with yourself and accept the fact that the market cannot be controlled. Yes, there is some manipulation, but nothing can control how nature works.

Nature works in cycles... After going down, everything grows.

Cryptocurrency is going up. Get used to it, because we are about to be showered with tons of profits, lots of money for all those who take the risk to buy and hold. Buy and hold now that prices are low.

Namaste.

Compound Gets Even Better —Bull Market ConfirmedThe trading pair COMPUSDT seems to be struggling short-term, daily timeframe, but what is actually happening? Why all the daily candles continue to close so small even while volume is high? Let me explain.

Resistance was present on the form of EMAs. Recently, COMPUSDT managed to break above EMA21 and EMA34, then EMA55. But one major level still needed to be taken out, EMA89. This is the blue line on the chart.

Two days ago COMPUSDT moved and close above this level. Yesterday, there was a Doji but no retrace. And today the action is green above $45.27 (EMA89). This is bullish confirmed.

See what happened back in November 2024, it is all the same. When COMPUSDT managed to close daily above EMA89, we have a massive bullish wave. It will be the same but different. The difference is that this time around the bullish wave will be many times bigger, prices will go much more higher.

Thank you for reading.

Namaste.

Compound Turns Bullish: Buy & Hold, Trade & WinCOMPUSDT challenged EMA89 June-4 but was rejected. June-5 ended as a red day. Today, the action is green again and back above EMA89. A close above this level and a wave above $100 is confirmed.

Good evening my fellow Cryptocurrency trader—it is still early for Compound—I hope you are having a wonderful day.

April-1 again, COMPUSDT tried to move above EMA55 and EMA89 but was rejected. The difference today is that the action is happening slowly, after several failed attempts, with high volume and two months of higher lows. In short, there won't be a rejection this time. And once the action moves above this level, blue on the chart, bullish confirmed.

This is just a friendly reminder, I posted about this one recently; this is one that you can't miss.

Whatever you do » Buy and hold, trade and win.

Namaste.

COMP/USDT Breakout Alert !!COMPUSDT has broken out of a long-term downtrend line on the daily timeframe, signaling a potential bullish reversal.

Chart Analysis:

Downtrend line broken with a strong bullish candle

RSI recovering to 57.28 — showing improving momentum

Price holding above local support near $36.41

Key Levels:

Support: $36.41

Resistance Levels / Targets:

Target 1: $54.68

Target 2: $89.71

Final Target: $123.13

Bias: Bullish — as long as price sustains above the downtrend line and holds support

Timeframe: 1D

Strategy: Watch for retest of breakout zone ($43–$45) as potential entry, with targets as mentioned.

This is not financial advice, please research before investing, as we are not responsible for any of your losses or profits.

Please like, share, and comment on this idea if you liked it.

#COMPUSDT #CryptoTrading #TechnicalAnalysis #Altcoins #Breakout #BullishSetup

Compound 3 Years Consolidation = Ultra-Bull Market (PP: 3,164%)Compound has been consolidating for three years now, similar to DigiByte in time but the chart situation is different, the price here is much better because it is trading lower near support.

I cannot stress it enough. You cannot fail with a pair like this one. Trading at bottom prices after years of consolidation. Once it starts going/growing you will be sitting on a very strong position. Long-term growth. Huge potential for profits vs a minimum risk potential.

Ok. I say "no leverage" but I share leveraged trades. Remember, many people so there is a little bit for everybody.

The trick is to go below 5X. If you do 3X, you are always safe basically, very little risk and you can maximize profits. 5X is also do-able. If you go beyond 5X, it is possible of course and we do it all the time but you run the risk of getting liquidated. So there are some trade-offs.

But of course, you need to do your own thing I am only sharing the charts.

Spot trading, 100% success guaranteed. Worst case scenario, a long wait.

To achieve these two you cannot use a stop-loss. If you do use a stop-loss then you can be shaken out of your position through a market flush. If you buy and hold, set it and forget it, you can win for sure long-term.

Compound has been consolidating for three years and is getting ready to move. Once it starts moving there is no going back. The longer the consolidation phase the stronger the bull market that follows.

Namaste.

OMG, Which One? Too Many Altcoins To Choose From —CompoundIt goes something like this, and this is easy: One of my friends ask me for a coin that is set to move now. High level of accuracy. Of course, the first thing I think about is all the trades in the past month that already went up, but, ok the show goes on and the market has lots to offer. This pair is the one that I showed him. This one is going up.

Compound here is easy and I will explain the chart for you right away. Quick and simple of course because simple is best.

We have the higher lows since June 2023.

We have higher highs as well. That's as simple as it gets cuz it reveals the bullish bias and bullish trend.

Now, how do we know if it will move right away?

Value. This is valuable... Notice the high volume candle 7-April. This reveals the bullish bias.

You can choose your own target of course, but my point is, this one is the ones that is going up.

There are many pairs to choose from, but some will move in three months, other in three weeks and other in three days. Some will not move at all... Choose wisely.

Thank you for reading.

Namaste.

Comp Spot Buy✅ Trade Setup Plan

🟢 Bullish Scenario (Long Entry)

📥 Entry:

Aggressive Entry: Now (~$41) after breakout from the descending trendline

Safer Entry (Confirmation): Break and close above $44 with volume

🎯 Targets:

TP1: $47.90 – $48.50 (recent local high)

TP2: $50.80 – $51.50 (resistance zone)

TP3: $56 (major resistance)

🛑 Stop-Loss:

Below $38.50 or tighter at $39.80 if you entered at $41

Below $36.50 if you're targeting a wider swing trade

🔴 Bearish Scenario (Short Entry)

📥 Entry:

If price fails to hold $39.80 and breaks below $38.50 with volume

🎯 Targets:

TP1: $35 (support region)

TP2: $33.20 – last tested bottom

🛑 Stop-Loss:

Above $41.20 or $42 depending on entry

📊 Indicators to Monitor

RSI: A clean push above 60 = bullish strength; drop below 40 = bearish pressure

MACD: A strong bullish crossover + increasing histogram = momentum confirmation

Volume: Confirm breakouts with increasing volume

Compound: Ready, Bullish, LONG (More Than 30X Growth Potential)Compound is ready. COMPUSDT is now confirmed bullish. Time to go LONG.

How are you doing my friend in this beautiful day?

I hope you are doing great. Another interesting pair with a great entry price, a great project as well.

Compound produced the highest volume in several years as we entered April 2025. This is huge. This signal alone reveals that the next bullish wave is already here.

A long-term support holds —fails to be tested, which is bullish; we have a higher low. A yearly double-bottom is present on the chart, August 2023 and August 2024. March 2025 produced the higher low.

The previous session produced the highest buy (bullish) volume since March 2022, three years ago. There is also a long upper wick on the candle. This means that resistance has been removed. The rise can now happen smoothly as all the sell orders all the way to $75 have been fulfilled. We are LONG on this pair.

Compound has been producing higher highs since mid-2023. These higher highs are part of a long-term, wide, consolidation phase. This consolidation is the preparation for the 2025 bull-market. We are looking at a potential of... I don't know, maybe $1,444 as the next All-Time High. Let's do the maths. Some 30X.

This is a timing based chart. "Seek you first great entry prices and timing, and all these profits shall be added unto you."

If you want to know more about the numbers and signals, search for COMPUSDT when you visit my profile, you will find all the numbers for the 2025 All-Time High and beyond.

This pair is good now to buy and hold.

Leveraged traders can also approach this pair with low risk and a high potential for reward.

Thank you for reading.

Your support is appreciated.

Namaste.

Compound COMP price analysisWhat is happening today?) Some coins are falling -50% per hour, and #COMP has grown +85% from $40 to $75 per hour

Does anyone know what kind of "breakthrough" happened in #Compound ?

Is this what we get, can we start dreaming about the growth of OKX:COMPUSDT to $175, and if we are lucky, to $215?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#COMP #COMPUSDT #Compound #Update #Analysis #Eddy#COMP #COMPUSDT #Compound #Update #Analysis #Eddy

COMPUSDT.P (( 3 Signals Analyzed on the chart ))

Update on the analysis of this currency for you, dear followers,

Everything is very clear on the chart and Important areas of the upper time frame for scalping are identified and named.

This is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

I have analyzed for you the 3 moves that this currency is going to make in its upcoming trends. For you, follow moves 1, 2 & 3 in order according to the comments left on the chart. First, take a long scalp from the first marked point to the red marked lines and then follow the second move. The best short point is to the low demand area, which is the green area. The red line with the entry of snipers is the text. Finally, follow and for the third move in the green marked demand area, look for confirmation for swing trading and also long-term spot investment.

It is never too late to buy and invest. Do not rush and do not be fooled by the positive movements and reactions of the market. Wait for the price to reach its valuable areas. In the analysis of the Compound currency, as you can see, there is a strong demand area that is intact. Be patient until the price falls from the decision or extreme flips to the green area of the important demand area. Be sure to check this currency in your Daily & Weekly time frame and draw the areas. Then refer to the weekly, daily and four-hour time frames and draw the lower time areas and look for confirmation for volatility.

Do not rush to invest and buy spot and let the price reach the support area.

Be successful and profitable.

"In the previous analysis of the Comp currency, we caught a beautiful pump. I hope you enjoyed and benefited from that analysis."

Review and view previous Comp currency analysis :

#COMP #COMPUSDT #Compound #Analysis #LONG #Eddy#COMP #COMPUSDT #Compound #Analysis #LONG #Eddy

COMPUSDT.P Ready For Long Entry

Important areas have been identified, the entry point has been touched in advance, and the pullback has been made on a lower timeframe, and it is ready to long entry upon receiving confirmation.

This is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the second target, and there is a possibility of a 40% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

Compound 6X Trade-Numbers (1,788% Potential)Compound hit bottom. This is a trade setup that recently went badly for us, it failed but, I would like to try again.

There is a clear double-bottom signal, short-term, and a long-term higher low. This chart setup is perfect for a new bullish jump. Truly a great set up based on the chart structure and signals.

Notice the volume. Always the volume. There is no volume on the bearish wave.

Notice the strong volume within the bullish wave.

That is all I have to say. I am going LONG.

Full trade-numbers below:

_____

LONG COMPUSDT

Leverage: 6X

Entry levels:

1) $53

2) $49

3) $46

Targets:

1) $57

2) $66

3) $81

4) $93

5) $105

6) $122

7) $144

8) $168

9) $183

10) $207

Stop-loss:

Close weekly below $45

Potential profits: 1788%

Capital allocation: 4%

_____

Thank you for reading.

Remember, you can do whatever you want. It is your life, your money, your computer... Your responsibility.

Namaste.

TradeCityPro | COMP: Navigating Consolidation👋 Welcome to TradeCityPro!

Today, I'll be analyzing the COMP token, a core component of a well-known DeFi project specializing in lending and borrowing, currently ranked 200th with a market cap of $100 million.

📅 Weekly Timeframe

In the weekly timeframe, we see a bearish trend that later transitioned into a consolidation box, with the current box's floor at $30.96 and the ceiling at $90.56. After the price was rejected from the all-time high of $800 and fell to $30.96, trading volume was initially high, affirming the downtrend.

🧩 However, after forming this box between the two levels, the volume decreased, indicating that whales and market makers have likely withdrawn their investments from this coin for now.

🔍 The primary support, as mentioned, is at $30.96, and if this level breaks, the downtrend is expected to continue. As observed, the price previously rose to the resistance at $90.56 and broke it, but then returned to the box, making this move a fake breakout.

📊 Currently, an important floor in the weekly timeframe is observed at $40.38, which is a good support. A break below this area could introduce significant bearish momentum and panic into the market. Additionally, the RSI indicator shows important support at 37.89, which, if broken alongside the $40.38 area, could early confirm a further bearish leg.

🔼 On the flip side, if the price is supported above this level and moves towards $90.56, breaking this area could enable us to hit the targets set for this coin. As shown in the chart, significant resistances are located at $252.60 and $800. However, for the coin to reach these figures, significant market cap growth is necessary.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️