Computer

Internet Computer (ICP) Have we found a Bottom? Can We hold $237I know Internet Computer (ICP) caught many of us off guard before and after the Coinbase release. I woke up this morning and It's already a top 10 cryptocurrency. Classic signs of a pump and dump. It seems like we've may of found bottom at $237 which would put ICP as of right now at an all time low. May not be a bad time to accumulate at these prices.

Like everybody else I'm wondering if we still have more room to drop further down. I'm keeping a very close eye on Internet Computer we may have major upside back up to ICO release prices.

According to Coinbase in a nutshell: "The Internet Computer is the world’s first blockchain computer that scales smart contract computation and data at web speed." This is suppose to facilitate and support the DeFi movement. Keep a close eye on ICP.

ICP - The Internet ComputerThe Internet Computer is here.

ICP has just launched on Coinbase (as shown in this graph), and on Binance.

The release from Binance reads:

"The Internet Computer is a layer-1 protocol that is developed by the Dfinity Foundation and aims to become ‘a blockchain network that evolves the internet’. This ‘internet computer’ intends to ‘extend the functionality of the public internet so that it can host backend software’ on a smart-contract compatible, distributed network."

ICP is the top 8 coin on CoinMarketcap at the time of writing.

What are your thoughts? Will you be buying ICP?

---

Please leave a like, and follow if you'd like to see more of this content.

Bullish Short corsair post earnings price projectioni can see this consolidating towards the 35 support level and re consolidating over the next couple weeks to make a build up. as u can soo top resistance has been getting rejected with signs of strong buying on the support. as long as earnings beat again i see this hitting a price target of 62$ exit. will enter between the resistance and support to gain a better position. exit price of 62$ stop loss at 44-48$

Maxlinear $MXL$MXL is a candidate for a new uptrend. there are good news coming for this company. watch for a breakout of $28.70

12 months Consensus Price Target: $26.5

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

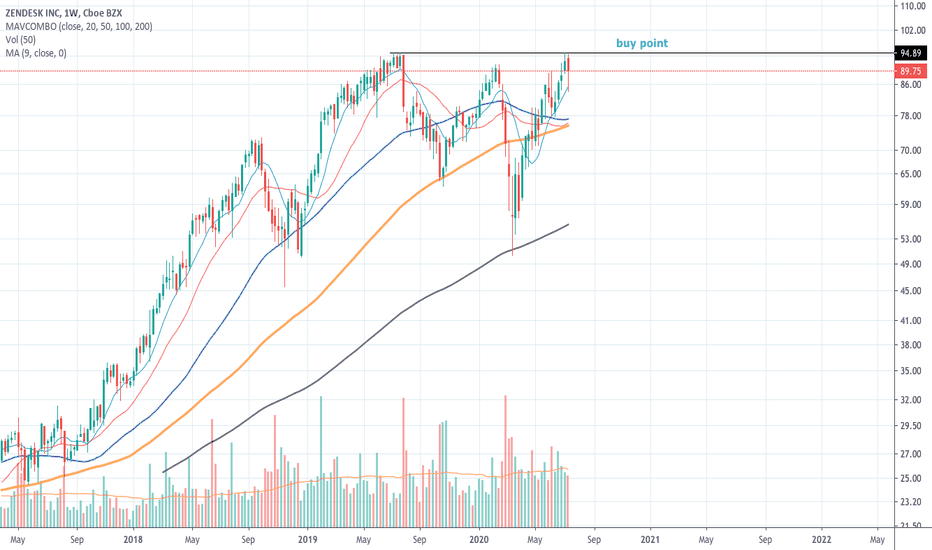

Zendesk $ZEN$ZEN is hitting the pivot to breakout. needs to hold above to get in. watch out for a breakout.

12 months Consensus Price Target: $94.10

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

FireEye $FEYE "Bounce back"$FEYE found support as 50SMA with high volume. It is a descent sign for a bullish trend.

12 months Consensus Price Target: $16.17

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

breakout buy out of a developing wedgeNYSE:DT Previous resistance was flipped into support as it is now wedging above that level. Volume is drying up and price action is getting tighter. 30% sales last quarter and 267% EPS last quarter. Annualized EPS and revenue growth also lines up nicely. High ROE and annual pre-tax margin. Last of all, ranked 1st in it's group. 43.45 buy against 40.69 is the place that I'll be looking for tomorrow.

Model N $MODN "cup w handle"$MODN is breaking the buying point of cup w handle on weekly chart.

12 months Consensus Price Target: $33.29

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

Lumentum Hldngs $LITE$LITE was on move yesterday and may attack upward. watch for break outs. It is safe to be long when it gets above $80.18

12 months Consensus Price Target: $90.44

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

PURE STORAGE $PSTG$PSTG is still below the trend and very close to brekout. Yesterday's volume was above the average and broke 20SMA (red) out . Needs to get above $18.08 to be long.

12 months Consensus Price Target: $20.10

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

Intel is coming!I like Intel! Because I use one in my computer. It is 12 years old and still running strong, but Intel is talking about AI computer chips that is suppose to 1000x faster than our current CPU. :P

Absolutely insane!!! We are not even talking about quantum computing yet!!!

Looking at the chart, we can see that Intel is slowly recovering from the drop in April and had been slowly going bull since.

MACD is showing signs of healthy bull movement, so I plan to long hold this one. :3

CTG - Big Earning Report Creates Bullish MovementComputer Task Group (CTG) came out with quarterly earnings of $0.09 per share, beating the Zacks Consensus Estimate of $0.08 per share. This compares to earnings of $0.08 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 12.50%. A quarter ago, it was expected that this information technology staffing company would post earnings of $0.07 per share when it actually produced earnings of $0.06, delivering a surprise of -14.29%.

Over the last four quarters, the company has surpassed consensus EPS estimates just once.

Computer Task Group, which belongs to the Zacks Computers - IT Services industry, posted revenues of $100.41 million for the quarter ended June 2019, surpassing the Zacks Consensus Estimate by 0.10%. This compares to year-ago revenues of $92.67 million. The company has topped consensus revenue estimates four times over the last four quarters. (Source: finance.yahoo.com)

Computer Task Group, Incorporated (CTG) is an information technology (IT) solutions and staffing services company. The Company primarily operates in the segment of providing IT services to its clients. The Company has operations in North America and Europe. The Company is engaged in providing IT services, including IT Solutions, and IT and other Staffing. CTG provides these primary services to all of the markets that it serves. The services provided encompass the IT business solution life cycle, including phases for planning, developing, implementing, managing, and maintaining the IT solution. It provides administrative or warehouse employees to clients to supplement the IT resources. The Company promotes a portion of its services through five vertical market focus areas: technology service providers, manufacturing, healthcare (which includes services provided to healthcare providers, health insurers, and life sciences companies), financial services, and diversified industrials.

SHORT INTEREST

29.52K 06/28/19

P/E Ratio (with extraordinary items)

-21.42

Average Price Target: $7.38

Recommendation: BUY

Bitcoin computer controlled push down Sat 19.5.17 13:00-16:00UTCHi

While looking at the charts I sometimes spot some funny or interesting patterns or movements and I try to share some of them.

Price manipulation is the norm in crypto and I'm still trying to understand how to react to it.

Yesterday (Sat 19.5.17) between 15:00 and 18:00 the price was pushed down from 7400 to 7200 following straight lines, possibly with the intention to trigger some long liquidations. In fact, in the relatively low volume phase there where two drops with noticeable sell volumes (both following a small bull trap). In both cases there were buying orders waiting 100 points below. After release the normal (natural) up and down resumed.

How do you trade in such situations?

Likes are very much appreciated!