GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

Consolidation

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!

XAUUSD Head And Shoulder pattern breakdownGold update 15m head and shoulder breakdown

Key Levels:

Resistance Levels:

3,040.000 (Immediate Resistance)

3,050.000

3,060.000

3,070.000 (Major Resistance)

Support Levels:

3,022.000 (Immediate Support)

3,014.000

3,006.500

2,999.000

2,991.000 (Major Support)

Price Action Overview:

Gold is currently trading at 3,033.785, showing a slight upward movement of +1.685 (+0.096%).

The price has been consolidating between 3,031.425 (Low) and 3,034.430 (High) in the last 15-minute candle. The market is testing the 3,035.410 level, which could act as a minor resistance.

Technical Indicators:

USB (Ultimate Support/Resistance Band):

Current Value: 38.301 (-1.279)

Indicates potential support/resistance zones around 3,830.4.

TAT & Skullers Indicator:

Current Value: -38.306 (-1.269)

Suggests a potential retest or breakdown level around 3,830.6.

Market Sentiment:

The market is showing slight bullish momentum, but the price remains within a tight range.

A breakout above 3,040.000 could signal a stronger bullish trend, while a breakdown below 3,022.000 may indicate bearish pressure.

Trading Strategy:

Bullish Scenario:

Entry: Consider a long position if the price breaks and sustains above 3,040.000.

Targets:

3,050.000 (First Target)

3,060.000 (Second Target)

3,070.000 (Major Resistance)

Stop Loss: Place below 3,022.000 to manage risk.

Bearish Scenario:

Entry: Consider a short position if the price breaks and sustains below 3,022.000.

Targets:

3,014.000 (First Target)

3,006.500 (Second Target)

2,999.000 (Major Support)

Stop Loss: Place above 3,035.410 to manage risk.

Risk Management:

Always use proper risk management techniques.

Risk no more than 1-2% of your trading capital per trade.

Adjust position sizes according to your risk tolerance and account size.

Review and plan for 21st March 2025 Nifty future and banknifty future analysis and intraday plan.

Few stocks analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

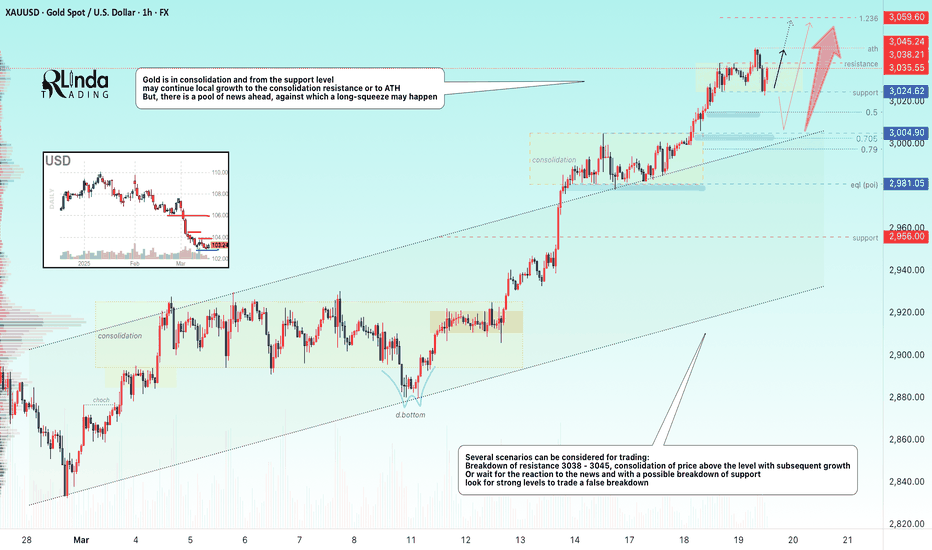

GOLD → Fading out before the news. Possible long-squeezeFX:XAUUSD continues its bullish trend, but locally, the movement is in a very narrow channel (wedge). To form a potential for further movement, the price may form a long-squeeze before or at the time of news...

Fundamentally, gold remains a bullish asset due to the Fed's rate cut forecasts and economic risks associated with Trump's tariff policy. Gold hit a new high on Wednesday after the Fed reiterated plans to cut rates twice this year, raised its inflation forecast and worsened growth and employment estimates.The price is further supported by escalating geopolitical tensions in the Middle East, with Israel announcing the resumption of ground operations in Gaza.

Gold is forming a bull market. Before further growth (before the news) the price may enter the liquidity zone (fvg, 3028, 3024), after which it will continue to grow. Dollar enters local correction before the news, which creates pressure on gold

Resistance levels: 3046, 3051, 3056

Support levels: 3038, 3030, 3024

Price is forming a retest of the wedge support, which increases the chances of a breakdown. If the support fails to hold, the price may go down to the above support before rising further.

But! If gold bounces from 3038 and consolidates above 3044, the growth will continue without a deep pullback

Regards R. Linda!

GOLD → Consolidation ahead of Fed rate meeting...FX:XAUUSD goes into consolidation 3038 - 3024 before the news - Fed rate meeting. The situation is generally predictable, but gold is reacting to rising geopolitical risks.

Gold is stabilizing before the Fed decision , markets are waiting for the data. The regulator is expected to keep rates, but Powell's forecasts will determine further dynamics.

“Hawkish” tone of the Fed may lead to the strengthening of the dollar and gold correction.

“Dovish” signals about economic risks will support the growth of metal prices.

Geopolitical tensions and Trump's tariffs continue to have an impact.The market is preparing for high volatility on the background of the Fed's decision and events in the world

Resistance levels: 2038, 2045

Support levels: 3024, 3015, 3004.9

Several scenarios can be considered for trading:

Breakdown of resistance 3038 - 3045, consolidation of the price above the level with subsequent growth to 3050 - 3060.

Or wait for the reaction to the news and with a possible breakdown of support to look for strong levels to trade a false breakdown, for example 3024, 3015, 3005.

Regards R. Linda!

USDJPY → Resistance retest (wedge) before the Fed meetingFX:USDJPY is forming a correction to trend resistance as part of the dollar index consolidation. An interesting situation is forming which could be a continuation of the downtrend.

Fundamentally, today is an important day. The FED interest rate meeting is ahead. Traders are waiting, the dollar is consolidating at this time. Most likely the rate will remain unchanged, but in this key everyone is interested in Powell's comments on monetary policy and their future actions.

USDJPY at this time is forming a correction to the bearish trend resistance, before the news the currency pair may test the resistance conglomerate: a wedge, 0.79 fibo, or an orderblock located outside the channel

Resistance levels: 150.16, 150.95

Support levels: 148.92

False breakout of the resistance zone can provoke a fall, as well as breakdown of the support of the “wedge” with the subsequent consolidation of the price in the selling zone. The price may test the zone of interest at 147.6, 146.54.

Regards R. Linda!

GOLD → Consolidation for continued growth. 3025?FX:XAUUSD is consolidating between 2981 - 2993. After strong growth there is no hint of a possible reversal, and consolidation above the channel boundary indicates readiness to continue growth

The gold price remains below the record $3,005 but is supported by the trade war, geopolitical tensions and expectations of Fed policy easing. The escalating US conflict with Yemen, the escalation in Gaza and possible talks between Trump and Putin are boosting demand for defensive assets. China's stimulus is also supporting prices. U.S. retail sales data may influence the dollar and further gold movement, but investors are cautious in anticipation of the Fed meeting.

Resistance levels: 2993, 3008

Support levels: 2891, 2956

Consolidation is being formed, regarding which, against the background of the bullish trend, two strategies can be considered:

1) resistance breakdown and consolidation above 2993 with the purpose of growth continuation

2) false breakdown of support 2981 and further growth after liquidity capture.

Regards R. Linda!

OMUSDT → Paranormal behavior. Rally readinessBINANCE:OMUSDT as a whole looks stronger than the market. After a strong rally a correction in the format of a bearish wedge is formed, subsequently the price broke the resistance and is trying to consolidate above the key support

Against the background of a weak market OM coin has good prospects as technically someone is interested in this project and the coin as a whole behaves strongly and looks stronger than the market.

A breakout of the bearish wedge (consolidation pattern within the correction) is forming. If the bulls keep the coin above the previously broken figure resistance and above the base of the 6.752 reversal pattern, the growth may continue in the short to medium term

Resistance levels: 7.39, 7.98

Support levels: 6.752, 6.51

One of the few coins that is rising while bitcoin is falling. Focus on the previously mentioned support levels, as well as on the local resistance 7.05, the break of which may provoke a prolongation of growth

Regards R. Linda!

NZDJPY → Attempting to change the downtrendFX:NZDJPY is trying to get out of the downtrend by breaking the channel resistance. Against the background of local strengthening of the dollar, the currency pair has all chances.

Technically, buyers are starting to gain momentum and support the market, it can be seen on the background of locally growing minmiums, which gradually leads to the breakout of the channel resistance. The trigger in our case is the resistance 85.240 - a key level that divides the market into 2 planes.

If the bulls are able to consolidate above 85.240, an impulse to 86.13, then 86.88 may be formed in the short-term.

Support levels: 84.500, 84.00

Resistance levels: 85.240, 86.13

Initial testing of the trigger may end in a small pullback due to liquidity formed above. The pullback may be directed towards the previously broken channel resistance. But the emphasis is on price consolidation above 85.240, as this will be a prerequisite that the bulls are holding the market in the moment and are ready to keep going up.

Regards R. Linda!

EURAUD → False breakout & Pin-Bar on W1FX:EURAUD is testing important resistance from the weekly timeframe. A false breakout is formed after liquidity capture. There is no potential for continuation of growth and the chart is drawing everyone's favorite “pin-bar”

After the price exits the consolidation, the resistance of which was the level of 1.6787, a distributive pattern is formed, the target of which was the liquidity behind the weekly resistance of 1.7196.

The target has been reached and the price is consolidating below the base of the reversal structure and thus preparing to continue falling. It is possible formation of liquidation or downward impulse to 1.71 - 1.70. The forex market has been behaving calmly since the opening of the week and the market can work out technical nuances calmly, until the fundamental factors are connected.

Resistance levels: 1.7196 - 1.7304

Support levels: 1.7107, 1.7016

Zones of interest are located behind the local lows, but from a technical point of view, the market is most interested in liquidity beyond 1.6787 and there are all chances to reach this zone, as there are no obstacles below 1.7016. Accordingly, when the support at 1.7016 is broken, a free zone will open up

Regards R. Linda!

BITCOIN → Short-squeeze 86-89K before falling further to 75KBINANCE:BTCUSD continues to form a downtrend after breaking the bullish structure on the weekly timeframe. There is no bullish driver yet, and technically, the price is heading to the global imbalance zone of 75-73K

The past crypto summit and any other talk of cryptovalt support cannot support the market. Such events end with further market decline.

Technically, the market continues to form a downtrend (global counter-trend), based on this alone, we can say that the price is now going against the crowd and this is generally logical behavior. Globally, the zone of interest is located in the following zones - 75K, 73K and order block 69-66K

Locally, I would emphasize the nearest liquidity zones, located at the top, which can be tested before the further fall: 86697, 89.397

Resistance levels: 85135, 86678, 89397

Support levels: 79987, 78173, 73512

After the false break of 78K support there is no strong reaction, the market is forming a struggle for 84-85K zone, which generally indicates buying weakness. Before the further fall there may be a short-squeeze relative to the above mentioned zones of liquidity, which may lead to a further fall

Regards R. Linda!

DEGOUSDT → An attempt to change the trend will end in a fallBINANCE:DEGOUSDT.P tried to break the trend, but faced strong resistance and a weak cryptocurrency market. The fall may continue...

After breaking through the resistance of the descending channel, a bullish momentum (distribution) of 45% is formed, but the price bumps into a strong resistance of 2.11 - 2.18, which forms a trading range. Bears are not ready to give this zone to buyers and put pressure, a false breakout of resistance is formed after a long struggle for this zone and liquidation is formed when the base of 2.0 is broken. Buyers are in the panic zone. If the price fixes below 2.11 - 2.18, the fall in the short or medium term may continue.

Resistance levels: 2.00, 2.18, 2.274

Support levels: 1.75, 1.584, 1.359

The market is generally weak and altcoins are reacting aggressively to local bitcoin movements (the point of which is to gather liquidity before a further fall). BTC has not yet reached a key target, which together with the lack of a bullish driver in the market creates pressure for altcoins.

Regards R. Linda!

$4 to $16 with power hour making +60% run $10 to $16It was consolidating for 4 hours after morning news that investor or group purchased at least 5% stake in the company and filled with SEC. This made the stock pop to +150% on the day as traders speculated it could be a big reputable firm or individual so they want to be in as well. After strong support it moved further to +300% area total on the day and I warned everyone on time to get ready for $10 and $11 buys for the vertical new highs.

Last hour brought easy money NASDAQ:RGC

GOLD → Distribution phase. One step away from $3000. Up!FX:XAUUSD breaks upward and reaches the intermediate target. After strong growth there is no pullback at all. A consolidation is forming which shows us strong levels.

Gold updates ATH to +2990, preparing to overcome $3,000. Growth is being fueled by Trump's trade war and expectations of a Fed rate cut. Investors are cautious ahead of the Fed meeting. A stronger dollar and hopes for a US-Canada trade truce may temporarily cause a correction, but it is not the strongest factor. However, recession risks and escalation of trade and geopolitical conflicts may increase demand for protective assets, supporting the growth of gold prices

Technically, the price is in consolidation, relative to which there may be a breakthrough of resistance and further growth. Or a local false breakout, correction to support at 2980 and continuation of growth after support retest

Resistance levels: 2993, 3000, 3008

Support levels: 2981, 2956

Thus, if the bulls are able to consolidate above 2993, the price may continue its aggressive growth.

BUT! There is a possibility of correction to the risk (liquidity) zone 2981 - 2977 before gold resumes its growth.

Regards R. Linda!

GOLD → Testing ATH. High chance of a breakout 2954FX:XAUUSD in the distribution phase of the previously formed consolidation. The price is testing ATH and the market has all chances for a breakout and further update of the high. We are close to 3K

Gold price continues to rise, approaching a record high of $2,956, amid fears of a global trade war. Lower US inflation has weakened the dollar and bond yields, boosting demand for gold. Markets now await PPI data, but escalating trade conflict remains key.

Technically, gold is testing global range resistance a month after last touching it. I don't like to trade primary breakouts in such a case and the ideal scenario would be to wait for a small consolidation near the level or a correction to 2945 - 2935 before the metal starts to tetse 2954.5 for a breakout

Resistance levels: 2954.5

Support levels: 2945, 2935, 2930

As a first move I expect a pullback after resistance test. A retest of 2954.5 (retest) will mean that buyers are ready to break the resistance and go higher.

BUT, we have important news today. Gold could break the level without a pullback. A close above 2954.5 will trigger a rally.

Regards R. Linda!

QUICKUSDT → Pending a false breakout of resistanceBINANCE:QUICKUSDT is forming counter-trend movement to the resistance of the range - 0.02957. A false breakdown of the key level is formed against the background of the downtrend

The cryptocurrency market is experiencing bad times. While bitcoin is testing new lows - 76K, altcoins are cutting through to find another bottom.

QUICK stands out in this picture, testing a strong resistance (liquidity) zone 0.02845 - 0.02957 and forming a false breakout.

BUT! in the morning session bitcoin strengthens after a strong fall and can pull the whole market up with it. Thus, before the further fall another attempt to retest 0.02953 or update the tail of the false breakout at 0.03000 (0.7fibo) is possible.

Resistance levels: 0.0285, 0.02953, 0.0300.

Support levels: 0.0243, 0.02118

If the next resistance retest ends in a false breakdown and price consolidation under 0.02957, QUICK coin may continue its decline in the short and medium term.

Regards R. Linda!

GBPUSD - LONGStrong cumulative flat. Buying opportunity after the formation of the Cypher pattern.

GBPUSD - LONG

ENTRY PRICE - 1.2912

SL - 1.28500

TP - 1.30780

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

USDCAD SHORTLongterm oportunity to short USDCAD. We are in bigger consolidation that we can see on Monthly chart. On weekly we touch upper area of consolidation and now we brake UP trend and currently we are in retracement.

Try to look for enteries for short.

SL: above highest point

TP: above lower band of consolidation (dont be too greedy)

GOLD → Long-sqeeze (double bottom) before breakout 2926FX:XAUUSD is forming the maneuver we need regarding the previously mentioned consolidation. False break of support on the background of the rising market, we discussed it with you yesterday. The reaction is the formation of a reversal set-up and bullish momentum

This week the markets are awaiting the JOLTS jobs report (today) and CPI data (Wednesday), which could provide fresh impetus to prices.

Additional pressure comes from expectations of US-Ukraine peace talks, a possible mineral agreement and ongoing trade tensions related to Trump's protectionism. However, a weaker dollar and lower bond yields are supporting gold, limiting its losses

Gold may test yesterday's high and after a slight pullback continue to rise with a target of retesting the 2926 consolidation resistance. The market structure is bullish at the moment and it plays to our advantage....

Resistance levels: 2918, 2926, 2942

Support levels: 2905, 2893.5, 2880

At the moment the price is still in consolidation, but the price is forming a bullish rally due to the collected liquidity in the Asian session. The local pattern “double bottom” is formed (false breakdown of support) and the next target is the resistance of consolidation 2926. Also focus on 2918 - possible retest and pullback to 0.5 fibo before the price will storm 2926.

Regards R. Linda!

GOLD → Strong consolidation. What could happen?FX:XAUUSD is consolidating in the range of 2926 - 2890. The market is generally bullish, but there is a high probability of a short / long-squeeze before the strong news, which will be on Wednesday.

Markets are waiting for data on inflation and employment in the U.S., which may affect the Fed's decisions. Despite a weaker dollar and expectations of monetary easing, Fed chief Jerome Powell remains cautious.

Gold demand is supported by China, which is increasing purchases, as well as growing fears of stagflation in the US. However, traders are keeping an eye on new economic data and the impact of Chinese tariffs on US goods

Technically, the focus is on 2926 - 2890. The ideal scenario in a bull market would be a false break of the support at 2893 - 2890 and further growth due to the change of imbalance in the market after liquidation and liquidity capture. But, based on the current situation (strong range) there is a high probability of short-squeeze or long-squeeze.

Resistance levels: 2926, 2942

Support levels: 2893, 2890

At the moment the emphasis is on 2926. Formation of pre-breakout consolidation, further breakout and price consolidation above the resistance can provoke a bullish impulse.

But the difficulty is that the support has not been tested yet. If the price approaches 2926 very quickly, a false breakout could be made and in that case the price could go down to 2890 to retest the liquidity zone before storming 2926 for further upside.

Regards R. Linda!

POPCATUSDT → False breakout of bearish trend resistanceBINANCE:POPCATUSDT.P is testing trend resistance on the 4H timeframe. A sharp approach and a false breakdown of the upper boundary of the channel may provoke a correction or continuation of the decline

The global trend is downtrend, the locational trend also coincides with the global trend. Bitcoin cannot become a bullish driver for altcoins yet. Yesterday's economic news also had a negative impact on the market. In addition, the cryptocurrency community was betting big on Trump, but he has put cryptocurrencies on the back burner.

Technically, POPCAT is testing the channel resistance with a false breakout within the downtrend. Consolidation of the price below 0.322 could trigger further selling.

Resistance levels: 0.322, correction resistance

Support levels: 0.2386, 0.1596

I do not exclude the possibility of retesting the resistance of the correction channel, but due to bearish pressure and weak market the decline may continue.

Regards R. Linda!