ONT/USDT - Continuation of the Pump 🫰#ONT/USDT Analysis

Description

---------------------------------------------------------------

+ ONT is currently on the bullish trend and just hit the resistance line around 0.2631 range

+ I personally don't think this is a major resistance and we can expect the price to break this resistance and continue the bullish trend

+ Lets get a clear confirmation for the trend so i have added entry price above the resistance. This will give a confirmed trend.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 0.2665

Stop Loss: 0.2306

------------------------------

Targets 1: 0.2784

Targets 2: 0.2983

Targets 3: 0.3311

Targets 4: 0.3699

------------------------------

Timeframe: 4H

Capital: 1-2% of trading capital

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Agree or Disagree with the ideas ? lets discuss in the comments.

Like and follow us for more ideas.

Regards

VectorAlgo

Continutation

BTC: Possibility of a Bearish Ascending Triangle?- The most recent pump has painted a bearish divergence on the 1h, 2h, and 4h RSI.

- If Bitcoin dumps from here, or even from a little higher, this could indicate the possibility of the formation of a Bearish Ascending Triangle if the price retests the ascending support line.

Ascending Triangles are characterized by a series of higher lows but the same highs. The horizontal upper trendline will experience multiple efforts as price resistance. The shape of the Ascending Triangle is altered by the slope of the ascending support line which ‘converges’ or; is inclined toward, the upper resistance line. Ascending Triangles vary in their duration, but will have at least two swing highs and two swing lows in price.

This bearish continuation pattern has 3 phases:

1) Background: A Strong impulsive, thrusting action with a surge in volume & price establishes a clear picture of the controlling bearish trend direction. In our ascending triangle price pattern it is represented visually by a Pole. Deeper and more drama the better as the Pole is the Key to recognizing the potential for the continuation of the pattern. The Pole represents trend direction as well as its strength & often this pattern is initiated as a new breakdown in price from an established area & sellers are in control.

2) The second phase is a pause for consolidation of the action both in volume & price and is represented by the ascending triangle.

3) The pattern confirms as a bearish continuation pattern if the action creates a new bearish breakdown with a surge again from the bears in both volume & price.

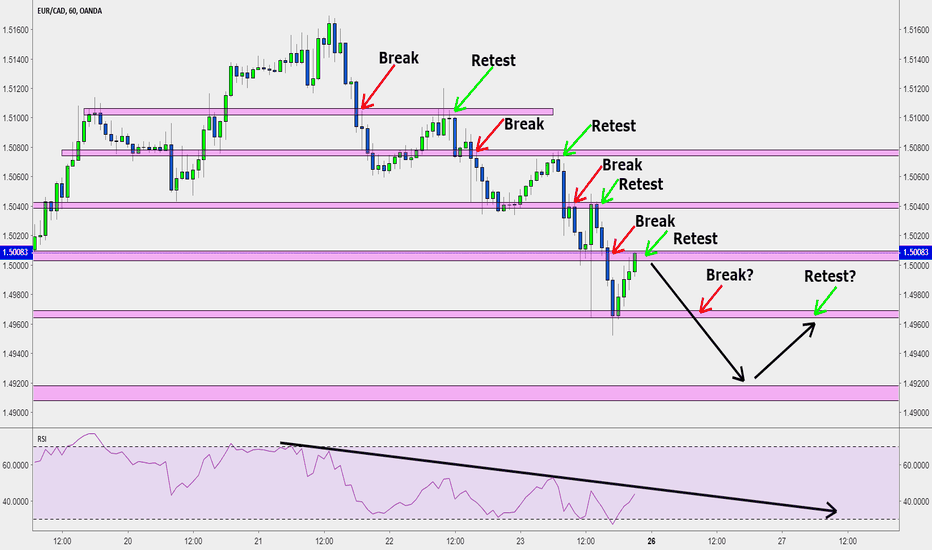

Key Levels EURCAD 06/11/2017Strong and fresh supply level for swing term position,

I'll sell at the supply level,

If the price will breakout the confirmation zone it indicates the price tend to reach the supply level,

there is a space of 80 pips between the confirmation zone to the supply level,

we can use this space and try to look for intraday buy position.

POSSIBLE BEARISH BREAKOUT AUD/JPYAfter being range bound for a while now AUD/JPY finally looks like it is preparing to make a break. I am favouring a downside break for this pair to 75.848 and possibly beyond. i will be waiting for a breakout, retest and continuation to enter into this one which looks like it could offer a nice risk reward as well. If this market was to turn on its head and break the other way i would expect a move up to 82.993 however at this point in time I am heavily favouring a downside break.