CORE

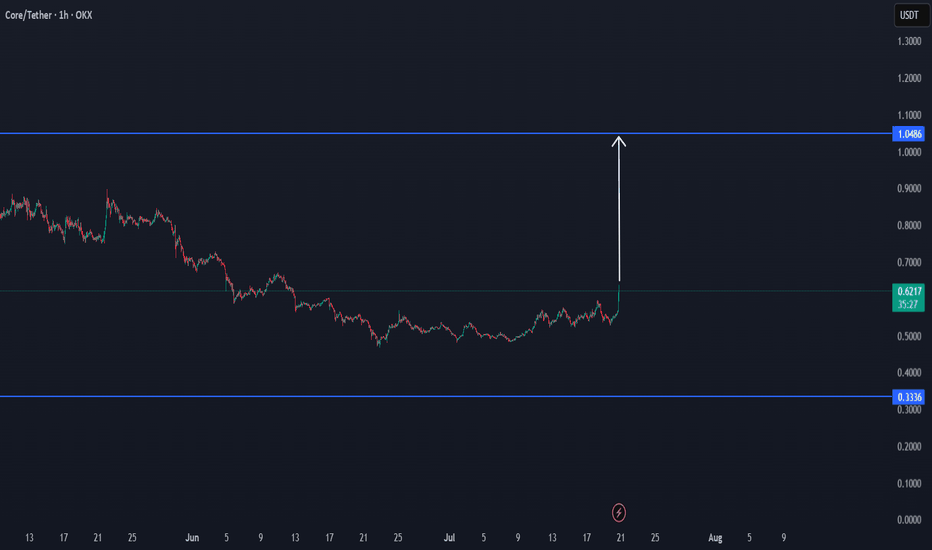

Core DAO Bullish Impulse, Elliott WaveI am giving two targets for the end of the fifth wave, the first wave is already in.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Here we have a classic chart setup, COREUSDT bearish since April 2024. The drop from April 2024 through March 2025 can be considered a big ABC. Once the correction ends, we can look for signs of a newly developing bullish wave. The signs are in.

Between March & May 2025 we have wave 1, ending clearly in a higher low. The first wave lasted 70 days, the third wave can easily last 90 days. Can be more or less, this is only a projection but we know the market is set to move higher.

Wave 2 was really short, it only lasted 28 days. So wave 4, the second correction within a bullish impulse, can last between 40 and 60 days. After wave 4 we get the fifth and final wave and this is the speculative wave.

These are very conservative projections on the chart, the market can move much higher. For example, wave 3 can end up going as high as wave 5. Then wave 4 would correct into what is now the wave 3 high. Then the final fifth wave would go off the chart and peak at $18. This is another version and it wouldn't surprise me, Crypto tend to go beyond all expectations when the bulls are on.

Regardless of how high the market goes, right now we have great entry timing and prices while at the same time knowing Crypto is going up.

Namaste.

TradeCityPro | CORE: Watching Trendline and RSI for Next Move👋 Welcome to TradeCity Pro!

In this analysis, I’ll be reviewing the CORE token. This project is one of the DeFi infrastructure developers for Bitcoin and also runs its own Layer 1 blockchain.

💥 The token currently holds a market cap of $826 million and is ranked 86th on CoinMarketCap.

⏳ 4-Hour Timeframe

As seen on the 4-hour chart, CORE is in an uptrend supported by an ascending trendline, with price consistently moving higher along it.

✅ In the last bullish leg, price only managed to retest the previous high around 0.8727 and is now undergoing a pullback.

⚡️ This shows signs of weakness in the bullish momentum. If the price fails to close above 0.8727 and drops back to the trendline, the risk of a trendline breakdown increases.

🔍 There’s also the potential for price to form equal highs and higher lows, forming an ascending triangle, which would favor a bullish breakout scenario.

🔑 Watch the RSI oscillator closely. Historically, every time RSI reached the 70 zone during a bullish move, the trend topped out and reversed. So if RSI manages to break above 70 this time, it could trigger a much stronger bullish leg.

📈 For a long position, potential entries include a breakout above 0.8727 or a bullish bounce off the ascending trendline.

🔽 For a short position, the first trigger would be a break of the trendline and activation of the 0.7560 support zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

CORE Rectangle BreakoutBITGET:COREUSDT appears to be breaking out of a 2 1/2 months long rectangle, and is currently challenging the 100-day EMA.

Confirmation: Daily close above $0.58

Invalidation: Break back below the rectangle resistance

Target: Previous support at $0.77 (resistance reinforced by 200-day EMA)

Breaking: $CORE Spike 19% Amidst Breaking From A Falling Wedge The price of Satoshi Core ( MIL:CORE ) broke our of a falling wedge delivering 19% in gains today.

The asset has since being in a falling wedge pattern ever since it surge to $2 in late November, 2024. This price correction led to about 84% loss in market value. However, recent price action posits that MIL:CORE is gearing up for a breakout with about 200% gain in sight.

With increasing momentum as hinted by the RSI at 69, MIL:CORE could be on the cusp of a breakout. Similarly, data from Defilama shows a growing ecosystem in the CORE blockchain, with about $549.72 Million locked in Total value lock (TVL) in DeFi.

What Is Core (CORE)?

Core (CORE) is built as an L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps). The Core network is powered by the “Satoshi Plus” consensus mechanism, which secures the network through a combination of delegated Bitcoin's mining hash and delegated Proof-of-Stake (DPoS). The protocol is backed by its native token, CORE.

Core Price Live Data

The Core price today is $0.598662 USD with a 24-hour trading volume of $58,909,857 USD. Core is up 19.65% in the last 24 hours. The current CoinMarketCap ranking is #88, with a market cap of $598,189,722 USD. It has a circulating supply of 999,210,618 CORE coins and a max. supply of 2,100,000,000 CORE coins.

Core Surge 12% Today Amidst Breaking Out From Falling WedgeThe Price of Satoshi Core ( MIL:CORE ) a L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), saw a 12% uptick today after it broke out of a falling wedge pattern, eyeing a 50% surge amidst broader crypto momentum.

Satoshi core ( MIL:CORE ) since listing has been thriving lately and manage to withstand the sellers even after mainnet airdrop tokens were distributed. Core blochain has been thriving lately that it keeps striving to solve the blockchain trilemma in the crypto world.

Further accrediting to MIL:CORE 's authenticity, data from DeFilama shows about $545.2 Million has been locked in Total Value Lock (TVL) in the CORE ecosystem. This fundamental shows a growing interest and trust in the CORE ecosystem.

Technical Outlook

As of the time of writing, MIL:CORE is up 3% consolidating after the brief 12% sojourn. The 4-hour price chart shows a tendency for MIL:CORE to pull a 50% stunt in the short term as the market stabilizes. The RSI at 67 further hints at a trend continuation pattern as traders are looking for a clear-cut entry on the MIL:CORE chart.

What Is Core (CORE)?

Core (CORE) is built as an L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps). The Core network is powered by the “Satoshi Plus” consensus mechanism, which secures the network through a combination of delegated Bitcoin's mining hash and delegated Proof-of-Stake (DPoS). The protocol is backed by its native token, CORE.

Just In: $CORE Surges 15% Becoming The Top Performing AltcoinAlbeit the bloodbath besieging the crypto market, one asset stood tall defying market odds surging 15% today with about 86.58% increase in 24 hours volume. "CORE" or Satoshi Core is a L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps).

With increased volatility today, MIL:CORE stood different surging 15%. The asset still has room for a continuation trend as hinted by the RSI at 59.

In the case of cool-off, the 38.2% Fibonacci retracement level is a suitable point for consolidation further selling pressure could push it lower to the 1-month low axis. Similarly, should MIL:CORE break above the 1-month high pivot, the $1 resistant will be feasible, therefore, attainable.

Core Price Live Data

The live Core price today is $0.476759 USD with a 24-hour trading volume of $71,813,902 USD. Core is up 13.98% in the last 24 hours, with a live market cap of $476,107,555 USD. It has a circulating supply of 998,633,921 CORE coins and a max. supply of 2,100,000,000 CORE coins.

#CORE/USDT#CORE

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3780.

Entry price: 0.3947

First target: 0.4070

Second target: 0.4200

Third target: 0.4337

CORE - Ready for another bullish wave up. Correlated w/BTCIf you are unfamiliar with what the CORE project is all about out I can tell you its heavy correlated with BTC price action. It likes to be near $1.00 like its own stable coin which its not, so the fact its 15% under its norm thats a solid play/low risk gain on the table.

#CORE/USDT / Ready to go up#CORE

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.7800

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.9632

First target 1.05

Second target 1.13

Third target 1.25

Core DAO ($COREUSDT): Daily Chart - Bullish Momentum SetupI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Core DAO ( OKX:COREUSDT ): Daily Chart Analysis for a Bullish Momentum Setup

Trade Setup:

- Entry Price: $1.3700 (Activated)

- Stop-Loss: $0.8576

- Take-Profit Targets:

- TP1: $2.5710

- TP2: $3.3331

Fundamental Analysis:

Core DAO ( OKX:COREUSDT ) is gaining traction as a blockchain platform focused on decentralized autonomous organizations (DAOs). Built to empower community-driven projects, MIL:CORE has seen increased adoption due to its robust governance model and efficient transaction capabilities. The platform’s ability to attract DeFi and dApp developers is driving its growth in the blockchain space.

With its focus on decentralization and governance, OKX:COREUSDT is well-positioned to capitalize on the growing interest in DAO-driven ecosystems. Recent network upgrades have bolstered confidence in its scalability and reliability.

Technical Analysis (Daily Timeframe):

- Current Price: $1.3720

- Moving Averages:

- 50-Day SMA: $1.1500

- 200-Day SMA: $1.0500

- Relative Strength Index (RSI): Currently at 66, signalling strong bullish momentum.

- Support and Resistance Levels:

- Support: $1.2000

- Resistance: $1.5000

The daily chart highlights a breakout above the $1.3000 resistance level, supported by increasing volume. The bullish continuation pattern suggests further upside potential toward the first take-profit target of $2.5710, with a long-term target at $3.3331.

Market Sentiment:

OKX:COREUSDT has witnessed a surge in trading volume, reflecting growing market interest. The token's association with emerging DAO projects and recent ecosystem partnerships have contributed to positive sentiment and increased investor confidence.

Risk Management:

The stop-loss at $0.8576 limits downside exposure, while the take-profit targets offer exceptional reward potential. TP1 provides an 88% return, while TP2 offers a 143% gain, making this setup ideal for swing traders aiming to capture significant upside.

Key Takeaways:

- OKX:COREUSDT is breaking out with strong bullish momentum, driven by growing adoption and ecosystem development.

- The trade offers excellent risk-to-reward ratios, suitable for both swing and long-term trading strategies.

- Discipline in execution is key to navigating potential market volatility.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

Core (CORE)Core is built as an L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications. The Core network is powered by the “Satoshi Plus” consensus mechanism, which secures the network through a combination of delegated Bitcoin's mining hash and delegated Proof-of-Stake.

Anyway, CORE been in a downtrend from birth. After CORE broke the downtrend line, CORE moved into an ascending channel, and recently CORE broke this channel with momentum and now reaching the first horizontal resistance area. Core probably rest at this area for a while; if break this area, further upward movement is possible. Let's see what happens.

CORE LongCORE/USDT Long

Reason:

Breakout of Trendline With Volume.

Broke major resistance and resting on it as support.

All indicators suggesting a strong bullish momentum.

initialization of next impulse.

Stoploss is 4H candle closing below 0.839

OKX:COREUSDT

BYBIT:COREUSDT

BYBIT:COREUSDT.P

MEXC:COREUSDT

MEXC:COREUSDT

CORE Technical Analysis in 12-Hour Timeframe.Hello everyone, I’m Cryptorphic.

For the past seven years, I’ve been sharing insightful charts and analysis.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

MIL:CORE has shown a decent rebound of 93%, forming a support trendline, and it is currently holding another support at $1.269.

If MIL:CORE rebounds from the CMP and breaks above the resistance trendline, then the primary support at $1.269 will be strong, and we will see a bullish rally, possibly a 30x gain in the altseason.

However, a breakdown will cause some trouble with the price, dropping it to the support trendline (a decent opportunity to fill MIL:CORE in your altcoin bag).

Key levels:

- Primary Support/Entry 1: $1.269.

- Lower Support/Entry 2: $0.9636.

- Resistance: $1.515.

- Long-term Target: $4.37 (30x).

- Invalidation Point: A close below the support trendline.

DYOR, NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

$CORE :: Indicate SELL & BUY LEVELSCore (CORE) is built as an L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps). The Core network is powered by the “Satoshi Plus” consensus mechanism, which secures the network through a combination of delegated Bitcoin's mining hash and delegated Proof-of-Stake (DPoS). The protocol is backed by its native token, CORE.

Top USD trades to watch ahead of Core PCE Data release The Federal Reserve’s preferred inflation gauge, US Core PCE (Personal Consumption Expenditure) Price Index MoM, is released at the end of the coming week. This means some USD trades could present themselves.

But first, a quick recap on why the Core PCE Price Index matters and why it is the Fed’s preferred gauge:

Unlike the more familiar Consumer Price Index (CPI), which uses a fixed basket of goods and services, the Core PCE offers a snapshot of consumer spending with a flexible and broader basket of goods and services that adapts to changes in consumer behavior. Importantly, it excludes volatile food and energy prices though. It is thus argued that the Core PCE provides a clearer view of underlying inflation trends.

Some trading opportunities might exist in the EUR/USD and USD/CAD. The Euro Area’s Inflation Rate (Flash) data is due a few hours before US PCE, while Canada’s GDP Growth data is released at the exact same time as US PCE.

#CORE/USDT#CORE

The price is moving in a bearish channel on the 4-hour frame and is largely sticking to it

The price rebounded well from the green support area at the 1.50 support level, which is a strong level

We have a trend to hold above the Moving Average 100, which is strong support for the rise

We have very strong oversold resistance on the RSI indicator to support the rise with an uptrend

Entry price is 1.60

The first goal is 1.84

Second goal 2.10

Third goal 2.40

Core Bullish Run with Weekly BreakoutCore (Coreusdt) has exhibited a bullish sign with a breakout in the weekly time frame. Currently trading at $1.26, the next resistance level lies at $1.51 .

A successful breakout above $1.51 could see the Core surge further to $2.54 .

On the downside, potential support sits at $1.00 in case of a pullback.

CORE SEEMS TO ENTER A NEW BUILDING TREND (CYCLE)Based on our study, CORE appears to be experiencing a significant upward trend, suggesting potential for further growth.

CORE is showing interesting indicates data trends both technically and in terms of data analysis.

we will follow its progress to see if it reaches the $1.11 mark soon.

we will continue to monitor CORE for any new updates. The current cycle for this coin cycle began at $0.58 and it's already gaining traction.

note that this update is not trading advice.

GOLD|Important areas of supply and demandHello friends, I hope you are well.

We have the gold chart in the one-hour time frame.

Yesterday we said that we will wait if the support zone is broken down, the next target is the zone (2005-2008).

Now in this area, with the formation of candlestick patterns, it has moved upwards.

The areas that are important for us are the bottom of the previous broken area (2013) and the next area of the origin of the downward aggressive movement, i.e. the price range (2024-2028) for sell positions.

If we lose the support area (2008-2005), our next target is the support area (1990-1995).