spread wheat vs corn 09:13 16-Aug-19.LOG

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

Trade accordingly your account size.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

CORN

spread wheat vs corn 07:34 16-Aug-19.LOG

spread wheat vs corn 07:34 16-Aug-19

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

Trade accordingly your account size.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

13:59 15-Aug-19 spread wheat corn .LOG

13:59 15-Aug-19 spread wheat corn

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

13:59 15-Aug-19

spread wheat corn 10:56 15-Aug-19.LOG

10:56 15-Aug-19

spread wheat corn

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

spread wheat corn 09:54 15-Aug-19.LOG

09:54 15-Aug-19

spread wheat corn

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

08:48 15-Aug-19 5000 units sold08:48 15-Aug-19

spread wheat corn

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

spread wheat corn 08:29 15-Aug-19.LOG

There is no audio in my videos.

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

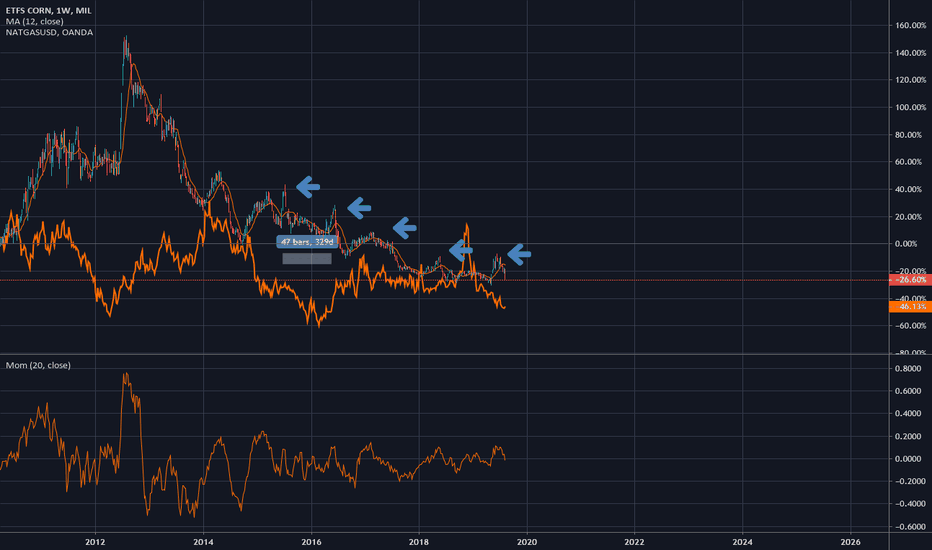

Corn and Natural GasCorn and natural gas show an interesting relationship, Corn has winter Lows with spring Highs with some swings between but roughly correlate to a yearly cycle.

Natural Gas is at all time lows, with price levels at pre 1995 prices at points in the recent past. Meanwhile the quantity and quality of dollars has risen. gas also follows a rough cycle of summer lows and winter highs which presents an interesting trading opportunity. Long Natural Gas in mid summer during peak withdrawal Into mid winter, with an exchange into corn going long into the summer, selling back into Gas or Gold.

In addition recent extreme weather events and forecast for a cooler winter increases demand for both Corn and Gas

spread wheat corn 13:51 14-Aug-19.LOG

spread wheat corn

13:51 14-Aug-19

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with the big money.

–A veteran trader, quoted in Futures

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades can last hours or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

OANDA:CORNUSD vs OANDA:WHEATUSD

spread wheat corn 12:29 14-Aug-19.LOG

12:29 14-Aug-19

This is a demo ac.

I have a real ac with oanda.

There is no sound recording.

I spread trade WHEAT versus CORN.

I follow more or less -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with the big money.

–A veteran trader, quoted in Futures

Everytime i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

The trades canlast hours or weeks.

Patience and discipline and money management. I will not lose more than 5% of the equity.

I can trade every hour or other.

wheat vs corn 14 aug 2019 9h45This si a demo.

Spread trading, a low-risk, high-profit technique, involves buying a contract in one market while selling a different contract in another market to profit from the imbalance between those markets. The Complete Guide to Spread Trading covers the step-by-step mechanics for successfully executing more than 25 calendar, intermarket, interest rate, volatility, and stock index spreads. It explains both basic and advanced spread techniques and strategies, revealing market situations where spreads are most appropriate as well as clarifying what it means to buy or sell a spread, and more.

The guy who spreads and makes a little every day is the one who walks away with the big money.

–A veteran trader, quoted in Futures

Spread Trading corn versus wheathello

I use spread trading. This is a demo. I have a real ac with oanda . I base my strategy with -

The Complete Guide to Spread Trading (McGraw-Hill Trader's Edge Series)

-Spread trading, a low-risk, high-profit technique, involves buying a contract in one market while selling a different contract in another market to profit from the imbalance between those markets. The Complete Guide to Spread Trading covers the step-by-step mechanics for successfully executing more than 25 calendar, intermarket, interest rate, volatility, and stock index spreads. It explains both basic and advanced spread techniques and strategies, revealing market situations where spreads are most appropriate as well as clarifying what it means to buy or sell a spread, and more.

ZCK2020-ZCU2019 - Commodity Spread Trading on Corn FuturesZCK2020-ZCU2019

Spreads on corn futures almost reaching Take Profit.

Spreads are one of the most profitable forms of trading there are thanks to the statistical advantage on the seasonality of commodities.

If done respecting the rules of operation, you get on average a Winrate of 87% with a Risk Reward of 2/1.

Joe Ross is my greatest master in this field.

Corn bottomed?Corn bounced right off the range I mentioned on my last idea, Aggressive traders might go long here but it's probably best to wait for MACD signal and further strength. Seasonally corn is Not bullish at this time of the year, so it's best to be careful with longs

**If you're interested in joining a group of like-minded traders, send me a PM. This is NOT a subscription service, just bunch of average traders sharing insights in a FREE group

"Corn: going down as expected" by ThinkingAntsOkDaily Chart Explanation:

- Price bounced on the Major Resistance Zone and started the down move.

- It reached our first target for the bear move at the Middle Support Zone (4.00).

- Now, it has potential to move down towards our second target at the Support Zone (3.395).

- We are looking for sell setups on lower timeframes.

Check our our Weekly Vision. Updates coming soon!

Weekly Vision:

Looking for a tradeable low in Corntarget for short corn idea that I posted was hit, now I’m looking for a tradeable low, more downside is likely but it’s probably better to stay flat and let the market figure out from where to bounce and then get on the trend.

If 400 doesn’t hold, a low might form in the 380-391 region

** Just an idea NOT a forecast

Corn - Looking Stronger BuyI have been hovering over the buy button on corn past week. Wasn't convinced enough to enter, and now heading back to Fib retracement towards $4. The closer to this the stronger chance of a rally - from either fundamentals coning out due to crop damage and lower yields, and also some technical short closing since last rally. Keeping in mind the August report, there could be some positioning before here too from fund managers, adding to volatility. That said, if crops are seen as doing well, with ample inventories, and no substantial buying even though China tariff waiver, prices could continue the current short term bearish trend and breeze through $4 down to $3.80. RSI already showing oversold on shorterm though with possible technicals support current prices and allow for some upside. Overall still see risk to upside despite last week's drop.

Corn - Leaning Towards Nice Long TradeI feel corn is an easy trade at moment. If we look at 4.29 as a kind of average way point at the moment.

If it shoots above that with more news of more crop issues in US, look for an overbought RSI to short or jump on the long train if feel confident. There are uncertainties of the amount of acreage planted, and extended heat causing further crop damage, but there is a good harvest in South American (from my understanding)

But if cooling this week ahead, and crop acreage isn't as bad as people thinking, could be a price breakdown below $4.

Basically, prices below that way point of 4.29 I wouldn't short, and above that I wouldn't long. I want to see some fundamental reason for long or short. Though if wanted to place a position at start of week, I would open a long with low risk equity position.

I feel that risk is to upside at moment, with some bullish news easily pushing to $5. Though over this, demand side reduction could occur, so if it gets there, a short position should be considered.

Unless some overly bearish news, I don't see any huge price drops, and see support around that current $4 - $4.29 level, I see this as an easy long trade (unless fundamental breakdown)