Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 699.50

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bearish bias. To add confluence to this, price is under the Ichimoku cloud which indicates a bearish market. Overnight price had bearish momentum downwards with price currently trading at 682.75 at time of writing. If this bearish momentum continues, expect price to possibly head towards the support line at 675.00 where the 78.6% Fibonacci projection line and 0% Fibonacci lines are located.

Alternative scenario: Price may go back up and head towards the 1st resistance at 699.50 where the 78.6% and 23.6% Fibonacci lines are located.

Fundamentals: There are no major news.

CORN

Corn Futures ( ZC1!), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 715.25

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bullish bias. To add confluence to this, price is above the Ichimoku cloud which indicates a bullish market. Overnight price had bullish momentum upwards with price currently trading at 693.2 at time of writing. If this bullish momentum continues, expect price to possibly head towards the Pivot line at 706.4 where the previous high and 100% Fibonacci line are located.

Alternative scenario: Price may go back down to retest the support line at 675.00, where the 100% and 0% Fibonacci lines are located.

Fundamentals: There are no major news.

CORN SELL IDEACorn has been on a downtrend for some time and this bear market is yet to complete. From analysis I predict further from current zone to the green lined zones currently below market.

Trade at your own risk, I am not a financial advisor, just someone who shares ideas and planned personal trades!

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.25

Pivot: 661.20

Support: 674.00

Preferred case: On the H4 chart, we have a bearish bias. To add confirmation to this bias, price is under the ichimoku cloud which indicates a bearish market. Overnight price had a bearish momentum downwards and closed below the 1st resistance line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bearish and head towards the 1st support at 674.00 where the 38.2% Fibonacci line is located.

Alternative scenario: Price may go back up to retest the 1st resistance level

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.50

Pivot: 661.20

Support: 680.25

Preferred case: On the H4 chart, we have a bullish bias. Overnight price had a small bearish retracement downwards. However, if this overall bullish momentum continues, expect price to continue bullish and head towards the 1st resistance at 698.50 where the previous high and 2 x 100% Fibonacci lines are located.

Alternative scenario: Price may go back down and close below the 1st support line at 680.25 where the 50% and 38.2% Fibonacci lines are located, and head towards the pivot at 661.50, where the previous swing low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.50

Pivot: 661.20

Support: 680.25

Preferred case: On the H4 chart, we have a bullish bias. Overnight price had a bullish momentum and went above the 1st support line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bullish and head towards the 1st resistance at 698.50 where the previous high and 2 x 100% Fibonacci lines are located.

Alternative scenario: Price may go back down and close below the 1st support level and head towards the pivot at 661.50, where the previous swing low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.25

Pivot: 661.20

Support: 654.20

Preferred case: On the H4 chart, we have a bearish bias with price under the Ichimoku cloud which indicates a bearish market, adding confluence to our bias. Price is currently consolidating along the 1st resistance line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bearish and head towards the pivot at 661.2 where the previous low, 100% Fibonacci line and 78.6% Fibonacci projection lines are located.

Alternative scenario: Price may go back up and close above the 1st resistance level and head towards the 2nd resistance line where the previous swing high is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.00

Pivot: 661.20

Support: 671.50

Preferred case: On the H4 chart, the overall bias for ZC1!, corn is bearish. To add confluence to this, price is below the Ichimoku cloud which indicates a bearish market. Price has tapped on to the 1st resistance at 680.00 where the 50% and 38.2% Fibonacci lines are located before closing underneath it. Expecting price to continue its bearish momentum towards the support at 671.50, where the 23.6% Fibonacci line is located.

Alternative scenario: Price may go back up and close above the 1st resistance level.

Fundamentals: There are no major news.

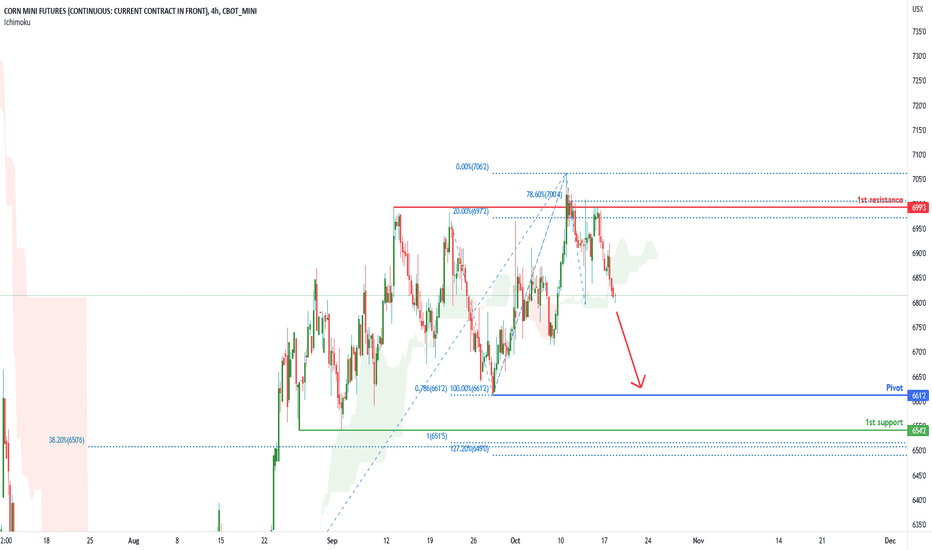

Corn Mini Futures ( XC1!), H4 Potential for Bearish Momentum Title: Corn Mini Futures ( XC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 699.3

Pivot: 661.20

Support: 654.20

Preferred case: On the H4 chart, price has tested the 1st resistance line at 699.3 multiple times where the 20% and 78.6% Fibonacci lines are located. Price then retraced downwards with price under the Ichimoku cloud which indicates a bearish market. Expecting price to continue bearish and head towards the pivot at 661.2 where the previous low, 100% Fibonacci line and 78.6% Fibonacci projection lines are located.

Alternative scenario: Price may go back up and close above the 1st resistance level.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 706.50

Pivot: 661.40

Support: 698.50

Preferred case: Corn prices have been rising since September 28, 2022. The price is above the Ichimoku cloud, indicating a bullish market. Price hit and bounced off the second support level at 680.4, which contains the 50%, 38.2%, and 61.8% Fibonacci lines, overnight. Price has now closed above the first support level at 698.50, which contains two 100% Fibonacci lines and one 0% Fibonacci line. If the bullish momentum continues, price may return to the first resistance level at 706.50, where the -27.2% and -20% Fibonacci lines are located.

Alternative scenario: Price may revert to the second support level at 680.50.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 698.4

Pivot: 661.40

Support: 680.40

Preferred case: Since September 28, 2022, corn prices have been rising. The price is above the Ichimoku cloud, indicating that the market is bullish. The price moved strongly upwards, approaching the first resistance level at 698.4, which contains two 100% Fibonacci lines. Price then bounced off it and closed below the first resistance level. If this retracement continues, price will fall towards the first support level at 680.4, which contains the 50%, 38.2%, and 61.8% Fibonacci lines.

Alternative scenario: Price may go back up retest the 1st resistance before heading down towards the first support level.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 696.25

Pivot: 661.40

Support: 680.50

Corn prices have been climbing since September 28, 2022. The price is above the Ichimoku cloud, which adds to the market's bullish bias. The price is currently consolidating along the 50% and 38.2% Fibonacci lines, which correspond to the first support level at 680.4. Corn has been rising with a strong bullish trend since last Friday. Corn is now trading at 688.4. If the bullish momentum continues, price will go towards the first resistance level at 696.2, which contains the 0% Fibonacci line and two of the 100% Fibonacci lines.

Alternative scenario: Price may retest the first support and go to the pivot at 661.4, which contains the 100% Fibonacci line and the last swing low.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.50

Pivot: 661.40

Support: 669.50

Preferred Case: Corn fell below the first resistance level at 680.50, where the 50% and 38.2% Fibonacci lines are placed. If the bearish trend continues, price could reach the first support level at 669.4, which is nearby the 78.6% Fibonacci line.

Alternative scenario: Price may retrace back up to the first resistance level at 680.4.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.00

Pivot: 661.40

Support: 661.50

Preferred Case: Corn has been rising since September 28, 2022. The price is above the ichimoku cloud, adding to the bullish market bias. Price is currently consolidating along the 50% and 38.2% Fibonacci lines, which mark the first support level at 680.4. If the bullish momentum continues, price may move towards the first resistance level at 698.0, which contains two 100% Fibonacci lines.

Alternative scenario: Price may break through the first support and continue to fall towards 661.4, the pivot point and previous swing low.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.00

Pivot: 661.40

Support: 661.50

Preferred Case: Corn has been on a bullish trend since September 28, 2022. Price is above the ichimoku cloud, which denotes a bullish market, adding to this confluence. Price reversed course through the first support level at 680.4, which is marked by the 50% and 38.2% Fibonacci lines. Expect price to continue moving upwards approaching the first barrier at 698.0, which is where two of the 100% Fibonacci lines are situated, if this bullish momentum persists.

Alternative scenario: The first support, at 680.4, may be where corn reverses back down. Price may then continue to fall toward the pivot point and prior swing low at 661.4 from there.

Fundamentals: There are no major news.

Corn Futures Continue to Consolidate Fundamental Spotlight:

Weekly Export Inspections

Corn: 661,658 metric tons; in line with analysts' estimates

Soybeans: 575,220 metric tons; in line with analysts' estimates

Wheat: 667,577 metric tons; above analysts' estimates.

Crop Progress

Corn: 20% harvested, this was within the range of estimates, 7% behind last year's pace

Soybeans: 22% harvested; this is a faster pace than expectations, but 9% behind last year's pace.

A Look at the Outside Markets

The dollar is continuing to retreat, trading back to one of the September 23rd breakout point near 111. If the dollar continues to retreat it may offer some support to commodities. Oil is approaching yesterday's high and equity markets are continuing to rally, trading roughly 2% higher this morning.

Technical Snapshot:

Corn

December corn futures were able to gain some ground to start the week, but the overall performance was still less than impressive considering the risk-on trade in other markets. The market is right in our pivot pocket this morning, we've outlined that as 678-682. A close above here could spark a move back towards resistance, we see that coming in from 698-700. We have been in and remain in the camp that believes there will be short term trading opportunities for participants on both sides. A break above resistance or below support would likely change that theses as we could see the market take more of a direction, other than sideways.

Bias: Neutral/Bearish

Previous Session Bias: Neutral/Bearish

Resistance: 698-700**, 725 3/4-728 1/4****

Pivot: 678-682

Support: 665-668 1/2***, 647 1/4-650 1/4****

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 691.0

Pivot: 661.40

Support: 675.60

Preferred Case: The H4 price is in a downward trend. Price breached and closed below the first resistance level at 691.00. Price could potentially reverse back down to the pivot line and 20% retracement level at 661.40.

Alternative scenario: If the bullish momentum continues, price will move to 688.0, where the 23.6% Fibonacci line is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 691.0

Pivot: 661.40

Support: 675.60

Preferred Case: The overall price on the H4 is bullish. Furthermore, the price is above the Ichimoku cloud, indicating that the market is bullish. Price attempted but failed to breach the first resistance level at 691.00. Price responded with a massive rejection wick. Price could potentially reverse back down to the first support level at 675.6, which also happens to be the 61.8% Fibonacci retracement line.

Alternative scenario: If bullish momentum continues, expect price to move towards 705.6, which contains the -27.2% Fibonacci expansion line and the 127.2% Fibonacci extension line.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 6.900

Pivot: 667.50

Support: 6.310

Preferred Case: On the H4, the overall price is bearish. In addition, the price is below the Ichimoku cloud, indicating a bear market. Price attempted but failed to break through the Pivot at 667.500 overnight. Price could potentially reverse up to the first resistance level at 6.900, where the 38.2% Fibonacci line is located.

Alternative scenario: If bearish momentum persists, expect price to continue falling towards the first support level at 6.310, where the larger 78.6% Fibonacci line is located.

Fundamentals: There is no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 680.00

Pivot: 667.50

Support: 661.75

Preferred Case: On the H4, the overall price is bearish. In addition, the price is below the Ichimoku cloud, indicating a bear market. Price has broken through the Pivot at 667.4, which corresponds to the previous swing low. Price also rebounded from the first support and rose above the first pivot. Price may maintain its short-term bullish momentum and move towards the first resistance level at 680.0, where the 38.2% Fibonacci line is located.

Alternative scenario: The price could reverse and head back down to the first support level at 661.75, where the -27.2% Fibonacci expansion is located.

Fundamsentals: There is no major news.