FISHY moves in the STOCKMARKETHey tradomaniacs,

Current markets mood is harder to indentify as we see the same cashflow like we`ve seen with the first vaccine-wave this year.

Comparing RUSSELL 2000 and SPX500 it looks like we see a flow out of big companies into the small-cap-section.

This is very weird as the small businesses were those who suffered the most during the COVID-Lockdown in the USA.

Does the market expect a BOOM of these companies with the upcoming vaccine?

There is one fact:

More than 50% of these companies listed in RUSSELL are not making any profit 👉 They are the "zombies" of the market who are only able to survive due to financial injections by the central bank.

These odd moves are forcing me to trade a bit less as I don`t think that institutional traders are willing to buy stocks of companies that only just able to buoy up.

Sell off coming soon?

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Coronavirus (COVID-19)

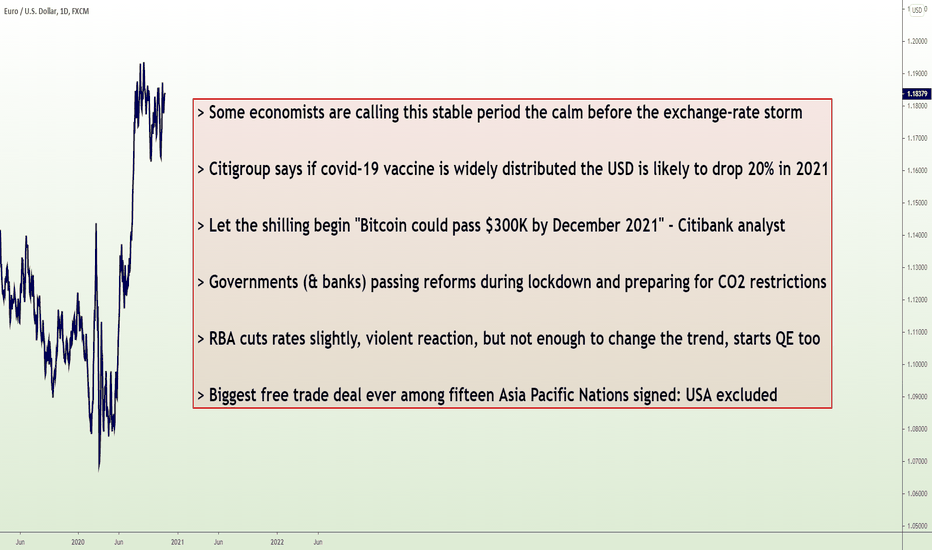

Economic & Currency news n°22> Some economists are calling this stable period the calm before the exchange-rate storm

***********************

The price move of around 10% this year is small compared to during the 2008 crisis: EURUSD fluctuated between 1.60 and 1.23, AUDUSD ~0.985 and 0.60, huge downtrend, GBPUSD too had a giant move, of 33%.

The main explanation they have is it's coming from the zero or near-zero interest rates, and this could keep the dollar stable but not indefinitely, and they expect the USD to fall fall fall.

> Citigroup says if covid-19 vaccine is widely distributed the USD is likely to drop 20% in 2021

***********************

“Vaccine distribution we believe will check off all of our bear market signposts, allowing the dollar to follow a similar path to that it experienced from the early to mid-2000s”.

Last week after a vaccine announcement, the US stock market saw one of the biggest inflow of money they ever saw.

Of course 2020 fundamentals was very bearish therefore Wall Street was bullish.

Bank of America predicts in 2021 there will be a recovery, bullish fundamentals, therefore let's sell.

Strategists have been positing for months that the U.S. election, vaccine breakthroughs and Federal Reserve policy could deal a serious blow to the currency. The election wasn’t ultimately the catalyst for a significant plunge, but Citigroup says the broad macroeconomic backdrop will be a bigger driver of the dollar going forward.

Citigroup sees a much bigger drop of the USD than other analysts, not sure they looked at the MZM and other things. Say Biden gets elected, he now plans on going forward with the green new deal? Senate will block it, but they won't block everything and the progressives might pass some changes without the senate or finding an agreement with them. I have never seen anyone look at the numbers (it's beyond belief) but there are scenarios where I could guarentee hyperinflation.

> Let the shilling begin "Bitcoin could pass $300K by December 2021" - Citibank analyst

***********************

Bitcoin has made yet another high, it is close to $17000 now. My only regret is not buying more.

A senior analyst at U.S.-based financial giant Citibank has penned a report drawing on similarities between the 1970s gold market and bitcoin.

He drew lines on charts, gold and bitcoin, and did TA (also known as wishful thinking) to project Bitcoin reaching $300,000.

When the calls for 1 million arrive you know a top is probably not far so I am ready to exit. Might happen this week?

> Governments (& banks) passing reforms during lockdown and preparing for CO2 restrictions

***********************

Reforms, in particular ones that were being met with great hostility, are being passed by politicians that are taking advantage of the lockdown they imposed.

They are also preparing their great resets, with banks in particular laying out plans for things such as "CO2 risk" and climate regulations.

The FED for the first time has included "climate risks" in its financial stability report, I have not read it, not sure what they put in there.

My own assessment (and I will be proven right as usual) includes 2 things: More moss on streets, they will be covered, and an explosion of animal populations, in particular brace yourselves for having 1 more animal roaming around in cities and destroying properties in top of cockroaches, rats & pigeons: wild boars.

> RBA cuts rates slightly, violent reaction, but not enough to change the trend, starts QE too

***********************

I do not know if it matters or not.

Anyway that's it! For the first time Australia is getting into QE.

Effectively the government is printing money, same thousands of years old story.

Back in ancient times governments that did this ended up being brought to justice but people are not as smart anymore (but they sure think they are and even more, much more smart than these "primitive idiots"... delusional).

> Biggest free trade deal ever among fifteen Asia Pacific Nations signed: USA excluded

***********************

Buh Bye. The world largest trading block has been created, it will include around 1/3 of the world economy.

"Communist" China is really loving free markets.

This + Silk Road. Who even needs the US?

I can see in real time sanctions and the weight of the USD evaporating.

Of course, US media silent on the subject, and american population as ignorant as ever.

$SPY 11/16 Daily Levels | Covid Cases RiseDaily Technical Analysis on $SPY, watch these levels.

-

Cases rise across US with over 11 million cases and 248k deaths in the USA alone, over 1 million deaths world-wide.

Levels To Watch:

- Support(s): $361, $358.86

- Resistance(s): $362.9

DotcomJack | Daily SPY

Bulls aren't buying on Mordena's vaccine dataCrude Oil didn't reach my initial $39.34 🎯 .

However, I'm still bearish expecting a further downward retracement of the Pfizer vaccine news bull run. The target is a strong level of support and is in confluence with a 0.618 fibonacci level.

Mordena's Vaccine news have bulged the commodity just a bit higher compared to the reaction of Pfizer vaccine data. This means investors are still not bullish as both companies have stated that it will take time to produce and ship the vaccine doses. The COVID19 outlook is getting worse with the US reporting more than 1m cases in 1 week. State governors are imposing strict restrictions on business and individuals and this could impact the demand for oil. The situation is similar in Europe, Asia and Africa.

Because of the weak fundamentals, I'm bearish on both US Oil and UK Oil.

Disney and 'Big Techs' Reacted Differently to Great Vaccine NewsDisney, McDonald's and 'Big Techs' Reacted Differently to Great Vaccine News

On Monday, markets were woken from a nap by an unexpected welcome surprise. With one accord, and for a few hours, the trading community even seemed to have entirely forgotten all the threadbare media refrains concerning the U.S. election agenda. A set of major European indexes soared by five to seven percent, quickly starting to storm all of their respective multi-month top levels, with the French CAC40 exceeding the best summer quotes, and the U.S. broad market S&P500 index even hit its new record all-time highs.

The reason for such agitation was the fresh and really breakthrough results of an anti-COVID vaccine. Headquartered in New York now and founded by German-Americans, a well-reputed pharmaceutical corporation called Pfizer, in cooperation with its close partner, a German bioengineering company BioNTech, declared their experimental COVID-19 vaccine was more than 90% effective on the third and final stage of trial results. There are still some questions to be answered surrounding the matter, such as, how long is immunity expected to last, but the base information was that Pfizer expects to seek U.S. emergency use authorisation for people aged 16 to 85 as soon as November.

By the way, the skills of Pfizer Co were applied to the mass penicillin production during World War II in response to the need to treat injured Allied soldiers, and most of the penicillin that went ashore with the troops on D-Day was made by Pfizer. And now it seems that the company is going to save lives and economics against the harmful coronavirus. “I’m near ecstatic,” Bill Gruber, one of Pfizer’s top vaccine scientists, said in an interview. “This is a great day for public health and for the potential to get us all out of the circumstances we’re now in.” Peter Horby, professor of emerging infectious diseases at the University of Oxford, commented: “This news made me smile from ear to ear. It is a relief to see such positive results on this vaccine and bodes well for COVID-19 vaccines in general.”

The scientists just need to wait for the finish of a follow-up safety data to assure no side effects crop up, and the necessary results are expected to be available in the third week of this month. Alex Azar, U.S. Health and Human Services Secretary, remarked it would take several weeks for U.S. regulators to receive and process the data before a potential approval. If it would be granted, companies estimate they can roll out up to 50 million doses before the end of 2020, enough to protect 25 million people with 2 necessary injections, and then their plan is to produce up to 1.3 billion doses in 2021.

Ursula von der Leyen, the head of the EU Commission, happily tweeted: "European science works! @EU_Commission to sign contract with them soon for up to 300 million doses. Let's keep protecting each other in the meantime." By the way, the European Commission currently has three contracts for the purchase of other potential coronavirus vaccines with AstraZeneca, Johnson & Johnson and Sanofi-GSK.

"A major breakthrough in the development of a coronavirus vaccine could deliver a vital boost of confidence to consumers and businesses", the Bank of England’s chief economist, Andy Haldane, said. "The economy may have reached a decisive moment," he added, as the vaccine could be a “game-changer”. He cautioned that, of course, it would take several months for the vaccine to be rolled out but that it would have an immediate effect on sentiment, as it would mean an end in sight to the "endless stop-start-cycle" of all business processes helping to unlock investments.

This news and commentaries may not serve as instant coffee, which could immediately cheer up the entire world economy, at least because the subsequent approval of the vaccine does not mean that the vaccine will be distributed to everyone who wants it in a week or even a month. But the new situation has already brought visible relief to the markets, although most of the various assets and composite indices failed to hold their initial gains of Monday evening. The S&P 500 index closed yesterday near the 3,550 point level, where it was also located by European midday on Tuesday. This is about 120 points below Monday's peak, and the index price was approximately 35 points lower at some moments in Asian trading.

It seemed as if some share prices jumped for joy, like those of the Walt Disney Company, which rose more than 12% just after the opening bell. Walt Disney even traded above $147.50 for a short moment, which was just a little bit above the quotes of the beginning of February. Prices beyond $150 were last seen in December 2019, at non-pandemic times, and Disney never traded higher than that before. The House of Mouse' shares have been generally within a range between $115 to $130 since July, amid the unnatural but "new normal" social-distance obstacles that accompany the reopening of theme parks, which amounted to a third of all the cartoon empire's profit in previous years.

Disney-themed cruises and hotels were also thriving on shared group experiences and suffering a lot after the forced closure of the resorts. A long pause in the running of worldwide movie theatres also influenced the revenue. Disney shares were already doing much better even before the news about the vaccine, but now they were seen to be flying up with a kind of crazy enthusiasm, and the following price correction reached only a local intraday bottom in the $138 area, and the next move was above $142.50 again.

Walt Disney is going to report its earnings for the fiscal 2020 fourth quarter, meaning the financial results of Q3, after Wall Street will close on Thursday, November 12. Analysts in numerous polls are expecting about $14 billion in Q3 sales on average and $0.73 loss per share. A bright spot in the upcoming earnings could be the number of subscribers on Disney's streaming service, Disney+, which may continue to benefit from the stay-at-home environment. But perhaps the most important thing to look at going forward is how investors will react to prospects that will arise after the pandemic is over. .

Some other shares behaved in a more controversial manner after the perspective of their financial report changed after the news of the vaccine yesterday. . For example, the movements of McDonald's share price were very emotional and rather surprising if compared with the last financial report just published before Wall Street’s Monday's trading session.

The reported profit, in a form of equity per share (EPS), was $2.22, a historical record for McDonald's and much above the average expectations of just $1.91 per share. The company’s highest EPS was at $2.32 in 2017 and its highest quarter revenue for this year stands at $5.42 billion. So, the shares' price started to trade with a large gap of $227 per share, but a mass profit taking process immediately loomed , so the price quickly fell by more than $10 lower and then even continued to dive, hitting a twelve-week low at $208.30. Then the situation on charts became more stable around the closing price of $213.22.

The fast food giant's massive network of drive-through locations helped to revive sales during the pandemic and on delivery apps orders when customers tried to avoid dining out during the pandemic. Now a positive effect of possible normalisation of life may play a role but rivals from the traditional restaurant segment will not fall asleep too. McDonald's CEOs said on Monday, they would test a "MyMcDonald's" digital loyalty program for customers to allow those who sign up to get tailored offers. Network restaurants are also planned to launch a new crispy chicken sandwich next year as it refocuses its long-term strategy after the pandemic. The world's largest burger chain plans next year to prioritise marketing, including new packaging globally with a "modern, refreshing feel and playful touches to unify branding in markets all over the world," it said in a statement.

In terms of financial figures, McDonald's repeated its own achievement in revenue for autumn 2019, which was already high. So, it reached its normal revenue level, since the fast food network showed approximately the same figures in three quarters out of four last year. The revenue figures now turned out to be the highest for any quarter in the previous three years, but throughout 2016 and 2017, McDonald’s revenue figures were exceeded $6 billion in some quarters. Earnings per share were then lower; it ranged from $1.23 to $1.99 per share. That means sales structures have become more efficient since then. Such indication may allow forecasting a gradual movement to some higher targets for share prices in the next 12 months, provided that everything gets better with the COVID-19 situation.

At the same time, further price movements of all index futures prices deleted most of yesterday's gains. Many "big techs" even lost some part of their giant capitalisation over the course of Monday's trade, including Amazon (-5.06%) or the so-called "stay-at-home" shares like Netflix (-8.59%). The market may doubt if they were overestimated to some extent under the condition that the vaccine may push the general public to more offline-activity after several months. Against this background, The Nasdaq 100 high tech index continues to lose its value, while the S&P dynamics are mixed today. Hopeful about a better future, many investors seem to be gradually returning to the realities of this transient world, where many countries still have partial lockdowns and viral cases, and there would probably be the lasting tension around the U.S. presidential seat. Donald Trump is showing no signs that he will engage in any power transition.

Moreover, the sitting U.S. President unexpectedly replaced the head of the Pentagon. He tweeted that Christopher Miller, Director of the National Counterterrorism Centre, unanimously confirmed by the Senate at that position before, will be acting as Secretary of Defence. That information created a small turmoil in the market before the end of Monday's trade, as it may indicate Mr Trump's determination to strengthen the security forces for the case of street riots, for example, while his claims on alleged fraud with votes are considered by the court, and he announced that he has already formed the teams to pursue recounts in several states.

Vaccine News! What Does this Mean for Stocks?News of the Moderna vaccine has sent stocks soaring this morning. Never mind the actual effectiveness of this 'vaccine', this is simply what the markets want to hear. The S&P has hit 3634, a fibonacci extension level and all time highs. The Kovach OBV looked like it was about to turn over, but has since upticked to reflect this move. The Kovach Chande has picked up dramatically. The S&P may see some resistance here, but it should have support at 3584, and 3547. If you did not enter this trade already, avoid FOMO, we are bound to see a retracement at some point.

Direction watchCurrently we are resting under a moderate pivot resistance point (.7270). If we can close out above this pivot we may see continued consolidation between this point and .7300 until a break out.

I personally am only looking for an intraday trade however my sentiment is low but here is my analysis none the less.

If we can get a MACD signal line cross up through 0 line on 2 hr chart to trigger the buy super trend line I may look for an entry.

MACD and signal on 1 hr chart have crossed up through 0 line as well as the 3 hr chart. Ill only be looking at the 4 hr chart pending the MACD and signal on the 2 and 3 hr chart cross up through the 0 line. If we get this far we can begin too look for a further push.

Based on inflation talk, gold will be up as it is extremely valuable in time of demand. We know that when gold is up the dollar is down as well as its positive effect on AUD.

Furthermore, we cannot forget about the pandemic. l Australia has had less than 100 new cases in at least the last 2-3 weeks, and the US has the most confirmed cases with the highest percentage of new cases. Australia is opening up borders and lifting regulations. This will help the economy drastically as spending and return will be increased. The US is seeing the opposite scenario. A huge influx of new cases have forced schools to go back to complete virtual, local governments have in-forced curfew’s, and more local business who were able to bounce back from the stimulus are now back in a hole as business continues to fall. I live in Massachusetts and am experiencing all of this. Curfew, school closing, business closing back up, etc.

So given the sentiment one would think that AUD would surge over the dollar. We shall see.

COVId-19 Scan for the US, GB, GER and CHNCOVID-19 Confirmed cases for the USA, Great Britain, Germany, and China...

Clearly the Western (world) major economies are having trouble handling the COVID-19 pandemic.

Germany appears to be the most parabolic, then Great Britain is similar although not as steep.

USA is not far off in the speed of spread.

Opposing to that, China has been doing well, and numbers are low, with the MACD having an opposing pattern, falling as time goes along.

This is going to be the stage for 2021; and the writing is on the wall (chart) now...

COVID-19 Scanning outlook for US, SG, MY and IDJust compiling a snapshot chart of the COVID-19 confirmed cases of US, SG, MY and ID.

These charts are avail in TradingView and if you are worried about the situation getting better or worse, you can use the MACD to give an indication.

Remember that these charts track the Confirmed cases, so the charts will only increase, else flatline.

Here we see how SG has flatlined much, such that the MACD is falling.

Contrary to that, the US numbers are escalating again, and MACD clearly shows it is in Wave 1.3

Indonesia is increasing, but the rate is moderating at best.

And in Malaysia, it is escalating so fast, it is almost going parabolic. The MACD accentuates the rising differences per week on week.

All these can give a better outlook into the fear of future lockdowns, and perhaps Forward economic status.

Hope this helps!

Is Gold Losing It's Relevance?Looking at some of the historic phases we were in (Dot.com Bubble, Real-Estate Bubble) and the current Zero-Interest Bubble, the M1 money stock and the development of the S&P500 the question arises if gold is losing it's relevance as safe haven. Given the explosion of central bank money and the clear trend to govern by central bank monetary policy one would expect gold should already show clear signs of strength and grow in value.

After the Dot.com bubble burst gold was in demand. After the real estate bubble burst gold was in demand. Then something happened. 9/11 and the "War on Terror" and continued M1 money stock or cheap central bank money flooding. Gold lost value continuously. Up until SARS-CoV2 and the Great Reset strategies being executed. With the sudden drop in oil prices in Feb. 2020 and Covid-19 being used to create quite a fear monster gold was in high demand.

But gold was put in check (for now) again by the central banks. This time with crazy rocket parabolic money supply explosion.

Now the question will be will central banks be able to contain the monsters they summoned by their strategies and keep the world economy afloat even when in the next couple of month the economic bad news will become visible and will have to be managed? Will the shy money seek yet another time gold as a safe haven?

Any of the yellow continuation arrow trends for gold seem possible. Note it does appear historically more likely that gold will rise to new heights.

Gold remains a valid portion of any portfolio. At what percentage and what shape (physical or digital ) is up to each of us to decide for ourselves.

The Most Important Levels for XAU After The Vaccine AnnouncementIn this technical analysis I will go over all the most important horizontal zones for Gold and explain what you need to look at while the market is closing over the weekend.

After a lot of news about the elections, and then the Pfizer vaccine news, the price of gold has moved a lot and showed great volatility. This creates fantastic opportunities for traders, which is why I am looking at gold now at more depth. There are very nice trading possibilities here, so let me walk you through the most important horizontal zones right now so that you can construct your own set-ups as well.

Horizontal Support Level I

The support zone here at the bottom of the chart is at the beautiful level of $1,850. A level not just strong based on the confirmation of price reversal that we have witnessed here. It is also important based on the psychological importance of being at an exact round number.

I decided not to chart any additional support zone on the chart, as I consider the price of gold extremely low at the moment. After coming from an all-time-high we have seen a bearish movement. But after the massive dump on the 9th of November, I only see it going upwards from here.

Horizontal Resistance Level I

Given that I chart this idea based on the bullish scenario of a long position, I suggest looking at this area for a solid take profit level. I see two main options for taking profit, one is to leave the trade near the resistance line of the descending parallel channel, and the other is to hold until the first level of resistance.

Horizontal Resistance Level II

Horizontal Resistance Level II is a more aggressive place to hold gold to and take profit. When we look at the height of the price just before the massive dump on the 9th of November, we see another small peak that could turn into resistance too.

Therefore, instead of holding to say ~$1,980, instead I suggest holding until ~$1,960 instead.

Horizontal Resistance Level III

This level is so far off the current price of gold that I would not suggest to use it for any trade set-up. Especially since this is a high volatility period, so many things can happen soon. I would suggest to enter relatively shorter trades to make sure you are able to update the chart often to include the latest information.

Follow me for consistent high-quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

BIONTECH | BULLISH EXPECTATIONSWith the announcement of COVID-19 vaccine developments, Biontech shares saw a surge in price. In terms of technical analysis, it gave a bullish sign by breaking the resistance with high volume and a gap in the daily chart. Expecting a further increase in price in the upcoming dates and week.

Two options for Crude OilFollowing positive Vaccine news on Monday, investors are already buying into reflation trade ideas. This implies that it won't be long till the global economy bounces back once vaccine distribution starts next year. However, we are still far from having an approved vaccine.

Therefore, US Oil has two narratives to go buy.

Vaccine approval happens sometime next month and distribution starts next year. This implies that economic activity will recover fully. This is bullish case for oil.

Global Oil supply is still high with OPEC members still trying to control oil supply as countries in the northern hemisphere head into winter with further pandemic-induced lockdowns reducing the demand. This is a bearish case for a minor correction.

In the long run, I'll be looking to buy oil for a recovery to the $51-$55 level.

MLCO Dip Buy MLCO has been trading very emotionally during COVID 19 and has bounced between support and resistance nicely. As we approach potential for vaccine and retail preforms this company could continue to post higher revenues as it recovers from Covid-19. After the earnings beat the stock jumped and saw prompt selling and price has pushed back down to the Gap/Imbalance from Sept. 13. My personal belief is that buyers are creating liquidity for a strong move. Considering the bounce in Airlines and Cruisers, there is a fair chance that MLCO holds support and tries for some of the unaccounted for areas from February once election uncertainty is cleared up. My target price for MLCO is 20.56 by Febuary 1 2021

Further weakness expected Markets are now taking on a reflation attitude. The EU is on track for further stimulus and this will further push the EURO lower. One of the best pairs to take advantage on is EURNZD as the New Zealand Dollar demand is high following a drop of Covid19 cases in New Zealand.

FX Update: Would a Covid-19 vaccine bring USD weakness forward?Summary: The news of a possibly effective Covid-19 vaccine jolted currencies in a sometimes confusing way, but beyond near term volatility, the rising promise of an effective Covid-19 vaccine might bring forward the longer term weakening of the US dollar.

Today’s FX Trading focus:

Are we on the cusp of an effective vaccine and what does that mean for the USD?

The Pfizer announcement of very good results for its Covid-19 vaccine candidate has provided a real jolt to markets and to FX. At first, the news was taken as universally positive, boosting equities and crushing the USD, as well as US treasuries, JPY, CHF and gold safe-havens even more aggressively. But since then, a curious diffusion of that move has unfolded, with the US dollar more mixed, while the JPY and CHF remain weak as US long treasury yields are up near the post-Covid-19 highs. Why is the vaccine hope not universally being celebrated along the lines of reflation and across-the-board strong risk appetite? (For the below thoughts, we assume that the promise from this Covid-19 is confirmed in the coming weeks and months.)

A Covid-19 vaccine means less stimulus (especially of the “money for nothing” variety and uncertainty that the central bank support under risky assets will be as profound as it would otherwise be. Given that the expected US political gridlock after the election results was supposed to mean that the Fed would be hyperactive in providing endless liquidity and support, the sharply higher US rates at the long end of the curve and implications for less stimulus as the end of Covid-19 lockdowns and restrictions means that stimulus could be tapered very aggressively next year. Oh, the irony of good news being bad for markets.

The above triggering an ugly market liquidity event, with the added uncertainty that Republicans are backing Trump’s effort to challenge the US election results, although I’m not surehow seriously the market is taking this particular risk – not yet, but stay tuned on that front.

Note the difference depending on the geography. US stocks – and the big tech stocks most notably – are clearly different animals relative to European stocks, which are profoundly higher after the announcement and remain bid in today’s session, even as the Nasdaq big tech stocks stumbled badly again today after coming sharply off their highs yesterday. See our Peter Garnry for his thoughts on the equity market reaction to this bit of news.

But for the longer term, we continue to keep the focus lower on the US dollar, as I discuss below. First, a brief look at the USDJPY chart.

Chart: USDJPY

The yen was far and away the weakest currency yesterday, responding with a massive jolt to the downside just after its recent break higher versus the US dollar had likely triggered heavy new interest in long positioning. The reversal will likely stick as long as US long yields stick higher (see thoughts below on Fed yield curve control – higher US yield per se won’t necessarily support the US dollar versus the JPY if the Fed feels compelled to step in to keep them from going higher still due to inflationary pressures.) As with any knee-jerk reaction to news, this one requires taking with a grain of salt, and the subsequent price action here may not live up to the steepness of this bullish reversal. Against commodity currencies, however, the JPY could yet prove very weak if the reflationary narrative is boosted in coming weeks with higher commodity prices and the growing promise of a vaccine rollout.

Yesterday, I indicated a struggle with the weak USD narrative based on the US election result, but the news of a possible Covid-19 vaccine could dramatically ease and bring forward the path to a weaker US dollar for the following reasons:

Pent-up US savings – The US private sector stockpiled a large portion of the incredible stimulus blitz – by some estimates, some $2 trillion. If a path is open to fully reverting to “normal” pre-Covid-19 behaviour, this consumption would help drive enormous external deficits as the US imports a high percentage of its consumption basket.

US Treasury has significant funds at the ready for stimulus – the Treasury has piled up over $1.5 trillion as it raised more money than it needed during the panic phase of the pandemic last year. The release of these funds will improves USD liquidity further as some form of stimulus will have to be forthcoming under a Biden administration to avoid a cliff-edge on some of the CARES act after December 31 and to prevent business closures. Also, given that the Treasury already has a good deal of stimulus money at the ready, it will mean that reduced fiscal stimulus after this winter and possibly spring made possible by a Covid-19 vaccine would mean a reduced need for US Treasury issuance, likewise a boost to USD liquidity.

Fed will still prove slow to respond to rising inflation: With its new flexible average inflation targeting (AIT) regime, the Fed has promised it will be very tardy to respond to inflation eroding the value of the US dollar. At the margin, here is the additional risk that the Fed moves against higher US yields if the treasury sell-off deepens, fearing that higher rates will slow the recovery in the US labor market. If the Fed threatens yield caps, or yield curve control (YCC), this would crystallize the USD bears’ strongest argument: the erosion of the USD value on negative real rates. (Yield curve manipulation can come in many forms, in a soft way via QE purchase weightings or more explicitly in new YCC guidance).

The G-10 rundown, express edition

USD – discussed above, not convinced USD upside gets much traction even in short term unless market volatility goes truly ballistic. A clear path to a Covid-19 vaccine brings forward a weaker US dollar.

EUR – if the Pfizer and other drugs continue to bring promise, great news for EUR, although strength could be modest as pro-cyclical beta is lower than for commodity- and EM F.

JPY – the action is in cross-JPY (yen weakness) more than USDJPY as long as market celebrates an improved global growth outlook.

GBP – need that Brexit breakthrough headline – and if Covid-19 vaccine hopes are sustained, EURGBP could have room for 0.8600 in short order, while 1.3500 is the big focus for GBPUSD, freeing up possibly 1.400.

CHF – the Swiss franc punished as global yields spiked higher and safe haven gold out of favour. If we can get post-Covid-19, post-Brexit and a solid EU fiscal package, may be room for a larger adjustment higher in EURCHF. For now, the 1.0900 level is the next hurdle.

AUD – if risk sentiment continues higher, AUD is well positioned for a post-Covid-19 boom if that is where we are headed.

CAD – USDCAD is teasing the major 1.3000 chart point – a deepening hope for a global recovery would open the path lower (stronger for CAD).

NZD – RBNZ is up tonight – and an interesting one. Expect “funding for lending programme” on track, but on the guidance, some chance for a hawkish shift as Governor Orr and company might want to extend the potential horizon for bringing a negative policy rate – or introduce doubt that they will go negative at all, given that the next couple of months could see the deepening promise of a Covid-19 vaccine.

SEK – the weight of Covid-19 on Europe lifting would be a huge boon for SEK, hence EURSEK already teasing below 10.20 at times today and ready for a try toward 10.00 if sentiment backdrop remains positive.

NOK – the path is open to the 10.36 range low in EURNOK and possibly more if oil can break above 46/barrel and the hopeful backdrop is maintained. Epic chart line in USDNOK don around 8.75 (price currently at 9.00).

John Hardy

Head of FX Strategy

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.