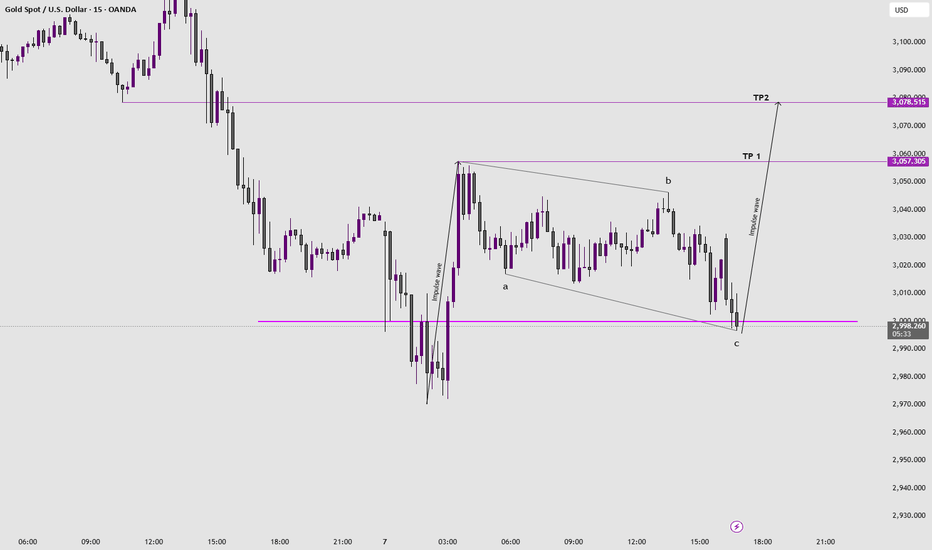

A larger corrective pattern is formingIn the previous analysis, a specific range was determined for the price to reverse, after reaching that price range, the price jumped upwards and the price grew by 1700 pips. However, considering that the structure of wave-c is not an impulse, the zigzag was not confirmed and it seems that a larger corrective pattern is forming.

It seems that the reverse contracting triangle pattern is forming, which is currently in wave-d of the triangle. With the completion of wave-d, we can better find the end point of wave-e.

Correction

One Last Drop Before Take Off?Price is still in a pullback phase, and the next potential target zone is around 0.07488 – 0.07334.

We might see one last dip before BINANCE:STPTUSDT resumes its uptrend.

If the price reaches this pullback zone with a bullish divergence, that would be a strong confirmation for a possible reversal.

But even without divergence, we can still rely on candlestick patterns to signal a potential reversal at that level.

What do you think — will BINANCE:STPTUSDT bounce from this zone or break lower?

BTC - The Perfect Retest!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

🔄Is history about to repeat itself?

If so, we are currently in Phase 2. 📈

What’s next? A dip toward the $87,000 - $88,000 zone would be the perfect retest to look for trend-following longs and expect the start of Phase 3.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

NVDIA Death Cross Quant Perspectives (Light Case Study)NASDAQ: Nvidia (NVDA ) has recently experienced an uptrend after a death cross formed consisting of the 65 and 200 EMAs on the 1 Day chart.

If we analyze back on Nvidia starting in 1999 , we can count a total of 10 death crosses that have occurred, and 9 have been immediately followed by downtrends. Although a single death cross did not have an immediate downtrend, shortly after this event (approx. 282 days) another death cross formed and price then fell roughly twice as it historically has , almost appearing to make up for the missed signal.

From a quantitative perspective:

If we calculate the raw historical success rate using:

Raw Success Rate = 9/10 = 90

With this calculation the observed success of 65/200 EMA death crosses correlating to an immediate downtrend is 90%

In order to avoid overconfidence we can apply Laplace smoothing using:

Smoothed Probability = 9+1/10+2 = 10/12 or 0.8333

With this calculation the observed success of 65/200 EMA death crosses correlating to an immediate downtrend is 83%

Given the results of the data I personally feel that there is a Very High (83%) chance this death cross that recently formed on the 1 Day chart (around 04/16/2025) will immediately lead to a downtrend. And a Low (17%) chance it does not. Furthermore these results support a technical analysis hypothesis that I formed prior.

Many different systemic factors can contribute to the market movement, but mathematics sometimes leave subtle clues. Will the market become bearish? Or will Nvidia gain renewed bullish interest?

Disclaimer: Not Financial Advice.

Nasdaq - This Is Still Not The End Yet!Nasdaq ( TVC:NDQ ) cannot resist bearish pressure:

Click chart above to see the detailed analysis👆🏻

Over the past three months, we saw such a harsh correction on the Nasdaq that a lot of people are freaking out entirely. However technicals already told us that something feels wrong and this is the result. If we see another -10% from here, buying the dip will most likely pay off.

Levels to watch: $16.000

Keep your long term vision,

Philip (BasicTrading)

Gold can exit from wedge and drop to support levelHello traders, I want share with you my opinion about Gold. Price action on Gold has shown strong bullish momentum earlier, as it broke out of the previous upward channel and started forming an upward wedge. The rally gained traction once the price left the buyer zone between 3006 - 3025 points, pushing through multiple resistance levels and creating a new structure of higher highs. After the breakout from the wedge’s support line, the price continued to grow and eventually reached the upper boundary of the wedge pattern. Here, we saw a clear reaction and reversal, signaling potential exhaustion among buyers. Currently, the price is trading just below the upper wedge resistance and has already made a pullback after the latest local high. Given this structure and the fact that the wedge pattern is tightening, I expect gold to reverse again and decline toward 3270, which is my first TP. If pressure continues, the price may drop to the 3210 current support level as TP2. The reaction from the upper wedge boundary, combined with weakening momentum and a strong support area below, supports my bearish outlook for now. Please share this idea with your friends and click Boost 🚀

Gold can make correction to mirorr line, after upward movementHello traders, I want share with you my opinion about Gold. After a strong breakout from the support area between 2975 - 3000 points, the price continued moving upward, forming an impulsive rally. This movement brought the asset directly into the upper support area, now acting as resistance, between 3195 - 3170 points. Once inside this zone, the bullish momentum began to slow down. This area also aligns with previous local highs and is showing clear signs of selling pressure. The recent reaction from the top of the zone suggests that the market could be preparing for a pullback. If this reaction develops further, I expect the price to head toward the mirror line, which currently acts as a dynamic support level, located around TP1 - 3120 points. This line has historically served as a key structure level - first as resistance, then flipped into support - and now may once again act as a magnet for price. A retest of this level would not break the overall bullish structure but could provide a healthy correction before the next leg. Considering the sharp push into resistance, the potential loss of bullish momentum, and the nearby structural support at 3120 points, I remain bearish in the short term, expecting a local decline. Please share this idea with your friends and click Boost 🚀

USDCAD - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCAD has been overall bullish from a macro perspective trading within the rising blue channel.

This week, USDCAD has been in a correction phase trading within the falling red channel.

Moreover, the green zone is a strong resistance turned support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red/blue trendlines acting non-horizontal support.

📚 As per my trading style:

As #USDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bond Futures Back At SupportTrade is fairly simple here. Go long treasuries and if it breaks down cut.

- A bounce and push back up could be another ugly catalyst for the US stock market.

- A breakdown however would push yields up (and economic growth forecasts) which would be quite bullish for stocks especially down at these levels

Ripple May Face Another Rally This YearRipple with ticker XRPUSD hit all-time highs for the final blue wave V as expected, so we should be aware of limited upside this year. However, despite recent slowdown, which we see it as an ABC correction within red subwave (IV), there can still be room for another rally this year, at least up to 4-5 area to complete final subwave (V) of V of an impulse on a daily chart.

SP500: Is This the 2025 Correction? Or Just Another Bounce?Looking at the weekly chart of the S&P 500 with RSI and key support trendlines, it’s clear we’ve entered a historically important level.

🔍 Context:

2020 → COVID Crash, RSI bottomed 💥

2022 → Bear Market, RSI again flagged a major drop 📉

2023 → Healthy correction, price respected trendline support

2025? → RSI flashing oversold, price testing the long-term trendline again.

📊 RSI is approaching the same low levels as the previous two macro shocks — is this a signal of another reversal opportunity? Or could this time be different?

🚨 If we break below this trendline convincingly, it could open the door for a deeper bear leg. But if we hold, we might just see another bounce-back rally like in 2020 and 2022.

📈 Watch for confirmation:

A strong bounce with bullish RSI divergence = potential long

Breakdown + volume spike = more downside ahead

Let’s see if the trendline holds up — it has for 5 years… 👀

#SP500 #Correction #BearMarket #RSI #TechnicalAnalysis #MarketUpdate #2025Outlook #StockMarketIdeas

Party's OverDow Futures daily forming a downwards channel with price targets potentially down to 34k and 31k. These drops would be about 20-40% which is considered a true market crash. The falling wedge pattern plays out until potentially June of 2027, but wedges from the top of the range are dangerous as they can turn into bull traps.

- Economic fundamentals have been disconnected from the financial system for some time but as the underlying economy begins to falter (ex. unemployment wave) markets begin to price in data such as falling retail sales.

- President Trump is going through with mass layoffs in the Federal Government which creates unemployment as the private sector has been going through layoffs and has halted actual new hiring since 2023.

- As more traders have become accustomed to "bad news is good news," they will most likely be wiped out trying to buy dips or chase false breakouts doing what they have always done.

- Tariffs regionalize trade which make global economies and supply chains less interconnected. A global economy that is also very levered up on USD denominated debt needs dollar liquidity to continue to function. By regionalizing trade that liquidity is starved which can lead to financial problems on a global scale if not handled carefully.

- Markets are likely to price in these risks over the next 2-3 months leading asset prices and interest rates lower. Expect individual companies to do well at times but then rotate to others while the Dow index itself falls.

- Even if the Dow were to play out the wedge during 2026, without significant improvements to the global financial system expect that move to be a bull trap or a best lead to minimal gains without a new wave of monetary inflation.

XRP just found bounce support on the bttm trendline of the wedgeLooking like a very valid pattern on the weekly hart. My guess is it will break upward somewhere around where I have arbitrarily placed the dottedmeasuredmove line, in which case the breakout target would be somewhere around $4.80 always a chance we retest the bottom trendline and even send a wick below. It before confirming a break upward though. *not financial advice*

SPX500: The trendline show a bottom in Sept 2025 at 4700 We're being magnetically pulled toward the trendline bottom around 4700.

Based on the current MACD and RSI signals, the bearish scenario could continue until September–October 2025. This correction is very similar to the one from 2022.

There will be some dead cats bounces, but do not be fooled, the MACD is reseting hard.

Stay sharp. Be ready.

DYOR.

Bearish Reversal Incoming? Key Resistance Holds as Price StallsAfter analyzing multiple timeframes, we observe that the price has surged significantly and is now trading within a key resistance zone. The resistance remains strong, and the RSI across multiple timeframes is in the extreme overbought territory, showing bearish divergences. Additionally, despite the sharp rally, the price has not undergone any meaningful correction.

Considering these factors—strong resistance, the proximity to a weekly trendline, extreme overbought conditions, and bearish divergence—along with the presence of a hanging man candlestick at resistance, a correction is likely. Our correction targets are the 50% and 61.8% Fibonacci retracement levels.

Will Monday Bring a Breakout or a Correction?Last week was characterized by extreme volatility, with price movements reflecting significant reactions across different trading sessions. On Friday, the Asian session managed to push past the $3057 mark, only for early European trading to see a pullback. However, the US session reversed course, fueling a rally that extended until market close.

Key Levels to Watch on Monday

Looking ahead, the critical question is whether the Asian session can break above $3086, potentially paving the way for a push beyond $3100. If this breakout fails, we could see a price correction similar to Friday's, especially during European trading.

At present, I'm taking a cautious approach, observing the market while many anticipate further upside. While momentum appears strong, I prefer to wait for clearer confirmations before making a move.

Potential Scenarios

Breakout Above $3086

A successful push above this level could signal continuation toward $3100+, reinforcing the bullish sentiment.

Failure at $3086 – Potential Pullback

If the market struggles to sustain levels above $3086, a decline to $3076 is likely.

A break below $3076 could see further downside to $3067 and possibly lower.

Technical Indicators & Market Sentiment

RSI (1H): Currently at 52, indicating neutral momentum.

RSI (4H): Around 90, showing overbought conditions—especially following the Asian session rally.

Market Sentiment:

Many traders expect an upward continuation, but caution is warranted given overbought signals and the possibility of a correction.

External Factors: Tariffs & Global Trends

As we approach April 2nd, when new tariffs take effect, global markets have been showing signs of weakness. Uncertainty persists, and with gold acting as a safe haven, investors may seek protection, adding another layer of complexity to Monday’s price action.

Conclusion

The start of the week will likely be dictated by whether the Asian session can achieve a breakout above $3086. If it does, bullish momentum could drive prices higher. However, failure at this level could result in a correction, with key support levels at $3076 and $3067 in focus. Given the broader market conditions and upcoming economic events, a cautious approach remains prudent.

📉 Will Monday bring a correction, or is there still room for another rally? Share your thoughts in the comments! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊