LOWER VOL, VOLU AND LOWS. HIGHER CORRS AND HIGHS (GOOG BUY @711)Google C-Class shares i am bullish over the 6-12m, hence I am buying any 5-10% pull backs from highs.

Goog has been moving sideways but i think it has just started a cycle higher, in which it is about to make a higher low at 715 before moving up again to 750+

715-750 is a 5% move hence i am interesting in buying at this price with reward skewed something 1.5:1 with risk.

Coming into earnings, Goog has to make at least one bull run to highs at 770 and i believe this will be the set up for the run for several reasons:

1. since april earnings lows at 687 goog has moved in an upward trend of 688-722-700-736, the next cycle i approximate to be down to 710-3 (volume traded price) then up to 750+ (previous support turned resistance).

Also the Linear regression for the on graph prices is $723, so prices below this are below this cycles average - encouraging mean reversion upwards.

2. Goog volatility correlation is in its negative cycle - the last bull cycle to 768 began with a turn from positive to negative price-volatility correlation change.

- Plus goog's volatility is at yearly lows. Low vols is something that imo is vital for any sustained bull run, as logically, more people want to own a stock that has a greater "normalised" return and risk profile.

3. Volume average divergence - google volume is trading below its 6 month average, lower volume characterises goog's bull runs typically. Since it signifies there are fewer structural sellers that are prepared to sell the stock, thus volume drops and the price is bid up until sell side liquidity is increased sufficiently to meet an equilibrium price.

4. *please see last 3 price bars* - these bars have been highlighted as having a "topside range skew". What is inferred by this is that the candle has more activity at the higher prices e.g. the candle traded at its highs and open more than its close and low - thus this is a bullish signal as the open high and close data stayed in the upper percentiles of the candle.

- Even the first candle in question (the first bear candle), opened and closed at apprx the median price.. this is unusual. the first bear candle after a strong bullish run, usually shows heavy open-close downside skew e.g. the price opens and then closes close to the lows (rather than in the middle of prices traded) - indicating that time period closed with the price being driven/held at the lowest possibility.

If we were to see the opposite e.g. the candles closing on the lows, this would be bearish and indicate the price is wanting to push lower, since there was no difference between the low and close.

Fundamentally i am also long google anyway, hence why i liike buying 5-10% pull backs.

Correlation

IS YEN REALLY RISK-OFF AND CORRELATED TO SPX (RISK-ON)?Though id post as just one example, perhaps the most obvious, that shows how heavily the JPY is considered a risk-off asset and to show the clearly, since the SPX is a risk-on asset, that the JPY is negatively correlated with the SPX.

In times of market fear/ uncertainty, YEN is sought out, just like bonds and gold, as a safe heaven asset. The theory behind this is that the JPY offers stability through the nation being one of the only developed nation with a net credit balance sheet.

Clearly, in the financial crisis, one with a hypothesis as the above, should see the SPX fall and the YEN risk.. Indeed, the chart shows exacty that, almost 1:1 correlation.

Now, the JPY SPX correlation DOES change, in times of extreme fear or extreme exuberance, the YEN will be proportionately more correlated with the SPX and other risk assets.

.

In "Normal" or non heavily trending markets, the correlation is less obvious - since it is the extremes that cause investors to seek difference assets and change their strategy in masses.

In times of fear, investors move their liquidity to risk-off YEN, hence we see USDJPY fall during the crisis. We also see SPX fall in a correlated manner, this is because investors pull their liquidity OUT of SPX and apply it in some proportion to YEN.

Correlation Trading - How to Trade Forex With Little to No Risk!Tonight we did a live stream on YouTube offering an in-depth explanation of correlation trading. You can watch the stream back in its entirety here www.youtube.com

Below will be a written explanation of correlation trading utilizing the AUDJPY vs. NZDJPY as the example:

Correlation trading is an amazing way to add diversification to your trading portfolio and in your trade plan. You can continue your trading plan and strategy but take advantage of correlation trading opportunities as they arise to increase your ability to profit from the forex market. In correlation trading the objective is to find currency pairs that are highly correlated, meaning that when one pair moves in any given direction the other pair also moves in that same direction. A great example of this would be the AUDJPY vs. the NZDJPY. Over the past year the correlation between the two pairs has been very positive, 92% of the time over the past year the two pairs have been moving in sync with one another. This correlation can be confirmed by using the Oanda correlation chart:

Once you have confirmed that you are looking at two pairs that are highly correlated to one another, you will want to then look into the charts and compare the price action over the past year. TradingView makes this very convenient with the ability to overlay charts. When we overlay the NZDJPY chart on the AUDJPY chart (candlesticks=AUDJPY, bars=NZDJPY) we can clearly see the times of the year when the two pairs were moving very much in sync and the times where the correlation cracked a bit and the two pairs moved oddly in opposing directions.

It is during these times when the correlation cracks that provides us with the immensely profitable and essentially risk free trading opportunities. If you notice on the chart throughout the past year you will see highlighted in yellow boxes all of the times when the correlation has cracked and a gap has formed. We can look at these moments and estimate the average maximum gap in correlation and use this information to gauge when to take a correlation trade on this pair.

You will notice every time the correlation has cracked and a gap in price action has formed, price inevitably moved back in correlation narrowing and even closing the gap You will also notice if you look back at the widest portion of the gap from every time there was a crack in correlation that it has been roughly anywhere between 400-500 pips . If we look at the second to most recent gap in correlation that we have labeled on the chart you will notice that at its widest point the gap in price was roughly 600 pips; the high being at 85.500 and the low being at 80.700. If we were watching this occur as it was happening and we noticed the gap in correlation approaching 400 pips and then 500 pips and then 600 pips, forming the widest gap in correlation all year, we could then look to take a correlation trade between these pairs.

In this given example around 3/11/16 we would look to take equal positions of long NZDJPY and short AUDJPY banking on the fact that the gap in correlation should statistically, with 92% likelihood, narrow and potentially even close completely so that the two pairs are moving back in correlation with one another. You will see that if we did this we covered on 3/30/16 we would have netted ourselves a fruitful profit of 300 pips. Our short position in AUDJPY would have been down about 20 pips or so but our long in NZDJPY would have been up about 340 pips.

This profit came with little to no direction risk because as one position goes against you the other statistically should go in your favor and if you are not netting a profit at any given moment your loss should be simnifically reduced as compared to what it would be if you were only holding the losing position.

Bitcoin and Gold - The connectionHello everyone! This is my first chart, so I hope you like it. There might have been other people that have already seen this, but I would like to give my view on this.

If someone takes a look on the last 1 year, he will notice that the bitcoin price followed a similar pattern to the one that gold had, with delay of 20-30days.

Also, in 2014 for about 215 days, they were almost entangled. In 2015, they had 5 opposite peaks and troughs.

I put vertical lines close to places where the prices of the two were either 'bottoming or topping' simultaneously, on either the same or different direction.

As some might have already noticed, these are probably due to major events in Cyprus, Greece etc.

If someone has any ideas on how to connect the two in a better way, in order to make better predictions, please let me know :)

Gold and AUD/USDAustralia is the third biggest gold-digger… we mean, gold producer in the world, sailing out about $5 billion worth of the yellow treasure every year!

Gold has a positive correlation with AUD/USD.

When gold goes up, AUD/USD goes up. When gold goes down, AUD/USD goes down.

Historically, AUD/USD has had a whopping 80% correlation to the price of gold!

S&P 500 vs. GOLD - unsustainable correlation?The two instruments are very different in nature, XAUUSD (g o l d) bullishness was explained this year by negative investment sentiment. Hovewer markets turned risk on since mid Feb' and gold still rises. Either stockmarkets or g o l d investors will have to suffer losses in the near future, especially as both are at technical resistances.

A Solid Correlation Setup Between NZDUSD & AUDUSDWe have entered a correlation trade between AUDUSD and NZDUSD this evening. The weaker than expected inflation numbers in New Zealand is causing the Kiwi to selloff while the Aussie hangs strong against the US Dollar.

This news has given us an opportunity to go Long NZDUSD while Shorting AUDUSD. The current spread is approximately 120 Pips on the hourly chart. In the past week any time we've seen a spread widen to 100 or more pips it eventually narrows back to 0 pips as the pairs come back into correlation with each other. The pairs have been 70% - 90% correlated during the past year, depending on the timeframe you analyze.

Our algorithm is currently an 82% chance AUDUSD pulls in while giving us an 65% chance that NZDUSD rebounds in price.

Please keep in mind this is not the same as entering into a Short AUDNZD position as one must account for the third economy introduced in this correlation position, the US Dollar. The US economy (therefore the US Dollar) may react to the New Zealand inflation numbers differently than the Australian economy.

Also keep in mind, a correlation trade greatly reduces our DIRECTIONAL RISK. To us it really doesn't matter if we are right or wrong, which way the pairs move, because ounce the correlation narrows and gets back on track close to 70% - 90% we will have a nice profit on our hands.

Here at Unique Forex we combine our team's 40+ years of trading experience with our proprietary algorithm to significantly enhance the trading experience. Utilizing the two, we are able to offer some of the most powerful research on an array of currency pairs. Here you will get all of our research on some of the more popular majors like the EURUSD, but if you would like to get access to the rest of our research head over to www.unique4xpro.com

AUDUSD x GBPUSD set up for a synced reboundAUDUSD and GBPUSD have synchronically tested dynamic supports based on descending trendlines from 09.Dec and 29.Dec, accordingly.

i.imgur.com - the screenshot reflects AUDUSD to GBPUSD correlation. Although in mid-term perspective it's evaluated as regular, in last month it's clearly above average value which supports view on correlated rebound.

USDCHF Bullish correlationCHF and EUR positive correlation has held up so far in 2016, opening the door far a long entry here. The only shocks to the downside would come from China devaluation/dollar selling overnight. With that considered, long at this breakout with three points of contact on support should show profits.

AUD experiences temporary pullback as gold prices life offAUDUSD has been in a counter-trend move since September, 2015. An early indication that selling pressure is dying down is by fractal counting.

As you can see, this pair failed to make lower lows from September and onwards. I currently believe it is too early to tell if this trend is over, but I highly doubt it. From my moving average settings, they have converged with the 60-period meeting the 120-period. This is the first indication that we may be looking at an upwards wedge breakout. I still remain bearish over the long term. Why?

Given that Australia is major commodities exporter and gold has taken a hit, the upside remain very limited for the Australian Dollar.

If we were to compare the performance of gold against on the weekly chart, there has been a strong correlation and leading indication showing how gold projects the Australian Dollar's next move.

As you can see, gold has been an early predictor for every major move for the Australian Dollar. Gold tends to rally a few days before that of AUD and the recent lift-off in gold is giving the Australian Dollar the wedge that it is trading in right now. My current trading plan is to buy into the upwards wedge breakout, but I will resume my long term short position at a higher, optimal price.

GLD & BTC Correlation?I struggle to fully understand the connection here, if anything I would have thought the direct correlation between these two assets would exist. Flight to safe haven be it a cryptocurrency or an asset like gold, I would have thought the same fear drives these actions.

This chart is contrary to that view / idea, here we have seen a pronounced tracking since early 2015, before this its very supurious, I can only link its rise to the complications arising with monetary policy experimentation in the US coming to and end and bitcoin settling down from its explosion in value.

If anyone has any ideas here of whats going on and how its likely to develop going forward I would be interested to hear!

Possible EUR/JPY and NZD/JPY Correlation TradeContinuing on from yesterday's chart, this extract comes from the Possible EUR/JPY and NZD/JPY Correlation Trade blog on the Vantage FX News Centre.

Zooming into the NZD/JPY chart on its own, you can see that price is still sitting right on resistance while EUR/JPY got the beginnings of a potential rejection yesterday.

If you took yesterday’s EUR/JPY short and have some floating profit, the opportunity to now take a correlated NZD/JPY short could be there.

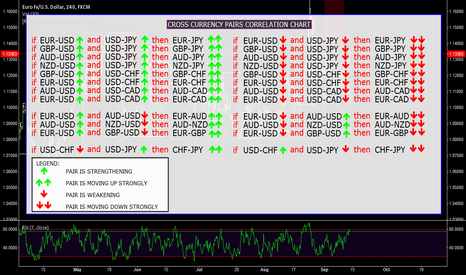

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL

Bearish Bat / Alt Bat / AB = CDMan.. There is a lot going on in this chart. Please excuse the mess everyone.

I've been monitoring the USDCHF for quite some time now, and we've almost reached our target zones. We're currently setting up for a nice long term trade than could easily come into our favor given that there are so many clues and indications that we could very well see a major drop in not only the Dollar Swissy, but the Dollar as a whole. Given some fundamentals and the correlation between Dollar Swissy and the Euro Dollar, we could see the Euro also rising substantially.

We're looking for the test of the 88.6% Fib drawn from X-A which just so happens to correlate into the Supply Zone established earlier this year in March. If this test is confirmed at 1.00012, we can take this pair all the way back down to our overall target of .94655 for 535.7 pips while risking only 104.5 pips. Patience will be the determining factor in this trade, along with concrete analysis and solid evidence for the next few weeks or so, but we also have the reassurance of a Bearish AB = CD Harmonic directly at the Supply Zone also.

Although this is shaping up to be a very nice looking trade, we still have nearly 300 pips to go before any of our target are touched. Make sure you are patient on this pair, and identify the swings correctly to ensure proper flow of the overall trend.

Take care

MACRO VIEW: USDRUB IS TESTING ITS UPTREND!Following WTI OIL downtrend failure last Friday, USDRUB tagging its relevant uptrend border first time since it started its descend back in July, marked by lower 1st standard deviation from quarterly (66-day) mean (@65).

If the price manages to break below the border, chances are the uptrend is over (or at least current leg of it).

Full stop of the uptrend, however, can only be declared when the price trades above the quarterly mean (@59).

MACRO VIEW: USDRUB CAN REVERT ON CENTRAL BANK SUPPORTUSDRUB was trending upwards in correlation with WTI Oil descend since beginning of July

Currently Oil fell to its 2015 lows (slightly below them now) while USDRUB was holding 65 level with apparent Central Bank of Russia support.

CBR is selling USD against RUB in attempts to stabilize the national currency.

If the Oil trend down stops at this level, USDRUB is likely to bounce back to 1st st deviation from quarterly (66-day) mean, and then to the mean itself, ceasing its uptrend.

JBLU & USDCAD - Long to 26JBLU has shown a strong correlation with USDCAD, as both financial instruments are inversely correlated with oil (shown below). It should also be noted that USDCAD has recently broken out of a cup and handle pattern on the monthly chart and a continued rise could be an early indication of similar price action in the aerospace sector. The wave count for USDCAD suggests that an extended fifth may be in progress, which if true would provide a confluent fifth wave target. JBLU targets may be placed at 26 and 30, extensions of wave ((3)). These extensions proved to be important in sub-degree 5th wave targets and the fractal characteristic of EW suggests that these levels may also play an important role on the larger degree. A SL may be placed below wave (1) high at around 21.40.

Correlation with USDCAD:

USDCAD Monthly Cup and Handle:

USDCAD Wave Count:

10 YEAR TREASURY YIELD SIGNALLING INFLATION EXPECTATIONSSince mid-summer 2014 the 10-Year Treasury Yield started correlating with WTI Crude Oil, which can be seen on the image below:

The correlation was established as a result of dynamics of oil prices, when falling oil was perceived as a risk to inflation. Expectations of lower inflation have driven the 10-Year Yield down with the WTI Oil. Market has perceived the situation correctly, as the CPI inflation has fallen down to about 0% on y/y basis consequently, where it stands now.

Recently, however, the 10-Year Yield started to diverge from WTI Oil price dynamics. As can be seen on our chart, the oil is trading laterally in the range of 57-62 USD per barrel since May 2015. The 10-Year Yield, on the other hand, actually started to move upwards since then, along the upper 1-st standard deviation from its quarterly (66-day) moving average.

Our idea is that current upwards dynamics of the 10-Year Yield in relation to lateral WTI Oil reflects positive inflation expectations of market participants. It means that in the observable future the CPI and PPI inflation measures are likely to start bottoming out on y/y basis.

If our proposition is true, it will be a positive development in terms of financial markets, as higher inflation expectations will offset the deflationary impact of current slow CPI and PPI inflation measures on the perceptions of market participants.

Correlation Trade Between EUR/USD & GBP/USD*Position Update: As of 05/15/2015 @ 7:41 EST we liquidated both sides of this correlation trade with a profit of 28.6 Pips.

The Trade: Long EUR/USD & Short GBP/USD

The correlation between these two pairs is 96% over the past year. The widest the spread has got over that time is about 700 Pips. Over the past 18 months we saw the spread widen to approximately 800 Pips. Currently these two pairs are 700 Pips apart.

With that said we will be entering 1/2 our intended position size with the intentions of easing into the second half if the spread widens significantly. We expect to see this spread narrow over the coming days/weeks. If it happens before we can put our entire position on we will feel comfortable closing out the position with a profit of any amount.

A Nice Correlation Trade Is Setting Up Between AUD/JPY & CAD/JPY*Position Update: On 05/05/2015 we liquidated both sides of this correlation trade with a profit of 73.1 Pips while taking advantage of the correlation spread narrowing after the interest rate decision in Australia.

A nice correlation trade is setting up between AUD/JPY & CAD/JPY. The spread in the correlation is currently 200 Pips, over the past year the max spread has been approximately 400 - 450 Pips.

We will be taking 1/2 our intended position size, if the spread widens to that max spread mentioned above we will add the second 1/2. Australia is announcing interest rates in 3 hours which could provide that opportunity or present us with a profit. The trade is Long AUD/JPY & Short CAD/JPY.

Correlation Trade USD/SGD to USD/JPY *We booked a profit of 27 Pips. Even though the spread is from from closing we decided to take the profit and move back into cash. Of course if this spread narrows we will be leaving a lot on the table but we are happy with the gain from a low level risk trade.

We will be initiating 1/2 our position in a correlation trade of USD/SGD to USD/JPY. The spread is currently 500 Pips and could potentially get wider, if it does we will then have the opportunity to add to our position, hence reducing our costs. The spread should narrow over time as it has done during the past year. One could wait until the correlation completely narrows to the point that both pairs touch or one could take their profit at any time during the closure of the correlation. Please see the chart for more information.