I think this is the beginning of a beautiful friendshipIf you remove the first two hours of trading on Coinbase, the performance of the share price looks a lot like the performance of Bitcoin.

It is never going to be 1-for-1 and nor should it, but there is a visible pattern there.

Will there be a spread/arb/reversion trade there? Maybe one day, but a reasonable correlation will allow those that can only invest in shares, such as many fund managers and retirement funds, to have risk exposure to the coin market. Same reason certain EFTs exist.

A senior analyst at Swissquote, Ipek Ozkardeskaya worte: "As such, a successful addition to Nasdaq should act as endorsement of cryptocurrencies by traditional investors."

It’s a new stock so still finding it’s ground, but interesting to watch a relationship develop, like the end of Casablanca.

Correlations

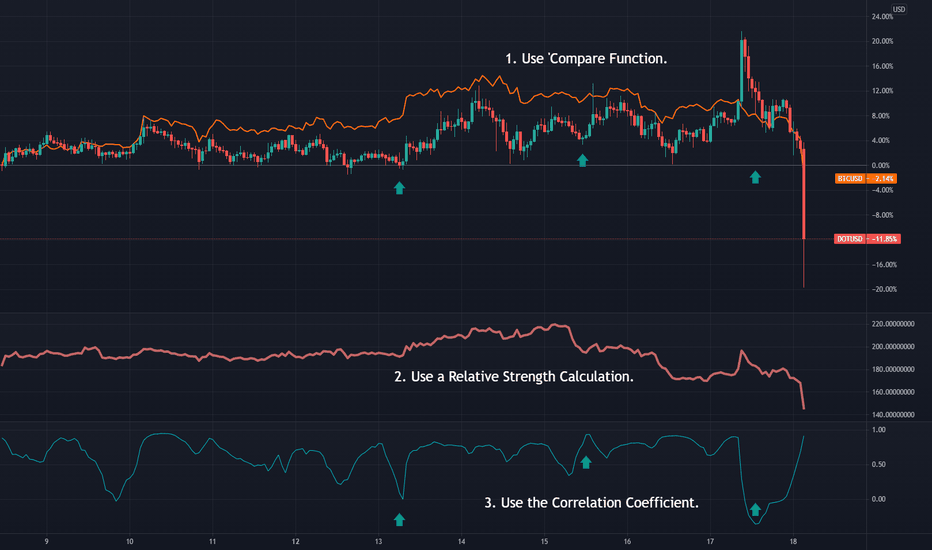

Three ways to follow market relationships on TradingView. All trading requires an understanding of how markets are related. Understanding these relationships will put you ahead of others that don’t get it.

Mean reversion and spread trades require a deeper understanding of how markets move together and how these relationships change. Like the weather, the degree of correlations, lag, convergence/divergence change all the time. It is that change that can bring about opportunity.

On TradingView, there are three really easy ways to measure relationships.

1 Use the ‘Compare’ Function.

Click Compare.

Select Market.

This creates an overlay, showing relative performance in percentage terms. The starting point is the visual start of the chart.

Tip#1: Choose starting points that are significant, like just before a big announcement or at a chart high or low.

Tip#2: Play around with time frames to look for patterns.

-

2 Use Relative Strength (not RSI).

This is not the RSI most of us know. This ‘Relative Strength’ shows the performance of one market versus another based on momentum and change.

Select indicator and search ‘relative strength’. Look for an indicator that compares to a 2nd market. Example: ‘relative strength to SPX’. For this particular one, the default setting is to compare to SPX (obviously). In settings, change this to your chosen market. In the above chart, we use BTC.

A falling index shows market#1 underperforming. This can be used to show overbought/sold conditions, relatively speaking.

-

3 Watch your Correlations.

The Correlation Coefficient measures the degree of statistical relationship between two markets.

Tip: Look for extreme levels/changes in the number. It can tell of a change in trend or breakout.

-

Try all three and see what works for you and your markets. Look for patterns.

-

USD/CHF SELL IDEA

Hey tradomaniacs,

welcome to another free trading-setup.

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

USD/CHF: Daytrade-Preparation

Market-Sell: 0.93990

Stop-Loss: 0.94280

Point of Risk-Reduction: 0.93700

Take-Profit: 0.93200

Stop-Loss: 29 pips

Risk: 0,5%-1%

Risk-Reward: 2,80

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

GOLD SELL SIGNALHey tradomaniacs,

welcome to another free trading-setup.

GOLD (XAU/USD): Daytrade-Execution

Notice:

Trading Gold can be very risky due to the current intermarket-correlations.

Keep your risk low or stay out!

Market-Sell-Order: 1729,00

Stop-Loss: 1746,00

Point of Risk-Reduction: 1711,00

Take-Profit: 1681,00

Stop-Loss: 17 points (170 pips)

Risk: 0,5%-1%

Risk-Reward: 2,90

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

Bond yields correlation with NASDAQ 100 and CryptocurrenciesAs the chart shows, after last Wednesday's FOMC announcement, the 10 Year Treasury yields broke above 1.65 for a test of 1.75 with potential move toward 2%. This is a hugely important move and is part of what has affected the NASDAQ and the recent corrections in crypto currencies. There is also the additional move out of the high growth and high performance stocks in NASDAQ to cyclicals and this can be seen in the divergence between NASDAQ and S&P 500; we saw multiple days when NASDAQ has either lagged S&P 500 or has been negative while S&P 500 has remained marginally positive. Given the correlation between NASDAQ and the crypto currencies these trends have also influenced the crypto currency trades.

It is worth noting that the yield on 10 year Treasury is the basis for corporate bonds and therefore, has a significant impact on the market; in other words, higher 10 year yields higher borrowing costs.

Therefore, as Jerome Powell and FOMC try to keep the current low lending rates to support and stimulate the economy, the market is pricing increasing inflation expectations into the 10 year Treasuries and this is creating increasing tension in the bond markets (for those who are familiar with technical analysis, this means increased convexivity).

Conclusion:

TLDR: This means we are up for a rocky ride going forward and somewhat downward pressure on risk appetite. Therefore, investors need to be more selective than before with their investment choices.

If you are investing in crypto currencies make sure you know and understand the projects you invest in.

NZD/USD SELL SIGNAL Hey tradomaniacs,

welcome to another free trading-setup.

NZD/USD: Daytrade-Execution

Market-Sell-Order: 0.72370

Stop-Loss: 0.72765

Point of Risk-Reduction: 0.72000

Take-Profit: 0.71000

Stop-Loss: 36 pips

Risk: 0,5% -1%

Risk-Reward: 3,80

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

ONE and CELR correlation strong af First Post on Tradingview

Just wanted to point out how crazy the correlation of these two charts, its interesting cause you could probably make good gains by just flipping between these two pairs, if any of these two pairs are at below 1 cent I see it as a good buy, comparing to what the price has reached previously. Has alot of upside potential in the coming months.

Thanks for reading and happy trading

AUD/USD BUY IDEAHey tradomaniacs,

welcome to another free trading-setup.

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

AUD/USD: Daytrade-Preparation

Notice: Market still shaky and risky to trade!

Market-Buy: 0,77500

Stop-Loss: 0,77340

Point of Risk-Reduction: 0,77650

Take-Profit: 0,77950

Stop-Loss: 16 pips

Risk: 0,5% -1%

Risk-Reward: 2,75

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

CRUCIAL MOMENT FOR US-DOLLAR!Hey tradomaniacs,

US-10-Year-Yields are currently re-testing a strong resistance, which is bad for equities but supportive for the US-Dollar.

Technically we see that YIELDS and DXY (US-DOLLAR-INDEX) are both at strong supply-levels while equities are at strong demand-zones👉

These are curcial moments as either rejection or violations of these levels could cause trend-continuations or reversals today.

I`m observing these two charts carefully and wait for confirmations.

If YIELDS drop US-DOLLAR is more likely to fall aswell in order to complete the previous S/H/S-Pattern. The Target-Zone for it is at 91,200.

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

So you wanna SHORT NZD/JPY? Here is why it could get tricky!Hey tradomaniacs,

since Jerome Powell stated that "there is no inflation" the market keeps betting against the FED and tries to poke Jeromes nerves with rising YIELDs.

This is obviously bad for equities, because higher returns provides a great alternative to Stocks, which is causing a strenght for the US-Dollar.

So why could a short NZD/JPY be choppy?

NZD/USD currently reacts so sensitive because stocks are falling. NZD/USD is a risk-on-currency and since correlations have changed in the market almost all majors against USD having very huge standard deviations.

This is basically because the economy improves when US-DOLLAR falls, due to the fact that the provided liquidity, or inflation, boost consume and investments -> Higher grow expectations -> Good for stocks.

Now we got these correlations in the market:

YIELDS and US-DOLLAR rise -> Equities fall

Equities fall -> NZD falls

YIELDS rise -> JPY falls

When NZD and JPY both tend to fall due to the current correlations, NZD/JPY could be the worst NZD-pair to short, or generally to trade.

The best JPY-Pair to trade is currently USD/JPY, as DXY moves up while JPY falls as long as the inflation-worries continues.

Non the less, we could see stop-losses getting triggered and so a fall of NZD/JPY.

Compare NZD/USD to NZD/JPY, and you will se what I mean. :-)

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

DID YOU KNOW? #Whipsawshey tradomaniacs,

Did you know that Wednesdays are typical for Whipsaws?

Don`t ask me why, but I have observed this phenomenon a lot of times. 👉https://www.tradingview.com/x/DJQDxMBy/

In very many cases we see a direction during the london-session and then an instant reversal with the open of the Walltreet.

Backtest it yourself🙏

GOLD (XAU/USD) BUY IDEAHey tradomaniacs,

welcome to another free trading-setup.

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

MY thoughts:

Since fundamentals seem to put YIELDS under pressure, we could see a cashflow out of Bonds into no-Interest-assets again such as Gold and Silver.

If Yields drop with US-DOllar we would get the very perfect circumstances to see a strong bullish impulse for Gold.

GOLD (XAU/USD): Day-Swingtrade-Preparation

Market-Buy: 1741,00

Stop-Loss: 1725,00

Point of Risk-Reduction: 1755,00

Take-Profit: 1794,00

Stop-Loss: 16 points (160)pips

Risk: 0,5% - 1%

Risk-Reward: 3,50

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

USD/CAD SELL IDEAHey tradomaniacs,

welcome to another free trading-setup!

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

USD/CAD: Daytrade-Preparation

Market-Sell: 1,26830

Stop-Loss: 1,27200

Point of Risk-Reduction: 1,26600

Take-Profit: 1,26100

Stop-Loss: 37 pips

Risk: 0,5% - 1%

Risk-Reward: 2,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

AUD/USD headed to the down side AndrewTheSage reporting to you live. My charts are messy and colorful. I am not a financial advisor I use arrows and different types of fib levels to show what's going on.. I will not put up an essay. I feel if you can read a chart you can understand what's going on with price by showing you a visual effect. The Dollar is going up....notice as the dollar goes up notice the negative correlation it has on AUD/USD it's going down mirroring the opposite.

DAX could MOVE UP!hey tradomaniacs,

Market is currently shaky and volatile but I don`t see any reasons for the recent moves in terms of fundamentals and correlations.

US-DOLLAR has corrected a little bit due to drastic moves down in indicies with the opening of the london-session.

If these moves were legit we would see a drastic continuation, which is currently not the case.

DAX30 👉

#Washouts

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

EUR/USD BUY SIGNALHey tradomaniacs,

welcome to another free trading-setup.

EUR/USD: Daytrade-Execution

Notice:

EUR/USD is currently one of the risky pairs due to the high weight in DXY and chaotic YIELDs.

Yields currently drop which is bad for the US-Dollar.

Market-Buy-Order: 1,20380

Stop-Loss: 1,20140

Point of Risk-Reduction: 1,20635

Take-Profit: 1,20950

Stop-Loss: 24 pips

Risk: 0,5% - 1%

Risk-Reward: 2,40

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me!

USD/CAD SELL SIGNALHey tradomaniacs,

welcome to another free trading-setup.

USD/CAD: Daytrade-Execution

Market-Sell-Order: 1,27500

Stop-Loss: 1,27960

Point of Risk-Reduction: 1,27160

Take-Profit: 1,26400

Stop-Loss: 44 pips

Risk: 0,5% - 1%

Risk-Reward: 2,50

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me!

AUD/USD BUY IDEAHey tradomaniacs,

welcome to another free trading-setup.

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

AUD/USD: Daytrade-Preparation

Market-Buy: 0,76000

Stop-Loss: 0,75695

Point Of Risk-Reduction: 0,76250

Take-Profit: 0,76995

Stop-Loss: 31 pips

Risk: 0,5% - 1%

Risk-Reward: 3,15

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me!

WHY IS FOREX not moving? Here is the answer!Hey tradomaniacs,

As you may have noticed the market is not moving as it should looking at fundamentals and news which is why I`m still staying aside.

A positive newsflow of economic data and very good earning reports plus a rising stockmarket are not really driving currencies as they should due to the fact possible stimulus could continue to boost US-YIELDS, which is currently in favour of the US-Dollar .

In this case we got two intermarket-correlations which are contrary making it harder for forex-pairs to move smooth and clear (especially risk-on-pairs such as AUD/USD and NZD/USD ).

Another example is USD/CAD as the market does not really know where to go as CRUDE OIL currently rises with the US-Dollar .

DXY (US-DOLLAR-INDEX) is by the way creating its first divergences looking at Momentum and indicators such as MAC-D and RSI and I`m waiting for the market either to break through the key-resistance or to create a double-top.

Bond prices and yield are by the way inversely related.

So what shall we look at?

As long as YIELDS continue to be strong with risk-on in the stockmarket we might see currencies stuck in major trend-areas.

This means we either wanna see risk-off in stocks for a bullish USD or falling YIELDS with rsik-on in the stockmarket for a bearish USD!

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me!

#Patience

Don`t get DUMPED by USD-BULL-PATTERN!Hey tradomaniacs,

The forex-market has been really choppy yesterday due to chaotic equityflow in the stockmarket as Hedge-Fonds are re-positioning.

After the big players were forced to generate margin by closing their red positions volume and open interest decreased drastically for stocks like Gamestop showing that there is no fuel for price to move up anymore. Also suspicious is that demand and supply were very equal and it looks like fonds are exchanging their contracts among themselves.

After a deleveraging-process that you can observe in stocks like Amazon, which dropped by almost -5% fonds took the chance and instantly bought shares back to re-position with longs.

Statistics are showing that fonds are primarily LONG in stocks, which means we might see a contiuation of the current rally and so soon a falling US-Dollar.

This chaotic cashflow out and back into stocks is obviously causing a weird price-action for the DXY (US-DOLLAR-INDEX) as its to and fro in demand and supply.

This current up-move by USD is by the way a very nice chance for fonds to sell as more retailers don`t want to miss the boat and buy.

As long as these reddit-groups are not causing too much uncertainy and fear we have to expect the primary trend to continue.

I`m still waiting for fresh CoT-reports but so far retailers are long against the large speculators.

DON`T get FOOLED by aby patter- THERE is no reason for USD ot go up (fundamentally) as long as the stockmarket stays bullish and BIDEN provides the promised liquidity!

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me!