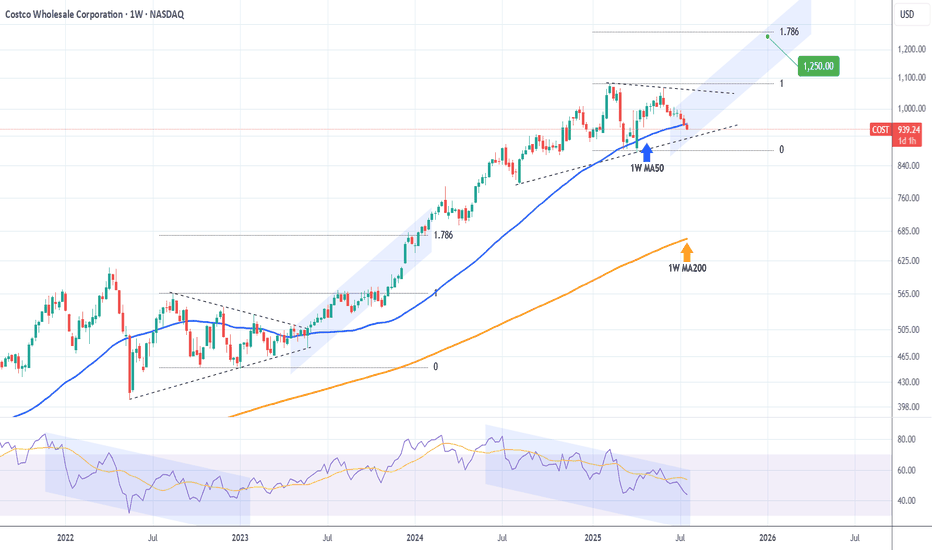

COSTCO Looking for a bottom to fuel rally to $1250.Last time we looked at Costco (COST) was 6 months ago (January 21) when we gave the most optimal buy signal exactly at the bottom of the Channel Up at the time, easily hitting our $1045 Target:

Since then, the stock has entered a new Accumulation Phase in the form of a Triangle and this week broke below its 1W MA50 (blue trend-line), which is where its previous bottom (Higher Low) was formed.

The last similar Triangle pattern was formed straight after the May 16 2022 market bottom and once it broke upwards it led to a massive rally. Even the 1W RSI sequences between the two fractals are similar.

Our Target is $1250, just below the 1.786 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COST

$AMD Swing Trade – Put Debit Spread Setup🔻 NASDAQ:AMD Swing Trade – Put Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025

🛠 Strategy: Buy to Open (BTO) Put Debit Spread

📉 Strikes: $31 / $30 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.21

🎯 Trade Thesis

This setup aims to capture short-term downside in NASDAQ:AMD via a low-cost, defined-risk spread. The trade fits within my broader portfolio of OTM spreads under $0.25.

Key Drivers:

🔻 Semi sector under pressure – NASDAQ:AMD showing relative weakness.

📉 Breakdown below key support near $31 and rejection at VWAP.

🧾 Weak momentum – MACD trending down, RSI near 44.

🔄 Trade enters into earnings season volatility.

📊 Technical Setup (Daily)

EMA(4) < EMA(8) < EMA(15): Bearish structure fully intact.

VWAP: Price rejected from 30-day VWAP zone.

MACD/RSI: Momentum still fading, no signs of bullish divergence.

⏳ Strategy Notes

Max loss: $0.21

Max gain: $0.79

Risk/reward structured for a drop into or below $30

Expiration: July 18

🧠 Journal Note

Most of my trades are swing-based using OTM debit spreads with tight risk control. No same-day entries — setups must have defined technical compression and short-term catalysts.

$LYFT Swing Trade – Low-Cost Call Debit Spread Setup🚗 NASDAQ:LYFT Swing Trade – Low-Cost Call Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025, 2:53 PM

🛠 Strategy: Buy to Open (BTO) Call Debit Spread

📈 Strikes: $16.5 / $17.5 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.25

🎯 Trade Thesis

This swing trade targets a short-term bullish move in NASDAQ:LYFT based on improving fundamentals and favorable technical setup. The structure uses a low-cost OTM call spread to define risk and limit exposure while capturing directional potential.

Catalysts supporting the move:

🚙 Autonomous vehicle rollout beginning this summer (Atlanta) and expanding to Dallas (2026) via Mobileye partnership.

🗳 Activist investor Engine Capital pushing for governance changes and strategic alternatives.

💵 Gross bookings at record levels, with net income and free cash flow turning positive.

📈 Analyst upgrade from TD Cowen with a $21 target (+30% upside from entry).

📊 Technical Setup (Daily Chart)

📉 EMA(4) < EMA(8) < EMA(15): Bearish alignment beginning to flatten – potential compression signal.

⚖ VWAP (30‑day): Price consolidating near long-term VWAP – watching for reclaim.

🔄 MACD: Bullish crossover emerging.

📉 RSI: ~36 – approaching oversold territory, setting up possible reversal.

⏳ Strategy Notes

Position type: OTM vertical call debit spread.

Risk defined: Max loss = $0.25 per contract.

Max gain: $0.75 if LYFT closes at or above $17.5 by expiration.

Timeframe: 2-week swing through July 18, ahead of Q2 earnings (~Aug 6).

🧠 Journal Note

This position aligns with a broader strategy focused on OTM spreads priced under $0.25, using technical compressions and fundamental tailwinds. Trade was opened not on an entry signal day - this avoids front-running momentum shifts.

$COST earnings short, possible uptrend selloff(Sorry for mobile charts/posts)

NASDAQ:COST Hello, looking at multiple time frames on Costco I am going to take a stab at a short. This name isn’t unfamiliar with big moves so an 8% to 10% move could take place here on earnings forecast. Granted, they could not divulge any details but I think that wouldn’t be good and amidst the tariff rhetoric which has been the narrative for retail names could add headwind. 6/6 $900p is what I will take a stab at. 1 contract will suffice as there could be a good R/R especially if you hedge. If you look at the Monthly chart this thing is bought up heavily. I am going to try and get a good entry so I’m not risking what I may feel is too much on an earnings “lotto.” $100-$150 on a contract will be good in my book.

WSL

COST Costco Wholesale Corporation Options Ahead of EarningsIf you haven`t bought COST before the rally:

Now analyzing the options chain of COST Costco prior to the earnings report this week,

I would consider purchasing the 800usd strike price Puts with

an expiration date of 2027-1-15,

for a premium of approximately $42

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

COSTCO: 4 touches/rejections. Can we pop over gap?Costco looks loaded.

4 touches along the resistance, looks like a big wedge forming. Next touch can be a break out to upside, fill gap and move with momentum upside.

OR

Green ray for the entry to downside. We got data tomorrow as well..

Do your DD! Not FA but let me know what you think!

COSTCO: Massive rebound on the 1W MA50 can go for +45% profit.Costco has just turned bullish on its 1D technical outlook (RSI = 56.966, MACD = -6.590, ADX = 35.211) as it's on the 3rd straight green week ever since it touched and held the 1W MA50. This rebound, though not an absolute bottom on the 2 year Channel Up, is the new technical bullish wave of the pattern. We've had so far 2 main +45.14% price surges in the past two years. We estimate that to be the 3rd and last up until the end of the year. Go long, TP = 1,270.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Breaking: COSTCO Shares Dip 2% In Premarket Amidst Earnings MissCostco Wholesale Corporation (NASDAQ: NASDAQ:COST ), together with its subsidiaries, engages in the operation of membership warehouses in the United States, reported fiscal second-quarter sales that topped analysts’ estimates, but earnings missed as costs rose.

The membership-based retailer saw revenue rise 9% year-over-year to $63.72 billion, above the analyst consensus from Visible Alpha. However, Costco's net income of $1.79 billion, or $4.02 per share, missed expectations, despite rising from a year earlier. The results came as merchandise costs rose 9%.

The period marked the company’s second quarter since its membership fee hike went into effect in September. Revenue from membership fees rose 7% year-over-year to $1.19 billion, though executives previously said they expect the impact on margins to be weighted to the back half of the fiscal year and into fiscal 2026.

Technical Outlook

Shares of Costco slid 1.5% in after-hours trading Thursday following the release extending the lost to premarket trading hours, with the asset down 2.02% in Friday's premarket session.

For Costco shares, the immediate support lies within the 1-month low axis. Should Costco shares face selling pressure the 1-month low should serve as a point of reprieve for Costco shares. With the RSI at 50 a breakout above the 1-month high should spark a bullish reversal for Costco shares respectively.

COST Costco Wholesale Corporation Options Ahead of EarningsIf you haven`t bought COST before the rally:

Now analyzing the options chain and the chart patterns of COST Costco Wholesale Corporation prior to the earnings report this week,

I would consider purchasing the 1030usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $22.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Selling Premium Going into Costco EarningsGiven Costco’s historical tendency for minimal post-earnings stock movement, along with inflated IV in the options market, selling premium via a bear call spread is a high-probability, risk- managed strategy to profit from an expected IV crush and minimal price movement following earnings.

Key Points Supporting the Thesis:

1. Historical Price Movement: Over the past 4 years, Costco’s stock has experienced an average post-earnings price movement of only 1.24%. The majority of moves have been within a modest range of -1% to +2%. This indicates that despite earnings announcements, the stock tends to remain within a predictable price range, minimizing the potential for significant directional price swings.

2. Implied Volatility and Overpricing of Options: Currently, the options market is pricing in a 4.6% move for Costco’s stock post-earnings. Given Costco’s historical price movement patterns, this is an overestimation of potential volatility. IV tends to collapse after earnings announcements.

3. Costco’s High Valuation: Costco is currently trading at a P/E ratio of 61, which is significantly higher than historical levels. This suggests that the stock is already expensive relative to its

earnings potential, making it less likely to experience a massive upward movement after earnings. The high valuation also means that even strong earnings may not drive significant upside, further increasing the likelihood of a muted post-earnings reaction.

4. Earnings Catalysts and Market Behavior: Costco’s earnings reports historically have had limited impact on the stock’s price due to the company’s stable revenue and earnings growth.

Investors have already priced in much of the growth potential, leading to minimal surprise reactions to earnings releases. The combination of low historical price movement and high IV makes this a prime environment for selling premium, as the likelihood of large moves is low, while option prices remain high.

After-Hours Update: COST 50% Retracement Break-Up?COST has been trading below it's most recent 200 Candles right around the $951.64 Price Level, currently consolidating and presenting an additional opportunity to get around that lower trend level (Bottom Purple) to ride this into the year.

With the planned Tariffs, we plan for that to be handed down to the consumer ultimately, causing a potential continued rise in Consumer Goods through it's Cyclical Rotation throughout 2025. Getting into things like COST, WMT, TGT and KR (which we reported on yesterday) could provide some great performance in a longer-term hold and nice returns along the way.

Let's see what #2025 has to bring to the table! Otherwise, connect with us everywhere you are in the meantime by visiting our website to access more of our Premium Personal Budgeting & Investment Portfolio Management Solutions to get started investing, as well as, optimize your potential for a better financial future at @MyMIWallet!

COSTCO New uptrend about to begin.Costco (COST) gave us the most optimal buy signal on our previous analysis (October 07 2024, see chart below) right at the bottom of the Channel Up, and easily hit our 1000 Target:

Yet again, we are ahead of a strong bullish break-out and the only Resistance level that remains is the 1D MA50 (blue trend-line). The 1D RSI has already given a buy signal right on its oversold barrier (30.00) on January 02 2025.

Once the 1D MA50 breaks, we will have a confirmed break-out buy signal. The previous tree Bullish Legs have been of at least +16.08%, so our new Target as of today is 1045.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COST Costco Wholesale Corporation Options Ahead of EarningsIf you haven`t bought the dip on COST:

Now analyzing the options chain and the chart patterns of COST Costco Wholesale Corporation prior to the earnings report this week,

I would consider purchasing the 1020usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $22.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$COST end of trend? Time to go short?NASDAQ:COST looks exhausted here. If you look on the weekly we got a big spike up that then closed under resistance which is usually a pretty good bearish signal.

I think NASDAQ:COST will start it's way down to the ~$400 support levels over the next year (by the end of 2025).

However, I think in the short term it's likely that we'll bounce at $761 or $667 support levels.

Let's see how the move plays out.

COST should continue short term rallyCOST expect short term rally as the part of sequence started from August-2024 low, while dips remain above 867.16 low. Short term, it either extending higher in third wave in (5) and expect two more highs, while pullback stays above 910 level. If it breaks below 910 then it should be diagonal in (5) and expect one more push higher to finish (5), while dips remain above 867.16 low to finish the impulse sequence started from January-2023 low.

COSTCO: 4H MA50-200 squeeze is forming the bottom.Costco is neutral on its 1D technical outlook (RSI = 49.149, MACD = -2.870, ADX = 33.443) as the price is trading inside the 4H MA50-MA200 range. This is taking place right at the bottom of the year long Channel Up, which has formed the previous two HL exactly on the 4H MA200. Coupled with a 4H MACD Bullish Cross, this is technically the new bottom formation. Our target is at least a +16.30% repeat (TP = 1,000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

COSTCO needs one more Low before it bottoms.Costco (COST) has been trading within a Channel Up pattern since the March 07 High and last week it hit the 1D MA50 (blue trend-line) for the first time since August 09. Even though this is the standard short-term Support level, we expect the price to break it and approach the bottom of the Channel Up where both previous Higher Lows were priced.

Our Target is $1000, just below the 2.0 Fibonacci extension, where the last Higher High was priced.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COST Costco Wholesale Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of COST Costco Wholesale Corporation prior to the earnings report this week,

I would consider purchasing the 907.5usd strike price Calls with

an expiration date of 2024-9-27,

for a premium of approximately $20.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Costco Wholesale deep diving into the fundamentals Sale Post ER?NASDAQ:COST is an interesting company that benefits from inflationary conditions where consumers are looking for cheaper products or more product for their money. Costco is aided from its membership business model. The Stock itself rallied 38.35% YTD "Year to Date" and 60.79% in the last Year "365 Days" I personally like the stock but think due to the valuation like the PE Ratio that is high to me personally, and the forward PE Ratio doesn't seem like the best price to me as a new investor with a short term interest, I would not personally add this stock to my portfolio until I see the stock pull-back in Share Price, Price to sales seems decent but I am hoping for a share price pullback which may never happen. I Put an idea/Chart that I Would not be too surprised if it played out that way but it could also be inaccurate. Only Time Will Tell! I am not initiating Buy, Sell, Or Hold Opinions and you should take No action suggestion

-------------------

Balance Sheet:

Cash: US$11.50b

Debt: US$6.91b

Total Liabilities: US$46.14b

Total Assets: US$67.91b

Debt to Equity Ratio: 31.7%

-------------------

Technicals:

RSI: 59

Short Interest: 1.66%

-------------------

Valuation:

PE Ratio: 56.1x

Forward PE Ratio: 52.3x

Price to Sales: 1.6x

Price to book Ratio: 18.5x

-------------------

Management Ratios

Return On Equity: 32.9%

Return On Capital Employed: 27.7%

Return On Assets: 9.9%

-------------------

Disclaimer: I am not a financial advisor and in no way am I signaling a sell, buy, or hold opinion on this stock (Costco Wholesale) I am just giving my personal opinion as a hobby trader, I have no certifications and I am not a financial analyst or a financial advisor, I also may be wrong about how I feel about the stock. I want you to do plenty more research on this and the stocks you are interested in because the stock market always holds a lot of risk that may pose different risks and overall be different for each investor and trader. Please do not make opinions based on this idea or any idea. Please be careful! this post is only for conversation.

-------------------

Idea:

-------------------

Source: SimplyWallSt for the Balance Sheet Numbers & Balance Sheet information.

COST, a Portfolio gem -- buy on dips / bargains, STABLE GROWTH.COST has been a staple go-to-retail outlet to US consumers. Costco Wholesale Corporation operates an international chain of membership warehouses, mainly under the "Costco Wholesale" name, that carry quality, brand-name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources.

It has been a rosier season for COST, as they beat earnings across the board in their recent quaretly fiscal data.

(USD) May 2024 Y/Y

Revenue 58.52B 9.07%

Net income 1.68B 29.11%

Diluted EPS 3.78 29.01%

Net profit margin 2.87% 18.11%

Operating income 2.2B 11.13%

Net change in cash 1.31B 374.42%

Cash on hand - -

Cost of revenue 51.17B 9.16%

The retail company has seen a +20% surge in the the last 8 weeks jumping from 700 to 850 range. Growth will be inevitable going forward as the company undergoes aggressive expansion and marketing campaigns to beat their counterparts with the likes of TARGET, etc.

The current price of COST is already at premium levels. We may want to see a trim down to EQL levels before re-entering. But this only applies if your swing trading this, otherwise, if you're into investing mode and plan to hold it for a bit, this won't matter.

At this point, profit-taking event may be inevitable anytime now, but just the same, it will be an opportunity to buy the stock on a discount when that time comes.

TAYOR.

$WMT 10D, $56 incoming, Tower Top BreakdownTower Top Breakdown in the works. Seems like whatever or whenever it happens, it will be close to next Friday. Remain Bearish unless new highs are established. Seemingly easy Trade here. MACD in same positioning as well as RSI. Seems like WMT doesn't get much volume in general. Not necessarily a bad thing. Options could pay well here.

Costco Partners Uber to Offer Delivery of Costco ProductsUber Technologies (UBER) announced six new products and features at its fourth annual Go-Get event, including a discounted Uber One membership for college students and an international rollout of Uber Eats delivery service of Costco ( NASDAQ:COST ) products. The ridesharing giant also announced new features for Uber Eats and Health, along with new ways to reserve rides at lower costs.

As of Wednesday, users in select locations across the U.S., Canada, Mexico, and Japan can order a number of Costco ( NASDAQ:COST ) products through the Uber Eats app, whether they have a Costco ( NASDAQ:COST ) membership or not. Uber rolled out its Uber One membership in November 2021, offering discounts on rides and free Uber Eats delivery, among other benefits, and currently has more than 19 million members. The company has decided to expand its potential membership base by offering a discounted version of the membership to college students at $4.99 per month, half the price of the original plan. Uber One for Students is launching now through the fall at an unspecified number of universities across the U.S., Canada, France, Australia, New Zealand, Japan, and Mexico. Sheridan said Uber plans to partner with a number of popular college spots like Domino's (DPZ), Taco Bell, and Starbucks (SBUX) for promotions going forward.

Uber also announced two new ways to plan rides in advance: expanding its scheduled ride system by bringing Uber Shuttle to the U.S., and introducing the ability to schedule an UberX Share ride in advance. Uber Shuttle General Manager Anthony Le Roux said Wednesday that Uber is prepared to bring the service to America later this year. Previously, the company had also partnered with some businesses in the U.S. to take their employees to and from work, but the feature will soon be available directly for users. This summer, Uber said it plans to partner with airports and event venues to coordinate trips to and from sporting events, concerts, and more in cities like Miami and Chicago.

Uber is also expanding its scheduling service with UberX Share, making the lower-cost service one that can be scheduled in advance. A ride can be scheduled as little as 10 minutes ahead of time or days in advance, and the app will tell users once the driver is approaching whether they will be sharing the ride with anyone else.

Starting in July in New York City and elsewhere later this year, Uber Eats users will have the ability to save restaurants and dishes in combined lists, which can also be shared with friends or publicly on the app. Finally, Uber Health users will receive the ability sometime this summer to add a contact from their phone as a designated "caregiver" for them. This could be a big help for those caring for elderly or sick relatives who may not be able to schedule those things on their own.

Uber shares were up 1.4% at 1:40 p.m. Wednesday to $66.25, and have gained over 70% in the last 12 months. Costco Wholesale Corp. ( NASDAQ:COST ) has grown into a major warehouse retailer in the U.S. and abroad by offering low prices on large packages of name-brand products. The company has over 127 million members who purchase long-term memberships to gain access to roughly 860 Costco warehouse stores in the U.S., Asia, Europe, and Latin America, and to make online purchases.