COSUSDT Forming Bullish MomentumCOSUSDT is displaying a strong bullish momentum pattern, indicating that buyers are firmly in control and pushing the market higher. This pattern reflects sustained upward pressure with minimal retracements, suggesting that market participants are confident about the asset’s future trajectory. With the current trading volume remaining solid, this momentum could pave the way for significant gains in the short to medium term.

The good volume levels behind COSUSDT’s price action are a key driver of its bullish outlook. Consistent buying pressure confirms that institutional and retail investors alike are accumulating positions, anticipating a breakout that could potentially yield gains of 70% to 80% or more. Such momentum patterns often occur when market sentiment is aligned with positive fundamentals or upcoming catalysts, which can further accelerate price appreciation.

Investor interest in COSUSDT continues to grow as the broader crypto market begins to favor high-potential altcoins. The momentum pattern, coupled with strong market participation, positions COS for a potential explosive move once resistance levels are broken. Traders should keep an eye on the next significant breakout zone, as it could trigger a rapid upward surge.

In summary, COSUSDT’s bullish momentum pattern is a strong technical indicator of continued upside potential. With market sentiment, volume, and pattern structure all in alignment, this crypto pair presents a compelling opportunity for those seeking substantial returns in the current market cycle.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

COSUSDT

#COS/USDT : Breakout setup ? #COS

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.003071.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area (in green) at 0.002970, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.003339

First target: 0.003520

Second target: 0.003740

Third target: 0.004000

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

COS (SPOT)BINANCE:COSUSDT

#COS/ USDT

Entry (0.0036 - 0.0041)

SL 4H close below 0.003460

T1 0.0048

T2 0.0060

T3 0.0070

Extra Target

T4 0.0080

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

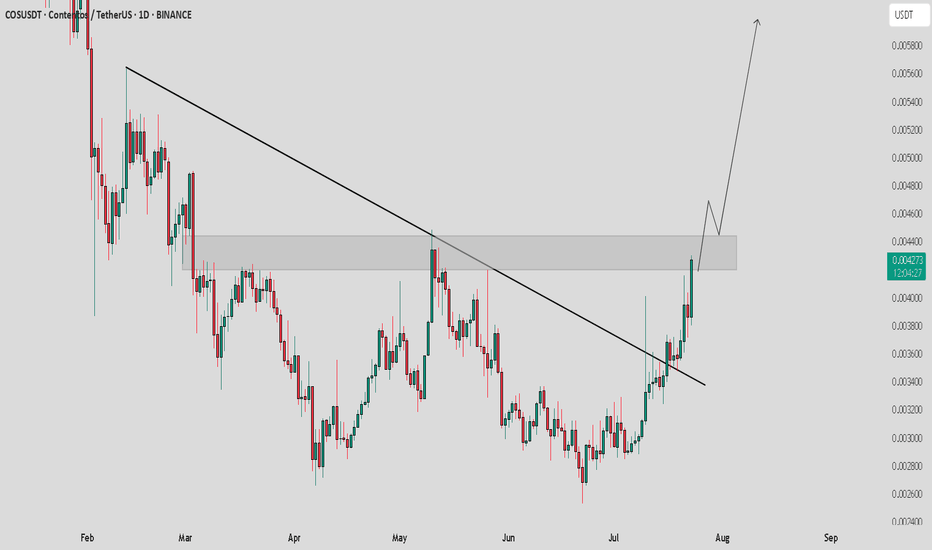

COS / USDT : Breakout setupCOS/USDT - Breakout Setup

COS/USDT is showing strong potential, currently trying to break out from horizontal resistance after a successful trendline breakout. Once the horizontal resistance is cleared, we could see a bullish move of +30% to +40%.

Bullish Scenario:

Break above horizontal resistance confirms continuation, targeting a move of +30% to +40%.

Pro Tip:

Watch for confirmation with volume before entering. Set stop losses below the breakout level for risk management.

Contentos 1550% Potential, Bitcoin & The Evolution of FinanceThe previous all-time low happened March 2020, more than five years ago. The "new all-time low" happened last week, 22-June, just a few days ago.

Contentos, we traded many times before in the past and it has been mixed but mostly a success. How are you feeling right about now? Are you ready for a new try on this Cryptocurrency trading pair?

The last bullish cycle produced a nice +1800% bullish wave, 19X. This time around something similar can happen, growth potential can be capped at 1550% or it can go higher, 2500% or more.

The chart is a standard one. A small cap. project so the action this year resulted in a new all-time low. This atl is the base from which the 2025 bull market wave will develop. Currently, we are seeing the best entry prices available before this event.

A major event truly for the market. There will be millions upon millions of participants exchanging crypto, talking crypto, living crypto, using crypto, buying crypto. It will be something not experienced before.

It will be the first bull market with the approval and even support of the US government and the recognition of all the important nations of the world. (The nations that are against Crypto are irrelevant and rooting for slavery basically. They are against growth, prosperity and freedom. It is as if the world was getting rid of slavery and some nations are against it, that's the best analogy.)

The stage is set for Cryptocurrency to take over. The evolution of finance right in your face.

We are living the most exciting financial times in the history of humanity, when money made a leap from centralized to decentralized; it is a development as big as the invention of the printing press. The world will never be the same. Prosperity will be the norm. Everybody will have access to banking; anybody can access, use and enjoy Bitcoin with as little as just a cell phone.

Namaste.

COSUSDT.1DIn my recent technical analysis of the COS/USDT daily chart, I've identified several crucial elements that suggest potential future movements. First and foremost, it's noticeable that the Ichimoku calculation has failed, suggesting a need to reapply or adjust this indicator for more accurate insights.

The Moving Average Convergence Divergence (MACD) is hovering near the zero line but below it, indicating a slight bearish momentum. The MACD line is very close to the signal line, showing a convergence that could suggest a potential change in trend if a crossover occurs.

The Relative Strength Index (RSI) is currently at 38.34, which indicates a bearish momentum but not yet in the oversold territory (below 30). This positioning suggests that while sellers have the upper hand, the market isn't extremely bearish, and a potential reversal could occur if external factors or market sentiment shifts.

Looking at the chart, COS/USDT has established a recent low at $0.003840, which is now acting as a critical support level (S1). The resistance to watch is at $0.009093 (R1). The green arrows depict a possible scenario where the price could rebound from the current levels towards the resistance if buying pressure increases. This potential upward movement could be triggered by positive market sentiment or bullish news specific to the token.

In conclusion, COS/USDT is currently in a delicate position where the next movement heavily depends on its ability to hold the support at $0.003885. Should it sustain this level, I anticipate a recovery attempt towards $0.009093. However, a break below this support could lead to further declines, testing lower historical support levels. Given the current technical setup, traders should remain vigilant and consider both protective stops and potential entries based on confirmation of trend reversal signals.

WHY COS COIN PRICE CRASH ?? COS COIN PRICE ANALYSIS AND !!FWB:COS Coin Update !!

• COS Coin Again Breakdown now its weekly strong resistance area... and from last 3 days its price regularly bleeding.

• currently near me these two possible scenerios expected that i mentioned on a chart...

• if you are planing now to buy it then its recommanded don't entre in it with upto 5% of your total portfolio... and must use tight stoploss . ( fundamentally waek project 🩸)

follow us for more free analysis !!

COSUSDT(Contentos) Daily tf Range Updated till 27-04-24COSUSDT(Contentos) Daily timeframe range. on a decent volume flow mcap it performed really well. 0.031717 holding for now, recent retrace point is at 0.023537 which is already touched. a cool down and staying above that can lead it to another run.

Cos/USDTHi Guys

Watch this chart and Decide.

Wait for the breakout or buy now but always don't ALL in one.

COS/USDT is targeting the red level .

PLZ DYOR.

Disclaimer: This article is for informational purposes only and not financial advice. Conduct thorough research and consult with professionals before making investment decisions.

Good luck.

COS ANALYSIS🚀#COS Analysis : What Next ??💲💲

✅️As we can see that there was a formation of Descending Triangle Pattern in #COS and given a breakout. Right now #COS is trading above its major resistance area. We are expecting around 50-80% bullish move 📈📈

🔰Current Price: $0.012559

🎯 Target Price: $0.023135

⚡️What to do ?

👀Keep an eye on #COS price action. We can trade according to the chart and make some profits. Stay tuned for further analysis and stay updated with market sentiments and news.⚡️⚡️

#COS #Cryptocurrency #TechnicalAnalysis #DYOR

COS/USDT is in Great Position to Rally? 👀🚀COS Analysis💎Paradisers, let's delve into #COSUSDT, showcasing dynamic market movements within an ascending channel pattern.

💎Currently, #Contentos is making strides towards the ascending resistance, emanating from the demand zone. This offers a chance for the price to rebound from this area and pursue an upward trajectory, setting its sights on the bearish Order Block (OB) as the next checkpoint.

💎However, If FWB:COS does not achieve the rebound and instead falls beneath the demand zone, we might witness a pullback to the Bullish OB vicinity around the $0.006020 mark, where it could gather renewed energy for an ascent.

💎The Bullish OB zone has historically been a critical point for catalyzing significant market recoveries upon engagement. Yet, a compromise of this zone, indicating a shift to bearish trends, may necessitate a pursuit of bullish momentum from a lower position.

💎In the event #COS doesn't harness the momentum from this or a further reduced level, a continued decline is anticipated. Rest assured, Paradisers, your ParadiseTeam is closely observing these shifts, prepared to offer guidance and insights through these evolving market dynamics.

COS has formed a bullish pattern below the resistance zoneCOS has formed a bullish pattern below the resistance zone

🔵Entry Zone 0.007891 - 0.008199

🔴SL 0.007362

🟢TP1 0.008969

🟢TP2 0.010858

🟢TP3 0.013847

Risk Warning

Trading Forex, CFDs, Crypto, Futures, and Stocks involve a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.

If you liked our ideas, please support us with your likes 👍 and comments.

CONTENTOS, about to make a run?For fun, guys.

COS, available on crypto.com and Binance (not Binance.us) amongst other exchanges, but not Coinbase.

Appears as though something is happening. I offer no insight or advice... But here's what the chart looks like...

COSUSDT 1H SETUP COSUSDT Analysis - Buying Opportunity

Overview:

Asset: COSUSDT

Current Price: 0.00643

Strategy: Buying Position

Technical Analysis:

Upon reviewing the current COSUSDT chart, a setup is evident, indicating a promising buying opportunity.

The overall trend appears favorable, with signals pointing towards potential growth.

Strengths:

Buy Zone: The current price presents an attractive buying opportunity with minimal risk, making it a favorable entry point.

Dip Strategy: If the price continues to decrease, consider accumulating more as it approaches the clearly defined green zone on the chart.

Transaction Goals:

Profit Target: Profit targets are clearly outlined on the chart in the zone where the transaction is expected to peak.

Stop Loss: A recommended stop-loss is advised to manage risks. Place it strategically to minimize losses in case of unforeseen market movements.

Conclusion:

This analysis suggests a buying opportunity with minimal risk. Loss management strategy and profit targets are clearly defined to guide you throughout the transaction.

Keep an eye on market developments and adjust your strategy accordingly.

Good luck with your transaction!

COS| To continue the upward movement!Hello trader! Today I have a new idea for you. Like and subscribe to the channel, there is a lot of useful information there.✅

On the daily timeframe, the coin is in a global downtrend, the price confirmed the local trend line on the reverse side and there was a rebound of 25%. I think that growth may continue here, I would try to enter the coin for the medium term.

Deal plan:

Entry - 0.00490/0.00475$

Stop - $0.00399

Take - 0.00568/0.00641$

Guys, the coin can show high volatility at the moment, be careful and follow risk management.

COS (Contentos) Token Analysis 12/04/2021Fundamentals:

Contentos is a decentralized global content ecosystem invested by Binance Labs (the blockchain incubator of world’s largest exchange, labs.binance.com), DHVC and various class-leading funds. Contentos TestNet was launched and its real-time network status can be viewed on Contentos Block Explorer (explorer.contentos.io). It aims to create a decentralized content ecosystem, where assets can be freely produced, authenticated, and distributed. The team consists of experts from the content industry, who have worked on top-tier consumer applications and blockchain projects. Contentos is not only a blueprint for what digital content ecosystem might look like in the future but we have multiple working use cases: Contentos is working with strategic partners, LiveMe and Cheetah Mobile, that have amassed over 60+ million monthly active users. With real-time user feedback, Contentos will become a premier blockchain project as it places the interest of users first.

the Clients does not require KYC for trading on the exchange, withdrawal and deposits.

Contentos price today is $0.03918404 with a 24-hour trading volume of $39,611,482. COS price is up 2.1% in the last 24 hours. It has a circulating supply of 3 Billion COS coins and a max supply of 10 Billion. Binance is the current most active market trading it.

Technical Analysis:

the Token has done its Initialization and Accumulation Phase and has shown an impulsive wave and Move Up Cycle

the Price has touched the 161.8%(Extension Level) of the Fibonacci Projection of the first Accumulation and impulsive wave which means the price is going to touch the 261.8% of the same Fibonacci Projection which is the 1 TP followed by some retracement and 2 TP.

COSUSDT - LTF Accumulation Play Contentos is a great project that saw a fair share of hype during the recent Bull Cycle, yet never saw its day above $0.08. None the less $COS is still a great project in my opinion and have been adding to my position well it was sitting in its Long-Term Demand Zone. With PA trading around half a cent, a trip back to LTF Supply would offer traders a return greater than 10x. The R:R is very attractive on this trade, with PA just breaking out of the STF downtrend we will see invalidation from a break below the current demand zone.

This idea is marked "Neutral" as I love the project and from a technical stand point I believe Contentos is ready for a trip back to supply to complete the LTF Accumulation pattern; But the Economist in me cannot help but take into consideration the external Macro Economic Factors. Currently the US Economy is due for a rough 2023 across all markets, and for this reason I remain cautious. In a matter of hours we've seen billions absorbed by both the Crypto market and Stock Market, always be prepared for the worst and position yourself accordingly to mitigate your exposure in unsure times. My overall sentiment is Bearish for the markets, but versatility is key in these moments. Being able to separate your bias' from the facts/numbers is crucial; play both sides of the chart and stay disciplined.

*This is not Financial Advice*