EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

COT

NASDAQ at Key Turning Point 🔍Technical Context

After testing the 23,600–23,800 supply zone, price printed a strong bearish rejection with a weekly engulfing candle.

The RSI broke decisively below the midline, signaling a clear loss of momentum.

Price is now trading back within the weekly demand zone between 22,800 and 22,950.

If a pullback toward 23,200 occurs, it could offer a fresh short opportunity, with downside targets around 22,600.

🪙 COT Report – July 29

Non-Commercials (speculators):

Long: +8,581

Short: +4,355

Commercials (hedging):

Long: +4,955

Short: +8,556

The market remains net long, but commercials are increasingly hedging with shorts.

The current imbalance — 88.6% long vs 11.3% short — suggests excessive bullish positioning, raising the risk of a correction.

🗓️ Seasonality – August

August is historically strong for the NASDAQ:

+222 pts (10Y)

+400 pts (5Y)

+912 pts (2Y)

While the trend is clearly bullish seasonally, caution is warranted:

Tops are often formed during the first half of August, followed by more pronounced corrections in September.

📉 Operational Summary

Primary scenario:

Wait for a retest of the 23,200–23,250 area

Look for rejection signals → enter short

Target 1: 22,800

Target 2: 22,600

Alternatively:

If 22,800 breaks on a strong weekly close, deeper downside scenarios may unfold.

SILVER Is About to Collapse? Watch This Critical Supply Zone!Price recently tapped a high near 39.20 before sharply rejecting from the 38.80–39.20 supply zone, confirming strong selling pressure. The current structure shows:

- Supply zone tested and rejected

- Likely return to the previous demand zone (36.50–36.00)

- RSI is turning down, confirming loss of momentum

A pullback toward 38.30–38.50, followed by a bearish continuation toward the 36.50 area, which acts as a key structural and institutional support.

🗓️ Seasonality

Historically, July is bullish for silver:

Last 5Y average: +0.89%

Last 2Y average: +2.18%

However, August–September are bearish months:

August: mildly positive, but weak

September: consistently negative across all time frames (-0.86% to -1.10%)

This increases the probability of a downward move starting in early August, in line with current price action rejection.

🪙 Commitment of Traders (COT) – July 22

Non-Commercials (speculators):

Longs: +656

Shorts: -516

Commercials (hedging):

Longs: +1,337

Shorts: +916

➡️ Commercials are increasing both long and short exposure, while non-commercials remain net long — a sign of moderate optimism.

However, long positioning is slowing down compared to previous weeks. A potential exhaustion in bullish momentum is forming.

📉 Sentiment

52% short vs 48% long

Volume: more lots on the short side (492 vs 454)

Sentiment remains neutral to slightly contrarian bullish, but not extreme. This may allow for a fake breakout before a deeper move down.

🧩 Operational Summary

Main bias: Bearish short to mid-term (starting August), supported by:

- Technical rejection at supply

- Negative seasonal tendencies ahead

- RSI showing momentum loss

- COT showing stabilization, not accumulation

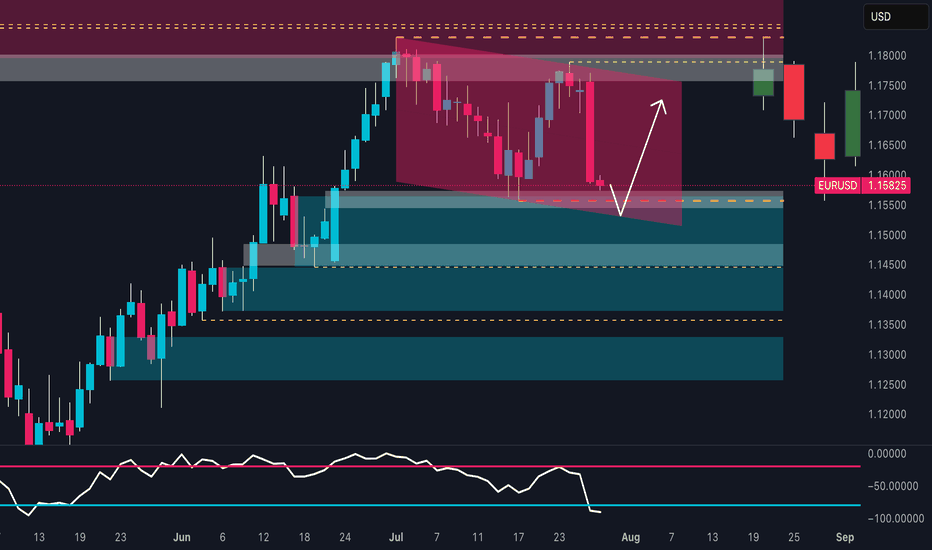

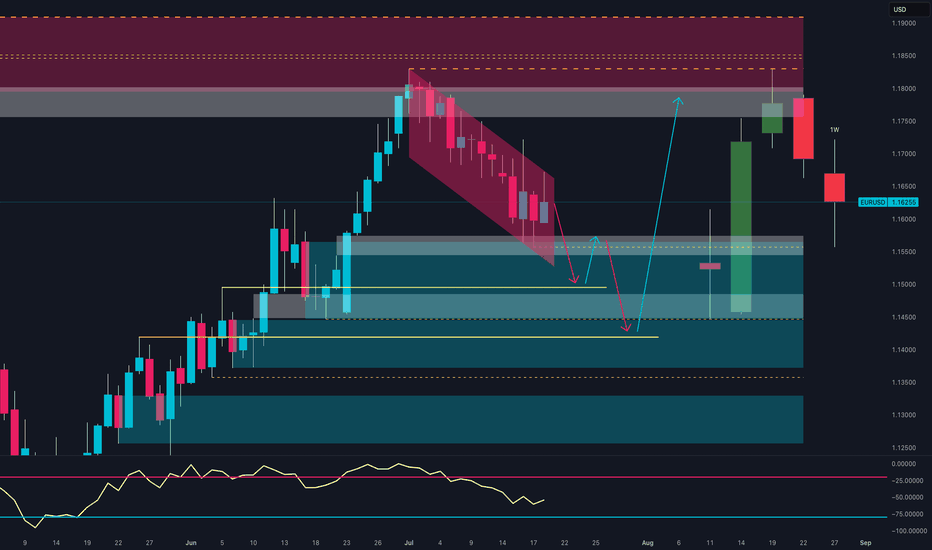

EUR/USD at a Turning Point:Rally or Trap for the Bulls?📉 Technical Analysis

Price has decisively broken out of the descending channel highlighted in recent weeks. The weekly support zone between 1.1540 – 1.1580 is holding, triggering a significant technical reaction. The weekly RSI has entered oversold territory, suggesting a potential short-term reversal.

Key Support: 1.1530–1.1580 (currently reacting)

Key Resistance: 1.1720–1.1780 (inefficiency & supply zone)

Base Case: Potential rebound toward 1.1720–1.1750 before next structural decision

🧠 Sentiment Analysis

82% of retail traders are long, with an average entry at 1.1635

Only 18% are short, a clear minority

This extreme imbalance suggests downside pressure may persist to flush out weak long hands before a genuine reversal takes place.

📊 COT (Commitment of Traders)

USD Index:

Non-Commercials increased both long (+663) and short (+449) positions → uncertain stance but slight USD strengthening

EUR Futures:

Non-Commercials increased long (+6,284) and short (+8,990) positions, but net increase favors the bears

This shift signals a bearish turn in sentiment among large speculators, indicating short-term downward pressure.

📈 Seasonality

In July, EUR/USD historically tends to rise, but:

This year’s price action is underperforming the seasonal pattern, showing relative weakness

August is historically flat to slightly bearish

Seasonality does not currently support a strong bullish continuation

✅ Strategic Conclusion

Current Bias: Bearish-neutral (with short-term bullish bounce expected)

A technical rebound toward 1.1720–1.1750 is likely (liquidity void + RSI bounce + retail imbalance)

However, 1.1720–1.1750 is a key supply zone to monitor for fresh shorts, in line with:

Dollar-supportive COT data

Overcrowded long retail positioning

Weak seasonal context

🧭 Operational Plan:

Avoid holding longs above 1.1750 without macro confirmation

Monitor price action between 1.1720–1.1750 for potential short re-entry

Clean breakout above 1.1780 → shift bias to neutral/bullish

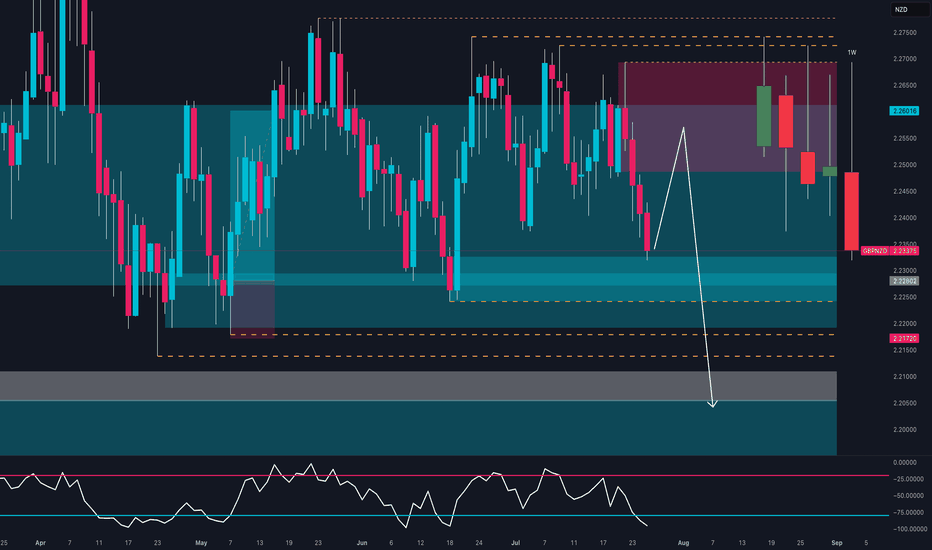

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle

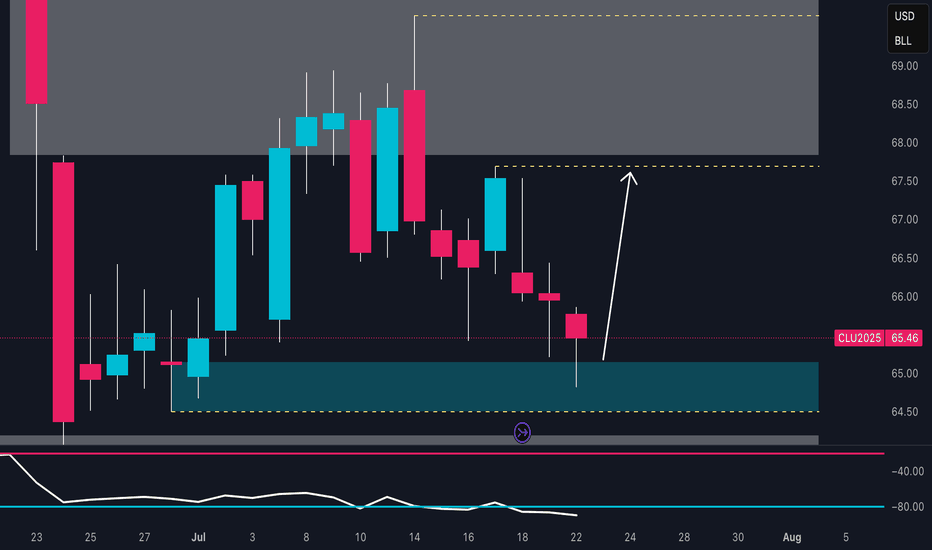

Crude Oil Rebound Incoming? Key Demand Zone 📈 1. Technical Analysis – Daily Chart (CL1!)

The price has returned to a demand zone between 64.60 and 65.30, an area that previously triggered strong bullish reactions.

The July 22nd candle shows a clear lower wick, indicating potential buyer absorption and a possible short-term reversal.

The next key resistance lies between 67.80 and 68.80, which aligns with a well-defined supply zone.

Daily RSI remains weak but shows signs of bullish divergence, suggesting potential accumulation.

Bias: bullish from current levels, targeting 67.50 – 68.00. Invalidation on a daily close below 64.40.

2. Institutional Sentiment – COT Report (CFTC, July 15, 2025)

Non-Commercials (Speculators)

Long: 308,915 (↓ -24,223)

Short: 146,488 (↑ +22,724)

Net Position: sharply declining → bearish divergence in speculative sentiment

Commercials (Hedgers)

Long: 857,803 (↑ +66,342)

Short: 1,046,199 (↑ +18,118)

Net Position: still negative, but improving → reduced hedging = less downside pressure

📉 Interpretation:

Funds are closing longs and adding shorts, showing bearish positioning. However, commercials are slowly reducing their hedging exposure, which could indicate short-term stabilization if the technical support holds.

3. Seasonality

Periods analyzed: 20, 15, 10, 5, and 2 years

July historically shows negative average returns:

-0.71% (20Y)

-1.26% (15Y)

-1.37% (10Y)

The seasonal pattern indicates continued cyclical weakness into August.

📌 Interpretation:

The summer period typically brings seasonal bearish pressure, which aligns with current 2025 performance.

🌐 4. Macro & Fundamentals

EIA inventory builds for 3 consecutive weeks → demand weakness in the U.S.

No additional OPEC+ cuts announced → supply remains ample

Stable inflation data in the U.S. and China → no uptick in energy demand

Overall macro data is neutral with a slightly bearish short-term bias

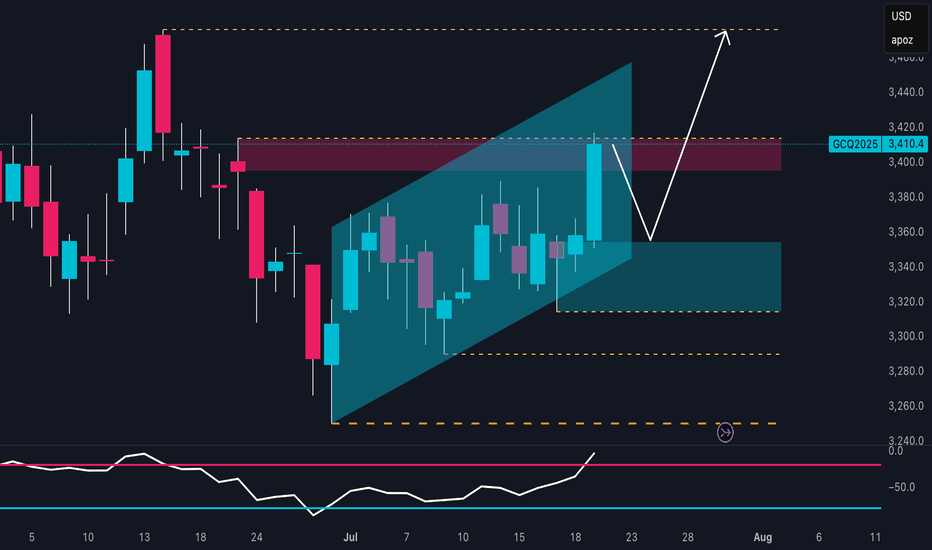

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area and significant daily structure. The reaction in this zone suggests a potential fake breakout, hinting at a short-term pullback before a continuation of the upward move.

The RSI oscillator supports this view, displaying bullish momentum with a breakout above the 60 level. However, the current slope hints at a possible minor correction before the next impulsive leg higher. The most relevant demand zone lies between 3,340 and 3,360 USD, at the base of the ascending channel—an ideal spot for buy orders to accumulate in anticipation of a move toward previous highs.

Backing this technical setup, the Commitment of Traders (COT) report as of July 15, 2025, paints a constructive picture. Non-commercial traders (institutional speculators) increased their long positions by over 8,500 contracts, while also cutting short positions by about 1,600 contracts, indicating a strong bullish bias. Commercials also increased their shorts (+16,448), a typical hedge during rallies, but not enough to invalidate the bullish structure.

From a seasonal perspective, July remains one of the historically strongest months for gold. According to MarketBulls data, over the past 2 years, gold has averaged gains of 105+ points in July, with solid returns also visible on the 5-year (+45 pts) and 10-year (+25 pts) averages. August also tends to be supportive, reinforcing the idea of a medium-term bullish extension.

Lastly, the retail sentiment is heavily skewed, with 72% of retail traders short, and only 28% long. From a contrarian standpoint, this is another strong bullish signal. When the majority of retail traders are short in a structurally bullish market, the potential for a short squeeze remains high.

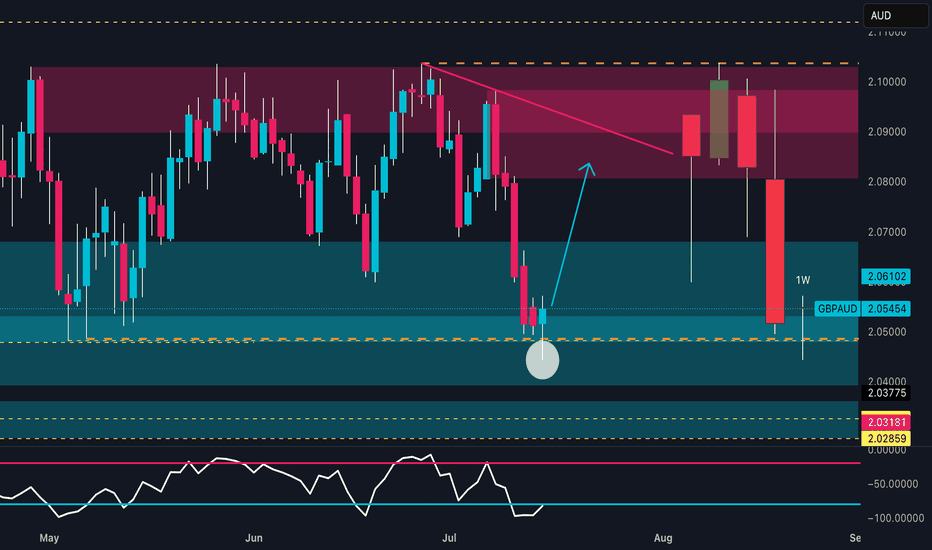

GBPAUD: Weekly Reversal | COT & Seasonality Support Bullish📊 Technical Outlook

Price strongly reacted from a key weekly demand zone between 2.0400 and 2.0500, showing clear absorption of bearish pressure. The RSI is rebounding from the 30 area, signaling early reversal potential.

The next technical target lies between 2.08900 and 2.10000, within a well-defined supply zone.

An early bullish reversal is in progress, with potential for a swing move toward the red zone.

🧠 Commitment of Traders (COT Report – 08/07/2025)

GBP: Non-commercial traders are net long, with positioning growing across the board: +869 longs / -926 shorts. Commercials reduce shorts and increase longs → Bullish bias.

AUD: Non-commercials are clearly short (-2,267 longs / +1,957 shorts). Commercials are increasing long exposure (+2,629), but still in the minority → Bearish bias.

➡️ The COT spread confirms a GBP long vs AUD short bias.

📅 Seasonality (July)

GBP: Historically strong in July, with average monthly gains across all timeframes (especially the 2Y window).

AUD: Less favorable seasonal profile in July; flat to slightly negative across all time horizons.

➡️ Seasonality supports GBP strength.

📉 Retail Sentiment

58% Long / 42% Short on GBPAUD

➡️ Retail traders are still heavily long → a shakeout of weak long hands is possible before the real rally begins.

🎯 Strategic Conclusion

GBP shows bullish convergence across technical, COT, and seasonal factors. AUD presents clear weakness.

The current price zone offers a clean entry point for longs, targeting the 2.08900–2.10000 supply zone.

EURJPY Hits Major Weekly Supply | Is the Bull Run Over?EUR/JPY – Institutional Macro Context (COT)

EUR (Euro)

Non-commercials net longs increased by +16,146 → strong buying.

Commercials added +25,799 long positions.

✅ Bias: Moderately bullish.

JPY (Japanese Yen)

Non-commercials decreased longs by -4,432.

Commercials cut -20,405 long contracts.

❌ Bias: Bearish pressure remains on JPY.

Conclusion (COT): EUR remains fundamentally strong, JPY structurally weak. Institutional flows favor long EUR/JPY, but positioning is stretched.

Seasonality (July)

EURJPY shows strong bullish seasonality in July, especially over the 2Y and 5Y averages (+1.03% and +0.66% respectively).

✅ Seasonality bias: Bullish.

Retail Sentiment

89% of traders are short on EUR/JPY.

Contrarian bias = bullish confirmation.

Technical Analysis (Weekly View)

Price is pushing into a major weekly supply zone around 172.50–173.00.

RSI still elevated but showing signs of weakening momentum.

Potential double top structure forming in confluence with liquidity grab.

First downside target sits around 169.50 (daily demand zone).

Awaiting a reaction in supply and confirmation for short.

Trading Plan (Top-Down)

Wait for price to reject the 172.50–173.00 area

Watch for bearish confirmation on Daily (engulfing or lower high)

Target: 169.50 zone

Risk: tight above 173.20 (invalidating supply zone)

Smart Money Reloading: Will EUR/USD Explode from Demand Zone?📊 Technical Context (Daily)

EUR/USD is currently in a corrective phase following the strong June rebound from the 1.1450 area, which culminated in a high near the 1.1850 supply zone.

The recent bearish move has pushed the pair back into a key demand area between 1.1450 and 1.1550, a zone that has acted as support multiple times in the past.

The latest weekly candle shows a potential bullish exhaustion signal (long lower wick), with the RSI hovering in oversold territory.

📌 Primary scenario: Possible consolidation above 1.1550 followed by a bullish continuation toward 1.1750–1.1800.

📌 Alternative scenario: Break of the recent lows could lead to a deeper retest of the 1.1350 zone.

📈 COT (Commitment of Traders)

Non-commercial positioning shows growing bullish interest in the euro:

EUR: +971 new longs, -6,654 shorts → strong increase in net long exposure.

USD Index: -267 longs, +92 spreads → signs of institutional indecision on the dollar.

This suggests a favorable shift toward the euro by smart money.

💡 Retail Sentiment

Retail traders remain heavily short on EUR/USD (63% short) with an average entry price of 1.1579.

This reinforces the contrarian bullish case, as retail traders are trapped short in a potential reversal zone.

📆 Seasonality

Historically, July has been a bullish month for EUR/USD:

➕ 2Y average return: +0.0287

➕ 5Y average return: +0.0166

This supports a seasonal bullish bias aligning with the current technical setup.

✅ Operational Outlook

EUR/USD is trading at a technically and macroeconomically significant area. The confluence of:

Weekly demand zone being tested

RSI in oversold conditions

COT positioning favoring the euro

Retail sentiment skewed short

Bullish seasonality

…makes a bullish bounce plausible in the coming weeks, with a first target at 1.1750. Invalidation level below 1.1450.

📌 Bias: Moderately Bullish

📍 Technical Activation Zone: Above 1.1550 with confirmed bullish price action

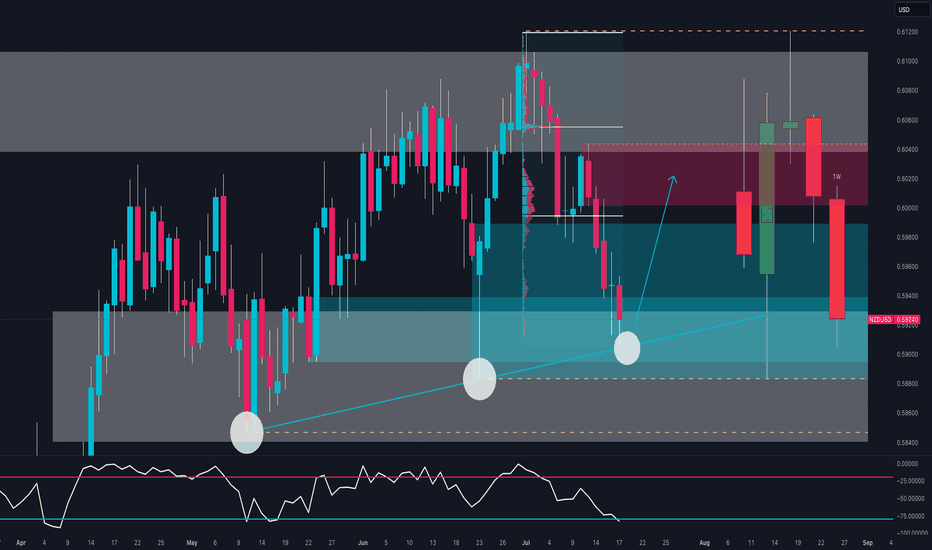

NZD/USD Ready to Explode? The Smart Money Is Making a MoveBias: Bullish Bounce from Key Demand Zone

NZD/USD is testing a strong confluence zone:

Long-term ascending trendline support

Weekly demand area between 0.5890 and 0.5940

Bullish RSI divergence near oversold conditions

The triple rejection wicks signal strong demand around 0.5900, suggesting a possible reversal toward the 0.6020–0.6050 resistance area.

🧠 COT Insight:

NZD: Non-commercial traders added +669 long contracts and reduced shorts by -102 → net bullish shift

USD: Net short exposure increases; total non-commercial shorts now exceed longs by ~4000 contracts

Implication: institutions are rotating into NZD while trimming USD exposure

📊 Sentiment:

86% of retail traders are long NZD/USD → retail sentiment is heavily skewed

This could delay or limit upside as smart money often moves counter to retail positions

📅 Seasonality (July):

July has historically been a bullish month for NZD/USD across all reference windows (20Y, 15Y, 10Y, 5Y, 2Y)

Average July return consistently positive → adds conviction to bullish thesis

🗺 Outlook:

If the zone at 0.5880–0.5920 holds, price may bounce toward 0.6020–0.6050.

Break below would invalidate structure and expose 0.5850 and then 0.5780.

USDJPY – Tactical Short in Weekly Supply or Bullish Breakout?COT & MACRO FLOW (Commitment of Traders)

USD INDEX

Non-commercials still biased short: Longs 16,208 vs Shorts 20,194 (slightly improved, but still negative).

Commercials remain net long, but the open interest is declining → no strong conviction from smart money.

JPY

Non-commercials added significantly to their short exposure (+6,751), while cutting longs (-4,432).

Commercials also cut long exposure heavily (-20,405).

The structure shows institutional bias is clearly bearish on JPY.

Conclusion: JPY weakness confirmed by both commercial and non-commercial flows. USD slightly weaker, but JPY is weaker → supports USDJPY bullish bias.

SEASONALITY (JULY)

USD/JPY tends to be weak in July across most historical averages (5y, 10y, 15y, 20y).

July is historically bearish for USDJPY, especially in the second half of the month.

This seasonality contrasts with COT flows → mixed bias.

RETAIL SENTIMENT

60% of retail traders are SHORT → supports contrarian long view.

Retail volume shows imbalance in positioning, another contrarian bullish signal.

📈 TECHNICAL ANALYSIS (DAILY CHART)

Price is testing a key weekly FVG zone between 148.4 and 149.2.

RSI has re-entered the overbought region, suggesting potential exhaustion.

Price bounced from the monthly bullish order block (143.5–144.0).

A clear move above 149.50 could invalidate short setups.

🧩 TRADE IDEA (SETUP)

Watch for price to retest 148.4–149.50 zone and react.

RSI divergence + seasonality could offer a short opportunity with confirmation (e.g. engulfing on Daily/H4).

If price breaks above 149.5 with volume → look for continuation to 152.00.

✅ FINAL BIAS

Macro and institutional flows remain in favor of USDJPY longs, but:

Seasonality turns bearish in the second half of July

Price is reaching strong resistance

Retail sentiment supports the long thesis

→ Tactical Short from 149-150 only with confirmation. Otherwise, long continuation above 150.

EURAUD Breakdown Incoming? Price + COT + Seasonality🧠 MACRO & INSTITUTIONAL FLOWS (COT)

EURO (EUR)

Strong increase in net long positions by non-commercials: +16,146

Commercials also added long exposure: +25,799

Bias: moderately bullish

AUSTRALIAN DOLLAR (AUD)

Non-commercials remain heavily net short (long/short ratio: 15% vs 63.6%)

Slight increase in commercial longs: +2,629

Bias: still bearish, but showing early signs of positioning exhaustion

COT Conclusion: EUR remains strong, AUD remains weak — but the recent extension calls for caution on fresh EURAUD longs.

📊 SEASONALITY (JULY)

EUR shows historically positive July performance across 2Y, 5Y, and 10Y averages

AUD also shows mild strength, but less consistent

🔎 Net differential: No strong seasonal edge on EURAUD in July

📈 RETAIL SENTIMENT

54% of retail traders are short EURAUD, 46% long

Slight contrarian bullish bias, but not extreme yet → neutral to slightly long

📉 TECHNICAL STRUCTURE – MULTI-TIMEFRAME

1. Weekly Chart

Strong bearish engulfing candle after 4 weeks of upside

RSI dropped below 50 → clear momentum shift

1.7960–1.8100 is now a liquidity zone that’s been tapped

2. Daily Chart

Confirmed break of the ascending channel formed since May

Price reacted from demand zone around 1.7460–1.7720, signaling potential pullback

Watch for rejection around 1.7910 (50% body of the weekly engulfing candle)

3. Entry Setup

Key area for short entries: 1.7910–1.7940

This zone aligns with:

✅ Former support now turned resistance

✅ Inside a valid bearish order block

✅ Ideal retracement level (50% engulfing body)

🎯 OPERATIONAL CONCLUSION

While the macro context still favors a stronger EUR against AUD, price action tells another story.

The weekly engulfing candle is a strong technical reversal signal, and the daily structure confirms the break.

→ Shorting the pullback into 1.7910–1.7940 could offer an excellent R/R trade setup.

Bias: Short-term bearish – Targeting 1.7700, 1.7550, and potentially 1.7315

Invalidation: Daily close above 1.8040

Contrarian Alert: Retail Is Buying, But Should You Sell?So far, there are no significant changes in the options flow suggesting a shift in sentiment or restructuring of previously established bullish positions. The market remains on watch, but interesting signals are coming from other sources.

According to the latest COT reports , institutional players continue to align with the current trend, reinforcing its stability.

However, retail positioning is starting to show signs of a potential reversal , with a noticeable increase in net-long positions and fresh buying activity over the past two days. This often indicates early countertrend interest.

The well-known contrarian principle — "do the opposite" — applies here, although it shouldn't be taken as an immediate signal to short.

For my part, I’ve identified the 0.6565–0.6570 zone as a key level where long positions are concentrated:

A rejection from this zone could offer a solid shorting opportunity.

A break above it would suggest the trend might resume higher.

By that point, updated options flow data and new positioning COT reports may provide further confirmation.

EUR/NZD – Macro Outlook & Why It’s a Conviction LongMacro Thesis:

EUR/NZD presents one of the clearest long opportunities this week, supported by a sharp divergence in macro fundamentals, a favorable positioning landscape, and confirmation across sentiment and structural models.

🔍 Key Drivers:

1. Macro Fundamentals (ENDO):

The euro area maintains a relatively stable inflationary outlook with moderate growth, while the ECB remains cautious but not overly dovish.

In contrast, New Zealand is showing consistent deflationary pressure – inflation data is softening, M2 growth is stagnant, and real activity (PMI, Retail Sales, NFP) continues to cool. This creates a clean fundamental divergence in favor of the euro.

2. COT Positioning:

There is no excessive long build-up on the EUR side, and NZD remains weak across institutional positioning metrics. This opens the door for further upside without the risk of crowded positioning.

3. Z-Score (Positioning Extremes):

Z-Score data highlights NZD as sitting at an extreme negative reading (Z_Long < –1.7), suggesting it is fundamentally oversold and under institutional pressure. EUR, by contrast, is neutral.

This imbalance further validates the long EUR/NZD setup, particularly from a flow and momentum continuation standpoint.

4. EXO Models (Score, RR_w, Interest Rate Bias):

The pair scores well in weekly RR analysis, supported by strong ENDO/EXO bias convergence. NZD continues to lose monetary support (dovish IR & Overnight trends), while EUR stays relatively neutral.

From a structural model perspective, the bias is clearly long.

5. Sentiment Environment:

The global risk-on tone continues, but it’s paired with relative softness in commodity currencies like NZD. That dynamic adds additional fuel to the long side of EUR/NZD, especially while EUR remains resilient and stable.

✅ Summary & Trading Plan:

Bias: Long EUR/NZD

Conviction Level: High (9/10 – multi-layer confirmation)

Holding Horizon: 1–3 weeks

Invalidation: Exit on reversal of NZD macro tone or shift to risk-off globally

Why This Pair?

EUR/NZD offers one of the clearest expressions of fundamental divergence in the current macro environment.

You have stable inflation and steady growth in Europe versus a weakening macro pulse in New Zealand.

There are no major positioning risks, sentiment supports the setup, and structurally the pair aligns with the broader market tone.

Clean macro. Clean structure. No crosswinds.

EUR/USD – Smart Money Trap at 1.18? Massive Rejection Ahead 1. Technical Context

The pair has been moving inside a well-defined bullish channel since May, forming higher highs and higher lows. Price is currently hovering around 1.1718, approaching the upper boundary of the channel and a key weekly supply zone (1.1750–1.1850).

➡️ Potential scenario:

A short bullish extension toward 1.1780–1.1820 to trigger stop hunts, followed by a bearish rejection toward 1.1500, and potentially 1.1380.

The daily RSI is overbought (>70), suggesting a likely short-term correction.

2. Retail Sentiment

80% of retail traders are short, with an average entry around 1.1318.

This signals a liquidity cluster above current highs, increasing the likelihood of a fake bullish breakout followed by a sell-off.

➡️ Contrarian insight: Retail heavily short → market may push higher first to wipe them out before reversing lower.

3. COT Report – USD Index (DXY)

Non-commercials (speculators) increased their short exposure on USD (+3,134).

Commercials cut their short positions (-1,994), indicating a potential bottoming on the dollar.

➡️ Conclusion: USD strength could return soon → bearish pressure for EUR/USD.

4. COT Report – EUR FX

Non-commercials increased longs on EUR (+2,980) and sharply reduced shorts (-6,602) → market is now heavily net long.

Commercials remain net short (581,664 vs 417,363 longs).

➡️ Over-leveraged spec longs → vulnerable to downside squeeze if macro sentiment shifts.

5. Seasonality

June tends to be mildly bullish for EUR/USD.

July historically shows even stronger upward performance over the last 5–10 years.

➡️ Shorts are high risk in the very short term, but a bearish setup is likely in the second half of July, especially if price action confirms.

6. Trading Outlook

📍 Short-Term Bias: Neutral to bullish toward 1.1780–1.1820

📍 Mid-Term Bias: Bearish on rejection from supply area and break of channel

🎯 Key Levels:

1.1780–1.1850: critical decision zone (liquidity + weekly supply)

1.1500: first key support

1.1380: next downside target (demand zone + previous POC)

📌 Final Conclusion

The most likely play is a short setup from 1.1780–1.1850 on strong rejection, supported by:

Extreme retail positioning (80% short),

COT pointing to USD recovery,

Extended technical structure,

Overbought RSI on the daily chart.

GBP/CHF Headed to 1.10 – But Bulls Might Regret It📉 1. Price Action & Technical Structure (D1)

Key demand zone tested with bullish reaction:

Price reacted strongly around the 1.0790–1.0840 structural demand area, previously the origin of a significant bullish impulse. The latest daily candle closed above the previous swing low, suggesting a potential technical rebound.

Immediate target:

The 1.0980–1.1010 zone, aligning with:

A clear supply area

RSI bouncing from oversold territory

A visible imbalance left unfilled

Technical bias: Short-term LONG to fill the imbalance before a potential institutional-driven short setup at supply.

2. Retail Sentiment

86% of traders are LONG, with an average entry of 1.0997

Only 14% are SHORT, with lower volume and better pricing

Current price: 1.0833, meaning most long traders are in drawdown

Contrarian view:

The heavy long positioning creates a liquidity pool between 1.0990–1.1010, making that zone highly attractive for institutional distribution and liquidation of retail longs, especially if accompanied by a structural shift.

🎯 Operational impact:

Supports a technical long to 1.10, but high risk of reversal once that level is reached.

3. COT Report

GBP (British Pound – CME)

Non-commercials:

Long: -6,434 → massive unwind of bullish exposure

Short: +2,028 → rising bearish bets

Net positioning is increasingly bearish

Commercials:

Long: +7,459 → increasing coverage against GBP weakness

Short: -569 → slight reduction

Positioning is mixed, but commercials are taking defensive long positions

GBP interpretation:

Bearish pressure rising from institutional speculators, despite some commercial support.

CHF (Swiss Franc – CME)

Non-commercials:

Long: +327

Short: +1,215

Net positioning still heavily short, but shorts increasing again

Commercials:

Long: +1,909

Short: +307

Commercials are accumulating long CHF positions (bullish sign)

CHF interpretation:

Divergence between commercials (bullish CHF) and speculators (still short) → shift may be underway.

4. July Seasonality

GBP:

Historically strong in July, especially the last 2 years (+3.5%)

Positive tendency across 10y/15y/20y averages

CHF:

Also seasonally positive in July, but underperforms GBP across most timeframes (except 2Y where CHF is also strong)

Operational impact:

Favors short-term bullish GBP/CHF bias, supported by seasonal momentum.

✅ Final Outlook

Current short-term bias is bullish, driven by:

Clear technical rebound

Visible imbalance toward 1.10

Seasonal divergence in favor of GBP

However, excessive retail long positioning + COT speculative pressure on GBP suggest this rally could be a distribution phase, offering an optimal short opportunity at 1.10.

AUDCHF at Make-or-Break Zone: Smart Money Reversal or Breakdown?1. Price Action

Price is currently trading within a descending channel, with 0.5244 hovering near a key demand zone (0.5150–0.5200), where a first bullish reaction has already occurred.

The structure suggests a potential fake breakdown, with room for a rebound toward static resistances at 0.5330, and possibly 0.5450.

RSI is rising from oversold, showing signs of a potential bullish divergence.

📌 Technical bias: Waiting for confirmation of a reversal at key support.

Upside targets: 0.5330 > 0.5450.

Ideal stop-loss below 0.5160.

2. Retail Sentiment

72% of retail traders are long, with an average entry at 0.5551, now facing a 300+ pip drawdown.

This increases short-term contrarian bearish pressure, but also signals liquidity above the highs, which could be targeted before a true bullish reversal.

3. Commitment of Traders (as of June 17, 2025)

AUD – Bearish

Massive drop in both commercial longs (-60k) and shorts (-60k) suggests broad disengagement.

Non-commercials remain net short (-69k), with overall open interest declining.

CHF – Neutral to Bullish

CHF also sees declines in positioning, but commercial traders remain firmly net long (+51.7k).

Non-commercials are net short (-25.5k).

📌 COT Conclusion: AUD remains structurally weaker than CHF, but both currencies are showing signs of positioning uncertainty. This compression phase may precede a technical rebound on AUDCHF.

4. Seasonality

AUD

June historically shows modest strength on 10Y and 5Y averages.

However, 2Y data points to weakness → any rally may be short-lived or fragile.

CHF

CHF tends to be strong in June, especially on 20Y and 10Y views.

Yet, short-term (2Y) data shows end-of-month weakness, suggesting possible profit-taking ahead.

✅ Operational Outlook

Short-term bias: Long AUDCHF (corrective rebound)

Medium/long-term bias: Bearish (still in a downtrend)

CADJPY Bearish Reversal? Smart Money + Seasonal Confluence🧠 COT Sentiment

Speculators are heavily net short on CAD (–93K), while maintaining a strong net long position on JPY (+144K).

→ This positioning clearly favors JPY strength over CAD weakness.

Commercials are hedging JPY downside, but the dominant flow remains JPY bullish.

📅 Seasonal Patterns

Historically, June is weak for CAD (5Y, 10Y, 15Y averages all negative).

Meanwhile, JPY tends to strengthen in the second half of June.

→ Seasonality supports a bearish outlook on the pair.

📉 Technical Structure

Price has reacted precisely to the Fibonacci 0.705 retracement (106.23) and is showing signs of RSI divergence.

We are trading within a key supply zone between 106.70 and 108.30, which also aligns with a major resistance cluster and harmonic extension.

First target sits at 103.88, with potential extension to 101.20 if breakdown confirms.

🛢 Macro Catalyst

Oil remains under pressure.

CAD retail sales dropped significantly.

Risk-off sentiment (cautious Fed + geopolitical tensions) favors JPY as a safe haven.

📊 Retail Sentiment

62% of retail traders are short, but with an average entry at 108.49.

→ A break below 106 could trigger liquidation, fueling further downside.

🧩 Trade Setup

🔹 Entry zone: 106.70–107.00

🔸 SL: Above 108.40 (invalidates the bearish thesis)

🎯 TP1: 103.88 (S/R retest)

🎯 TP2: 101.20 (extended target on risk aversion)

🧭 Synthesis

Every angle aligns toward a potential bearish reversal on CAD/JPY:

✅ COT positioning

✅ Seasonality

✅ Macro narrative

✅ Technical confluence

✅ Retail sentiment trap

EURJPY Just Broke Out – Is This the Start of a Summer Rally?📊 1. COT Report – Euro & Yen

EUR (Euro FX – CME):

Non-Commercials:

Long: +5,968 | Short: -4,293 → Net Long increasing

Commercials:

Long: +11,480 | Short: +24,451 → Net Short

→ Speculators are clearly bullish on the euro.

JPY (Japanese Yen – CME):

Non-Commercials:

Long: -5,319 | Short: +1,235 → Net Long decreasing

Commercials:

Long: +31,893 | Short: +25,462 → Hedging, but still net short

→ The yen continues to be sold, especially by institutional players.

📌 EUR/JPY COT Summary:

Speculators are buying EUR and selling JPY → strong bullish bias on EUR/JPY.

🧠 2. Retail Sentiment

80% of retail traders are short EUR/JPY, with an average entry at 161.50

Current price is around 167.20 → retail is heavily underwater

✅ Strong contrarian bullish signal

📉 3. Technical Analysis

Price broke out of a long-term range, printing new yearly highs

RSI is overbought but with no active bearish divergence

Price sits inside a major supply zone between 166.50 and 168.00, where previous rejections occurred

A potential pullback to the 164.60–164.15 area aligns with ascending trendline support

🟡 Likely Scenario:

A healthy technical pullback to 164.50–165.00 to cool off RSI,

followed by a continuation higher if supported by momentum and COT positioning

📅 4. Seasonality

June is historically a bullish month for EUR/JPY:

5-year avg: +1.167%

2-year avg: +2.41%

→ Seasonality supports more upside into early July

🌍 5. Macro Context

BoJ remains dovish, no sign of imminent tightening

ECB is steady but relatively less dovish → rate differential still favors the euro

No signs yet of verbal intervention from Japan.

USD/CAD Trap in Progress? Smart Money Flips BearishUSD/CAD is currently in a rebalancing phase after the strong downside correction seen over recent weeks. Following a rejection in the 1.3900–1.4000 supply zone, price retraced down to a major demand area between 1.3500 and 1.3650, where it has shown a notable bullish reaction. The pair is now trading at 1.3734, and multi-frame data suggests we are in a transitional phase—not yet a confirmed bullish trend reversal.

COT Report – Institutional Positioning

The latest Commitments of Traders data (June 10th) reveals critical signals:

Commercials (hedgers and large institutions) have aggressively increased their long exposure on CAD, adding +27,999 contracts. This indicates strong expectations of Canadian dollar appreciation—bearish implications for USD/CAD in the medium term.

Non-Commercials (speculators) reduced their short CAD exposure by -14,319 contracts, signaling that speculative players are starting to unwind long USD/CAD positions.

Overall, the net shift shows institutional sentiment turning bearish on the pair, potentially pointing to a deeper downside once the current technical pullback completes.

USD Index COT – Dollar Momentum Weakening

On the USD Index, Non-Comms have added +1,279 long contracts, but positioning remains moderate. Commercials are flat, suggesting the dollar lacks strong bullish backing. This makes any sustained USD/CAD rally structurally fragile.

Retail Sentiment

Retail traders are 57% short and 43% long on USD/CAD. Although not extreme, this imbalance suggests confidence among retail participants in a bearish move—often preceding a short-term upward squeeze before an eventual trend continuation.

We could therefore see price move toward 1.3900 as a liquidity grab, setting the stage for a larger reversal.

Technical Analysis – Outlook

Key highlights:

A strong bullish reaction occurred from the 1.3500–1.3650 demand zone, previously well-respected.

The weekly RSI is still below the 50-level but is turning upward—momentum is improving.

Price structure shows room for a pullback to the 1.3900–1.4000 supply zone, which aligns with higher-timeframe order blocks.

This zone remains a critical resistance, and unless the macro and positioning context changes, a renewed bearish impulse is expected from this area.

Trading Outlook

The current picture presents a tactical short-term long opportunity, followed by a potential structural short setup.

📈 Scenario 1 – Bullish Pullback (in play):

With price above 1.3700 and consolidating, there’s space for a rally toward the 1.3900–1.4000 supply zone. Ideal for short-term targets.

📉 Scenario 2 – Structural Short (priority bias):

Should price reach 1.3950–1.4000 and show bearish confirmation (e.g., engulfing, doji, rejection on H4/H1), this would be a prime area to initiate swing shorts, targeting 1.3600 and eventually 1.3450.

✅ Final Bias: Structural Bearish – Corrective Bullish

Watch for potential false breakouts above 1.3800–1.3900 to liquidate retail shorts before a more meaningful downside move. The sharp increase in commercial net long CAD positions supports a bearish USD/CAD bias for the coming weeks.

EUR/USD Bulls in Control... But the Trap Is Set at 1.1600? 🇺🇸 EUR/USD – Technical & Macro Outlook

EUR/USD has posted an impressive rally over the past few weeks, driven by a combination of technical and macro factors. It is currently trading around 1.1586, right at the edge of a major supply zone where previous sharp rejections and reversals have taken place.

🔍 Technical Analysis

Price action remains within a well-defined ascending channel that began in mid-April, fueling the bullish move from the 1.07 lows.

The current daily candle is showing signs of exhaustion within the 1.1550–1.1600 resistance zone, with upper wicks and declining volume.

RSI is in a high-neutral zone but not yet overbought, leaving room for more upside — but also increasing the probability of a technical pullback.

🔁 Key Levels:

Primary resistance: 1.1600 (multi-touch supply area)

Support 1: 1.1460–1.1430 (previous resistance, now potential support)

Support 2: 1.1300–1.1270 (demand zone + channel base)

📉 COT Report – June 3, 2025

Non-Commercials (speculators) remain net-long with over 200,000 contracts, though both long (-1,540) and short (-4,830) positions saw reductions. This suggests a bullish structure with early signs of profit-taking.

Commercials are heavily net-short, with 575,000 short contracts versus 437,000 long — a structurally bearish stance from physical market participants.

Open interest increased significantly by +20,813, pointing to renewed speculative participation and potential volatility.

🧭 Retail Sentiment

Retail traders are heavily short (80%) with an average entry around 1.1253.

This contrarian behavior is typically supportive of continued upside pressure — especially if price holds above key supports.

📅 Seasonality – June

Historical averages over 10, 15, and 20 years show a slightly bullish tendency in June.

The 2- and 5-year patterns suggest more neutral to mildly bearish behavior.

This supports a consolidation or corrective pullback, without ruling out higher moves during the summer rally.

🎯 Trading Conclusion

Current bias: Moderately bullish, with rising pullback risks near 1.1600

Possible setup: Tactical short between 1.1580–1.1610 if confirmed by bearish price action

Target: 1.1430–1.1300

Bullish scenario remains valid unless we break below 1.1270

📌 Summary

The bullish trend is strong but technically extended. Speculative positions remain net-long but are starting to unwind. The retail crowd is still betting against the move, which favors bulls. However, structural resistance calls for caution — a pullback could be imminent.