CPG Quality mid-cap energy, 15-20% near-term 1W upsideCrescent Point Energy

Fundamental Analysis

Price to earnings ratio is around 1.4X (substantially lower than the sector and equities broadly)

Q1 Revenues were $950

Q1 Margin was 95% income to revenue

Following a 25% decline in recent price from $10.25 per share to below $7, $CPG appears to technically bullish on a long-term (6-9 months). Energy equities has a recent pull-back following the June inflation reports, however, upward momentum has just built up with the latest price now trading higher than the price 10 bars ago. The Commodity Channel Index on longer trading scales (4H) shows that $CPG has been oversold.

There is significant support channels at $6.90 (-5%) and resistance above at $7.95 (+9.42%). Above this, the next channels are $8.72 (+18.8), and $9.18 (25.1%)

Risks:

Exposed to global crude oil supply levels. Crescent Point Energy primarily is involved in the extraction of crude oil from Western Canada. Demand remains roughly around pre-COVID 2019 levels and therefore $WTI pricing is driven predominantly by supply. Currently, the price closed to below the 3-month mean, while the fundamentals of global crude supply have not changed significantly.

There are reports that the conflict in Europe may advance to various possible scenarios, which may (a) see the Russian Federation limiting and stopping export of oil to its current trading partners in Europe, bringing $WTI to above $300 USD based on current supply and demand figures, and (b) the G7 and EU may cap the price they may pay for Russian oil.

Competitors and related stocks in sector:

$VET Vermillion Energy

$OBE Obsedian Energy

$WCP Whitecap Resources

CPG

CPG CRESCENT POINT ENERGY CORPORATION NYSE:CPG

Weekly chart For CPG

We Will see a good move

Good luck every one

Head and Shoulders Pattern

Looking at a head and shoulders pattern forming. After taking a beating due to oil prices, the stock is looking at a textbook head and shoulders pattern. Although oil fears continue, the stock has dropped so much over the past few weeks with zero recovery so far, it is worth the play.

Compass Group - Buying the dip to the long term trend line.Buy Compass Group (CPG.L)

Compass Group PLC provides food and support services. The Company's segments include North America, Europe, Rest of World and Central activities. The Europe segment includes Turkey and Russia. The Rest of World segment includes Japan. The Company delivers services in sectors, including business and industry; healthcare and seniors; education; defense, offshore and remote, and sports and leisure.

Market Cap: £31.19Billion

Compass is trading in a fantastic long-term uptrend and this is showing no signs of stopping. The latest correction appears to have found some buying support at the long-term trend line. We expect the shares to rally towards the upper end of the corrective channel before eventually breaking higher towards new highs.

Stop: 1890p

Target 1: 2050p

Target 2: 2145p

Target 3: 2250p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

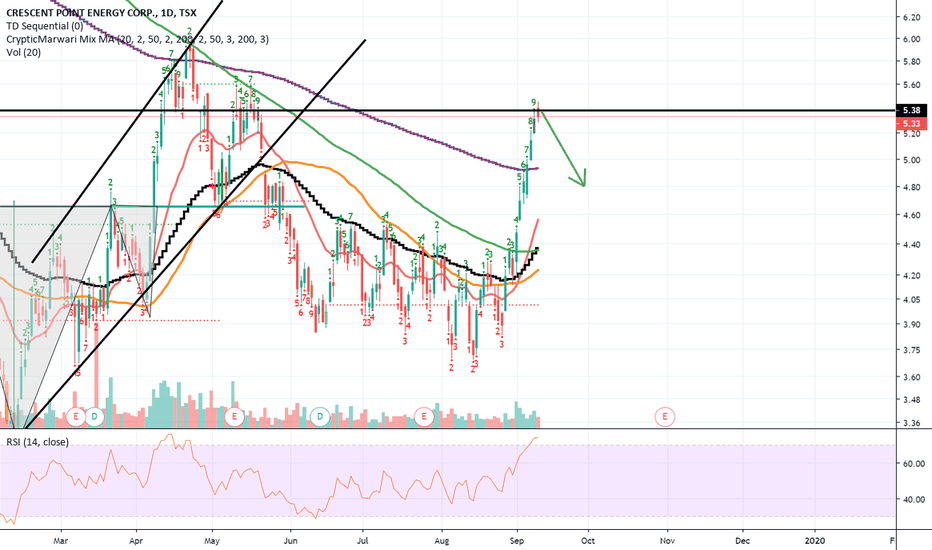

Short term pullback on Crescent Point Energy likelyDaily 9 on the TD Sequential. CPG has gone up exponentially so I am expecting a pullback at the very least the prior support level. A daily close above 5.6 would invalidate this trade idea.

CPG - Double Bottom Doubles MoneyQuick refresher to previous ideas on CPG. Patience will pay off on this trade. Owning CPG is pretty safe right now after 90% drop from highs and consolidation/reversal pattern showing up at the bottom.

CPG - Major break retest 75% gainHello Friends,

This is complementary idea to long term CPG idea (linked).

Yesterday, CPG has completed Reciprocal AB=CD pattern and produced a bullish daily candle. I believe that correction from $4.46 to $3.33 is over now and CPG is ready to rally to its next target at around $6.21. That would be a retest of once major support break. It also coincides with potential Bat pattern D point at 0.886 fib.

This move should give about 75% profit.

See details on a chart.

If you have any questions feel free to ask in comments.

Good luck!

CPG long It has been a while since I posted one of my plans for the week ahead and I've missed the process, this week I would like to share my Compass Group (CPG) set up which I think is a great long. Compass posted strong half year earnings on the 15th of May which was well received by the market sending the stock up to an area that has played a role as resistance in the past, 1820. The price tested this area in April of this year and was unable to break through since then we have seen the stock go through some weakness to bounce back to then level on the strong earnings report. Last week's candle saw the formation of a doji where the market is making it's mind up about the 1820 where we will either fall away or break through and see new all time highs which is always a good time to trade a stock as it will be on a lot of peoples watch lists. The moving averages I use mainly 200/50 SMA and 7 EMA are all leaning upwards supporting the idea that the stock is in an uptrend and buyers should have control.

The plan for this one is to, set a stop order at 1821 as we haven't seen a full break yet so the level still holds good meaning we can get a tight entry to it without there being too much overhead resistance. I have my stop loss set at 1789 which clears most of the lows from last week easily giving the stock enough room should it fail to break out at the open but still tight enough to get a 1% account loss set which is vital for risk management. My target for this set up is a 5/1 RR giving me 1986 however, I will trim the potion by at third at the whole numbers of 1850 and 1900 making the psychological burden of holding a bit easier. I hope you have enjoyed this analysis and if there is anything you see differently feel free to comment. Thank you!

Joe

LSE:CPG

CPG on it's way up CPG, it's looking poised to go up again, I'm not entirely sure on this one....yet, but maybe just maybe...yeah it should make some gains wait a little longer for confirmation but yeah it's getting ready

CPG - A Profitable Range?Assuming CPG shows signs of stopping volume as it falls back into the accumulation zone here, the 6.45 - 6.48 zone appear to be a potential low-risk long entry with use of a tight stop.