CPRX Growth Stock with Favorable UpsideCatalyst Pharmaceuticals, Inc. ( NASDAQ:CPRX ): Growth Stock with Favorable Upside

Trade Setup:

- Buy Price: $21.31

- Stop-Loss: $19.31

- Take-Profit Targets:

- TP1: $25.32

- TP2: $30.22

Rationale:

Catalyst Pharmaceuticals is a commercial-stage biopharmaceutical company focusing on innovative therapies for rare neurological diseases. The company's solid revenue growth and market position in niche segments offer a compelling reason for potential upside.

Financial Performance:

- In Q3 2024, the company reported **revenue of $128.7 million**, a **25.3% increase year-over-year**, driven by strong demand for their lead product, FIRDAPSE®, and the successful U.S. launch of AGAMREE®.

- Net income improved to **$45.6 million**, compared to $35.2 million in the same period last year.

Analyst Ratings:

- Catalyst Pharmaceuticals has a consensus **"Strong Buy" rating** from analysts.

- The average price target is **$31.14**, suggesting a potential upside of approximately 46% from the current price.

Volume and Market Dynamics:

- Short interest sits at around **7.47%**, signaling moderate bearish positioning but also potential for a short squeeze if bullish momentum builds.

- Trading volumes have shown steady growth, reflecting increased investor interest.

Risk/Reward Analysis:

With a stop-loss at $19.31, the risk is approximately **$2 per share** from the entry price. The first take-profit target offers a reward of **$4 per share** and the second target extends it to **$9 per share**, creating a favorable risk-to-reward ratio of **1:2** and **1:4.5**, respectively.

Conclusion:

Catalyst Pharmaceuticals presents a balanced opportunity for growth-oriented traders. While short interest and volatility indicate some risk, strong financial performance and favorable analyst targets provide confidence in the stock’s potential.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

CPRX

Long trade in CPRXCPRX is the #1 stock in the biotech group by almost every metric. The table on the chart shows its ranking out of all 795 biotech stocks by 3 metrics from IBD's MarketSmith.

Sales and earnings are surging and the rate at which both are growing has increased in each of the last 4 quarters.

The stock made a false breakout on December 14 when the market gapped up on CPI data. It then put in a shakeout move to hit stops before rallying right out of its base.

I am taking a small position in the stock here with a tight stop at 17.65. I want to see new highs in the next several days to confirm the breakout has legs.

Where I'm Buying CPRXCatalyst Pharma (CPRX) is an absolute monster. Not only is the company posting huge sales and earnings growth in a sector that rarely has either, the stock has more than doubled over the last few months.

There are 801 stocks in the biotech group tracked by Investors Business Daily, and CPRX ranks at the very top (see image in chart).

After such a large advance higher, we must remain cautious to the possibility of a retracement. So we need to see signs of additional strength to trigger an entry.

I’m watching for a move above last week’s high for my buy signal. This way, I can place a stop below last week’s low and still get away with a risk of 8% or less on the trade.

Ready for the second round! Good day traders!

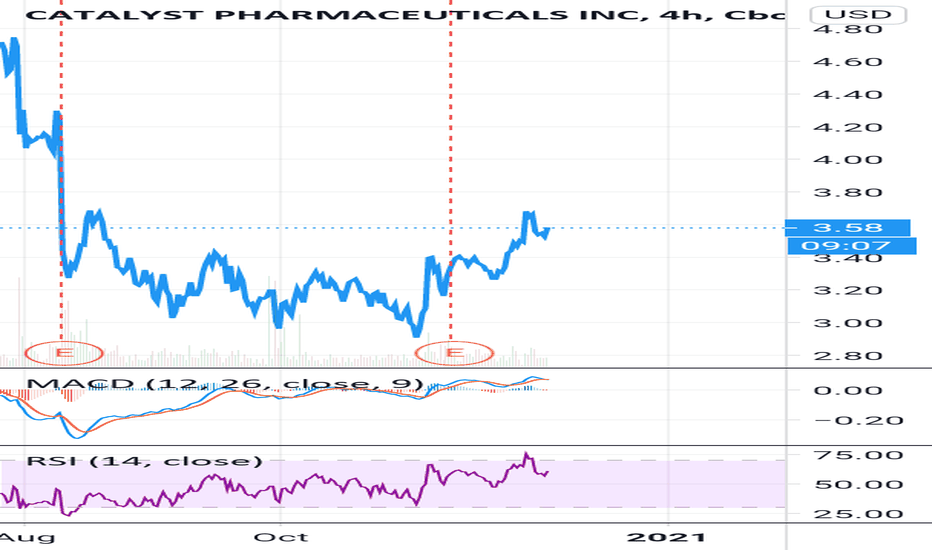

CPRX rallied 500% from the 1st moon shot, now it seems that it shows another strong mooning momentum.

Oversold MACD & Stochastic RSI & dropped almost 50% from the 1st rally..

Goodluck traders! Enjoy!

Thank you CPRX ABRALOCK AND LOAD!

This might be the bottom and ready for a profitable reversal!

Moon Shot!!

CPRX Catalyst Pharmaceuticals $40M Repurchase P/E Ratio 6.5 WOWCatalyst Pharmaceuticals is a biopharmaceutical company that specializes in therapies for rare neurological and neuromuscular diseases. It announced its fourth-quarter and 2020 financial results on March 15, 2021, reporting a 16% increase in revenue for fiscal 2020 and a 30% increase in operating income. (investopedia.com)

The company posted adjusted earnings of $0.11 per share, up 57% year-over-year, with the figure exceeding analysts’ expectations of $0.09 per share.

The company remains focused on acquiring or in-licensing innovative, technology platforms and early stage programs in therapeutic areas different from neuromuscular diseases. (smarteranalyst.com)

CPRX it`s an easy 50% in my opinion.

$40 Million Share Repurchase.

Market Cap 453.715M.

PE Ratio (TTM) 6.15.

75mil revenue, 119mil earnings in 2020

haven`t seen such a great balance sheet on a penny stock.

now trading at 4,94usd.

3/18/2021 Roth Capital Boost Price Target Buy $6.50 ➝ $7.00

H.C. Wainwright analyst Andrew Fein reiterated a Buy rating on the stock with a price target of $9

If you are also interested to test some amazing BUY and SELL INDICATORS that i use, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

Cprx predictionMy prediction is that cprx cup will form a handle on 9-11 December at 3.7$. After the handle (don't know direction, straight or downtrend) should go up around 4.5$ then a retraction should happen. This may be a big prediction so check on your own if everything goes to this plan. However financials are good and this stock is cheap.

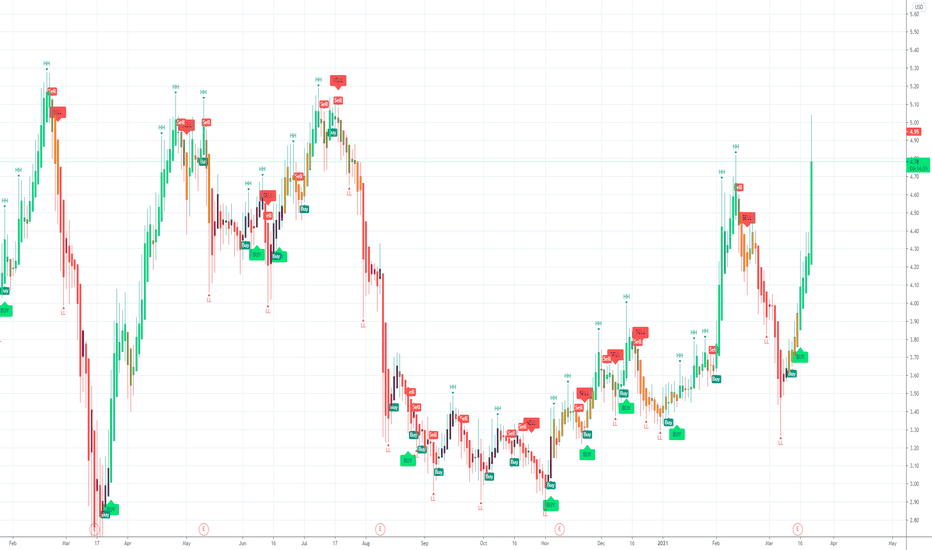

$CPRX Trade Plan - Short $CPRX would of been the easiest stock to trade since 2013.

2013: Gaped Down to around 0.50 and consolidated for awhile between 0.37-0.60 creating a strong support level. Half way through 2013 it broke out of consolidation and rallied for 2 years over 840% to 5.80.

2015: After it made this huge run It crashed all the way back down to its last major support zone around 0.50 which would of been a great short trade to play if you held the entire year.

2016: Soon after $CPRX hit 0.50 it started trending back up again and ran for 3 years all the way back to its last major resistance level around 5.30-5.80 which would of been another 840% gain.