Crabpatterns

STG (1H) Crab PatternThe information contained herein has been prepared for general information purposes only. The comments and recommendations contained herein are based on the personal opinions of commenters and recommenders. It should not be interpreted as a buy-sell recommendation or a promise of return on any investment instrument. These views may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not yield results that meet your expectations.

Crab Pattern Suggest a Bullish Movement For BTC!🌳BTC was in an Ascending Triangle .This means the Price Can Increase as Much as the Measured Price Movement( AB=CD ). SInce The Break out Has Happened,The Price can Increase Further without any problems. also if we Put Crab Harmonic Pattern on the Chart, We can See That The Price is Capable to reach around 24K$ Pretty Easily.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

🌍Thank you for seeing idea .

Have a nice day and Good luck

Gold...and those CrabsHarmonically at least, Gold appears to be operating under two crab harmonic patterns.

The longer pattern, in place since the peak on March 8th 2022, has hit its target 1.

The shorter Deep Crab Pattern has hit targets 1 and 2.

In the short term, it would not be unreasonable for Gold to retreat back to the late September low.

A solid bottom here should trigger a retest of the original targets and perhaps more follow-through.

As confirmation, I would want the stochastic indicator to head down the 25 level and reverse.

Assuming a position my stop would be just under $1600.

So I am waiting for sub $1620 and then I will take a hard look at a long position.

This is not investment advice and so your own due diligence.

S.

Perfect automated detection of DeepCrab PRZ - LongA bullish-type big DeepCrab pattern may occur when drop to 1.1044.

There is also a support zone at 1.0980-1.1000.

(In this support zone, there was a rebound in 17 Aug, 15 Jul,...)

Long after pattern generation and seeing the rebound.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

GBPUSD - Bearish Crab retestA great shorting opportunity for me. I love to engage the crab pattern although to most traders they shy away from it.

There's a retest on this and is great to see a RSI Divergence on this bearish crab.

One of the combo I love to see is a completion of harmonic patterns within supply zone or demand zone or simply a consolidation zone.

Candlestick pattern confirmation is just as important.

p/s pls do not follow blindly

Perfect automated detection of Butterfly & DeepCrab PRZ- LongA Bullish-type Butterfly pattern occurred.

If the price drops to 0.8529, a Bullish-type DeepCrab pattern could occur.

Long after seeing the rebound.

*Harmonic patterns are automatically detected using the indicators below.

- Harmonic auto-detect PRO

Episode578 CADJPY - Bullish CrabAs much as I like to prize this Crab Pattern as the ultimate setup for the week, this Bullish Crab Pattern has a major warning sign.

Trained Harmonic Pattern traders can comment at the bottom.

The reason I would still consider this a Crab Pattern is because the levels converge at 104.08.

The better setup this week is the Bearish Crab Pattern on the USDJPY Daily Chart, check out the link at the bottom.

USDJPY-Weekly Market Analysis-Sep22,Wk5Monetising on the idea that USDJPY has a completed Bearish Crab Pattern on the Daily Chart, I'm waiting for this odd-looking Bearish Shark Pattern to complete at 145.27.

Normally, I wouldn't have factored in the fact of BOJ intervention that makes the chart an odd-looking one, but because the level of the PRZ within the shark pattern converges, I'm going to observe how the market reacts at 145.27 before engaging the trade.

Perfect automated detection of Crab pattern - ShortA Bearish-type Crab pattern occurred near the resistance zone of 1.696-1.718.

(In this resistance zone , there was a rebound in Jul 2022, Aug 2021,...)

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 1.652-1.663.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of Crab PRZ - ShortA Bearish-type Crab pattern with a clean waveform may occur when exceeding 1.1307.

There is also a resistance zone at 1.129-1.136.

(In this resistance zone, there was a rebound in Oct 2017, Mar 2016,...)

Short after pattern generation and seeing the rebound.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Crab Harmonic and Head and ShouldersA bearish Crab Harmonic and a Head and Shoulders. These are actuallythe most reliable chart patterns playing out. Some swing traders seriously considering a double top from Alt-Time-High but before this we have an imponent H&S that became valid from the fulfillment of your pullback to the neckline and really more reliable. So, I'm targeting a reliable level at 14.6% of the Fibonacci retracement. As we can see on this daily chart I'm adding a confluent projection from the prior bearish CRAB Harmonic. This extension of Fibonacci ratio is in fact 1.278 wich is the square root of 1.618 from a AB=CD pattern.

USDJPY-Weekly Market Analysis-Sep22,Wk3USDJPY's daily chart has a potential bearish crab setup and the 1hourly chart has a potential bullish crab setup.

On the current timeframe, USDJPY has respected the HOP level and reversed, what interest me more is the buying opportunity it presented.

When market opens on Monday, I will wait for a retest of support for a buying opportunity.

📉✌USDCAD Short position ✌📈FX:USDCAD

You can enter a short position between Now and the Yellow area.

If the price falls and reaches the risk-free level, you can risk-free the position.

TP 1&2&3 are on the chart.

The optimum stop-loss is above the determined line.

Please share ideas and leave a comment,

let me know what's your idea.

CrazyS✌

Perfect automated detection of Crab pattern - ShortA Bearish-type Crab pattern occurred within the resistance zone of 137.0-137.6.

(In this resistance zone, there was a rebound in 28 Jul, 19 Jul,..)

Also on the daily chart, Bearish-type Gartley pattern is occurring.

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 135.2-135.80.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

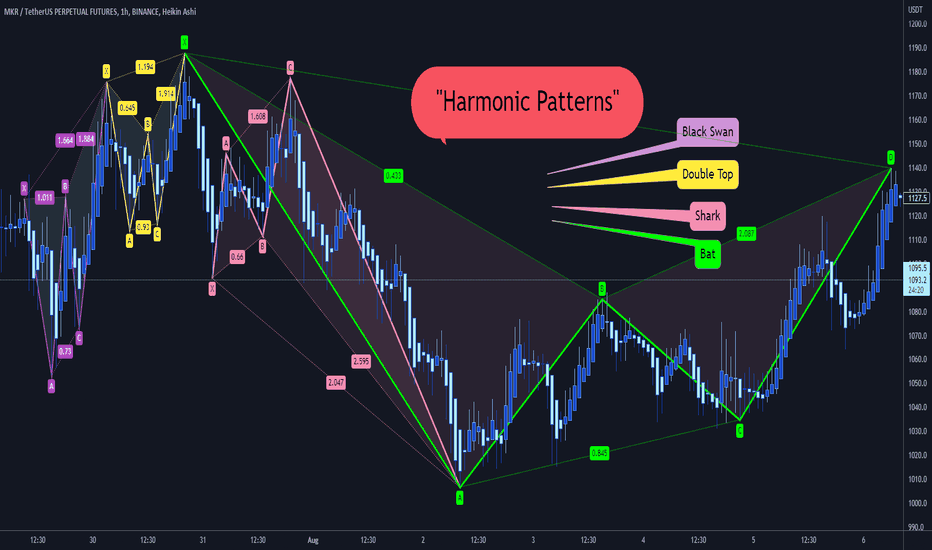

Harmonic PatternsHarmonic Patterns

we have so many kinds of “Harmonic Pattern”:

Black Swan

Bat

Crab

Butterfly

Gartly

White Swan

Shark

Zero_Five

Cypher

Double Top

Double Bottom

📚👌🏻 Each one of them has its unique Fibonacci levels.

⚡️ Do you want to know them?

😍 Happy to see what you find in the charts, please share yours with us