Crash

Global Recession is triggering As USA federal reserve government .. boost up another high rates.. this effects other big indices markets as well across the world.

The 4th time 75 basis points. This triggering global recession ad seems like it is coming. For EUSTX50 WILL DROP HARD .. should expect the bottom at 3000

If it doesn’t hold then 2600 area is a good area to buy.

Trade safe and this isn’t financial advice.

FEDS MEETING WONT BE PRETTYThe big day , the big event tomorrow

November 2nd the moment of the day we all been expecting and waiting for. Turns out they want to blow up the economy in order to take the inflation under control, even so they set to send another 75 basis point … this is the 4TH TIME OF THE MEETING !!!!

This percentage total of 5 percent of hiking aggressive..

This trigger a global recession in 2023.

USA depressions of finance is coming in 2023, and the Feds WONT STOP raising rates not sooner as you think.

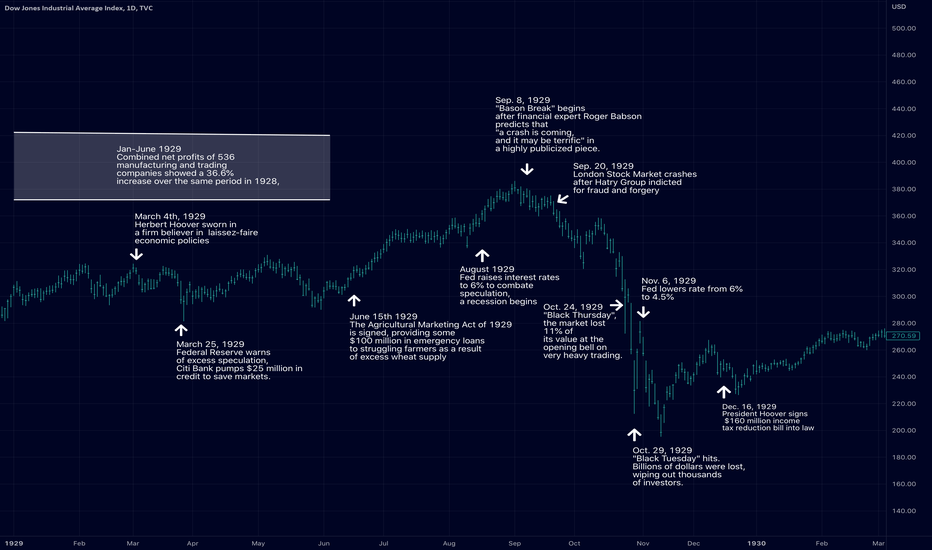

We will face and see worse than the Great Depression.

Same as for nas from US30

Should expect even lower than where we were before ..

FOMC FEDS MEETING WONT BE PRETTYThe big day , the big event tomorrow

November 2nd the moment of the day we all been expecting and waiting for. Turns out they want to blow up the economy in order to take the inflation under control, even so they set to send another 75 basis point … this is the 4TH TIME OF THE MEETING !!!!

This percentage total of 5 percent of hiking aggressive..

This trigger a global recession in 2023.

USA depressions of finance is coming in 2023, and the Feds WONT STOP raising rates not sooner as you think.

We will face and see worse than the Great Depression. As for NAS … the crash has already started.

Dow Jones monthly points to WWIII bear trap ruse just like C0V1DThe strong bounce on a confluence of supports--plus the usual "but we've only seen the beginning of the bear market lol" articles--would strongly suggest that the yellow brick inflation road will continue (see both related ideas) and that recent market activity is another ploy to keep retail anxious / confused / short (valid for as long as the highlighted supports hold)

Pain is just starting for crypto - 3k area at play?! for Pain is just starting.

The US treasury bonds are decreasing as the debt to GDP ratio is going through quantitative cumulative tightening resulting in increased pressure on subscription prices and falling demand for butter cookies and other commodities. This will only worsen as the BOJ (Bank of Japan) is issuing rate hikes at a pace of 75 bipperinos per hike, eventually leading to a bottleneck in its economical orbit. This could lead to two scenarios : recessional (unilateral) crash or hyperdeflationary catalytic sme-GMA event as seen in 1945. As of now, any long is destined to be a losing trade. The probability of a bottom across US equities is low as they're indirectly correlated to the rate of growth in Brazilian government subsidized index KRVM4GA , which has been seeing major bearish divergences as the ambassador of Peru declared Brazil to be debt-solvent, meaning that its portfolio of foreign asset is absorbing damage at unsustainable pace, with no sign of improvement until FY2036. Furthermore, FAANG companies are set to launch a global campaign in support of Ukrainians, which puts pressure on Kremlin forces currently controlling the black sea canal ; all of this could lead to a shortage in wheat and forced selling on the BVT-PLU5 index , possibly impacting the life of millions of Europeans, thus directly decreasing their income and risk appetite when it comes to volatile assets like BTC.

Overall, this puts global macro conditions in a dangerous spot as they are set to worsen by EOY, possibly reaching a doomsday-level bankrun scenario.

For those reasons, I will be looking for shorts (and shorts only) until we hit the 3k area (possibly marking the bottom for this cycle).

Dollar broke Trend The TVC:DXY Dollar has broken critical support

The dollar has broken down from its parabolic curve that has been intact since October 2021.

We now have 3 daily closes below the curve indicating a significant trend change in the dollar. Risk assets are generally negatively correlated to the dollar. Therefore Crypto and the stock market tend to go up when the dollar goes down and vice versa.

The DXY has also perfectly hit the upside target of $114 - the 1.618 fib extension target.

We also have multiple bearish divergences on the daily and weekly timeframes.

Daily bearish divergence: MACD, RSI, Stochastic, Momentum as well as the Vwap

Weekly bearish divergence: Stochastic

Downside targets are as follows:

Short Term : $108 & $104.5

Longer Term: $103 (This is a strong monthly support and will be tough to break)

$101 to $98 - Golden Fib (0.5 to 0.618 fib retracements

Conclusion:

We should see a rapid decline in the DXY over the coming months which will trigger a bullish wave across many sectors of the stock market as well as Crypto.

Don't forget about the seasonality aspect that could be in play - i.e the Christmas Rally

Good Luck

Bitcoin gets the "all clear" from VIX and Dollar dump!So, I've been pretty clear that disinflationary data has been coming in hot and heavy, and that at some point, the fed will have to reconsider its current extremely hawkish strategy, pivot, and become more dovish. QT will become QE.

Inflation has topped.

The dollar has topped.

The VIX will drop.

The markets will pop.

For one last blowoff top.

Somebody bust that rhyme for me!

Most of the above appear to be taking place. Now we wait for the Fed to pivot and the blowoff top to come to fruition.

In the meantime, let us take a look at Bitcoin from a technical perspective. Triangles, triangles, triangles.

You will observe that after breaking out of our year-long descending wedge, the price action remained underwhelming, as it has since June. From a technical standpoint, there are two big reasons for this:

#1 - Since June (with the exception of a few weeks) we have remained rangebound between $18,700 and $22,000.

#2 - We hit a resistance trendline (BLACK descending TL) that also started in June AND formed the topside of another triangle we existed inside of since the beginning of September. Now, many traders were claiming this triangle was bearish with a probability ratio of 54/46 to the downside. Typically, this might be the case. My objection to this statistic became that this particular triangle poked through our RED resistance zone (now support) and outside of the year-long descending wedge; therefore, I was bullish this triangle instead of bearish.

Fast forward to today. BTC has, in fact, broken to the upside and the target appears to be that descending 200 day ma.

Now, if you are a follower of mine, you'll know that I entered a 5x long position at $18,300. I've adjusted my SL once to $18,500 putting me quickly in the green for this trade even with my SL triggered. I will now be moving this up again to our critical support area of $18,700. Should we remain above our 50 day ma tomorrow (RSI must also cooperate - see chart), I will move it yet again to around the $19,200 level.

Congrats to those of you who are following me in this trade!

Stew

S&P500 Going down another 40% - Market Bottom in May 2023In conjunction with my previous Dow Jones analysis (Link to it down below), we foresee another 40% drop in S&P500 until mid-2023.

The analysis done on these charts is based on old repeated market cycles that were last seen during the market crash of 2008.

As you can see clearly on the charts, the market has been playing the exact scenario of 2008, since March of 2022!

It's fascinating how similar markets are working their way, and people don't seem to notice at all...

There is a verse of the bible that W.D.Gann used a lot in his books which says: "What has been will be again, what has been done will be done again; there is nothing new under the sun." Always keep this in mind when you are reading the market.

A big challenge for BITCOINPrice keeps bouncing from the downtrend and now it seems harder to regain 20k level.

On last week Dollar Index drop (DXY), Bitcoin managed to bounce off the $18,600 but at the very last moment of weekly candle close price shoot up to be stopped right above 2017 all time highs $19,666.

Starting the weekly trading period DXY is recovering for another attempt to break resistance giving weakness to Bitcoin. We will see what price action tells us during the week but crypto bulls need to step up if not the flush down on BTC will be imminent.. 16k first 13,8k later.. in case of a breakout 20k must be held then 25k likely for end of November for a double local top.

Bitcoin Capitulation is coming…..19K won’t hold any longer .. still in bearish and I knew this all along even so the capitulation is near. So we be seeing the big crash during this bear downtrend.

Short buys don’t trust or try that even if your a very high risk taker.. be extremely careful because it’s volatile, while we be seeing the shorts these are the targets but first obviously down 17K even.. short retrace.

The bottom buy zone I see still 12-10K area .. if these zones doesn’t hold then buy about 6500 area even the dip. If those buy zones expect the bulls to take over and won’t overcome then we will see down to 2000 area.

So we are still bearish again don’t think we are bottomed it’s too soon , too early.. because the Feds still will go aggressive increase high rates , the midterm election, USA is in the recession and worst of all 3rd world war is coming.

Trade safe and let’s watch this fall

Crash Call: The time is nowHello trader!

Welcome back to another episode with analyst Aadil1000x.

This is a crash call. There is going to be a crash soon. Patterns are already completed and we are going to sell it now.

Crash does not happen by coincidence it happens because of chains of reactions we use chart patterns to predict the market and i can say some very sad NEWS is going to hit the world soon.

This post is for a signal and in the next post, I will give a detailed analysis of this crash.

BTCUSDT Sell now its at 19174

Stoploss 20173(-5.1%)

Target 1, 17239(+10%)

Final Target 15000(+21.7%)

This crash might not stop at 15K

Don't forget to hit the like button and follow to stay connected.

Housing Market Crash Incoming!Demand always rules supply. Always.

BLUF:

Short-term projection = TBD

Mid-term projection = bullish

Long-term projection = bearish to extremely bearish

Traders,

I have been quick to point out the tremendous amount of disinflationary data in my videos which leads CPI reports in some cases by as much as 6 months (i.e. -rent). Now, let's take a closer look at the NAHB's Housing Market Index data which helps us to better denote market sentiment.

First, observe that we have entered well below the weak demand zone. This is generally an area in which we can notice softening demand. Though the housing market may still remain hot in certain cities, others have noted softening demand.

Once we dive below this "Weakening Demand Zone", it can often represent the beginning of a housing market recession, or, in the case of the 2008 era, a crash! We began this crash with certain city markets plummeting through this weakening demand zone, Detroit comes to mind along with a few others. These were our lead cities to watch at the time. At the point in which weakness in these markets began to be acknowledged and reported, it was already too late. Michael Bury (aka - The Big Short) knew this. The crash had begun.

The markets did not react immediately, as we all know. In fact, the opposite: it would be a full 17 months before the stock markets reached their tops and then crashed hard. In a similar fashion, the Fed was notoriously tardy in recognizing lead disinflationary indicators and reducing rates accordingly. Not until a full year and two months AFTER the housing demand fell below its weakening zone would the Fed jump in and begin to diminish rates. By then it was too late.

Fast forward to 2022. Despite the fact that our U.S. housing demand has fallen far below the weakening demand zone and below the approximate median for a housing crash start, the Fed continues to raise rates at a historic record pace. These rate hikes will come home to roost eventually, but not immediately. This is why I am under the persuasion that we WILL enter a more disastrous recession or worse in 2023. The lag effect of the Fed rate hikes will have a significant consequential impact. Just as in our past housing market crash story the impact will be significantly delayed and by the time they are noticeably felt, it will be far too late. Disinflationary data, low demand, low consumer sentiment, etc., will have hit us harder far in advance and the Fed will have realized they should have pivoted sooner.

Though my longer-term outlook appears rather dismal at the onset, my mid-term outlook may be rather surprising to many. I do believe that just as occurred before the 2007-2008 market crash, the preceding price action will become bullish. It took the market a full 17 months to recognize the significance of our housing data, and the fed wasn't much better. Will it be any better this time around? It might be, but as we can learn from history, the market collective and the fed are often irrational and reactionary. The case for my blowoff top past the previous year's November highs still stands. The market will begin to recognize and digest more and more disinflationary data not least of which is housing market demand. The Fed will begin to be pressured more and more to pivot. And whether due to pressure or reason, I believe they will pause or pivot soon. Then the meltup (aka blowoff top) will begin. And sometime mid to late 2023, it all ends. Secular bull market (since 2009) exited. Secular bear market entered.

Be ready my friends!

And pray that I am wrong!

Stew

2022 Crash - My plan to trade the volatility I don't really post these for anyone else but for my own intuition to see how it turns out. But I'll have a go at explaining for anyone who finds it worth reading.

I've been waiting for this moment for a long time - and at times, been impatient. But it is now becoming clear where we are in this 'volatility cycle', in comparison to the volatility cycle of the 2008 financial crisis.

I'm sure many of us are aware of the risk of serious economic crisis literally around the corner. Not to say I/we know when, or how serious -but rather that I'm pretty cock sure there is elevated risk of serious economic crisis.

I won't go too deep into the macros because, well, you should know. And the conclusion I come to with what I think I know is that the fed may have created a multi asset bubble. How? Go google what % of dollars currently in circulation were printed in 2019-20.

To conclude, kicking the covid recession can down the road gave us the final over extended bull run of. Bringing the end to a 12 year bull market. This goes for economic cycle too - monetary policy has been largely loose for this entire period (correct me if I'm wrong, I haven't actually checked the data on this.). But I do know it has been loose for a long time and the fed has stood ready to rescue markets and the economy where required to keep things tidy - ie. markets and economies growing.

But as we all know, economies go in cycles, too. And after every boom comes a necessary evil - the recession. After every recession comes a boom again.

We need a recession - but the further the can is kicked down the road, the higher the risk that it goes deep.

Long story short and probably way to brief, the fed and government's over stimulation of the economy plus the supply issues born from pandemic and war have caused dollar devaluation and inflation. I don't care what anyone says - the SPX should not have gained 120% from the Covid lows. This is just silliness because of overstimulation (Michael Burry would agree).

Why? How? Go google what % of dollars currently in circulation were printed in 2019-20.

I'm surely not the only who sees things this way, right?

All of this, plus some amateur looking TA comparison to 2008, and staring at these charts for far too many hours, days, weeks, months, - I think capitulation is around the corner. Terrible news for most, I know. I don't wish for this to happen - I'm just following the fed. And would rather profit from the consequences of policy mistakes (kicking the can down the road) finally being rectified (Quantitative tightening, increasing interest rates = restrictive monetary policy = no more money printer until inflation and demand and prices calm tf down).

So, how do I plan to profit from this?

Well, volatility takes off to it's high's of $90 when we see capitulation. But, if history rhymes, we will see one last rally in the SPX - and the last sustained drop in volatility before a capitulation event. I am short VIX currently, but stand ready to build long VIX at tops of SPX rallies, eventually neutralising my position towards support, and phasing out shorts and tightening up stops on shorts. I expect this to happen over the next 1-2 months. Let me be clear - the short position is no biggy here - it's just because clearly we may see a relief rally soon, before capitulation. So I expect volatility to drop BEFORE taking off. So I'm short, phasing into long. Then I'll see you all when VIX is at $80-90 - then I will phase out of longs into MAXIMUM short positions on VIX. Let me be clear - I'd short VIX at $80-$90 with everything I have. And I plan to. Seriously. I encourage you to think about it and debate your reasons why that is a bad idea.

And with the proceeds from going long VIX through the volatility spike and then shorting VIX at $80-90, once volatility drops to c$35-25, I will start phasing into QQQ - 3 x leveraged Nasdaq 100.

Anyway, the anticipated capitulation event could be triggered by any external factor - war escalating, fed increasing rates more than expected, something completely unforeseen etc etc, it's not important - what's important is that the economy has been running hot, inflation is high, asset prices are in bubble territory, and as a result the whole system is vulnerable - we just need something to happen for it to be an excuse for the dominoes to fall as they should at the peak of an economic cycle, and should have happened two years ago. Then, once the dust settles in a couple years (possibly longer depending how bad) we can all grow sustainably (hopefully in more ways than one) again in the next boom cycle.

Thank you for reading.

This is not financial advice

Key levels on TSLA and how a prolonged bear market could lookSimilarly to the linked AMD broadening symmetrical this toppy-looking wedge with exceptionally clearly-defined levels ought to show that there could be a long way down still in a multi-year bear market and that buying levels on this particular chart could be where all time lows on the weekly RSI would later be created

Hard fork and death wishes for LunaLFG has announced that a hard fork will happen and this hard fork my cause the price to pump up as people assume the volatility and the price would continue go upwards. This is a trap and the this price move to the upside will be followed by a mass sell off from investors taking profits.

This may further harm investors.

Luna has massive inflation and zero belief which has caused the legal team of Luna to remove themselves from the project. This further means that the project cannot double its market cap and continue to the upside as the believe only causes massive sell off and with the inflation makes it next to impossible for the market cap to double.

Another problem is the illiquidity of the recourses in LFG recourses as they used their most liquid recourses to keep the stablecoin UST alive where as other recourses as staked in for example AVAX. LFG therefore does not have enough recourses to keep the sinking ship a float.

In the next coming days would the airdrop of the new Luna cause a short increased belief on both coins followed by the same price movement as showed in case 1 and 2 in the chart.

In the regulatory future may also the SEC increase regulations on stablecoins which further gives people less of an incentive to invest in Terra/Luna.

SE ~ Lower Lows incoming? Buying Opp incoming?SE, Sea Limited has been suffering massive losses ever since its peak in the fall of 2021. This massive bull run was led with the Tech & Growth Stock boom that's bubble has recently bursted through out the current Bear Market of 2022!

Sea Limited owns multiple varieties of Business in the South-Eastern Asia Region. Businesses Like :

Shopee - Ecommerce Giant

Garena - Gaming + Esports

& Much more smaller companies

Sea Limited has grown a massive amount of revenue, but has most definitely struggled with its debt and spending to make a profit.

Nonetheless, let's get to Technicals!

SE has suffered such huge losses, many wonder where is the bottom!?

My thesis for this Stock is a short / mid term short position, followed by long term accumilation.

Short : SE has 2 major gaps to still be filled from back before COVID, and the gigantic Rally that took place on SE. I see huge potential for this company's future growth, but I think more downside is to come to give SE fair value.

Along with fair value, and these gaps SE has been unable to reclaim any weekly moving averages, and the TTM_SQUEEZE Momentum Indicator shows more bearish momentum coming.

The monthly chart will get to the point of being oversold, probably near these gap fills. At these gap fill areas, and the way down would be a proper time imo to be covering short positions.

The market also seems to have some more pain ahead, and interest rates will only hurt this company and the markets more, driving the stock down fundamentally.

Long : I do believe in this company's long term outlook and performance. I do think that this will take a while to turn around... But if these gaps get filled, the Risk/Reward on SE will be favorable if the company has only grown. I am going to be extremely patient on SE but will be ready to hunt the discount if these gaps do become filled. I Will also keep my eye on the TTM_Squeeze on the MONTHLY chart, as the Monthly chart has been getting extreme momentum to the bearish side, and will look extremely oversold in the coming months with more downside.

Thesis : Short to Gaps ; Long @ Gap Fills

One or two more huge crashWe all could see bitcoin is very struggling near 20K but emerge to be under 19K.. very bad news for bitcoin should expect the huge crash.

We are NOT Bottomed.. don’t be foolish.. the bear market isn’t over.

The bottom is around 10K that has a huge amount of volume of the last cycle since 2018. Even so the erase of the inflation data then the update of the inflation is 8.2% which will effect bitcoin as well to amid that US is in the risk of the recession and second the Feds will go aggressive to increase higher rates.

If you are waiting for a buy please buy at the 10K mark I had this prediction since the begin crash and my prediction is getting there.

As the bottom hits 10K then the target will be over 120K in the merge of 2023-2024.