A little Crash for the next 2 years. DowJones only -70% from ATHHi,

take it with a grain of salt, take it dead serious or whatever you want.

Logarithmic Chart. Although it will be terrible,... this will be not doomsday.

The historical trend of the stock market is in good order. This will be always the case until the end of the world. (the real end)

What i did not comment:

I think XRP will solve the coming liquidity crisis, as the banks will be able to close their nostro accounts. This money will flow back into the market.

It is also possible, that we will be stop the downtrend at the old ATH.

This is for entertainment only and not an Advice.

I always like to have some new perspectives, so feel free to comment.

Thank you very much, have fun and enjoy

Crisis

SP500, Similar fractals, Is this the comming financial crisis?

Hi folks, this is my first time posting an idea/"short" analysis publicly, hope you'll enjoy it

This is the chart from SP500, I mirrored 2007 financial crisis structure, unedited, raw and pure, pasted it below our chart, checked the fractals/similarity, and it's deadly alike.

With the somewhat positive sentiment from OPEC and 90 Days truce between president Xi Jinping and Donald Trump we have something that might bring the SP500 back to "normal" comming weeks, months.

Once the truce resolves, I bet we'll get into a "fear" phase... Nothing is new in the stock market... said J Livermore... and I concur.

Not sure of how it was back in 2007, but perhaps some of you older folks remember what caused the "back to normal" phase... and we can compare...

Stay safe or play it safely folks.

cdn-images-1.medium.com

The Death of the Stock Market and Why Most Traders SuckThe good traders never get famous. They're lone wolves. They won't give you what you want because being a good trader requires peak IDGAFness.

What you want is 8 meticulously detailed and data intensive paragraphs about why the stock market is going down 53% from the ATH and how you could have know that back in October. But you actually don't need to know anything about finance to see it in the chart.

Why waste my breath? I posted the chart. A picture is worth a thousand words.

The people who will benefit from this trade idea are the people who are free thinkers. You will see the chart and think for yourself: How could this be 99% accurate and/or how could this be 99% wrong?

You need to be able to envision both possibilities in your head and manage your risk around what is the most probable scenario. Forget the narratives, forget the "news".

.....But I dont need to tell you good traders that, if you see this post your already figuring out what you can learn from this chart; the rightness and wrongness of my idea (statement) based of of your own interpretation.

Like modern art it tis.

This is honestly just a normal market cycle. A measly correction is unlikely. Once we fall past the MA200 its a rippity rippity wrap. (but first Im gunna long the bounce off the MA200 before it continues to break down)

BEAR GANG GOING FOR THE SLAM DUNK

Monday Bloody Monday - We just toppedThe strong volume we had on Friday has peaked my interest. And a massive drop on Monday would not surprise me. Either somebody is selling the top, or I am unaware of some logical reason for this surge of volume. It's never possible to try to call the absolute top without making constant predictions, but I would like to try. Monday will mark the end of the bull market.

USD/TRY potential LongThis potential Long entry point in the chart is based on multiple technical and fundamental confluences, most of which i'm not going to give out

Note that FX markets and Turkish lira movement is based on fundamental information as any breakout of technical levels happens for fundamental reasons so I highly advise you to be unbiased and watch topic related news and periodical economic releases.

My stance (long/short/TP/SL/entry point) might change anytime if some new crucial info would come out.

Note that Turkey has highest USD denominated corporate debt burden among emerging market countries, with maturities sharply rising from 2019 and peaking in 2022. Meaning any near/medium term USD strength will have negative Lira effect as USD strength will complicate Turkish foreign debt repayment and will have negative pressure on Lira (USD/TRY strength)

Stance of TCMB on any potential Lira weakness will be interesting to see as well as FED tightening

Greek philosopher Plato once said "Opinion is the medium between knowledge and ignorance"

Don't ignore anything and do your own research thoroughly before you commit any capital.

You can make money pretty quick in FX markets but you can lose them faster than anyone

S&P500... !!! This is my view on the SPX500

I believe there will be a last effort to drive prices higher; one to two more extensions which target the 127% Fib extension and the 168% Fib extension of the last bullish range.

I also see the start of a strong divergence in the RSI(14) and there could be a third maximum peek to complete the Fib extensions mentioned before.

Trying not to get too much into fundamentals, technically this is an interesting buying opportunity for there is still a strong support area being respected.

Illustrated are the 3 options/outcomes I think are likely to occur.

Don't sell your beds... yet...

Best of luck!

financial crisis and posible rising of bitcoin.hi, financial crisis is here , in the next months dow jones get down hard to 0.61 fib.and the world economy will go into recession. follow this chart bearish div in rsi and macd, media of koncorde d'ont have volume, mago staperlo in negative zone. you need a plan for this crisis good luck.

S&P 500 does market crash come to us? Market crash is coming. Price dropped 4% down. It looks like big players closed their position.

Technically price will move down. I will wait for pullback to 2857, because it's key mirror level. Near that level i can open an entry with low predictable risk and potential profit in 5 – 7 times bigger.

Also, take a look on Google, Apple, Facebook shares, all of them started down trend.

Such down move like today can be a start of new economic crisis.

P.S. Push Like and Subscribe if you want to see more signals in the future

S&P - Bears are in ControlDear Traders,

As predicted before, the S&P's price went down. As you can see my red ''support line'' got breached and in my opinion, we are now heading towards the 200 ema on the 4hr chart. Bears are in control. Next stop is the 200 ema at 2876$. It held last time it touched it, let's see how that works out this time.

S&P - Time to short again ?Dea Traders,

As we have seen last week, the S&P took a hit and big-time money was made by shorters. The question now is, is it time to short again?

Now as a trader, you need to look at the bigger picture. The S&P had a hell of a ride and never really retraced. Well, I think its about time. We are now located in a bearish channel, which can only be broken if the price breaks upwards from this channel. If it's price goes down today, we will remain in this channel, and that would mean that more and more shorter's will jump in.

It's a huge gamble tho. Gambling on the fact that it's time to have a good retracement, but hey, what if I am right? What if this is the start of a Crisis again? What if the S&P's price would have gone down by 40% within 3 months? wouldn't you be mad at your self that you didn't give it a shot? I live with no regret's and that's why my I went short when the second ATH failed to create itself. That was my sign to jump in, and I'm happy I did.

What are your thoughts?

10Y US/DE : Bond market distortion at historical bounderies...This is loooong term chart here, but the process in motion is a really dangerous one because it concerns the bond market that is supporting every bit of the investment process and credit liability throughout the market. This spread between german and US yielding is reaching long term dangerous levels of distortion and may lead to some credit troubles.

Hope this idea will inspire some of you !

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

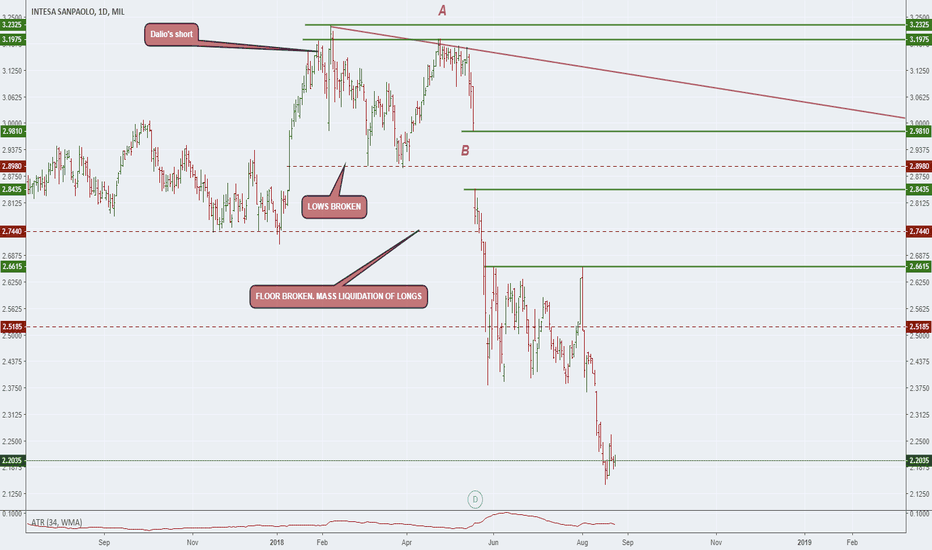

WHALE TRACKS !! A CASE STUDY. ISP is an Italian bank that has really taken a beating this year. Under all metrics it is a really weak institution.

What I wish to demonstrate today is how whales operate and hopefully how to take advantage of it.

Before I continue I'd Like to state two Axioms I take with me anytime I chart

1) A body in motion stays in motion unless an external force acts on it

2) Don't trade or look for the bottom , always wait for it and act on the weaker price action

Ray Dalio put a huge net short position on this bank , before the Italian fixed crisis and the Turkish mayhem that had a bleed over on the whole of the EU.

It is the actions of institutions that guide us , not our hypotheses. With that said are you willing to go long , short or wait? What are the positions in the market , who are in control of the market . Where and how does that change.

Those are the questions that I ask price , and I use its answer to give me a position.

HAPPY WEEKEND.

SWISS as LAST opportunity? Where is the MONEY going?!Hey guys,

the market is nervous - We all can`t doubt on that.

Traderwar

Turkey

Iran

Seasonality

Brexit

Upcoming ECB changes

and much more...

AS the asia-crisis shows, we all need to think about the coming capital flow!

Where will the money go? What happens when there is almost only falling assets?

We`ve seen less yields in state bonds and an increased interest!

Is that our alternative?

How long can that USD climb that fast?

What will the FED do to stop that in order to prevent a deflation?

And how does that effect the interest in USD and stocks?

There is so much money in US-Indicies, especially in the tech-sector or stocks like

Netflix & Co. Where will the money go as soon as the recession comes? Which is obvisouly a consequence of higher interest rates! :-)

Back into other countrys?

There is too much to discuss about.

But I think it`s time to get prepared for the EURO-crisis, the stock-market-drop and an escalating tradewar.

AT LEAST get prepared.#

You never know.

Cheers and good trades

Irasor

Wanna see more? Don`t forget to follow me for daily ideas and posts! :-)

JPY or CHF: Which safe haven FX To Trade During Market Turmoil ? The JPY and the CHF are both well-established safe havens and from time to time other currencies can exhibit safe haven behaviors.

In 2017, this was periodically true of the EUR. That said, this year’s return of concerns about Italy’s fiscal restraint is a reminder that the Eurozone’s crisis years are too recent to allow the single currency to adopt the mantle of a true safe haven, despite the region’s huge current account surplus.

The USD has only a flirtatious claim as a store of value. Its huge liquidity, importance as a reserve currency and the role of Treasury paper as a safe haven asset means that the USD has strong safe haven links. However, the US’s budget and current account deficits significantly undermine any claim that the USD is a true safe haven currency.

Since the SNB maintains the use of FX intervention as a policy tool, it is reasonable to assume that the JPY may be the safe haven currency preferred by many investors.

While the CHF may be more reactive to news from Russia and Europe, the JPY can appear more sensitive to news stemming from Asia. The JPY responded to worrying news regarding N. Korea’s nuclear capability in the early part of 2017. Interestingly, the JPY seemed to become less sensitive to N. Korean related news into last summer, despite the worsening tone of the headlines. We have linked this to the broad strengthening of overall risk appetite during 2017 as world growth beat expectations.

The role of the JPY and CHF as safe havens has long since provided a problem for both the SNB and the BoJ, since unwanted currency strength has contributed to deflationary pressures.

Risk appetite rather than interest rate differentials will continue to be overriding driver of the value of safe haven currencies in times of heightened market tensions.

Broadly speaking, due to the risk of FX intervention from the SNB the JPY is favored over the CHF as a safe haven currency.