Cronos

CRON 3.25.19Just digging into the #mj stock world. Looking at Cronos. Possible H n S pattern forming. Charts are fractal. We see repeating patterns. Maybe it's because the human brave craves form in repetition or maybe there's some deeper underlying level of connectivity. Either way we saw a head and shoulders play out earlier with very similar volume and RSI characteristics going along with similar price movement. We wait and see if it plays out here again.

(It seems like the SPY has stronger correlation to the cannabis world then the crypto world so that is also something to be mindful of.)

CRON looking fairly technical with what appears to be an impulsive wave up so far on the bigger chart. If that is correct then looking towards fibonacci levels during the correction seems prudent.

Is the marijuana stock world another bubble burst or about to burst or just on the cusp of filling towardst a big old balloon of cash large enough for every one to get a huff before it finally eventually inevitably bursts?

Time will tell...

Keep on huffin

-peyote

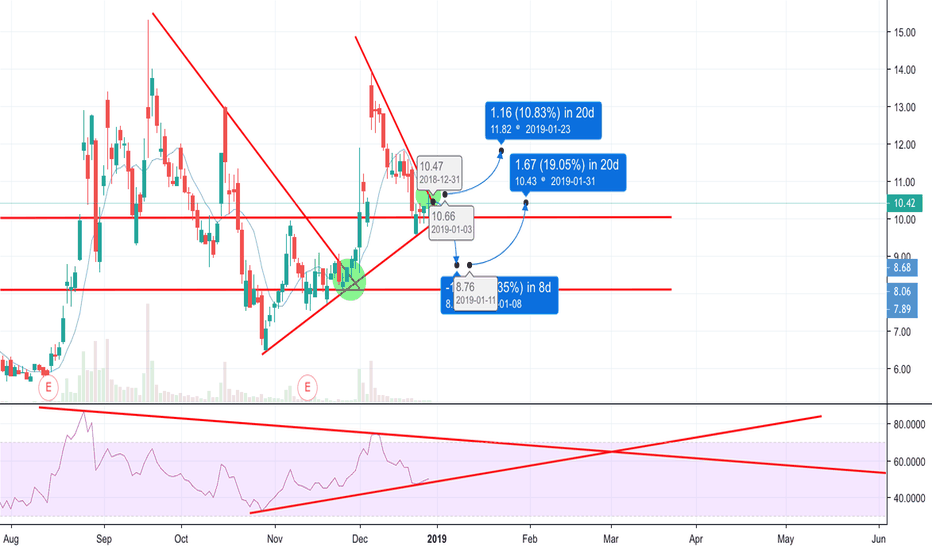

CRON Wave AnalysisAs charted in today's YouTube video, full details on how I arrived to the counts there.

Cronos is one of the older assets in a young market. On a long term view, I believe it's in the final waves of it's current cycle. However, that doesn't mean that it can't make significant new highs. It appears to be forming a flat continuation pattern here. With fundamentals coming into play, pot stocks could well be the next parabolic rise. Overall, the equities within the market have yet to break market structure of higher highs. Once that market structure is broken, I would expect a multi-year bear market. However, for now, fundamentally, I don't see how it would start today.

To play the flat, look for a confirmed lower low on low time frames to draw a downtrend line similar to the blue one pictured. Look for a break of that downtrend and buy any consolidation.

CRON update - CHOP Current Pos: Short Apr18 $20 USD puts. Scaled down to 1/3 Position Friday Close.

Idea: Locked in profits from Short in case of bullish ACB earnings (Guide down could pull an AAPL). if ACB bullish, looking for bounce to play weekly calls intraday. Will reload puts on strength, any rally likely to fade going into CGC earnings. Still a good chance this runs into CRON earnings (est Feb 22nd) sector sentiment still divided. Macro eyes on China reopening and possible gov't shutdown 15th.

Looking GREAT!!I have multiple wave counts going here right now, but all of them look like we have plenty of room to go up!

Might get a small pullback to $16, but honestly I'm going in now around 18 just in case. If it goes down to 16, I'll just buy more to get my average share cost down. That hemp bill and the new congress means good things for cannabis.

CRONOS GROUP, CRON, Bull Run Once Support Has Been Tested!Self explanatory chart....Bull Run coming with three possible upward movements at key support levels which can be supported by the 50, 100, and 200 day EMA's ranging from the next week to next month. Win, win, and win situation!

Get into the Canadian Weed market now while the U.S. market tanks in 2019.