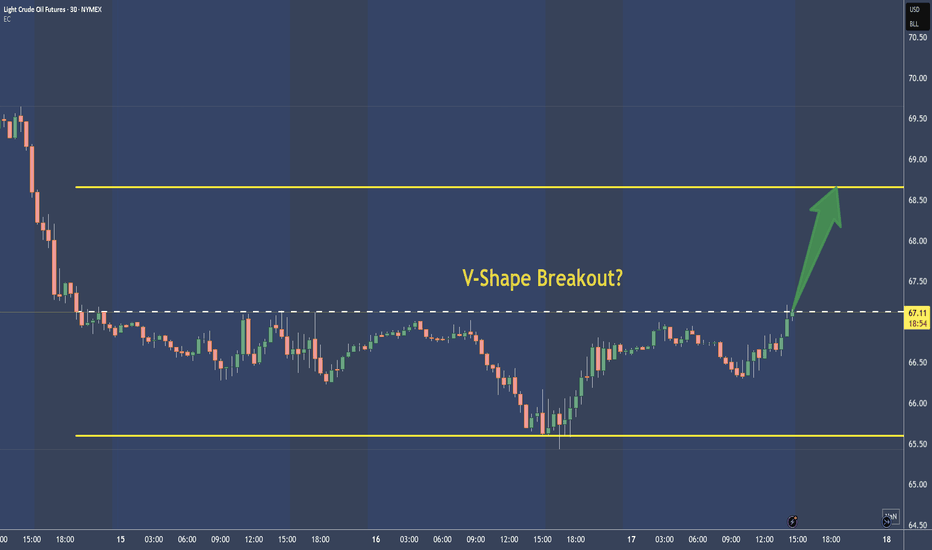

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart with multiple limit traps. The crew never FOMOs, we trap the market 🎯.

💣This is a layered loot plan, not for weak hands. Watch how we load up quietly while market sleeps 😴, then hit hard when the vault cracks open 🔐.

Support this heist by smashing that ❤️LIKE button

💬 Comment your plans below & join the real thief squad

🤝 Together we rob the market — LEGALLY & LOGICALLY

#ThiefTrader #OilHeist #CL1 #BullishTrap #DCA #CrudeOilStrategy #SmartMoneyPlay #MarketRobbery #TeamLoot #NoRetailPanic

Crudeoillong

US OIL - BULLISH REVERSAL Get ready for a reversal on crude oil - Price currently testing a fresh demand zone and with the Iran/Israel war going on, oil is likely heading much higher in the coming months.. Currently the world is awaiting Israel's response to Iran's attack on Israel few weeks ago.. This war will only escalate from here and crude is set for big gains due to it... technical can't get any better

Crude Oil upside Target 71.70Crude oil is presenting a promising buying opportunity as it approaches a crucial support level at $66. This level has demonstrated significant resilience, making it an ideal point for traders looking to enter the market. Our target for this trade is set at $71.70, which aligns with key resistance levels that could be tested as the market moves upward.

In addition, our proprietary indicator has signaled a buying opportunity on the daily chart, further validating our bullish stance. The geopolitical tensions in the Middle East add another layer of urgency, as such instability often drives oil prices higher due to supply concerns.

As we navigate through these market dynamics, now is an opportune time to consider adding crude oil to your portfolio. Keep an eye on price action around the $66 support, and be prepared for potential upward momentum towards our target of $71.70.

Buying at Current Label

Stoploss - 66

First Target 70

Second Target 71

Third Target 71.70

Smart Money Positioned to LONG Crude Oil - COT StrategyDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

LONG

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL if we get a confirmed bullish change of trend on the Daily timeframe.

COT Commercial Index: Buy Signal

OI Analysis: Generally last few weeks OI has drifted lower while CM's adding to longs - bullish. CM's approaching extreme long positioning, but not quite there yet.

True Seasonal: True seasonal to go up until mid October - bullish.

COT Small Spec Index: Buy Signal

Front Month Premium - Bullish

Supplementary Indicators: %R & Stochastic

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the upside, which we will participate in with a confirmed Daily trend change to the upside.

Good luck & good trading.

Bullish on Crude oilNYMEX:CL1!

TVC:DXY

Right now as the Crude Oil prices are at *premium and technically we are around a strong support area I think we would see a rally somewhere between 67.5 and 72.5. However, this week, we have PMI and NFP news ahead so if the reports come out to support DXY, Crude oil might stay around this area for a while (as it's seasonality suggests)

* look at the closing price of the futures contracts between July and December 2024.

WTI Crude oil global trade analysis

U.S. crude oil inventories fell by 6.674 million barrels in the week ended January 19 from the previous level of 483,000 barrels. WTI prices were lower on the day as traders focused on rising U.S. oil production and rising supplies from Libya and Norway.

The short-term (1H) trend of crude oil has repeatedly fluctuated near the E point of the triangle, with the range ranging from 75.30 to 73.30. Oil prices cross the moving average system up and down, and the short-term objective trend enters a volatile rhythm. Judging from the gradually rising arrangement of lows and highs, the short-term subjective trend is still bullish. Crude oil is expected to continue to hover within the range during the day, and buying operations will be dominated by waiting for lows.

Crude oil trade analysis

WTI crude oil showed a roller coaster trend. It fell to an intraday low of $74.03 during the European trading session, then recovered all losses, and rose to an intraday high of $76.18 in the US market. It finally closed down 0.19% at $74.99 per barrel. ; Brent crude oil once fell below the $80 mark during the session, and then fluctuated around this mark, finally closing down 0.14% at $79.99 per barrel.

Crude oil opened lower and fluctuated today, stabilizing at the 74.9 line. The daily chart shows that yesterday it fell first and then rose. The daily line included a negative cross star pattern with long upper and lower negative lines. Recently, oil prices have been fluctuating in the upper shadow line in the 74.0 area, further indicating that this level has reached a certain level of support. position, but it is difficult to open up the situation without breaking through the upper resistance level.

In the crude oil shock triangle, today's operation considers rebound short selling as the main strategy, and low and long strategies as the supplement. The top focus is on the resistance of 76.5-77.1 US dollars per barrel, and the bottom focus is on the support of 73.5-72.3 US dollars.

WTI Global Trade Analysis

The crude oil market experienced a volatile last week, rising first and then showing signs of weakness. This market volatility has investors wondering whether prices are being overextended. This has been happening repeatedly in this market for months. However, in the current environment, it's not hard to believe that this could happen.

If the market is able to break above the $90 level, it could pave the way towards the $95 level. Conversely, if the price declines from current levels, the $87.50 level represents a key support area. Beneath this, the 50-day EMA near $85 provides major support. We expect continued volatility and volatility in this market.

WTI overall analysis

The continuity of the rebound is not strong, which belongs to the rhythm of shocks and upwards. It bottomed out twice at 77.5 to form a double-bottom probe structure. In the early morning, it bottomed out and rebounded to a depth of 78.0, closing at the 80.0 line. Crude oil is around 79.3 on Monday, the stop loss is 78.5, and the target is 80.4-81.0!

Buy CL(Crude Oil) in Short TermTechnical Analysis:

- As you can see in the chart, the medium term correction is finished in the wave II in red. Now we expect that CL(Crude Oil) goes up at least in 3 waves to around $105

- H1 & H4 Right Side are Up

- CL seems strong in short term

Technical Information:

- We like to buy CL in wave (2) in blue around $77 as hedging

Crude Oil (WTI) - Long; Load up on it!Just a near term play here on the anticipated, transitory USD weakness.

The main chart ought to be self explanatory - just follow the arrows. (The dates in the chart are only denoted because I am building a sizable option position here, one part of which consists of diagonal spreads.)

Fundamentally, Russian oil companies have already figured out - and are using to deliver -, alternate routes for most of their hydro-carbon exports, circumventing current and potential future EU sanctions. (Sales are already exceeding pre-sanctions levels!) As it turns out, contrary to EU and US delusions, Russian oil companies know their own businesses a lot better than their US or EU counterparts. - Who would've thought?! :-O

The majority of the anticipated price fluctuations are conditioned on a near term, transitory USD weakness/fluctuations.

CRUDE OIL TRADE IDEAhi all

Being that the price of cruel oil failed to reach a new high on the first attempt, the head and shoulders pattern it is forming and the neckline it has broken suggest that this is a second pullback.

My trading strategy is not intended to be a signal service. It's a process of learning about market structure and sharpening my trading skills.

Like, subscribe, and happy trading to everyone!

WTI Crude oil : Last chance to buy before new ATH? 18.05Inflation, inflation, inflation.

In China, 15/16 districts have zero Covid cases and all restrictions are set to be cancelled by June.

Globally, the disease is under control - Pretty much insuring a very busy summer for travel.

So fundamentally - Crude oil has plenty of room to rise in the short-term and mid-term.

When we look at the technicals we see :

1) Clear breakout and retest above triangle consolidation which led to strong bullish movement and bull trend ongoing now.

2) Clear close above key support/resistance zone of 108-109.

3) Probable immediate term target is resistance zone of 112.90 to 114.80.

4) A break above 114.80 could be strong confirmation for rally back to previous high and above.

5) Range trading between 108 to 114.80 is also very possible.

Bottom line -

Good chance for strong rally, downside to 108 is possible.

A close below 108 would be bearish in the immediate term.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Thank you so much for reading! If you found my idea useful, please like and follow! It would mean a lot.

Don't hesitate to comment/ask me anything - I promise to respond to each and every one.

I am not a financial advisor and encourage you to do your own research and be cautious when trading.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------