WTI Crude Eyes Bullish Momentum Above $68.9FenzoFx—WTI Crude Oil broke resistance at $68.9 in the last session, now trading near $70.6. This breakout supports a bullish shift.

Yet, RSI 14 and Stochastic indicate overbought conditions, suggesting possible consolidation. Support at $68.9 could offer a discounted entry if prices retreat.

Watch for bullish signs like candlestick formations and inverted FVG around the $68.9 support.

Crudeoilsignals

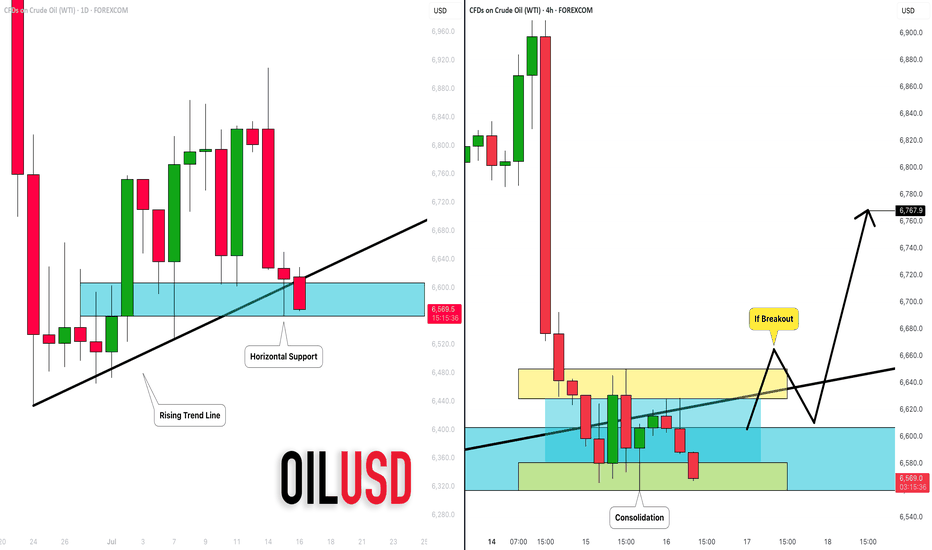

CRUDE OIL (WTI): Your Trading Plan Explained

Do not forget that today we expect Crude Oil Inventories data

release - it will be 10:30 am NY time.

Ahead of this news, the market is testing a significant daily support cluster

that is based on a rising trend line and a horizontal structure.

You signal to buy will be a bullish breakout of a minor intraday

horizontal resistance on a 4H.

4H candle close above 66,5 will be your confirmation.

A bullish continuation will be expected to 67.6 then.

I suggest waiting for the news release first and then check how

the market prices in the news. If our technicals align with fundamentals,

it will provide an accurate setup.

Alternatively, a bearish violation of a blue support will push the prices lower.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Bullish Move From Support

WTI Crude Oil may continue rising from an underlined blue support cluster.

As a confirmation, I see a quick liquidity grab below that and a consequent

bullish imbalance candle on an hourly time frame.

I expect a rise to 66.24

❤️Please, support my work with like, thank you!❤️

CRUDE OIL(WTI): Bullish Continuation Confirmed

One of the setups that we discussed on a today's live stream

was a bullish flag pattern on WTI Crude Oil on an hourly chart.

Its resistance breakout provides a strong bullish confirmation.

We can expect growth at least to 70 level.

❤️Please, support my work with like, thank you!❤️

Light Crudeoil Futures hourly trend forecast for March 24, 2025According to my analysis, this commodity is at its strong resistance at 68.46 and the likely support levels are at 67.56 and 66.83.

According to my "Advanced Market Timing" indicator, Light Crudeoil Futures is likely to see a bearish trend and then bounce back.

Those who trade are suggested to use your own technical studies for entries, stops and exits.

Go long crude oilDear Traders,

Currently, crude oil continues its downward trend, though the pace of its decline has moderated, showing signs of bottoming out. Moreover, oil has now pulled back to the critical support zone around the 68 level. Should oil fail to decisively break below this support, a technical rebound could occur at any moment. Additionally, with oil’s relatively low valuation, it becomes increasingly attractive in the market.

For short-term trades, I favor initiating long positions on crude oil, with an initial target of a rebound toward the 69.5-70.5 zone, which seems well within reach.Bros, profits are the ultimate goal in trading. Accumulating profits is what changes lives and destinies. Choosing wisely is far more important than just working hard. If you want to replicate trade signals and earn stable profits, or if you want to deeply learn the correct trading logic and techniques, you can consider joining the channel at the bottom of this article!

CRUDE OIL (WTI): Pullback From Key Level

Crude Oil looks overbought after a yesterday's bullish movement.

The price may retrace from the underlined blue daily resistance

at least to 69.9 price level.

As a confirmation, I see a double top pattern on an hourly time frame.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI) More Growth is Coming

After quite an extended consolidation on a key daily horizontal support,

WTI Oil bounced and violated a resistance line of the range.

It is an important sign of strength of the buyers.

With a high probability, the price will go up and reach 72.3 level soon.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Short-Term Bearish Sentiment

Crude Oil looks bearish after a breakout of a key daily horizontal support.

The next key supports are 68.5 - 69.2 and 66.4 - 67.4.

The price will most likely continue falling, at least to the first support.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI) Classic Gap Opening Trade

I see a nice example of a gap down opening on WTI Crude Oil.

As always, there is a high chance that the gap will be filled.

I already see some sign of strength of the buyers:

a double bottom pattern on 30 minutes time frame.

I think that the price will reach 75.3 level soon.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Confirmed Bullish Reversal

WTI Crude Oil looks bullish from both daily/intraday perspectives.

On a daily time frame, I see a confirmed breakout of a resistance line

of a wide horizontal parallel channel and a trend violation and reversal.

On a 4H time frame, I see a retest of a recently broken resistance of the channel

with a consequent strong bullish movement and change of character CHoCH.

I believe that the market will continue growing.

Next resistance - 77.0

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI) Intraday Bearish Confirmation

Update for our yesterday's setup on WTI Crude Oil.

The price successfully retested a broken structure.

Our intraday bearish confirmation is a breakout of a support line

of a bearish flag pattern on an hourly time frame.

The fall will continue now at least to 72.1

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Bearish Outlook & Breakout 🛢️

WTI Crude Oil formed a huge head and shoulders pattern on a daily.

With the release of the yesterday's fundamentals, the market dropped

and sharply violated its neckline and a solid rising trend line.

2 broken structures compose the expanding supply zone.

I will look for shorting from there,

anticipating a bearish continuation at least to 77.8 support.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Bullish Move From Key Support 🛢️

On a today's live stream, we spotted a very bullish pattern on WTI Crude Oil:

inverted head and shoulders formation after a test of a key horizontal support.

We see a confirmed neckline breakout of the pattern.

It increases the probabilities that the market will go up now.

Target - 84.5

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Bullish Move From Support 🛢️

CRUDE OIL formed a nice double bottom pattern

after a test of a key intraday support.

The breakout of the neckline of the pattern is an important bullish confirmation.

We can expect a bullish movement at least to 86.0 level.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Can We Expect a Pullback? 🛢️

Crude Oil is currently testing a solid rising trend line on a daily.

I see a double bottom formation on that on an hourly time frame

with multiple rejections and a peculiar gap up.

The price may bounce.

Goals: 73.27 / 74.16

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Morning Scalping 🛢️

Crude Oil is taking off from a major horizontal daily support.

As a confirmation, I spotted a tiny horizontal range with a confirmed neckline violation on that.

We can expect a pullback before the OPEC meeting today.

Goal - 77.0

❤️Please, support my work with like, thank you!❤️

Crude Oil (WTI)This looks like it is poised to head back into a well established $70-$80 range (and then some!). Anticipated long-term USD strength, as well as extended Global economic weakness bodes well for an enduring price weakness outlook.

Technically, Crude is at a major pivot, both, at the top of a rising daily channel, as well as at the top of a descending weekly channel trend line, resulting in a significant confluence region - both of those having price-negative connotation.

The Daily (main signal);

SHORT on any reversal!

... and the 240 min. (secondary signal);