CRVUSDTPERP

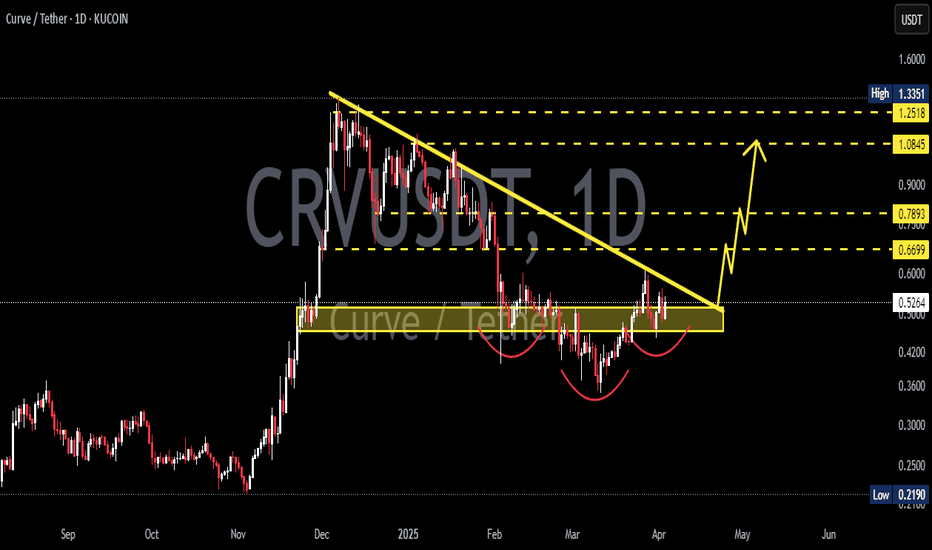

CRV Breakout Retest – Eyes on the Next Leg UpLSE:CRV has been trading within a well-defined ascending channel, showing a consistent bullish structure. Recently, the price broke above a key horizontal resistance level and is now retesting it—this is a classic breakout-retest scenario.

As long as CRV holds this support and remains within the channel, the bias stays bullish. A successful bounce from this zone could lead to a strong continuation toward the upper boundary of the channel or higher.

DYOR, NFA

#CRV/USDT#CRV

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.6600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.6614

First target: 0.6840

Second target: 0.7120

Third target: 0.7420

Curve DAO CRV price analysis🤑 Did it really happen?) CRYPTOCAP:CRV price has finally “really” come out of the 3-year down trend. A confident breakout, on high volumes, "just like a book says".

💰 Now OKX:CRVUSDT price has hit the mirror level, so we can assume that the correction may be delayed to gain strength to break higher.

A correction in the range of $0.43-0.67 fits into the canons of wave analysis and will not break the structure and growth trend.

And the global 5th wave of growth #Curve DAO token can be expected at least to $4.10-5.50

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#CRV/USDT#CRV

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 0.5250

We have an uptrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 0.3000

First target 0.4000

Second target 0.5071

Third target 0.5071

Curve DAO CRV price perhaps it's time to surprise the hodlers?)Today, we are going to give you a medium- and maybe even long-term idea for the CRVUSDT price to make it easier to follow.

Recently, the CRV price has finally managed to show some growth and break through the trendline.

Now, theoretically, price may be testing trend line "strength".

If everything goes well, and the CRVUSD price is not allowed to fall below the critical level of $0.50 , then there is a chance for growth.

The minimum upside target is $1.30 per CRV

The maximum target (with the current input data) is around $2.50

Fundamentally, the Curve Dao project is strong, the creator has a mathematical mindset, if only he had a team of marketers like memecoins, then everything would go where it should)

CRV/USDT Short TermHello, We've seen CRV/USDT ranged between $0.442 - $0.484 for almost two weeks. With the trade volume slightly decreasing and the RSI(14) levels appearing in the resistance zone, I expect the CRV/USDT pair to retreat to the support zone within this range.

Short Term:

Short Trigger: $0.484

Stop Limit: $0.510

Take Profit: $0.442