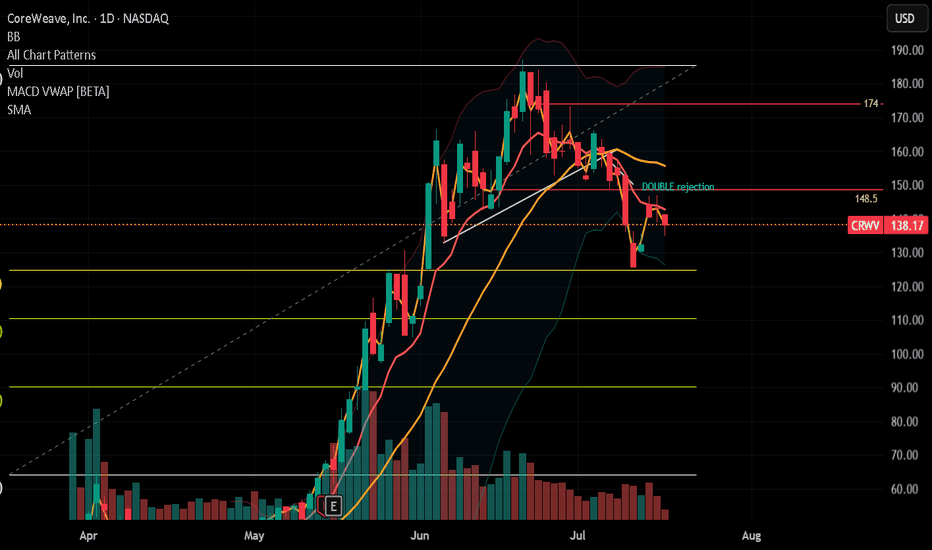

CRWV

Who Silently Powers the AI Revolution?While the spotlight often shines on AI giants like Nvidia and OpenAI, a less-publicized but equally critical player, CoreWeave, is rapidly emerging as a foundational force in the artificial intelligence landscape. This specialized AI cloud computing provider is not just participating in the AI boom; it is building the essential infrastructure that underpins it. CoreWeave's unique model allows companies to "rent" high-performance Graphics Processing Units (GPUs) from its dedicated cloud, democratizing access to the immense computational power required for advanced AI development. This strategic approach has positioned CoreWeave for substantial growth, evidenced by its impressive 420% year-over-year revenue growth in Q1 2025 and a burgeoning backlog of over $25 billion in remaining performance obligations.

CoreWeave's pivotal role became even clearer with the recent partnership between Google Cloud and OpenAI. Though seemingly a win for the tech titans, CoreWeave is supplying the critical compute power that Google then resells to OpenAI. This crucial, indirect involvement places CoreWeave at the nexus of the AI revolution's most significant collaborations, validating its business model and its capacity to meet the demanding computational needs of leading AI innovators. Beyond merely providing raw compute, CoreWeave is also innovating in the software space. Following its acquisition of AI developer platform Weights & Biases in May 2025, CoreWeave has launched new AI cloud software products designed to streamline AI development, deployment, and iteration, further cementing its position as a comprehensive AI ecosystem provider.

Despite its rapid stock appreciation and some analyst concerns about valuation, CoreWeave's core fundamentals remain robust. Its deep partnership with Nvidia, including Nvidia's equity stake and CoreWeave's early adoption of Nvidia's cutting-edge Blackwell architecture, ensures access to the most sought-after GPUs. While currently in a heavy investment phase, these expenditures directly fuel its capacity expansion to meet an insatiable demand. As AI continues its relentless advancement, the need for specialized, high-performance computing infrastructure will only intensify. CoreWeave, by strategically positioning itself as the "AI Hyperscaler," is not just witnessing this revolution; it is actively enabling it.

CRWV Weekly Options Outlook — June 3, 2025📈 CRWV Weekly Options Outlook — June 3, 2025

🚨 AI Model Consensus: Moderately Bullish with Overbought Risk

🧠 Model Summary

🔹 Grok (xAI)

Bias: Moderately Bullish

Setup: +46% 5-day move, price > EMAs, RSI ~65, call OI stacked higher

Trade: Buy $152.50C @ $7.75 → PT $9.69 (+25%), SL $6.20

Confidence: 70%

🔹 Claude (Anthropic)

Bias: Moderately Bullish

Setup: Strong momentum, MACD flattening, bullish flow, max pain at $128

Trade: Buy $155C @ $7.10 → PT $10.65 (+50%), SL $4.25

Confidence: 72%

🔹 Llama (Meta)

Bias: Moderately Bullish (No Trade)

Setup: Daily RSI >70, price overextended beyond Bollinger; MACD weakening

Trade: No trade—premium too expensive, risk/reward not ideal

🔹 Gemini (Google)

Bias: Moderately Bullish (No Trade)

Setup: Parabolic move, minor MACD divergence, resistance near

Trade: No trade—warns of short-term pullback risk

🔹 DeepSeek

Bias: Moderately Bearish

Setup: Daily RSI 72, MACD bearish divergence, low put OI

Trade: Buy $140P @ $5.30 → PT $8.00, SL $4.30

Confidence: 65%

✅ Consensus Takeaways

📈 Price action is bullish — strong trend confirmed across models

⚠️ Overbought signals: RSI >70, Bollinger breakout, MACD divergence

🧲 Max pain at $128 = potential late-week gravity

💡 Only 2 models recommend entry (calls); 2 models abstain; 1 model (DeepSeek) favors puts

🎯 Recommended Trade

💡 Strategy: Bullish Naked Weekly Call

🔘 Ticker: CRWV

📈 Direction: CALL

🎯 Strike: $160

💵 Entry: $5.40 (ask)

🎯 Profit Target: $6.75 (+25%)

🛑 Stop Loss: $4.32 (−20%)

📏 Size: 1 contract

📅 Expiry: 2025-06-06

⏰ Entry Timing: Market Open

📈 Confidence: 70%

⚠️ Key Risks to Watch

🔄 Overbought RSI + Bollinger extension = pullback risk

🧲 Max pain at $128 may drag price if momentum fades

💰 High IV = expensive premiums — reduce size or use tight SL

⌛ Theta decay accelerates Thursday–Friday — momentum must hold