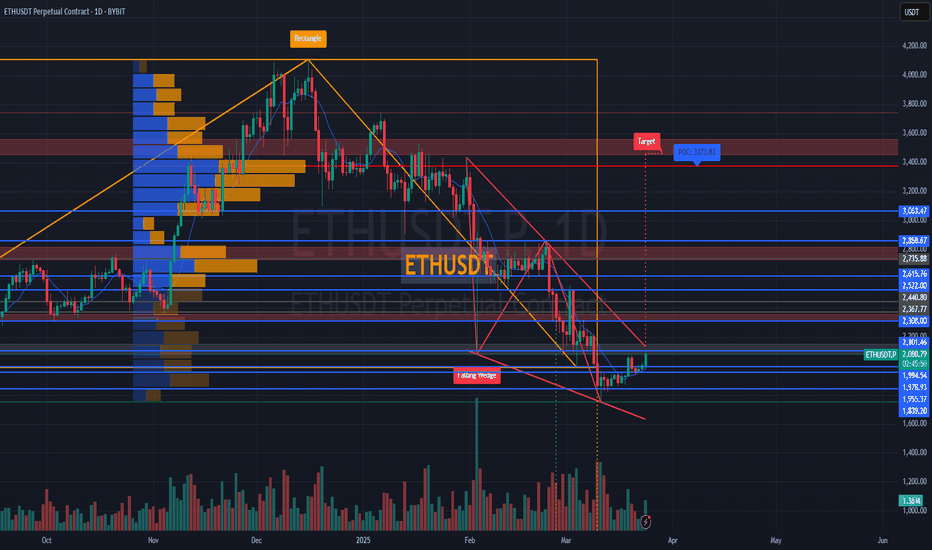

Awakening of #ETH – Return of the Bulls and Wedge Breakout📊 Overview of the BYBIT:ETHUSDT.P Situation on 4H and 1D Timeframes

✅ Trend and Technical Indicators:

➡️ The chart shows a strong downtrend that began in late December 2024, when the price dropped from a peak of around 3400 USDT to 1620 USDT by March 2025.

➡️ A correction followed, with the price recovering to around 2100 USDT, where it is currently consolidating.

✅ Volume: The volume at the bottom of the chart was high during the drop, confirming the strength of the bearish trend. Now, volume is decreasing, which may indicate a weakening momentum.

✅ Patterns: A Rising Wedge pattern is forming on the chart — typically a bearish signal, especially after a strong downtrend. This may suggest a potential reversal to the downside.

➡️ A Falling Wedge pattern appeared earlier, and its breakout upward gave a short-term bullish impulse.

✅ Positive Factors:

➡️ Price bounced from a strong support level at 1620 USDT, which gives bulls hope for recovery.

➡️ Declining volume may indicate seller exhaustion.

➡️ The earlier breakout of the Falling Wedge supports the current correction.

✅ Negative Factors:

➡️ The Rising Wedge now forming is a bearish pattern, and a breakdown could lead to further decline.

➡️ The overall trend remains bearish, and price has yet to break through key resistance levels (e.g., 2400 USDT).

➡️ The crypto market, especially BYBIT:ETHUSDT.P remains volatile, and external factors (news, macroeconomic conditions) could significantly impact movement.

📉 4H Timeframe:

➡️ A Rising Wedge is forming; price is testing the upper boundary of the wedge and a key resistance level at $2,101.

➡️ There's a potential retracement zone targeting $1,839 — aligned with the lower edge of the wedge and a liquidity area.

➡️ Support exists at $2,068 and $2,041, but if the wedge breaks downward, the decline may accelerate.

➡️ Volume is increasing, confirming active participation and the importance of this zone.

📈 1D Timeframe:

➡️ BYBIT:ETHUSDT.P bounced from a demand zone and is currently testing the $2,100 area.

➡️ The next strong resistance lies between $2,308–$2,367, and the previous downtrend hasn’t been fully broken yet.

➡️ There's a glimmer of strength on the daily (a +4.5% candle with notable volume), but the move is not yet confirmed as a sustained uptrend.

➡️ A breakout from the Falling Wedge is confirmed — a bullish pattern that played out.

➡️ Price has broken above the descending channel (orange line), increasing the likelihood of a trend reversal.

➡️ The measured target from the wedge breakout is around POC $3,373, aligning with previous volume accumulation — ambitious but logical.

⚠️ Risks / Limitations:

➡️ If price fails to hold above $2,101 and drops below $2,068, a return to $1,955 or even $1,839 is possible.

➡️ Volume is present but the momentum must be confirmed in the next 1–2 days.

📍Important Note:

👉 On 4H – a bearish setup is forming.

👉 On 1D – a weak recovery attempt, still under pressure.

👉 A reaction from the $2,100 zone is critical: either a rejection downward (per the wedge), or a breakout that invalidates the bearish setup.

👉 This area is a decision zone — a key point for planning potential trades.

📢 Conclusion: A breakout, retest, and confirmation of the structure and volume are visible.

🔵 Bullish Scenario:

➡️ The Falling Wedge breakout confirms a bullish impulse. The target at 3373.83 USDT looks realistic long-term, if price breaks 2100 USDT and holds above 2400 USDT.

➡️ To confirm this scenario, we need volume growth and a breakout of major resistance levels (e.g., 2400 USDT and above).

🔴 Bearish Scenario:

➡️ The Rising Wedge identified earlier remains valid. If this pattern plays out, the price may drop to 1901.73 USDT or even lower, to 1620 USDT.

➡️ The long-term downtrend (marked by a red line) is still intact, supporting the bearish outlook.

📉 LONG BYBIT:ETHUSDT.P from $2102.90

🛡 Stop loss at $2083.00

🕒 Timeframe: 1D (Mid-term idea)

✅ Overview:

➡️ BYBIT:ETHUSDT.P Falling Wedge breakout confirmed on the daily chart.

➡️ Successful retest of the $1,955–$2,041 zone.

➡️ Holding above $2,101 opens the way to higher levels.

➡️ Volume is increasing post-breakout — confirming buyer interest.

➡️ Next strong resistance block lies between $2,308–$2,522.

🎯 TP Targets:

💎 TP 1: $2112.00 — nearest resistance and key liquidity zone.

💎 TP 2: $2125.00 — a critical daily level, zone of pullback from previous drop.

💎 TP 3: $2134.00 — potential impulse target toward major POC ($3,373).

📢 If price fails to hold above $2,068 and breaks below $2,041 — the setup is invalidated.

📢 A retest of $2,101 from below may be needed before a stronger upward move.

📢 Volume support at $1,955 is critical for the bullish case.

🚀 BYBIT:ETHUSDT.P is forming a potential mid-term reversal — if price holds above $2,101, a move toward $2,200+ and beyond is expected.

Cryptoanalysis

Is #AVAX Making Much Needed Comeback or Another Bull Trap Ahead?Yello, Paradisers! Is #AVAX on the verge of a major breakout, or is this just another bull trap? Let's look at the latest setup of #Avalanche:

💎#AVAXUSDT has been stuck inside a falling wedge for weeks, respecting both the descending resistance and descending support levels. However, bulls have finally pushed through the upper trendline, signaling a potential shift in market sentiment. The question now is: will it sustain the momentum, or will we see a sharp rejection at key resistance levels? AVAX has been stuck inside a falling wedge for weeks, the breakout shows a high probability of an impulsive move toward the highlighted zones.

💎The immediate support to keep an eye on sits around $18.38, a level that could act as a strong demand zone if retested. Below that, $16.61 serves as a critical invalidation level for the bullish setup. A breakdown here would shift the momentum back in favor of the bears.

💎On the upside, #AVAX faces its first major challenge between $23.00 and $26.00, where sellers are likely to step in. A clean breakthrough of this zone would open the door for a more aggressive rally. RSI & Volume Confirmation – The RSI is showing early signs of strength, but volume confirmation is still needed. A strong push above the resistance zone on high volume would solidify the bullish breakout.

💎If #AVAXUSD can flip $18.38 into strong support, we could see an impulsive move toward the $23-$26 range. However, a failure to hold support could result in a bearish breakdown toward the $14 region.

The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

ETH Breakout Setup: Eyeing $2,550 Target!"Key Observations:

Strong Support Level: ETH has bounced from a strong support zone around $1,792 - $1,905.

Retest & Buy Zone: Price has broken above a key level and is now retesting it, indicating a potential buy opportunity.

Resistance Zone: A key resistance zone is marked near $2,557.71.

Target Levels: The first target is set at $2,557.71, with a possible further extension to $2,854.38.

Bullish Confirmation: If ETH maintains support above $1,981, the uptrend towards the target is likely.

Trading Idea:

Entry: Buy on successful retest.

Stop Loss: Below the strong level at $1,905 - $1,792.

Take Profit: First target at $2,557.71, extended target at $2,854.38.

This setup follows a classic breakout and retest strategy, suggesting bullish momentum if Ethereum sustains above key levels.

Bitcoin Breakout: Potential Rally Towards $110K!"Key Observations:

Descending Channel: The price has been moving downward within a channel, showing lower highs and lower lows.

Support Level: Marked near $79,912.83, where the price recently bounced.

Breakout Scenario: BTC appears to be breaking out of the channel, suggesting a potential bullish trend.

Target: The projected target is $110,146.67, indicating a significant upward move.

Stop Loss: Positioned below the support level to manage risk in case of a price reversal.

Trading Idea:

A long trade setup is suggested, with entry upon confirmation of the breakout.

Stop-loss below the recent low ($79,912.83) to minimize risk.

Profit target near $110,146.67, aligning with previous resistance levels.

This setup follows a classic breakout and retest strategy, expecting bullish momentum if Bitcoin sustains above the resistance zone.

POPCAT ideaGreetings, fellow traders!

My analysis suggests a developing potential for a bullish move in POPCAT/USDT. I'm observing a possible breakout scenario, and I'll outline a potential long trade setup.

Entry Rationale:

A long entry is suggested above the $0.2135 level, contingent upon a confirmed breakout from the currently established neutral-bullish channel. This breakout would serve as confirmation of increasing bullish momentum.

Trade Setup:

Entry: Above $0.2135 (post-breakout confirmation)

Target 1: $0.2435

Target 2: $0.2650

Stop-Loss: $0.1910 (This provides a risk management level below a recent swing low, it's just an idea.)

Risk Management:

A stop-loss order placed around $0.1910 is recommended to mitigate potential losses should the trade move against the anticipated direction.

Disclaimer and Call to Action:

I welcome your constructive feedback and alternative perspectives on this analysis. Please conduct your own independent research and due diligence, including thorough risk assessment, before making any trading decisions. This analysis is for informational purposes only and does not constitute financial advice.

#VICUSDT shows signs of reversal and strength📉 LONG BYBIT:VICUSDT.P from $0.2507

🛡 Stop loss $0.2470

🕒 1H Timeframe

📍 Important Note:

Wait for confirmation around the $0.2507 level. Enter the trade only if price holds above with volume.

✅ Overview BYBIT:VICUSDT.P :

➡️ The chart shows a completed Falling Wedge — a bullish reversal pattern that typically leads to an upside breakout.

➡️ After that, a Bearish Pennant formed but failed to push the price significantly lower, indicating weakness in sellers.

➡️ Currently, the price is breaking out of the triangle pattern, hinting at a possible bullish continuation.

➡️ Entry level marked at $0.2507, right after the breakout zone, supported by steady volume and short-term uptrend.

➡️ Volume Profile on the left reveals a low-volume zone above, making it easier for price to climb toward TP targets.

🎯 TP Targets:

💎 TP 1: $0.2525

💎 TP 2: $0.2545

💎 TP 3: $0.2565

⚡ Plan:

➡️ Monitor price reaction at TP1 — partial exit recommended.

➡️ Watch for confirmation above $0.2507.

➡️ Enter LONG after retest and volume confirmation.

➡️ Set stop loss below recent low — at $0.2470.

🚀 BYBIT:VICUSDT.P shows signs of reversal and strength — holding above the breakout zone could lead to upside movement!

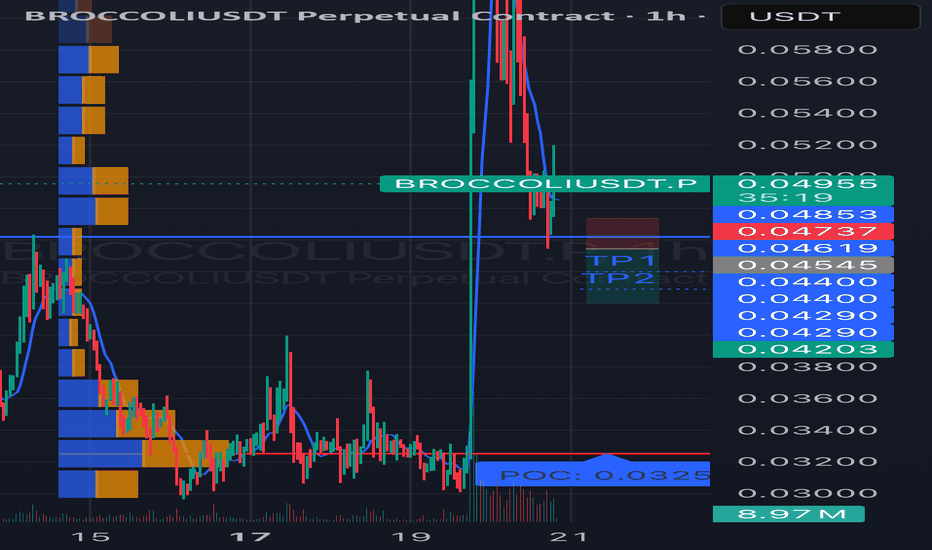

#BROCCOLIUSDT is showing bearish potential SHORT BYBIT:BROCCOLIUSDT.P from $0.04545

🛡 Stop Loss: $0.04737

🕒 Timeframe: 1H

⚡️ Overview:

➡️ BYBIT:BROCCOLIUSDT.P is showing bearish momentum on the 1-hour timeframe after a significant drop from $0.06000 to the current consolidation zone of $0.4203–$0.4885.

➡️ The price recently tested the $0.04545 level (a possible retest of a broken support, now acting as resistance), which could serve as an entry point for a short.

➡️ The volume profile on the left shows strong buyer interest at $0.0325 (POC), which acts as a key support level. However, the lack of significant buying volume at current levels suggests potential for further downside.

➡️ The price structure remains bearish: lower highs and lows are forming after the drop.

➡️ The RSI (14) indicator on the 1H timeframe is presumably around 45 (based on price action), indicating neutral momentum with room for a downward move.

🎯 Take Profit Targets:

💎 TP 1: $0.04400

💎 TP 2: $0.04290

💎 TP 3: $0.04203

⚡️Plan:

➡️ Entry: Sell below $0.04545 after the 1-hour candle closes below this level to confirm the rejection from resistance.

➡️ Stop Loss: Set at $0.04737, which provides a 7% risk from the entry point and protects against a potential breakout.

➡️ Risk/Reward Ratio: From 1:2 (for TP1) to 1:5 (for TP3), making this trade attractive from a risk management perspective.

➡️ After the drop, the price has stabilized, indicating possible consolidation or accumulation.

➡️ Resistance zone: $0.04885 (upper boundary of the current range).

Technical Indicators:

➡️ The chart shows candles in red and green, reflecting bearish and bullish movements.

➡️ After the sharp decline, the price has formed lower highs and lows, but in recent hours, there’s an attempt at recovery.

📢 A price rejection below $0.04545 with increasing selling volume increases the likelihood of reaching the targets.

📢 The $0.04400 and $0.04290 levels may act as areas for partial profit-taking, so monitor price action in these zones.

📢 Risks: If the price breaks above $0.04885, it could signal a false breakdown and a potential reversal to the upside. In this case, consider reassessing the position.

📊 The decline in BYBIT:BROCCOLIUSDT.P aligns with cautious sentiment in the crypto market.

📊 As of March 20, 2025, BYBIT:BTCUSDT.P is trading around $90,000, showing signs of consolidation, which may pressure altcoins like BYBIT:BROCCOLIUSDT.P

BYBIT:BROCCOLIUSDT.P is showing bearish potential on the 1H timeframe.

⚡️A confirmed rejection below $0.04545 is your signal to act!

#FORMUSDT: Quick Breakdown of a Long Setup!📉 Long BYBIT:FORMUSDT.P from $1.9037

🛡 Stop Loss: $1.8313

🕒 1H Timeframe

⚡️Overview:

➡️ Current Price: $1.8831 — this is where BYBIT:FORMUSDT.P is trading right now.

➡️ The price recently dropped from around $2.0000 to $1.4000 — a sharp decline! But then it started recovering and is now in a consolidation zone.

➡️ Volume: At the bottom of the chart, you can see volume bars. There was a particularly large volume at the $1.4000 level, where the price reversed. This suggests a lot of activity — possibly big players starting to buy.

➡️ Key Levels: The right side of the chart shows important price levels:

➡️ $1.8313 — stop loss to protect us from losses.

➡️ $1.8932 and $1.88313 — the nearest resistance levels that the price needs to break to move higher.

➡️ $1.7464 — a support level below, in case the price goes down.

🎯 TP Targets:

💎 TP 1: $1.9690

💎 TP 2: $2.0400

💎 TP 3: $2.0890

⚡️ Plan:

➡️ Entry Point: $1.9037 — this is the level to enter the buy. The price is currently slightly below ($1.8831), so we need to wait for it to rise to this mark.

➡️ Stop Loss: $1.8313 — if the price falls below this, the trade will close with a small loss to minimize risks.

Risk/ Reward: If we calculate, the distance from the entry to the stop loss is $0.0724, and to TP1 — $0.0653 (a ratio of nearly 1:1). To TP2 — $0.1363 (1:1.88), and to TP3 — $0.1853 (1:2.56). This is a good profit potential if the price moves up!

📢 The BYBIT:FORMUSDT.P price just bounced off the strong $1.4000 level, where there was high volume. This could be a signal that big players started buying, and the market is ready to rise.

📢 The $1.9037 level (entry point) aligns with the POC (Point of Control) — the zone with the highest trading volume, which often attracts the price.

📢 If the price breaks the resistance at $1.8932, it could easily reach $1.9037 and then move toward our targets.

🎯 How Does This Signal Relate to the Market?

The recent news about the resolution of the #Ripple vs. #SEC case, which I wrote about earlier, creates a positive backdrop for the entire crypto market.

➡️ When major projects like #Ripple gain clarity, it adds confidence to investors.

➡️ Altcoins like BYBIT:FORMUSDT.P can catch this wave of optimism.

➡️ If the market continues to rise, BYBIT:FORMUSDT.P has a chance to break resistance and move toward our targets!

➡️ Important: The crypto market is volatile, so don’t forget about risk management. Don’t risk more than 1-2% of your deposit on a single trade.

#AVLUSDT continues its downtrend 📉 Short BYBIT:AVLUSDT.P from $0,4060

🛡 Stop loss $0,4136

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is 0,4201

🎯 TP Targets:

💎 TP 1: $0,4015

💎 TP 2: $0,3975

💎 TP 3: $0,3945

📢 Monitor key levels before entering the trade!

BYBIT:AVLUSDT.P continues its downtrend — watching for further movement!

#RAREUSDT continues its downtrend📉 Short BYBIT:RAREUSDT.P from $0,08345

🛡 Stop loss $0,08460

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is 0,09094

🎯 TP Targets:

💎 TP 1: $0,08196

💎 TP 2: $0,08050

💎 TP 3: $0,07950

📢 Monitor key levels before entering the trade!

BYBIT:RAREUSDT.P continues its downtrend — watching for further movement!

ONDO Trade Setup: EMA Break ConfirmationWe're monitoring the EMAs for a breakout, which will trigger this trade. RWA (Real-World Assets) remains a strong narrative, and if the market turns bullish, ONDO could see a significant pump.

🛠 Trade Details:

Entry: Around $0.88

Take Profit Targets:

$0.98 (First TP - Key Resistance Level)

$1.12 (Second TP - Upside Expansion Zone)

Stop Loss: Below $0.79

Waiting for EMA confirmation and market momentum shift before execution. 🚀

#CAKEUSDT is setting up for a breakout📉 Long BYBIT:CAKEUSDT.P from $2,710

🛡 Stop loss $2,607

1h Timeframe

⚡ Plan:

➡️ POC is 2,515

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $2,790

💎 TP 2: $2,870

💎 TP 2: $2,920

🚀 BYBIT:CAKEUSDT.P is setting up for a breakout—preparing for an upward move!

#1000XUSDT is setting up for a breakout📉 Long BYBIT:1000XUSDT.P from $0,05470

🛡 Stop loss $0,05297

1h Timeframe

⚡ Plan:

➡️ POC is 0,04229

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,05640

💎 TP 2: $0,05775

🚀 BYBIT:1000XUSDT.P is setting up for a breakout—preparing for an upward move!

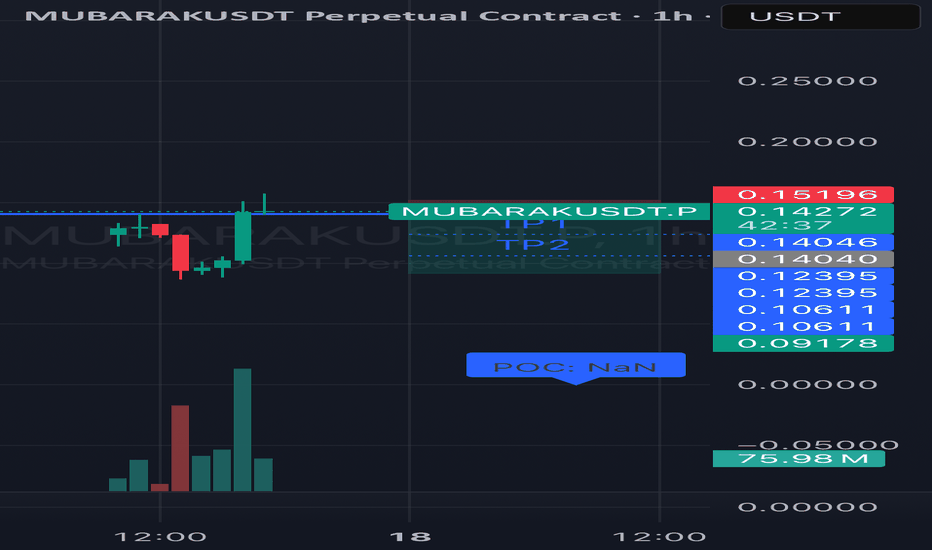

#MUBARAKUSDT continues its downtrend📉 Short BYBIT:MUBARAKUSDT.P from $0,14040

🛡 Stop loss $0,15196

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is Nan

🎯 TP Targets:

💎 TP 1: $0,12395

💎 TP 2: $0,10611

💎 TP 3: $0,09178

📢 Monitor key levels before entering the trade!

BYBIT:MUBARAKUSDT.P continues its downtrend — watching for further movement!

#REDUSDT continues its downtrend📉 Short BYBIT:REDUSDT.P from $0,7814

🛡 Stop loss $0,8061

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is 0,5802

🎯 TP Targets:

💎 TP 1: $0,7600

💎 TP 2: $0,7330

💎 TP 3: $0,7112

📢 Monitor key levels before entering the trade!

BYBIT:REDUSDT.P continues its downtrend — watching for further movement!

#INJUSDT is setting up for a breakout Long BYBIT:INJUSDT.P from $10,346

🛡 Stop loss $10,182

1h Timeframe

⚡ Plan:

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $10,550

💎 TP 2: $10,730

💎 TP 3: $10,849

🚀 BYBIT:INJUSDT.P is setting up for a breakout—preparing for an upward move!

#VIRTUAL Ready For Another Leg Down Before Bullish Reversal Yello, Paradisers! Is #VIRTUAL gearing up for a full-blown collapse, or will the bulls fight back at critical support? Let’s break down #VirtualsProtocol:

💎#VIRTUALUSDT has already broken below the falling wedge, confirming that sellers remain in full control. The breakdown from this pattern signals that the expected bullish reversal has failed, and the trend remains decisively bearish. The price action is also clear—momentum is heavily bearish, and unless something shifts fast, we could see much lower levels ahead.

💎The previous major support zone at $0.60 - $0.65 has flipped into resistance, making it a crucial level to watch. Any short-term bounce into this area is likely to face strong selling pressure from sellers of #VIRTUALUSD. Only a break above $0.935 would invalidate this bearish outlook and signal a shift in momentum.

💎If the rejection plays out, the next downside target sits at $0.40, with a high probability of further decline toward the major support zone at $0.31 - $0.07. This is where buyers must step in—otherwise, a much deeper drop could follow.

💎RSI remains weak, and volume is declining, confirming the lack of strong buying interest. As long as this continues, the bearish pressure is likely to persist.

The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

MOVE Price Analysis: Key Levels & Potential ScenariosCurrent Market Structure

Since mid-February, MOVE has been consolidating, with a critical support level forming around $0.4371.

This level aligns with a bullish daily gap and the midpoint of a previous candle tail, making it a key area to watch for a potential retest.

Following the mainnet launch, a "sell the news" reaction may test this support level before determining the next directional move.

Downside Risk: Key Support Levels

If $0.4371 support fails, there is minimal historical support below, making a drop more probable.

Possible profit-taking zones include:

$0.3705 (near bulls' stop levels)

$0.3500 (a major psychological support level)

Upside Potential: Resistance Levels to Watch

If MOVE rebounds off support and breaks above $0.4980 (previous rejection zone), the next bullish targets include:

$0.5573 (first major resistance level)

$0.5820 (historical rejection zone)

Conclusion & Strategy

Bullish Scenario: A strong bounce from $0.4371 could lead to a push toward $0.4980 and potentially $0.5573 if buying pressure sustains.

Bearish Scenario: A break below $0.4371 could accelerate losses toward $0.3705-$0.3500, where buyers may attempt to step in.

Key Watchpoint: How the price reacts at $0.4371 will dictate the next significant move. If it holds, bulls regain control; if it fails, further downside is likely.

Bitcoin at a Crucial Level: Another Pump Ahead?The price of Bitcoin is at a crucial region, with buyers continuing to defend the 200-day moving average on the daily chart and holding off the bearish pivot on the weekly chart. Yesterday's closing candle (March 11, 2025) is a PFR (Closing Price Reversal), indicating buyers defense in an important area. The fact that the price has consolidated since its last major bullish leg (Trump trade) strengthens the possibility of another upward move. Considering all the actions Trump is taking regarding cryptocurrencies, I see another pump ahead.

#MKR Bears in Control: Is a Breakdown Inevitable or Not?Yello, Paradisers! Is #MKR setting up for another leg down, or will the Bulls finally step in? The structure is clear; this could get ugly unless something changes soon. Let’s break down the #Maker setup:

💎#MKRUSDT is forming a Descending Leading Diagonal, a classic bearish pattern within a larger zigzag correction. This structure suggests that sellers remain in control, with each bounce being met by renewed selling pressure.

💎Price is currently reacting off the descending support near $1,160. While a short-term bounce toward $1,250 - $1,300 is possible, it remains within the bearish framework. The critical resistance to watch is at $1,333—a breakout above this level would invalidate the bearish setup and signal a shift in momentum.

💎If the bearish structure holds, the next leg down could take us to the strong support zone at $1,000 - $950. This is where buyers will have their last real chance to defend the trend. A failure to hold this level could open the door to a deeper correction.

💎RSI remains weak, showing no strong bullish divergence, signaling that momentum is still in favor of the sellers. The volume is declining, meaning the recent price action lacks strong buying conviction.

Strive for consistency, not quick profits. The market rewards discipline and patience—trade smart, Paradisers!

MyCryptoParadise

iFeel the success 🌴

Bitcoin will make a Breakout Chart Analysis:

1. Timeframe and Price Context

Timeframe: 4-hour chart (each candlestick represents 4 hours of trading).

Price Levels:

The current price is $92,812.72, with a slight decrease of 0.23% as of the latest data point.

The price range on the chart spans from approximately $80,000 to $108,255 (the recent peak).

Trend Overview:

Late 2024: Bitcoin experienced a strong uptrend, peaking near $108,255.

Early 2025: The price has corrected downward, forming a descending triangle pattern, with the current level at $92,812.72.

2. Key Patterns and Annotations

Descending Triangle:

The chart features a descending triangle pattern, a common consolidation pattern that can signal either a continuation of a downtrend or a reversal.

Upper Resistance: A horizontal resistance line around $108,255 (the recent peak where the price failed to sustain higher levels).

Lower Support: A descending trendline (sloping downward) that the price has been testing, currently near $92,000-$93,000.

The price is nearing the apex of the triangle, suggesting an imminent breakout (upward or downward).

Accumulation Zone:

The chart labels an "Accumulation Zone" near the $80,000-$85,000 range, indicating a potential area where large players (e.g., whales) may have been buying during the correction.

The current price ($92,812.72) is above this zone, suggesting a bounce or stabilization after reaching this support.

Breakout Prediction:

An upward arrow with a Bitcoin symbol points toward $120,000 or higher, indicating a potential bullish breakout targeting a new all-time high.

3. Support and Resistance Levels

Support:

The $92,000-$93,000 level is acting as immediate support, aligning with the lower boundary of the descending triangle.

The $80,000-$85,000 accumulation zone is a stronger support level, likely a key area of buying interest during the correction.

If this support fails, the next level could be around $75,000 (a psychological and historical support).

Resistance:

The $108,255 level is a major resistance, marking the recent high.

The next significant resistance could be around $120,000 (as suggested by the arrow), a psychological level and a potential new all-time high.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely peaked during the rally to $108,255 and decreased during the correction as selling pressure eased.

A breakout would require a volume spike to confirm, especially if the price breaks above the descending trendline (around $100,000-$105,000).

Momentum indicators (e.g., RSI or MACD) could indicate if Bitcoin is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If Bitcoin breaks above the descending trendline (around $100,000-$105,000) with strong volume, it could confirm the breakout.

The target of $120,000 (a ~29% move from $92,812.72) is plausible, especially if whale accumulation in the $80,000-$85,000 zone drives momentum.

This aligns with the upward arrow and suggests a resumption of the prior uptrend.

Bearish Breakdown:

If the price fails to hold the $92,000-$93,000 support and breaks below, it could signal a bearish continuation.

The next support at $80,000-$85,000 would be tested, potentially leading to further downside toward $75,000.

Consolidation:

If the price remains within the triangle (between $92,000 and the descending trendline), it might continue to consolidate until a catalyst (e.g., market news, volume surge) triggers a move.

6. Market Context

Whale Activity: The accumulation zone at $80,000-$85,000 supports your earlier narrative of whales accumulating during corrections to set up a breakout. This could indicate strategic buying by large players.

Market Sentiment: As the leading cryptocurrency, Bitcoin’s price heavily influences altcoins like Ethereum and UNISWAP (from your previous charts). A bullish breakout in BTC could trigger similar moves in the broader market.

Timing: The chart’s position near the triangle’s apex suggests a breakout could occur within days to a week on a 4-hour timeframe, depending on market conditions.

UNI Trade Setup: Key Support RetestUNI has pulled back into a primary support zone at $7.20, a critical area for bulls to hold. A bounce from this level could trigger upside momentum, while a breakdown could invalidate the bullish structure.

🛠 Trade Details:

Entry: Around $7.20

Take Profit Targets:

$9.00

$10.00

$13.00

Stop Loss: Daily close below $6.50

If buyers step in strongly at support, UNI could stage a significant recovery. Keep an eye on market conditions! 🚀

LTC Long OpportunityMarket Context:

LTC is testing the range's low support level, which presents a strong buying opportunity if support holds. A potential bounce from this level could lead to a move toward the next resistance zones.

Trade Details:

Entry Zone: $102.00

Take Profit Targets:

$109.00 - $115.00

$132 - $140

Stop Loss: Just below $98.00

This setup offers a good risk-to-reward ratio, making it an attractive trade for a possible reversal. 🚀