BTC/USD Eyes $109K After Bullish Breakout!!🧠 Chart Type and Indicators:

Chart Type: Candlestick

Indicators Used:

EMA 50 (red line): 85,335.18

EMA 200 (blue line): 85,657.29

🔍 Technical Pattern Analysis:

Pattern Identified: Ascending Triangle

The price has formed higher lows (ascending trendline support) while repeatedly testing a horizontal resistance zone (~$88,000), forming an ascending triangle.

This is typically a bullish continuation pattern when it occurs after an uptrend, though in this context, it's forming after a consolidation, giving more significance to the breakout.

🚀 Breakout Confirmation:

The price has broken above the horizontal resistance and is currently trading at $92,766.51.

Volume is not visible but should be increasing during a valid breakout.

Both EMAs have been decisively breached to the upside, signaling momentum shift in favor of bulls.

🧩 Key Levels:

Support Zone (Post-Breakout Retest): ~$88,000

Previously a resistance zone, now likely to act as support.

Immediate Resistance: ~$96,000

Historical resistance zone shown on the chart with a horizontal black line.

Extended Target (measured move): ~$109,420

Based on the height of the triangle projected from the breakout point.

📈 Price Action Forecast:

Two possible scenarios (depicted with arrows on the chart):

Bullish Continuation:

A retest of the $88,000 zone followed by continuation to $96,000, then $109,420.

Short-Term Pullback:

Price may dip to retest the breakout zone (~$88,000), consolidate, then rally higher.

✅ Bullish Signals Summary:

Breakout from a bullish ascending triangle.

EMAs crossed and price holding above them.

Clear higher highs and higher lows formation.

Momentum suggesting further upside.

🧨 Risks to Watch:

False Breakout Risk: If the price fails to hold above $88,000 and falls back into the triangle range.

Macro Factors: Bitcoin remains sensitive to macroeconomic news and regulations that could disrupt technical setups.

Cryptocoins

#SWELLUSDT longsignal📉 LONG BYBIT:SWELLUSDT.P from $0.01928

🛡 Stop Loss: $0.01890

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:SWELLUSDT.P is showing a strong upward movement after breaking out of consolidation. The price has broken key resistance levels and is now forming a retest zone, confirming bullish strength.

➡️ POC (Point of Control) is located at $0.01175, far below the current price, indicating a shift to a new accumulation phase.

➡️ Trading volumes have increased significantly, which could further strengthen the upward impulse.

⚡ Plan:

➡️ Enter LONG at $0.01928 after confirming the breakout level.

➡️ Stop-Loss set at $0.01890 to protect against false breakouts.

➡️ Primary targets – $0.01967, $0.02013, and $0.02065, where partial profit-taking is possible.

🎯 TP Targets:

💎 TP1: $0.01967

🔥 TP2: $0.02013

⚡ TP3: $0.02065

🚀 Expectation: If the current trend holds, BYBIT:SWELLUSDT.P may continue its upward movement towards $0.02065 and beyond.

Bullish GST is setting up the same as COINBASE:SPAUSD before it ran 4x. I was the first to comment and chart SPA go look. GST is going to run hard in my opinion based of TA and the current overall market trends. Seen in the chart is a bullish pennant break out and riding that trend line up. SPA did a similar sit up a few weeks ago and followed with one solid big green candle. Waiting for a solid big green candle. So far chart is primed for a massive new leg. Of course not financial advice and do your own DD. Crypto is very volatile but as we peak alt coin season and COINBASE:BTCUSD calms down, all these other coins will run 20-50x. There will be growing pains and pull backs but the next 2-3 months will be interesting to see how high some of these coins spike. This is in game currency tied to COINBASE:GMTUSD on the COINBASE:SOLUSD

Once Sol and GMT continue to pave the way, this will continue to explode. First resistance we need to flip will be .042ish area.

Coins unlocks - why its not so bad?Weekly token unlocks are a regular occurrence in the cryptocurrency market. These tokens are typically released to early investors, funds, and project teams. Upon receiving these tokens, some investors choose to sell them, either through market orders or limit orders. These sales can have a noticeable impact on the token's price. However, there are some key points to consider regarding token unlocks:

Market Reaction: It's common for every “guru” who trying speculate on the market's response to these future distributions. While some traders may try to accumulate on these events. Predicting market movements in response to token unlocks can be quite challenging.

Project Quality: High-quality projects usually plan their tokenomics meticulously to minimize the influence of early investors on the price. They design their token release schedules to prevent significant disruptions to the market.

Small Unlocks: In many cases, only a small percentage of total circulating tokens becomes available. When this percentage is low, it may not significantly affect the market. Selling pressure from a 1% or 3% unlock, for example, may not be substantial.

Unintended Reactions: Sometimes, the market reacts in unexpected ways to token unlocks. Prices might not immediately rise upon the unlock, and they can even experience downward movements. Breakouts do not always result in immediate asset sales. Or someone can sell before unlock and bring a fear, so at unlock this whales absorb all coins and push price back up.

Project Strategy: Occasionally, projects may opt to postpone large token releases that were anticipated. This delay can have unexpected consequences, such as liquidations of short positions, leading to significant price movements.

Every case is individual. You remember when DYDX postponed 1 year 15% unlock. But during this year price will stay in a same range. Or upcoming HFT unlock. If HFT was at 1$ price do you think its a smart idea for people who will get now some % from 15% supply sell now at 0.28? If they can just wait a bit and sell higher? Of course everything depends of personal situation. Some investor want out of project, some accumulate more, some need money NOW, someone can wait 1-2 year longer but with full amount of coins on wallet now.

Always just imagine, behind every unlock the same people like you. And ask yourself if you invest in some coin on early stage, you believe in potential of this coin. Now you got your coins from unlock period but price so low, and we are at the bottom will you press - SELL? I think not, because you understand the potential. Also you got a big bag of this coins and you better wait alt season for % step by step fixation with perfect average price.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

$BLFDF Blockchain Foundry Inc. entry PTs .24-.27 Target PTs .70Blockchain Foundry Inc. develops and commercializes blockchain-based business solutions in the Americas, the Caribbean, and Europe. Its solutions include Syscoin Spark Wallet that allows clients to have their custom wallet based on their syscoin platform token; Syscoin Price Peg Server, which allow non-coders to create and configure its own price peg server; and Blockmarket suite, a marketplace platform. The company also provides consulting services to corporate clients seeking to incorporate blockchain technology into their business. Blockchain Foundry Inc. was founded in 2016 and is headquartered in Toronto, Canada.

CryptoCoin Bitcoin to continue Up till 11k before reversal LBLSHello Friends,

Look at the chart closely .

As per the LBLS script indicator the Bull started from 9600 and still it continues as the candle color still in Blue .

Is it the right time to go for short ,In my view and as per the LongBuyLongSellIndicator it is big No No No!!!

The reason is ,Look at the last 11 candles ,it is evident that each of the candle on the bottom side shows Higher Low !

Yes of course the upper side candle shows bearish push it is a fake signal to make us into the trap.

So What is next as per the LongBuyLongSellIndicator.

Look at the back extreme zone where the support is at 10949 that means still up move will continue. Once it touches this point it may try to reach 11k and then 700 points reversal would start from there.

Watch this chart closely with all the time frame before you would take any position .

Currently i am bullish until 11k and then bearish for 10300. Both target is possible in week time.

Keep this post checked for one week of time to get how this is performing .

If you wish to look at the script here is the link below for the same.

Comment ,Like and share if you feel this is worth analysis.

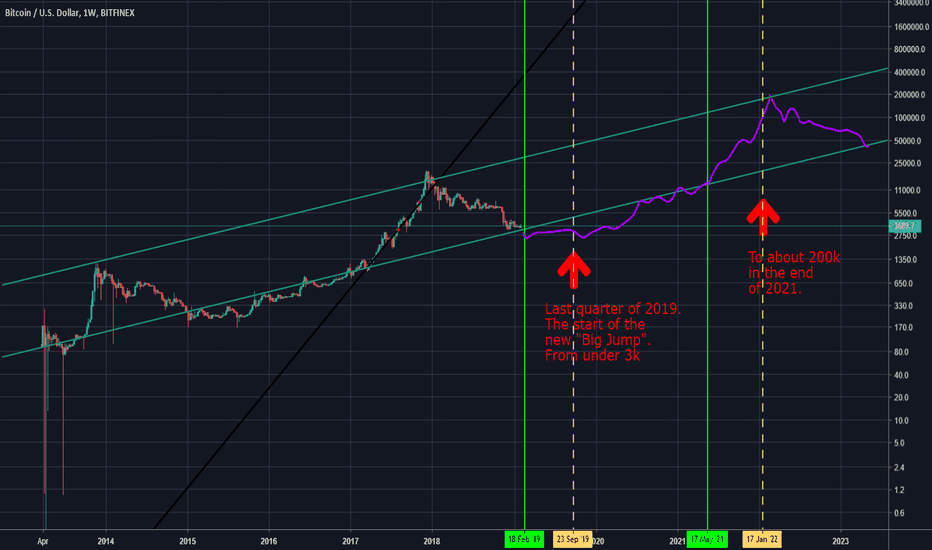

Seeing the future via the BTC/USD chart -part2:The Real Bull RunHere is an update from my last post (check " Link to Related Idea " at the bottom) from February 2019, with a corrected curve : now, I copy-pasted correctly the exact curve from December 2013 to February 2019, instead of drawing it with my hand. So, the projected graph in light blue is now 100% accurate.

-As I said in my previous post:

" If we use a logarithmic chart to examine the evolution of Bitcoin in time, we can see that what happened on December 2017 (All Time High) happened before, on December 2013.

What is happening now (depression) {sic: February 2019} happened before, between December 2013 and January 2015 ".

-Why copy-paste a graph and project it in the future?

Because, as I said in my previous post: " In economics, we must know and read history, because history makes cycles, tending to repeat itself ".

-Why use a logarithmic chart?

Because, it help us see that Bitcoin seems to be moving in time in an ascending channel, with probably predictable "highs" and "lows".

In my opinion, we are NOT already on a bull run, even if in the last few days Bitcoin touched (and even passed) several times the 8000 US$ barrier. It seems that investors that lost their money during 2018 are actually trying to take their money back.

If I am right, we might first see a BTC fall, and then, by the last quarter of 2019 we will have the " Real Bull Run ". So, IF in the next few days you see the BTC price falling really down to 6500 USD (or even lower), keep calm and accumulate at the bottom .

Then prepare for a " Golden Period " that will last from the last quarter of 2019 until January 2022: prices could touch more than 150000 USD.

(Will US$ be menaced then? In my -radical- opinion, if BTC price passes 100000 USD it will be the final countdown for all FIAT currencies in our world).

* If you win good money with my help and wish to offer me a beer, you can donate me some (fractions of) BTC !

BTC: 1BoZCLAoS26wAQPd75WixojoupW1mB4e3b

Cryptos market – Seeing the future via the BTC/USD chartIf we use a logarithmic chart to examine the evolution of Bitcoin in time, we can see that what happened on December 2017 (All Time High) happened before, on December 2013.

What is happening now (depression) happened before, between December 2013 and January 2015.

Actually, cryptos are evolving every day, and by using the word “evolving”, I do not refer to ICOS, but to real platforms that are trying to invent a new blockchain correcting issues like speed, scalability, security and volume of transactions per second. There are a lot of examples out there, like XTRABYTES who will soon enter in patent pending status for 3+5 patents, Waves etc. Soon or late, we will see the fruits of all those efforts and the crypto ecosystem will change forever. Then, the whole crypto market will pass from the distribution phase to an accumulation phase. Investors will soon see the actual low prices as a big opportunity, given the big potential hidden in some cryptos and prices will explode again.

In economics, we must know and read history, because history makes cycles, tending to repeat itself. If we try to reproduce the past BTC chart in the future, it seems that actually the price will go under 3k for some weeks and then, by the last quarter of 2019, if will start moving up again. Year 2020 will be characterized by a very significant bull trend permitting investors to get back what they lost lately. Year 2021 will be a milestone for the entire crypto ecosystem with an explosive rise in the crypto market. If this comes true, FIAT money & traditional banking system may be menaced.

I do not know if Bitcoin continues to be the king for long, or if there will appear other(s) cryptos to dethrone it. The fact is that all cryptos prices are extremely low and the potential is enormous. We have some months -until the last quarter of 2019- to accumulate.

* If you win good money with my help and wish to offer me a beer, you can donate me some (fractions of!) BTC or altcoins!

BTC: 1Ety8UbujJSNmVcmgWXRewMkSbWf1sNoHb

ETH: 0xcfb9742471e27b113e4752ce73af937c1c3b6681

LTC: LKFsPTckeJrMA7ojiiHmXHarriacAmGcna

Bitcoin about to breakout... but which way? 5k or 7k? [BTFD]Sideways trading over the weekend with a few squeezes, claiming false breakouts but with higher lows and lower highs we are witnessing the forming of a breakout triangle

This will break out this week starting 8th October

BUT which way????

going back to this chart and looking at repeating patterns: - its pretty clear to me we have still not completed a full rally from the bulls to push the price into the desired fib level, so.... for this week

are we still awaiting a rally to peak over the 0.618 fib level, which is roughly around the 7400 area?

....or are we to see a false breakout followed by a short move back down to under 6400 and start testing 6100 targetting high 5k area?

personally due to the volume im seeing it could be a stalemate either way right now at the start of Sundays market open, so a good move up or down is needed to create some early fireworks as we move into October and of course this is the time where we see seasonality of Bitcoin and cryptocoins reaching/breaking ATH's as we move towards December 2018 and 2019

**** looking for this week a break above 6825 for the bulls to go further or a clear close under 6320 to push thru the price action from the previous weeks ****

EVERYONE, you could say the smart money is expecting the bullrun season to kick off due to seasonality but objectively we have been repeating these false bullruns since January due to the enormous and quite crazy price valuation on 20th Dec 2017

So we have some clear lines of support/resistance both from trendlines and fibonacci, bears seem to have less room to move, whereas the bull targets seem further away but certainly have more room to move into

safe targets are shown in the purple lines on the charts, all pretty valid and possible for the next coming week or so...

wishing you all good trades and thank you for the support, donations and commitment towards BTFD and our missions to bring you unbiased and sensible analysis on the markets

we have started looking at other markets too and if you missed this trade on WTI Oil, i will bet ur kicking yourself:

have a great and profitable October and check the telegram channel for updates as we progress into the week ahead

XRP - ANALYSIS - LONG - BOTTOM & BREAKOUTKRAKEN:XRPUSD

M:

D:

Squeeze.

6HR

Mini Wave

Correction: Flat 5-3-5

D:

Targets

6HR:

3HR

KRAKEN:XRPUSD looks ready to break out.

1. Mini Wave

2. Flat Correction (C Wave almost complete)

Indicators:

OBV: Turning and improving...

MACD: Positive momentum

Will update.

-AB

BCH - Fibo Spiral Analysis - Bottom & Breakout Fibonacci Spiral Analysis.

Chart patterns follow Fibonacci Spirals and gives you ideas on where the price of a security is heading.

If you would like to see this analysis again or would like more information please leave comments.

Notable Screenshots:

See Related Idea for updated analysis on BCH.

Buy the dip in stellar lumenStellar price is moving in a descending channel after a strong rally in end 2017. It can go a bit lower short term, buy the dip.

This cryptocoin will go back to normal because it's a jokeDogecoin was literally created as a joke. Before the January dip doge was worth over 1.000.000.000 dollar! Cryptocoins are in a bubble right now. This is a nobrainer imo. Once people realise doge is not worth almost 1 billion dollar this coin will drop >80%. The question is not if it will crash but when. Only problem is, you can't short dogecoin long term. So it's not possible to capitalise on this idea. There are no futures on this coin. If i could i would buy long dated puts. Don't know how low this can go in the near term. It depends how the cryptocoin market behaves. Most coins are heavily correlated to each other.

The BTC Bear is Still Out! - Heavy Overhead Resistance IncomingI don't think bitcoin's down-trend is over just yet, there is too much heavy over-head resistance. Lots of investors missed their chance at selling near the highs and there are a lot of others who bought high and are stuck with a loss plus I don't believe new buyers will have the stomach to buy at prices beyond 10k, so this rally should die down and the down-trend resume. First heavy resistance is between 9-10k, top of descending channel (black) and a big psychological level, if the buyers have enough in them to break through this resistance then the top of the larger descending channel(red) should prove to be too much. The market can only go higher if buyers are willing to buy higher, yes buyers are willingly to get in at 6k, but will the demand still be there at 10k or higher? Will early investors take the opportunity to sell at higher prices? I still think this market will see 5k.

ETHUSD - ETHEREUM flakes out! Bulls away getting takeouts!Ethereum has failed us at $1000 and has consolidate below after rejecting the 20 MA on the 4hr chart.

We now have a lot of bearish signals from both candlestick patterns as well as the indicators.

As we mentioned last week Ethereum was correcting but still bullish above $1000, not that support has failed and we will look towards lower prices to jump into the market again.

At the moment $900 is acting as very short term support, but will surely break if this momentum continues.

It is very dangerous to call bottoms in crypto markets, those that wish to play “catch the knife”, could be wise to stack buy orders in the $600 – $800 zones.

If we see some decent increase in ETHUSD trading volume we might get the bounce from the $800 – $950 zone, but this is High Risk zone and I would advise you to manage your capital and your Risk/Reward accordingly.

At this point the bulls need to capture $1100 if ETHUSD is going to recapture its bullish momentum.

Come chat with me at the Best Crypto Trader Hangout here .

Buy the dip in ripple once the storm is overLast year cryptocoins have made spectacular returns, now the market is cooling down. Fear, uncertainty and doubt are controlling the market. The bears are still in the game. I believe we are first heading to lower levels before the tide can turn into favor of the bulls. I sold the bounce back up a few days ago once i realised the party is over for now. Made the mistake not selling in December. For the last 4 years every January there is a dip. Sell in December and come back in ... ? On a fundamental point of view i do like ripple a lot. I'm going to wait some more till the storm is over.