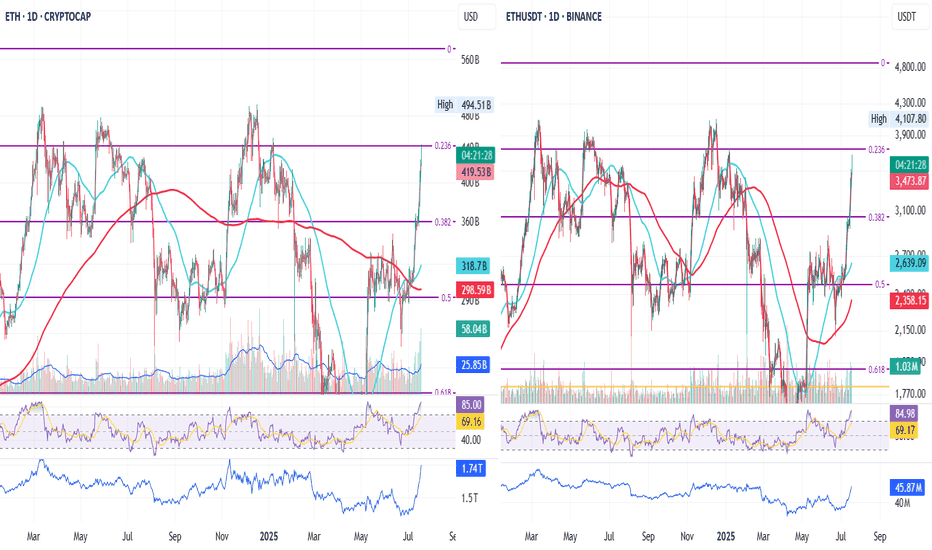

Ethereum's Path to $53,000: Multi-Year Breakout Pattern?This is a long-term technical analysis chart for the Ethereum/TetherUS (ETH/USDT) pair, presented on a weekly (1W) timeframe and using a logarithmic scale. The logarithmic scale is important as it visualizes percentage-based movements equally, which is crucial for analyzing an asset that has experienced exponential growth over many years.

Crucially, the date on the chart is "Jul 20, 2025," which is in the future. This indicates the chart is not just an analysis of past events but a speculative forecast of future price action.

Key Elements and Pattern Analysis

The chartist has identified and drawn a classic bullish continuation pattern known as an Ascending Triangle. Let's break down its components:

The Prior Uptrend (The "Flagpole"): Before the triangle formation, there was a massive upward price move starting in 2020 and peaking in late 2021. This powerful uptrend is the prerequisite for a bullish continuation pattern.

The Ascending Triangle Pattern: This is the multi-year consolidation phase that has been forming since the peak in late 2021.

Horizontal Resistance: The top of the triangle is a flat resistance line drawn at the previous all-time high, marked with a label at $4,637.01. The price has tested this level and failed to break through it, establishing it as a significant supply zone.

Ascending Support: The bottom of the triangle is a rising trendline. The price has made a series of "higher lows" since the market bottom in 2022. This indicates that despite pullbacks, buying pressure is consistently stepping in at higher price levels, showing underlying strength.

The Projected Breakout and Target: The core of this analysis is the prediction of what happens next.

Breakout: The chartist predicts that the price will continue to consolidate within this triangle until approximately late 2025 or early 2026. At that point, it is projected to break out decisively above the horizontal resistance.

Measured Move Target: The extremely bullish price target of $53,255.61 is calculated using a common technical analysis technique called a "measured move." The height of the triangle at its widest part (from the low around mid-2022 to the resistance line) is measured and then projected upward from the breakout point. This results in the highly ambitious target.

Interpretation and Narrative

The story this chart tells is as follows:

After its parabolic run in 2020-2021, Ethereum entered a necessary, long-term consolidation period.

During this multi-year phase, it has been building a massive base of support, with buyers absorbing selling pressure at progressively higher prices (the higher lows).

The chartist believes this long period of accumulation will eventually resolve to the upside, with a powerful breakout above the previous all-time high.

Such a breakout would signal the end of the consolidation and the beginning of a new major bull market cycle for Ethereum, with a projected target far exceeding the previous peak.

Important Caveats

Highly Speculative: This is a long-term forecast. Technical patterns are about probabilities, not certainties, and they can fail. The future date and extreme target price highlight the speculative nature of this analysis.

Pattern Invalidation: The entire bullish thesis is invalidated if the price breaks down below the ascending support trendline. Such a breakdown would be a significant bearish signal, suggesting a major trend reversal instead of a continuation.

External Factors: This technical analysis does not account for fundamental factors, macroeconomic shifts, regulatory changes, or other black swan events that could dramatically impact the price of Ethereum.

In summary, the chart presents a very bullish long-term outlook for Ethereum, based on the formation of a classic ascending triangle pattern. It forecasts a multi-year consolidation followed by a powerful breakout and a new, explosive bull run to over $50,000. However, this should be viewed as one possible scenario among many, with its own specific conditions for validation and invalidation.

Disclaimer: This is not a financial advise. This analysis is purely for informational purposes and should not be considered as investment advice. Trading involves risk, and you should consult with a financial professional before making any decisions.

Cryptomarket

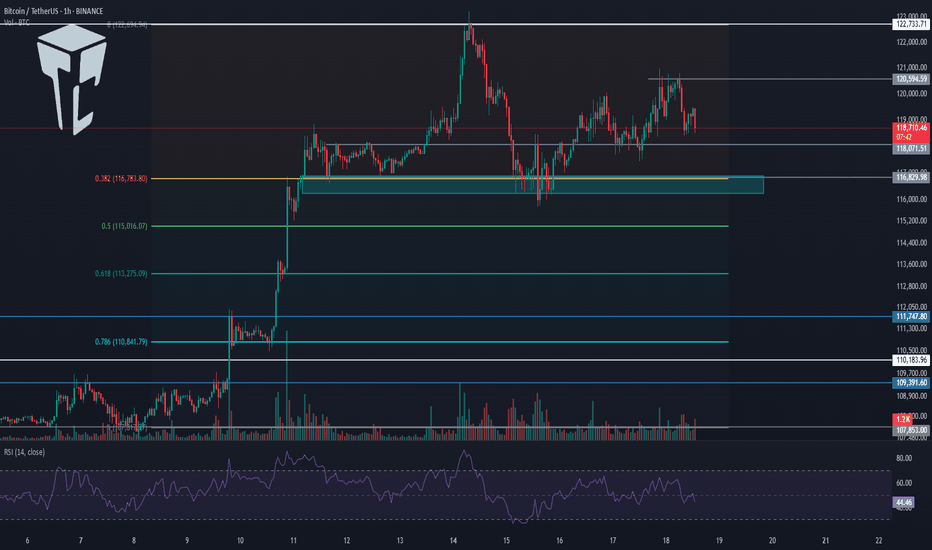

TradeCityPro | Bitcoin Daily Analysis #132👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis I’ll review the futures triggers for the New York session.

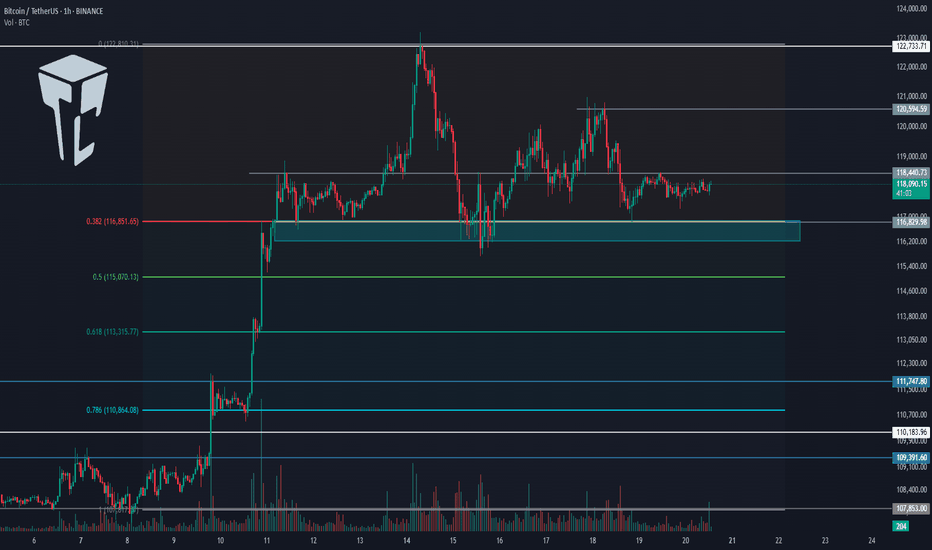

📅 1-Hour timeframe

On the 1-Hour timeframe, as you can see, Bitcoin is still holding the key support at 116829 and has been ranging between 116829 and 118440 since yesterday.

✨ Today, if the 118440 level breaks, we can open a solid long position. However, I still believe that due to Bitcoin Dominance being in a downtrend, altcoins are a much better choice for opening positions.

✔️ If you're only planning to trade Bitcoin, this trigger is suitable. The next entry points would be 120594 and 122733. If we open positions at all three triggers and the market moves upward, we can get strong risk-to-reward setups since we’ve entered with significant volume across three positions.

📊 If the 116829 level breaks downward, we might see sharper corrections. In that case, the next supports will be the 0.5 and 0.618 Fibonacci levels.

👑 BTC.D Analysis

Looking at Bitcoin Dominance, as you can see, the trend is heavily bearish and moving downward.

⭐ The downtrend in dominance is quite steep, and the next support we have is at 60.49. There’s still room for dominance to drop to this level.

📅 Total2 Analysis

Moving to Total2, yesterday the 1.46 trigger was activated and price moved to 1.5, and it is now sitting just below that level.

💫 If this level breaks, another bullish wave towards 1.62 could form.

📅 USDT.D Analysis

Looking at Tether Dominance, this index is also in a downtrend similar to Bitcoin Dominance, which shows that money is exiting both Bitcoin and Tether and entering altcoins.

🎲 So keep a close eye on altcoins in the coming days, because a lot of capital is flowing into them and they could see significant pumps.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

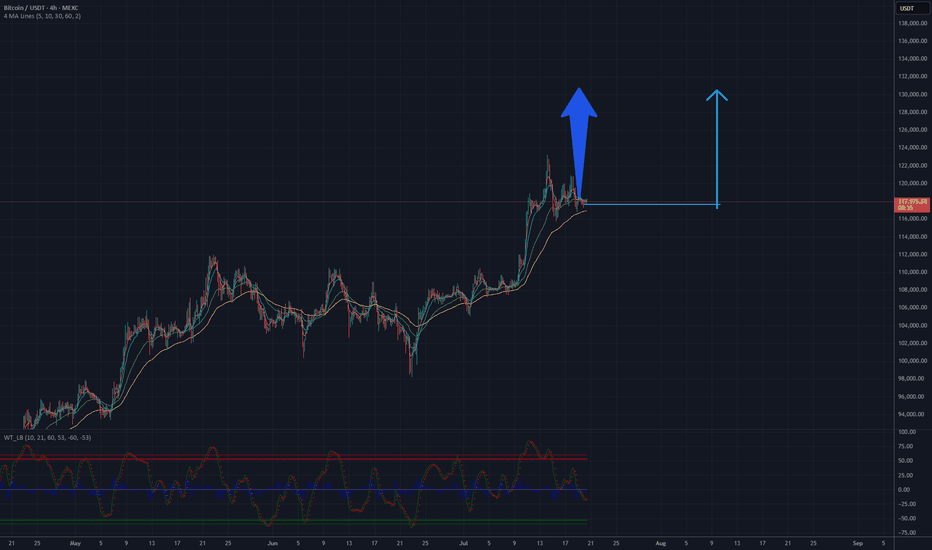

BTC will be 130 K USD? Potential target 130 000 USDAnalysis of the Bitcoin (BTC/USDT) chart on the MEXC platform indicates a positive upward trend. The price is currently hovering around $117,823, with clear support at approximately $100,000, as confirmed by the lower channel line. Moving averages (MA) suggest a sustained upward trend, and the trend line drawn from the lows points to potential for further growth. The current resistance is in the $120,000-$125,000 range, but if momentum holds and this level is breached, the price could head toward $130,000 in the short to medium term. It is recommended to monitor volume and key support and resistance levels to confirm further upward movement.

Potential TP: 130 000 $

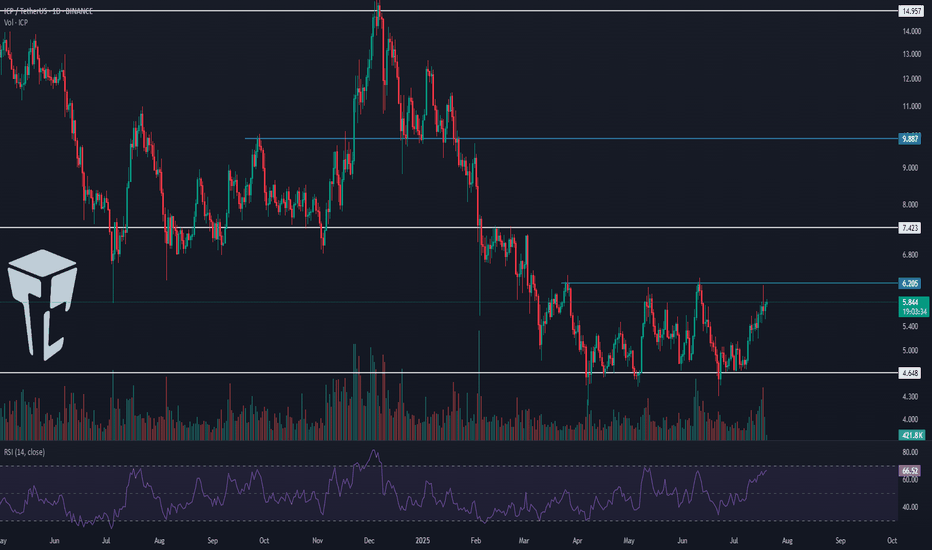

TradeCityPro | ICP Eyes Breakout as Altseason Speculation Grows 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ICP coin for you—one of the DePIN and AI-related coins, ranked 37 on CoinMarketCap with a market cap of 3.11 billion.

📅 Daily timeframe

As you can see on the daily timeframe, a ranging box has formed around the key support at 4.648, and price is fluctuating inside this box.

🔔 The top of the box is at 6.205, and price has touched it multiple times. It just wicked into it again and got rejected.

📈 This level has become a very important resistance. If it breaks, we can enter a long position—and it’s even suitable for a spot buy.

🛒 I already hold this coin in spot from lower entry points and don’t plan to increase my spot volume, but I’ll open a futures position if 6.205 breaks.

🔽 If Bitcoin Dominance moves downward, the 6.205 trigger will be a very good entry point. A break above 70 on the RSI will also be a strong momentum confirmation.

📊 If price gets rejected from the top of the box and drops to the 4.648 support, we can open a short position in lower timeframes. A break below 4.648 would confirm the bearish outlook.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Solana (SOL/USDT) 4H Reverse H&S PatternSolana (SOL/USDT) – 4H Market Outlook | July 1, 2025

Introduction

SOL has formed a reverse head and shoulders pattern, followed by a clean breakout above resistance. While the lower time frame is bullish, the higher time frame remains bearish, creating a short-term opportunity within a broader downtrend.

Context 1: Key Zones

Supply Zone: 176 – 187

Demand Zone: 126 – 143

Psychological Levels: 140 and 160

Context 2: Technical Structure

Pattern: Reverse Head & Shoulders

Breakout: Confirmed above neckline/resistance

FVGs:

One below price (within demand)

One above price (potential target)

Golden Pocket: Sits just above lower FVG and inside demand — strong confluence support

Context 3: Volume Insight

OBV Indicator: Shows a sudden volume spike, adding strength to the breakout and the bullish pattern confirmation.

Bullish Scenario

Price pulls back into the golden pocket + FVG + demand zone

Finds support → bounces to form higher low

Second leg of the move breaks swing high → targets upper FVG and 160 psychological level

Bearish Scenario

Price breaks back below demand zone and invalidates the golden pocket

Fails to hold structure → reverts to macro bearish trend

Potential retest of previous swing low below 126

Summary

SOL is showing bullish momentum on the 4H after completing a reversal pattern and spiking in volume. A pullback into the demand zone confluence may offer a strong long setup — but failure to hold could revalidate the higher timeframe downtrend.

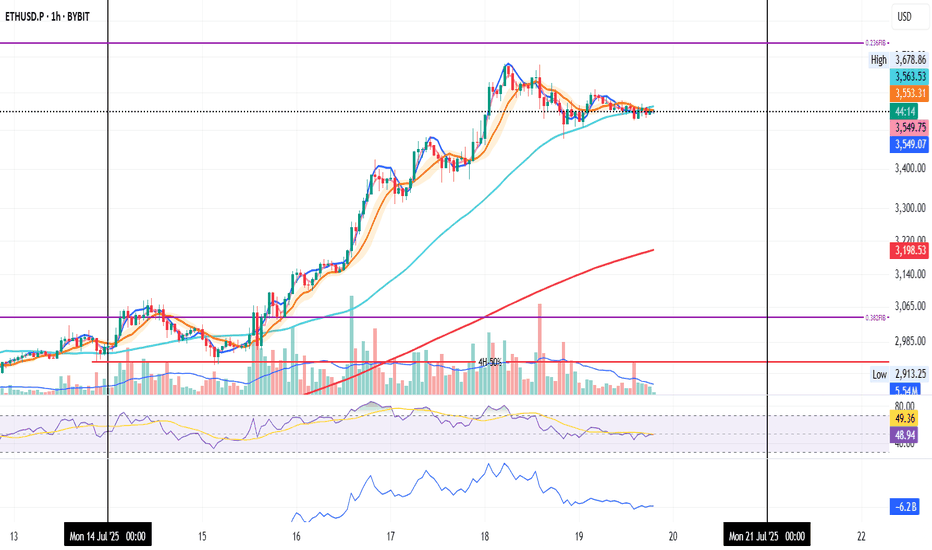

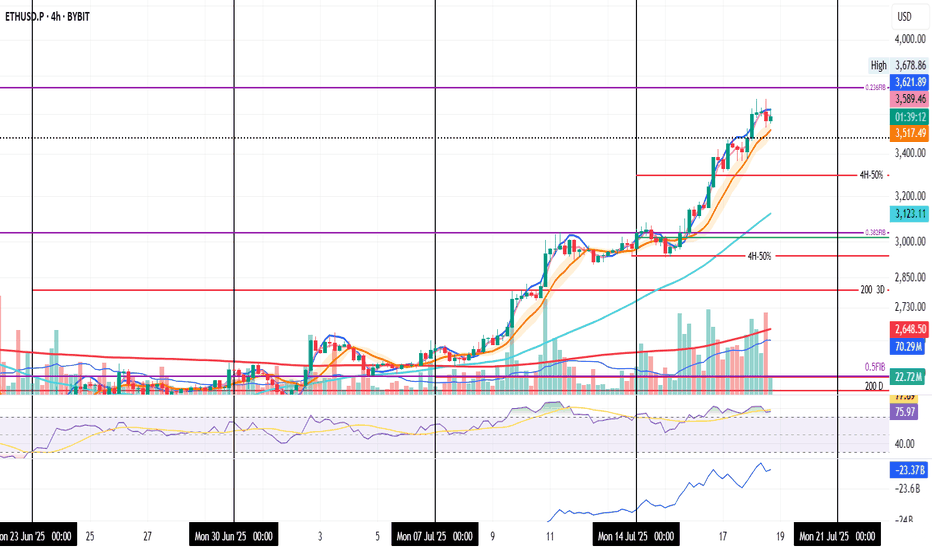

ETH on the 1H timeframe

Indicators are showing slight weakness:

MLR < SMA < BB Center

Price is trading below the 50MA

RSI is under the midpoint, and green volume is fading

This could just be a pause before the next leg up

but I’m curious whether the last high of $3,678.86 was this week’s top,

or if price will try to break it tomorrow.

Always take profits and manage risk.

Interaction is welcome.

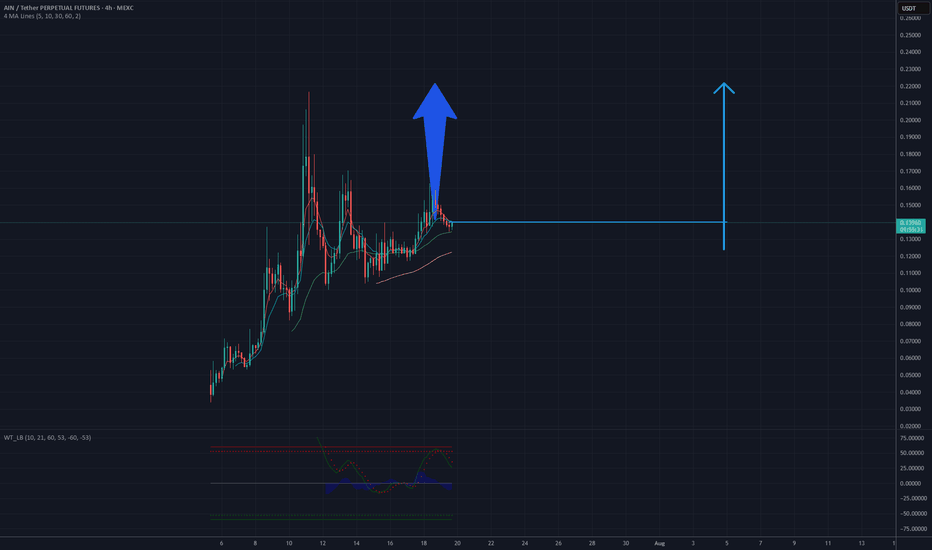

It's a time for AINUSDT! 0.22 USD will be soonAnalysis of the AINUSDT chart on a 4-hour timeframe suggests potential for an upward move. The current price is near a support level around 0.13 USD, where consolidation is observed after a previous decline. The upward price movement from the lows, supported by an ascending trendline and a break above resistance near 0.15 USD, indicates a possible continuation of the trend. If buying pressure holds, the price could test the resistance level around 0.22 USD, which would align with a projected increase of approximately 69% from the current level. Key support to monitor is 0.13 USD, with a break below potentially invalidating this scenario.

Potential TP: 0.22 $

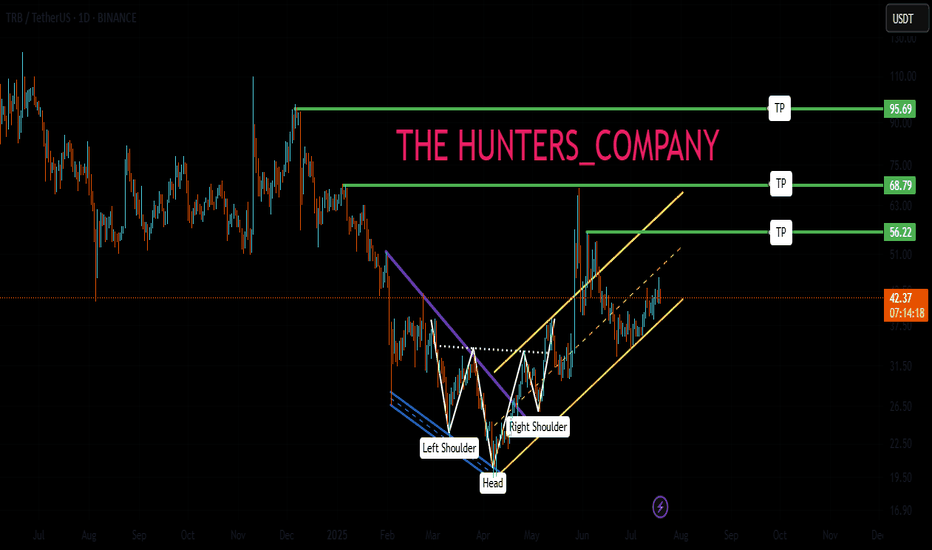

TRB : FREE SIGNALHello friends🙌

📈Given the price reaching its bottom and the buyers supporting it, you can see that a classic head and shoulders pattern has formed and buyers have entered. For this reason, you can buy with capital and risk management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

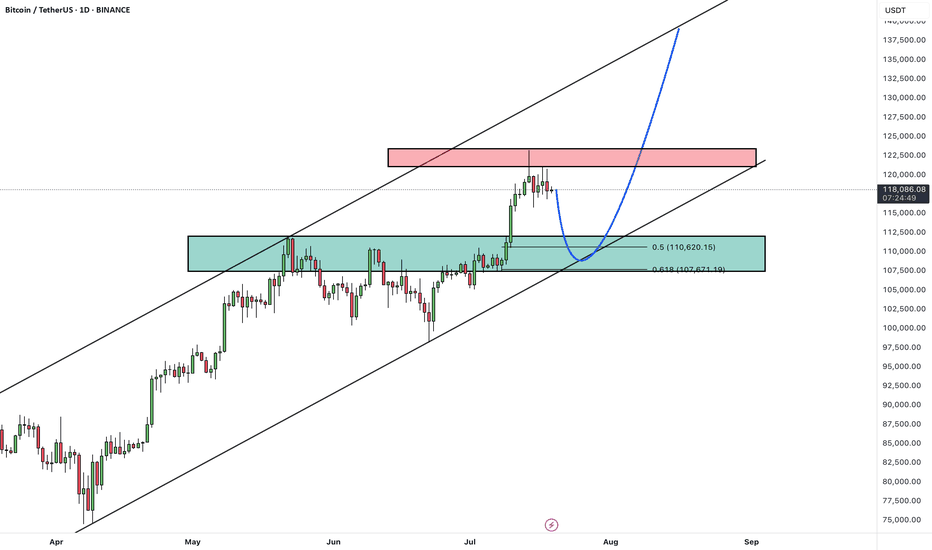

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin has recently posted a new all-time high and is now undergoing a healthy correction. This pullback is expected to extend toward a key support zone, which aligns with both the previous breakout level and the bottom of the ascending channel.

Once the correction is completed near the channel support / previous high, we anticipate a bullish continuation.

The next leg higher could take Bitcoin toward the upper boundary of the current channel.

As long as price remains above the key support area, the overall structure stays bullish and this correction is likely to be a buy-the-dip opportunity within a broader uptrend.

Will Bitcoin use this pullback as a launchpad for new highs? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

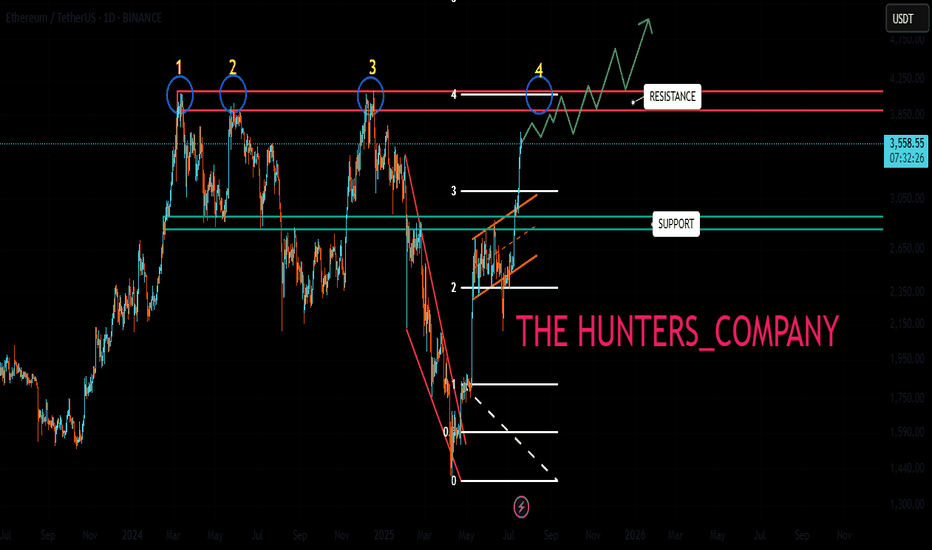

ATH FOR Ethereum!!!Hello friends🙌

As you know, Ethereum has been on an upward trend these days and we can say that buyers have entered, but not completely...👀

🔊Now, considering the resistance that Ethereum is facing, namely the number 3900 to 4100, we need to see what reaction the price will see this time when the price reaches this resistance for the 4th time?

✔We will most likely make a small correction and this time this major resistance will be broken again and we will witness a higher ceiling.

✔Otherwise, I have an important and key support that we have identified for you and if the price drops, this support is a good area to buy again.

And finally, observe risk and capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

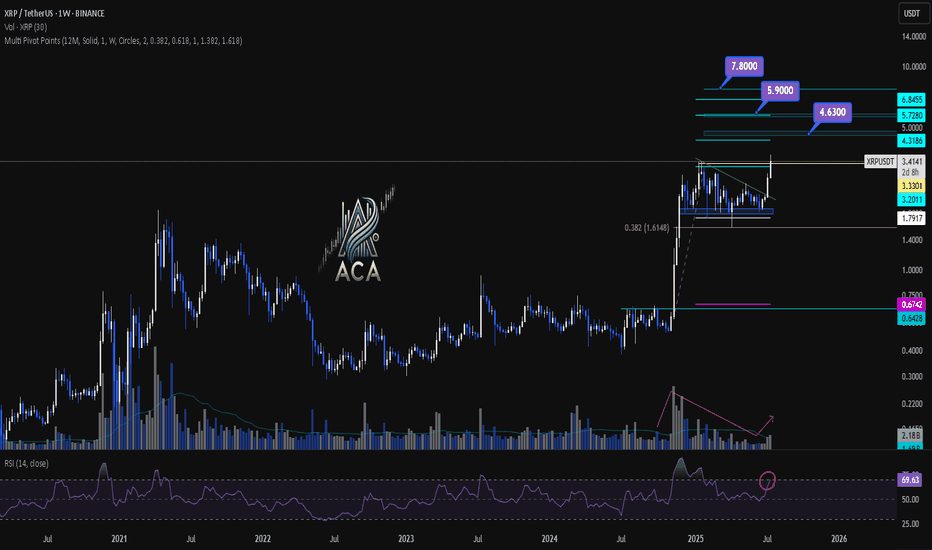

XRP : ETF...Hello dears

Considering the good growth we had, you can see that the price is stuck in a long-term range and has not managed to break it yet...

We must be prepared for any scenario, so the best thing to do is to buy stepwise, of course with capital and risk management.

Note that this analysis is on a daily time frame and may take a while, so if you are not patient, do not enter.

*Trade safely with us*

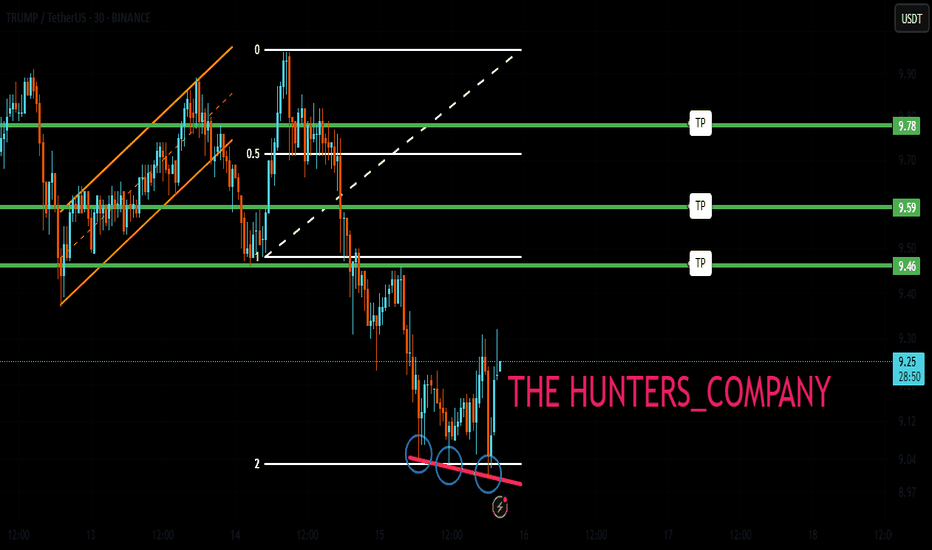

TRUMP UPDATEHello friends🙌

👀You can see that the price formed a reversal pattern after falling at the specified support and the buyers supported it.

⚠Considering the entry of buyers, the price is expected to move to the specified targets, of course, don't forget about capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

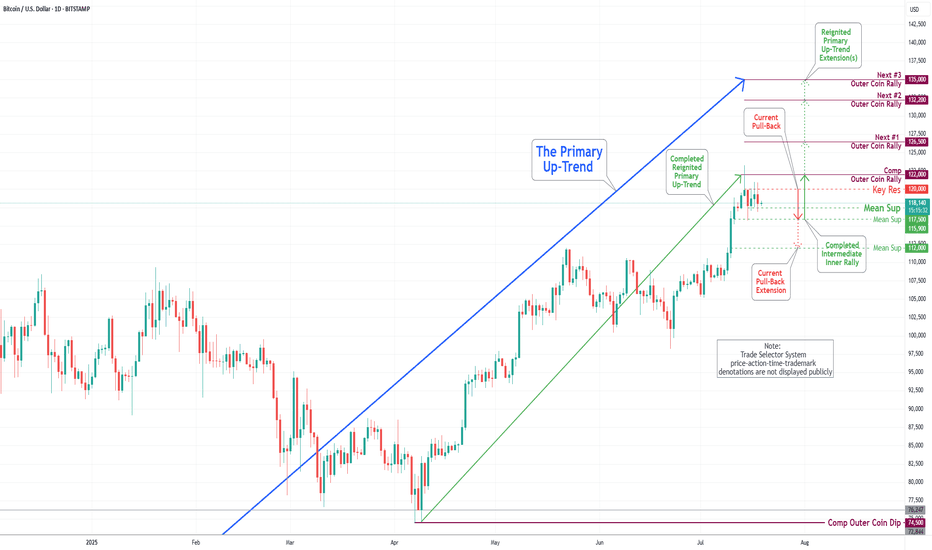

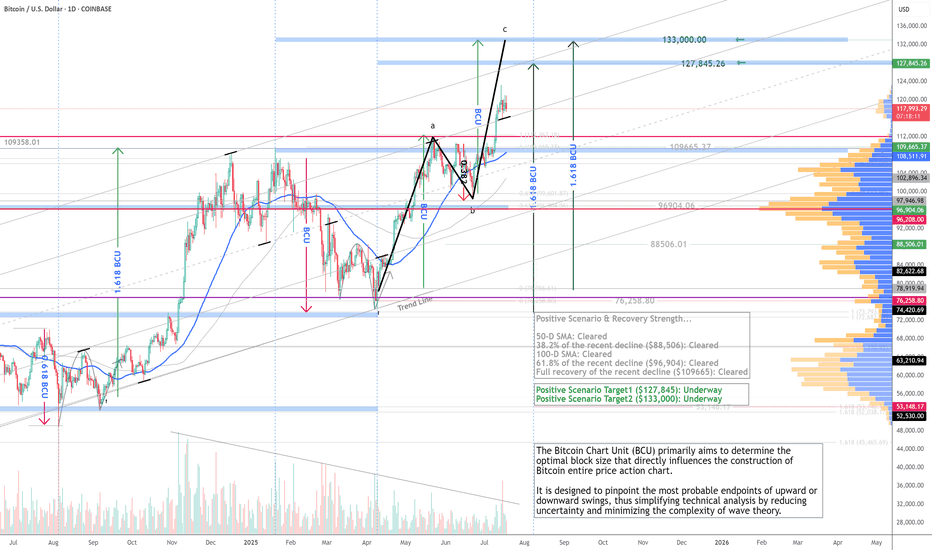

Bitcoin(BTC/USD) Daily Chart Analysis For Week of July 18, 2025Technical Analysis and Outlook:

In last week's trading session, we achieved a new historical high by completing our Outer Coin Rally at 122000. Following this milestone, the coin retraced, as expected, to the newly established Mean Support at 115900 and is currently trading at the Intermediate Mean Support at 117500. Presently, the coin is set to retest the Mean Support at 115900, with the potential for a further pullback to the Mean Support at 112000. This anticipated decline will necessitate a retest for the completed Outer Coin Rally at 122000. The designated targets for the renewed Primary Up-Trend are 126500, 132200, and 135000.

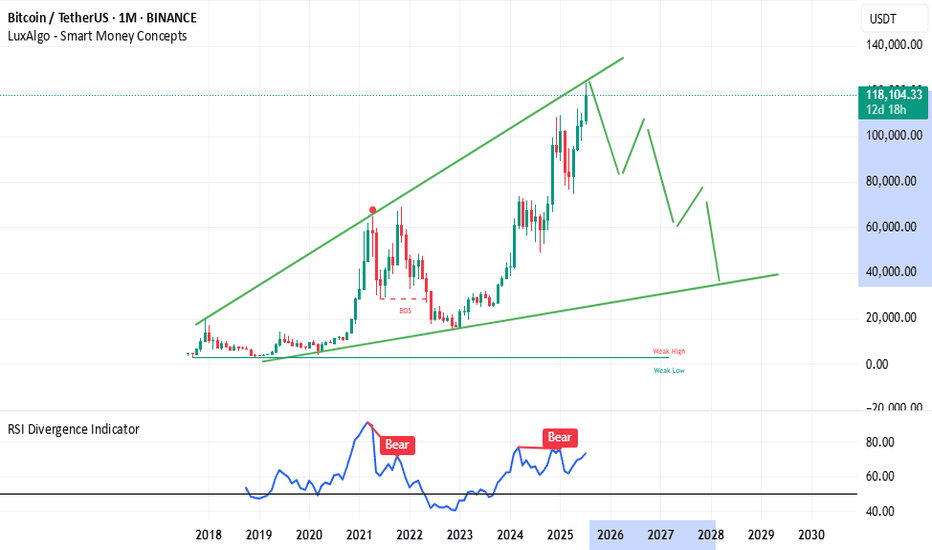

ETH Charging Familiar Resistance

We’re looking at ETH Cryptocap (left) and ETHUSDT (right), both on the daily timeframe.

ETH Cryptocap has just touched the 0.236 Fib level, and ETHUSDT is only a few dollars away from it.

Since March 2024, this level has consistently acted as resistance — each time price crossed it, it eventually retraced after hovering briefly above.

Will this time be different?

What’s clearly different now is volume : it’s rising along with price.

In the past 10 days, there’s only been one red volume candle, and even that was minor.

Meanwhile, RSI is firmly in the overbought zone.

I don’t know if ETH will go higher or start retracing, but I can prepare for both.

The simple solution: place a trailing take-profit order and let price move.

If it pulls back, I’ll lock in some gains.

If it keeps climbing, I’ll stay with the trend.

For me, everything else is just unnecessary complication.

Always take profits and manage risk.

Interaction is welcome.

ETHFI Coil Tightens Above Key SupportThis is ETHFI on the daily.

It’s currently consolidating above four major support levels:

• The black line at $1.097

• The 200-day MA

• The 50-day MA

• Bollinger Band center

A golden cross is approaching, and if price pushes higher, it could confirm soon. RSI is holding strong above both the 50 level and the signal line, suggesting bullish momentum is intact.

There’s also a bullish triangle forming between the series of lower highs and the $1.097 black line. Volume is decreasing, just as expected before a breakout. While breakouts can technically go either way, my bias remains bullish here.

From a fundamental standpoint, ETHFI benefits from the rising trend of restaking staked ETH, now regulated and attracting serious institutional interest.

Holding this support and completing the golden cross could be a volatile process, especially with ETHFI’s small $424M market cap and big macro events this week (like CPI and potential tariff news) on the radar.

Always take profits and manage risk.

Interaction is welcome.

*ETH 4H — Charging the 0.236 @3700$ETH on the 4H is getting ready to charge the 0.236 Fib level.

MLR > SMA > BB Center — momentum is aligned.

Volume confirms the move.

Even though I don't enjoy it — and last time I sold just a part of the position too soon —

I placed a partial TP again. It needs to be done. The market can always turn.

We’ll be here to see it unfold.

Always take profits and manage risk.

Interaction is welcome.

Wings of Opportunity: LINK’s Harmonic Setup Unfolding🦋 Title: A Butterfly on the Edge – But Only with Confirmation

On the 2H timeframe, a Bullish Butterfly Harmonic Pattern is unfolding. The wave structure (X → A → B → C → D) aligns closely with harmonic principles, and point D lies above X, within the 1.27 to 1.618 Fibonacci extension of XA — reinforcing the pattern’s validity.

📌 No entry has been triggered yet.

We are currently waiting for price to break and hold above the key resistance at 13.60 to confirm the bullish scenario.

🔹 Bullish Scenario (our primary and preferred outlook):

Given the strong reaction around the 12.74 demand zone and the harmonic structure completion, we are primarily focused on a long opportunity, if and only if confirmation is achieved above 13.60.

📥 Entry Zone: 13.05 – 13.65

🎯 Target 1: 17.94

🎯 Target 2: 18.76

🛑 Stop-Loss: Below 12.74 (structural invalidation)

🔻 Alternative Bearish Scenario:

If price fails to break 13.60 and instead loses the 12.74 support, the bullish setup becomes invalid, and the market could enter a deeper correction phase.

Potential downside targets in that case:

📉 11.80

📉 10.90 – 10.30 (if bearish momentum continues)

📊 Risk Management Notes:

Position sizing should not exceed 1% of total capital

Avoid early entries before confirmation

Prefer partial entries after breakout and retest

Stick to the invalidation level strictly

📈 While both scenarios are on the table, we are currently favoring the bullish setup, as long as price action supports it. Discipline and patience are key — confirmation first, trade second.

XRPUSDT Weekly Chart Analysis | Next Bullish MoveXRPUSDT Weekly Chart Analysis | Major Resistance Levels Align for Next Bullish Move

🔍 Let’s break down the XRP/USDT weekly setup, highlighting key technical signals and major upside targets for the next rally.

⏳ Weekly Overview

The weekly chart shows consolidation just below a major resistance, with price action tightening and preparing for a breakout. A recent correction found support near the 0.382 Fibonacci retracement level, which has acted as a springboard for renewed momentum. Notably, the R2 pivot point level aligns closely with this area, strengthening its importance as a decision zone for bulls.

🔺 Upside Targets & Confluences:

- First Target: $4.63 — This coincides with the R2 monthly pivot point and aligns with key Fibonacci extension targets, offering strong confluence for a reaction zone.

- Second Target: $5.90 — Our most realistic medium-term target, also backed by cluster resistance from both pivot analysis and fib projections.

- Final Target: $7.80 — This is the major Fibonacci extension level, marking the highest projected upside if momentum persists.

📊 Key Technical Highlights:

- Pivot Point R2 & Fibonacci Confluence: The R2 level reinforces a critical resistance, overlapping with the $4.63 Fibonacci target.

- Fibonacci Retracement: Price respected the 0.382 retracement during the latest correction, signaling healthy trend continuation.

- Volume Confirmation: An uptick in volume confirms that buyers are stepping in, supporting the bullish momentum.

- RSI Signal: RSI is entering the overbought zone, which typically indicates a strong surge in buying pressure and can mark the start of a momentum move.

🚨 Conclusion:

XRP is setting up for a major breakout as key technical levels align. Watch for a sustained move above $4.63 to unlock the $5.90 area, with a final potential push towards $7.80 if bulls maintain control. Volume expansion and an overheated RSI are both classic signs of an incoming momentum wave—keep your eyes on these levels for validation of the setup.

TradeCityPro | Bitcoin Daily Analysis #131👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll review the futures session triggers for New York.

⏳ 1-hour timeframe

Over the past few days, the market hasn't been very focused on Bitcoin, and altcoins have been moving more strongly to the upside.

⚡️ Bitcoin is still ranging between 116829 and 122733 and is fluctuating between these two levels.

💥 Currently, a local top has formed at 120594, and if that level breaks, we can open a long position. The main long trigger will be the breakout of 122733.

📈 If the market decides to correct, key support levels are 118071 and 116829. I’m setting the stop-loss for my previously opened positions below the 116000 zone.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. The reason I’m saying Bitcoin isn't currently the center of attention is exactly this dominance chart.

🔔 As you can see, BTC Dominance is in a very sharp downtrend with strong momentum, which means capital is flowing out of Bitcoin and into altcoins—giving us better long setups on alts.

✨ For now, I see the trend as bearish, and the next supports are at 61.34 and 60.49.

📅 Total2 Analysis

Total2 is still moving upward and has broken above 1.46, continuing its upward momentum.

✔️ The new top is at 1.5, and a breakout above this level can be used as a trigger for long entries.

📅 USDT.D Analysis

Let’s move to Tether Dominance. The 4.22 support was broken yesterday, and the index is now moving downward.

💫 The next support level is 4.08, and breaking that will confirm continuation of the downtrend.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.