TradeCityPro | Bitcoin Daily Analysis #130👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll go over the futures triggers for the New York session.

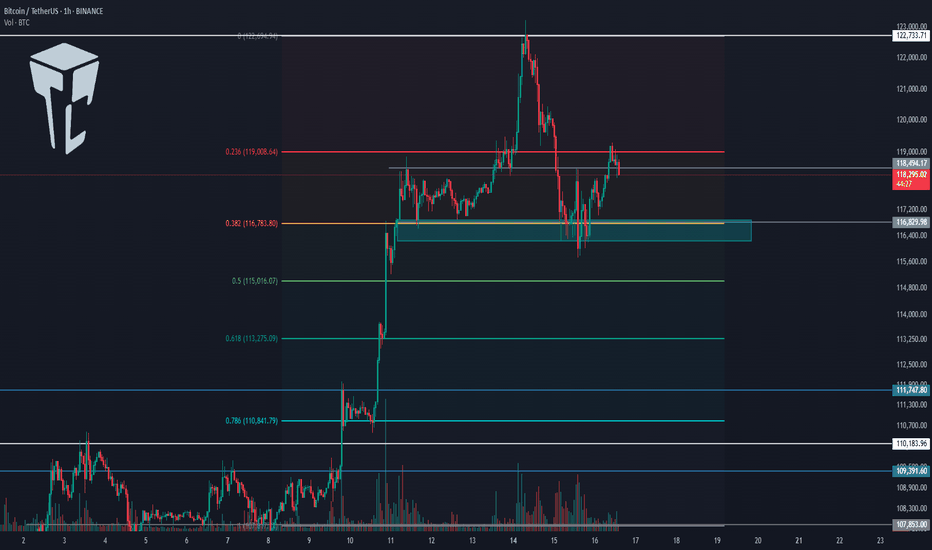

⏳ 1-hour timeframe

As you can see in the 1-hour timeframe, Bitcoin was supported at the 116829 zone yesterday and is now moving upward.

📈 The long position trigger at 118494 has been activated, and the price is currently pulling back to this level.

💥 The 0.236 Fibonacci level is right above the price, and if it breaks, the price can continue moving upward.

⚡️ The current local top is 122733, which can be the first target for the long position. Breaking this level would also be our main trigger for a long entry.

👑 BTC.D Analysis

Bitcoin dominance is still falling and has now confirmed below the 63.96 zone.

🔍 Currently, the trend is fully bearish, and breaking 63.50 will confirm continuation of the downtrend.

📅 Total2 Analysis

Total2 is rising alongside the drop in Bitcoin dominance and has confirmed above 1.33.

🎲 The next resistance is at 1.41, and the current uptrend can continue toward that level.

📅 USDT.D Analysis

Tether dominance has confirmed below 4.36 and is continuing its downward move.

✔️ The next support is at 4.22, and breaking this level would initiate the next major bearish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Cryptomarket

ETHUSDT 1D Chart Analysis | RSI Strength & Fibonacci TargetsETHUSDT 4H Chart Analysis | RSI Strength & Fibonacci Targets in Play

🔍 Let’s break down the latest ETH/USDT setup — bullish momentum is building with confluences pointing toward key upside targets.

⏳ 4-Hour Overview

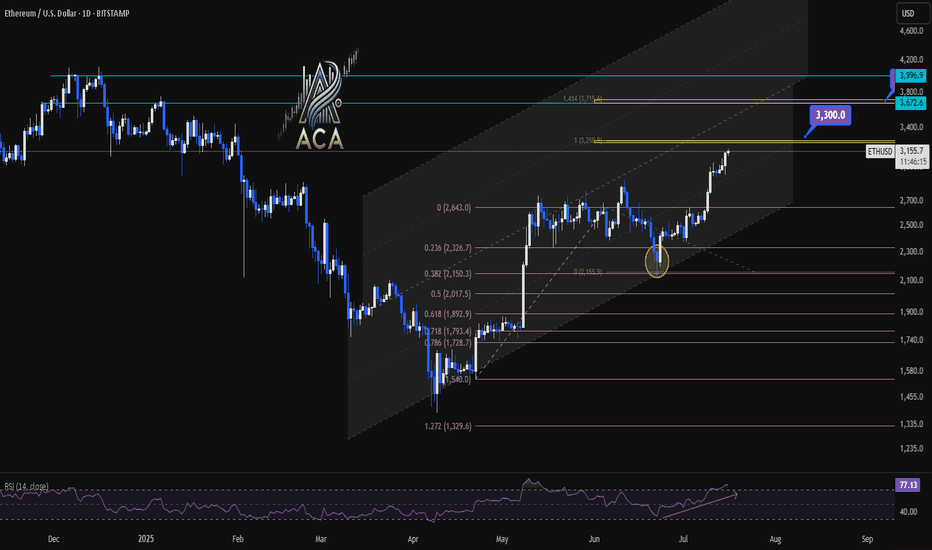

Ether continues climbing within a well-defined ascending channel, with recent candles holding above mid-level support. Price is pressing higher from a clean bounce at the 0.5 and 0.618 Fibonacci retracement zone ($2,017–$1,899), signaling the correction has likely ended.

📉 Fibonacci Levels & RSI Confirmation

- The strong recovery aligns with rising volume and a bullish structure.

- RSI is pushing into overbought territory (above 73), often a sign of strength during trends—not exhaustion.

- ETH is now positioned for a breakout continuation move if momentum holds.

🎯 Bullish Targets Ahead

- Immediate resistance: $3,300 (1.414 Fib extension + historical supply)

- Next major target: $3,700 (1.618 extension + upper channel confluence)

- Pullback zones: $2,950 (mid-channel) and $2,017 (Fib support base)

📊 Key Highlights:

- Price is respecting the rising channel structure — higher lows, higher highs in play.

- Volume supports the breakout narrative, rising on green candles.

- RSI breakout supports trend continuation, not exhaustion.

- Targets at $3,300 and $3,700 remain actionable on a confirmed breakout.

🚨 Conclusion:

ETH is showing a multi-variable bullish setup with clear continuation potential. A strong move above $3,300 could quickly send price toward $3,700. Pullbacks to $2,950–$2,017 could offer high-risk/reward re-entry zones. Momentum favors bulls — stay alert.

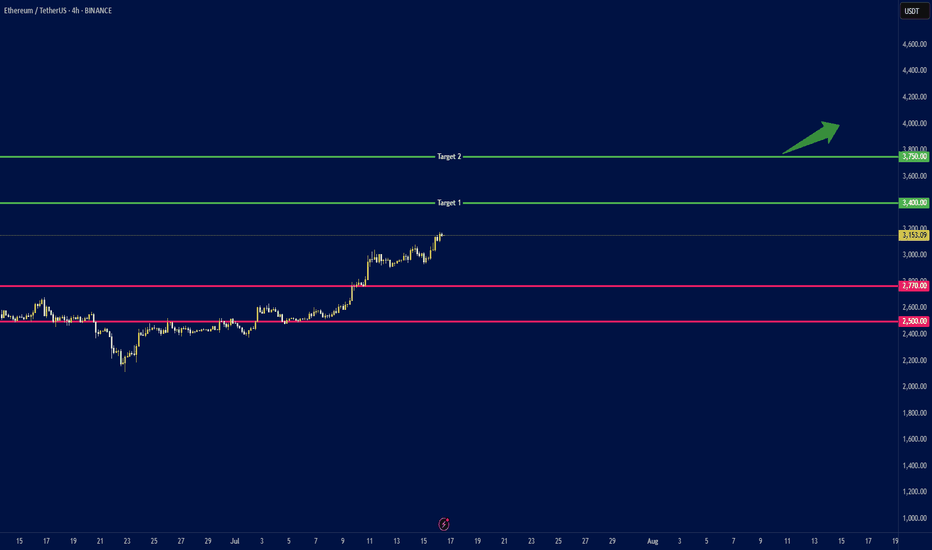

ETH to $4K ? Whales Accumulate as ETFs Break Records🕞 Timeframe: 4H

.

🟢 Bias: Bullish

1. 🧭 Fundamental Overview:

📈 Massive Institutional Inflows:

Ethereum ETFs have recorded over $1.2 billion in net inflows this July, with $908M just in the week ending July 11. This strong demand from institutional players (notably through ETHA and Bitwise) has pushed ETF AUM above $13.5 billion.

🏢 Corporate Accumulation:

Companies such as SharpLink Gaming have begun adding ETH to their balance sheets. SharpLink's 10,000 ETH (~$49M) purchase highlights growing corporate adoption of Ethereum as a store of value and strategic reserve.

🛠️ Ecosystem Resilience:

Ethereum continues to lead in network upgrades (e.g., Dencun), institutional DeFi, and tokenized assets—strengthening the long-term fundamentals of the chain.

2. 🧠 Sentiment & On‑Chain Metrics

🏦 Institutional Sentiment:

Ethereum ETFs have seen 12 straight weeks of inflows, outperforming Bitcoin in institutional allocation growth (ETH: 1.6%, BTC: 0.8%).

🐋 Whale Activity & Exchange Flows:

Declining ETH balances on exchanges suggest accumulation and reduced sell pressure. Whales and smart money are taking positions.

📊 Public Sentiment:

Bullish expectations remain strong amid price consolidation above key levels and positive ETF momentum.

3. 🔼 Key Levels:

Support: $2,770 and $2,500 (major trendline and psychological level).

4.🎯 Price Targets:

Short‑term (2–4 weeks):

If ETH breaks above $3,150: next targets at $3,400 and $3,750.

Medium‑term (by end of Q3 2025):

ETH could reach $3,500 with potential upside to $4,000.

.

.

.

⚠️ Disclaimer: This analysis is for educational purposes and not financial advice. Please do your own research and risk management.

.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

Bitcoin Ranges While Altcoins Rise — Follow the Liquidity TrailHeyy traders, it’s Skeptic from Skeptic Lab! 💙 Dropping a red-hot update on Bitcoin and the crypto market to catch the next big wave. We’re diving into the Daily timeframe and market dynamics to track where the money’s flowing. here’s the play:

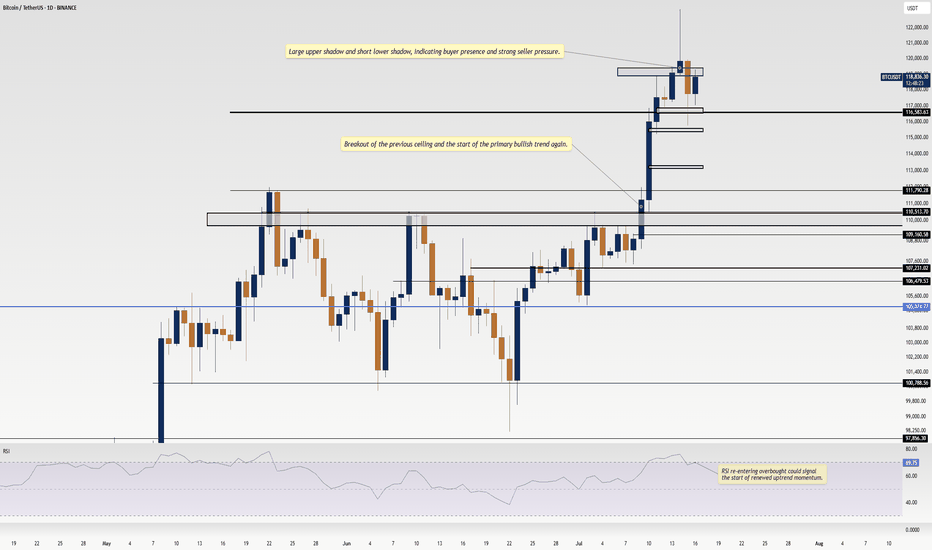

✔️ Daily Timeframe

As we flagged in my last Bitcoin chart, the $ 120,000 level is a liquidity magnet with heavy action. The July 14 candle tried breaking it but failed, leaving a downward shadow showing strong seller presence at this level. Plus, last week we hit the 4-week pivot point on the Weekly , and as expected, we’re now ranging around $120,000. Does this mean we ditch crypto? Big NO.

📊 Bitcoin Dominance (BTC.D)

Let’s zoom in on BTC.D —it’s gone sharply bearish, with yesterday’s candle screaming capital exiting Bitcoin. Traders who profited up to $120,000 are locking in gains and moving funds elsewhere. So, what’s the story?

Bitcoin broke its ceiling after 168 days, surging 10% to $122,000. Buyers took profits, pulling liquidity out.

Where’s the money going? Let’s test two theories:

USDT? Nope. USDT.D is also bearish.

Altcoins? Bingo! TOTAL2 (altcoin market cap) smashed its Daily resistance at 1.34 after months, signaling liquidity flooding into altcoins.

📉 Which Altcoins? Here’s the trick: check pair/BTC ratios . For example, to pick between Solana or Ethereum, compare S OL/BTC and ETH/BTC . The one with a stronger uptrend is soaking up more liquidity from Bitcoin.

🔔 Key Insight: This liquidity flow game is a game-changer for crypto traders. Want a full dominance tutorial? Let me know —it’ll show you how to track where the money moves and which coins get the most action.

🔼 Key Takeaway: Bitcoin’s ranging at $120,000, but altcoins are heating up as BTC.D drops. Hunt for altcoins with bullish pair/BTC charts to ride the liquidity wave. Risk management is your lifeline—cap risk at max 1%–2%. I’ll catch you in the next analysis—good luck, fam! <3

💬 Let’s Talk!

Which altcoin are you eyeing? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

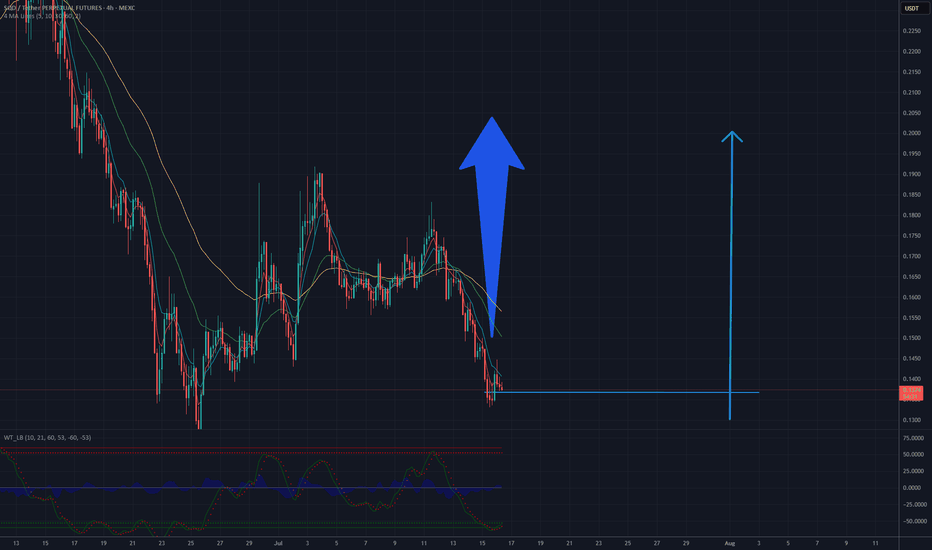

SQD/USDT – Bullish Reversal in Sight with Target at $0.20After a prolonged downtrend, SQD/USDT has reached a significant support zone between $0.13–$0.137, where a local bottom appears to be forming. The WT_LB oscillator is showing a positive divergence — price is making lower lows while the indicator is making higher lows — which often signals a potential reversal. The price is beginning to consolidate above the support, with early signs of strength emerging through small breakouts. If the pair breaks above the $0.15–$0.16 resistance range, momentum could accelerate, potentially driving the price toward the $0.20 target, aligning with the previous high from early July.

Potential TP: 0.20 USD

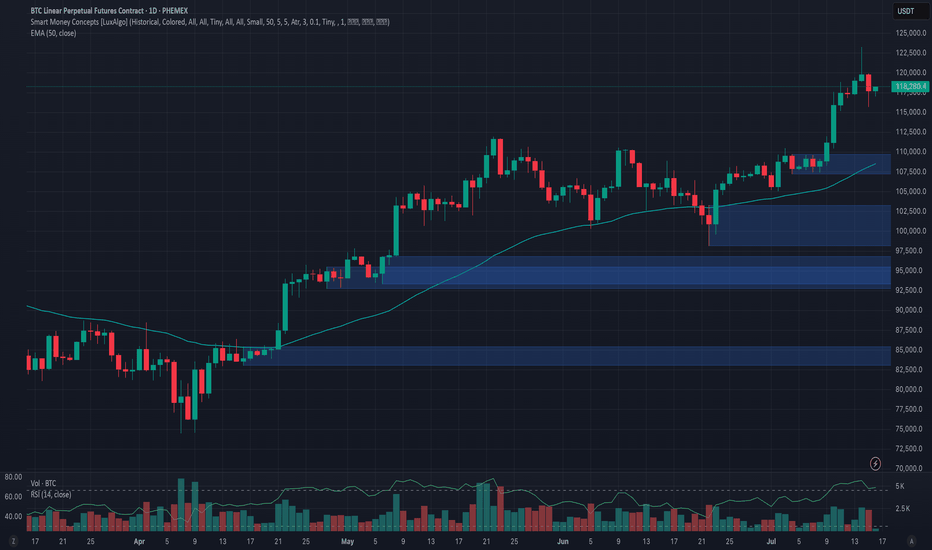

Phemex Analysis #97: What's Next for Bitcoin, After $123k?!Bitcoin ( PHEMEX:BTCUSDT.P ) recently made history by hitting an all-time high of $123,251 on July 14, 2025. However, enthusiasm was quickly tempered as BTC retraced by approximately 6%, dropping sharply to around $115,696 on July 15. Currently, the price has partially recovered and is trading at about $118,200.

With the market sentiment at a pivotal juncture following this volatile movement, traders and investors are carefully considering their next steps. Let's dive into several possible scenarios that might unfold in the coming days.

Possible Scenarios

1. Bullish Continuation (Breakout Above $123k)

If Bitcoin quickly regains bullish momentum, it may retest and surpass its recent high at $123,251. Breaking decisively above this resistance could trigger another strong rally, driven by renewed market optimism and potential institutional inflows.

Pro Tips:

Entry Strategy: Look to open or add to existing positions upon confirmation of a clear breakout above $123,251, especially if accompanied by high trading volume.

Profit Targets: Key resistance zones for profit-taking after a breakout include psychological levels at $128,000, and the significant milestone at $130,000.

Risk Management: Use protective stop-loss orders placed below the recent low around $115,000 to manage downside risks effectively.

2. Extended Consolidation (Range-Bound Scenario)

Bitcoin could enter a period of price consolidation, fluctuating between support at approximately $115,000 and resistance near $123,000. This scenario often occurs when the market awaits clearer directional cues.

Pro Tips:

Range Trading: Employ a grid-trading strategy, placing buy orders near support ($115,000–$116,000) and sell orders around resistance ($122,000–$123,000) to maximize profits from short-term volatility.

Monitoring Indicators: Keep an eye on declining trading volume, which often signals the potential for an upcoming breakout or breakdown.

3. Bearish Pullback (Correction Scenario)

Given the rapid recent surge to all-time highs, a deeper market correction remains possible. If BTC decisively breaks below support at $115,000 with strong selling pressure, further declines towards $107,218 or even $98,132 could ensue, especially if accompanied by negative broader market sentiment.

Pro Tips:

Short Opportunities: Experienced traders might explore short positions if BTC convincingly breaks below the $115,000 support level.

Accumulation Strategy: Long-term investors can strategically accumulate positions around significant lower support levels such as $107,218 and $98,132, provided price stabilization signals are evident.

Conclusion

Bitcoin is currently at a crucial technical and psychological level after hitting its latest all-time high. Traders should closely monitor the outlined scenarios—particularly watching key resistance at $123,251 and essential support at $115,000. By utilizing disciplined risk management, proactive profit-taking strategies, and careful market analysis, investors can effectively navigate BTC’s ongoing volatility and strategically position themselves for the next significant move.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Volume Spread Analysis (VSA) reflects increasing selling!🚨 Bitcoin Market Update 🚨

Bitcoin recently hit an All-Time High (ATH) but is now experiencing a downward correction. Multiple technical indicators suggest continued bearish momentum:

📉 Volume Spread Analysis (VSA) reflects increasing selling pressure.

📊 A bearish engulfing pattern confirms the market is trending lower.

📕 The synthetic order book reveals a heavy concentration of sell orders.

📈 The 50 & 100 SMA are acting as strong resistance levels, keeping price action suppressed below them.

🔍 Key Watch Level: If BTC breaks above the 50 SMA, we could see a potential pump. However, as of now, all confirmations point toward a bearish continuation.

💡 DYOR – Do Your Own Research

🛑 Not Financial Advice

Bullish Outlook for Ethereum (ETH/USD)The chart shows a **bullish outlook for Ethereum (ETH/USD)** on the 1-hour timeframe, suggesting a potential continuation of the uptrend after a recent breakout.

Chart Breakdown:

* **Current Price:** \~\$3,038

* **Key Levels:**

* **S1 (Support 1):** Around \$2,996 — a key breakout and retest level.

* **S2 (Support 2):** Around \$2,945 — secondary support and accumulation zone.

* **EMAs:**

* EMA 7: \$3,023

* EMA 21: \$2,996

* EMA 50: \$2,970

The price is currently above all three EMAs, signaling **short-term bullish momentum**.

Bullish Scenario:

* The price recently **broke out above a strong resistance zone (\~\$2,996)**.

* If ETH successfully **retests and holds S1 as support**, we could see a continuation move toward:

* **\$3,080 → \$3,120 → \$3,160** as short-term targets.

* The green path suggests a **healthy pullback and continuation pattern**, which aligns with bullish market structure.

Invalidation/Bearish Scenario:

* A **break below S1 (\$2,996)** may shift bias toward S2 (\~\$2,945).

* Loss of S2 support could open the door for deeper correction..”

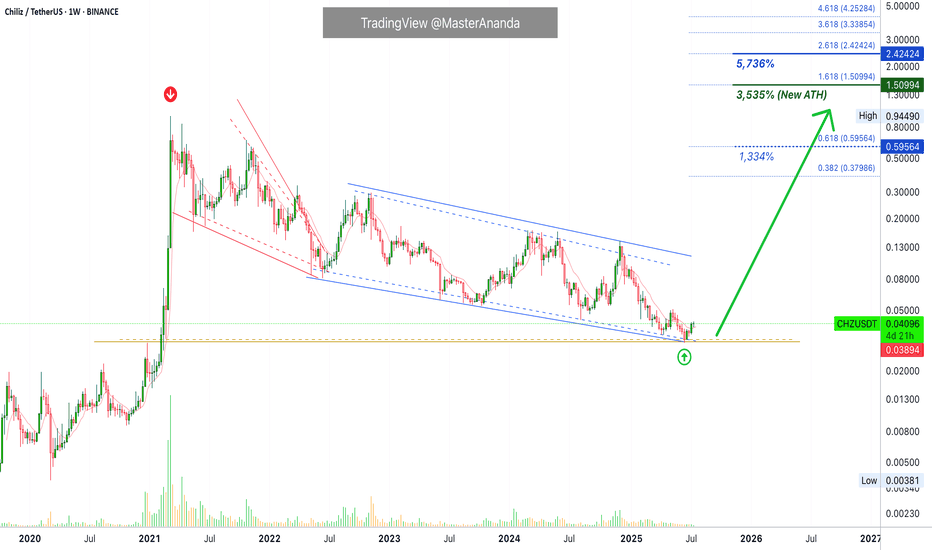

Chiliz Hitz Bottom · Opportunity Buy Zone (PP: 3,535%)Chiliz is trading at a true bottom right now after producing the lowest price in more than three years. The lowest since February 2021. No need to worry though, an early recovery is already happening and we are sure the bottom is in.

The past three weeks have been green while CHZUSDT managed to close above EMA8. This means that the trend is changing or is about to change and we know it will change because we are right in front of the 2025 altcoins bull market. Chiliz will not stay behind, it will also grow. We don't know how strong but there is plenty of room for rising prices. You will be surprised by what the market does.

What the market does is to condition you in some way. First, you become conditioned to seeing higher prices, unlimited potential and that's the start of the bear market, long-term a downturn. But this isn't the end.

When you are conditioned to seeing the market go down, more down; down, down, down, forever more, then it changes suddenly, as if by surprise and prices start to grow. The growth feels strange because it is something not seen in a while and we wonder, will it last? I don't know.

That's the first answer if you don't have access to years of data and this amazing chart.

Seeing the chart long-term coupled with marketwide action and what Bitcoin does, yes, the market growth will last a long time because an uptrend means higher highs and higher lows.

Right now we are looking at the best possible entry prices, an opportunity buy-zone. Buying now can result in incredible gains in the coming months.

Thanks a lot for your continued support.

Namaste.

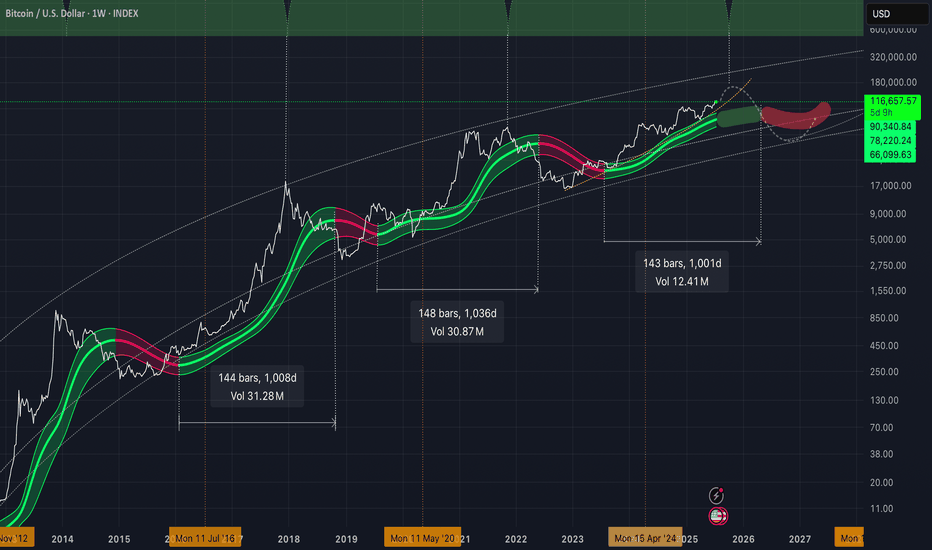

Gaussian suggesting the last leg to the upside!As we approach close to the ~1000 days of bull market conditions above the green GC. Volatility to the upside should be coming before peaking at some point probably in October. Make sure to sell some coins before we get back to the core of the Gaussian. We could be seeing the price tank from 40k-50k later next year. Cheers!

DOGS BUY !!!Hello friends🙌

📉Regarding the price drop, you can see that the price has been suffering for a while and even the resistance has broken, which is not a valid failure (80% of failures are fake in the range)

📈Now, with the successful failure we had and the moneyback that the price has made, we can expect the price to move to the specified targets. Note that for trading, be sure to observe capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

BITCOIN UPDATEHello friends🙌

📈Given the upward trend we had, you can see that the price is in an upward channel and has also formed a bullish pattern, which, given the strength behind the trend, seems to have higher targets.

🔊Be careful, the basic principle of trading is capital management, so be sure to follow capital management.

🔥Join us for more signals🔥

*Trade safely with us*

Is Pepe growing? Read the caption, it's important.Hello friends🙌

✔Some factors caused the price to fall, but in a support area that we have drawn for you with several Fibonacci waves, you can see that a classic double bottom pattern has been formed and buyers have entered.

🔊Now there is no more news of a fall and buyers have raised the price to the point where it has created a higher ceiling and floor, and this is very important and signals a change in trend.

📈Now that the price has broken the specified resistance line and is well supported by the specified support line, we can expect the price to move to the specified areas, but do not forget that the most important thing to observe in trading is capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

NEON : How long does the decline last?Hello friends

If you are a holder of this currency or have bought it, you should know that the token release is coming and this will cause the price to drop, so be careful.

We have identified good buying ranges for you, where you can buy in case of a drop, with risk and capital management.

*Trade safely with us*

AGI : The fall is comingHello friends

As the price has reached a strong resistance area, you can see that the price has been corrected and lower lows have been made. Now, given the token release that this currency has, there is a possibility of further decline, so we can buy at lower points with capital and risk management and move with it to the specified targets.

*Trade safely with us*

LITCOIN : So what is an ETF ?Hello friends

Be careful with the recent fluctuations of this coin because the movements of this coin have become unpredictable and we suggest that if you want to buy, buy in the specified support areas and in steps, of course with capital and risk management...

We have also specified targets for you.

*Trade safely with us*

NOTCOIN AGAIN ...Hello friends

Due to the change in the bearish structure and the weakness of the sellers, you can see that the buyers entered and were able to create new ceilings.

Now, according to the trend, we can buy in steps at the specified support points and move with it to the specified targets.

*Trade safely with us*

Solana:Daily free signalhello friends👋

As you can see, after the drop that we had, insider buyers showed and were able to support the price well.

But it was not enough, and as you can see, a noisy pattern has formed, which can indicate a further decrease in the price.

Now we can take advantage of this opportunity and make step-by-step purchases with risk and capital management in the support areas that we have obtained for you and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

Ethereum:Daily signalhello guys👋

According to the drop we had, you can see that buyers came in and the price had a good growth, and after that a trading range was made in which the price got stuck.

Now, considering that the price is in the trading range and it seems that the buyers have shown their support, it is possible to step into the specified support areas with risk and capital management and move up to the set goals.

🔥Follow us for more signals🔥

*Trade safely with us*