Cryptos

Crypto Market Slows Down For A Pullback Within A Bullish TrendGood morning Crypto traders! Cryptocurrencies are coming slightly lower on the intraday basis due to stock market decline yesterday, but we still see them approaching support, so still be aware of a bounce and recovery at the end of the week or maybe next week because of an upcoming weekend. Crypto TOTAL market cap chart can be trading in wave »y« of a complex w-x-y correction in wave 4, unless it's a flat correction, but support is the same at 3.6T – 3.5T area, from where we may see a bullish continuation within wave 5.

SHIB/USDT: Shiba Inu Setting Up for a Bullish Reversal?Shiba Inu (SHIB) is currently trading around $0.00001208, showing signs of stabilizing near a key support zone after a recent pullback. The market appears to be forming a rounded double bottom pattern, which could evolve into a strong W-shaped bullish reversal if confirmed with volume and breakout above short-term resistance (~$0.0000135).

This level could be pivotal for long-term accumulation.

What to Watch

*Key Support Zone: $0.00001200 - price is holding this level firmly.

*Short-Term Resistance: $0.0000135 - a breakout could confirm bullish continuation.

*Indicators: RSI is cooling off after a high, which could provide momentum for a new leg up.

SHIB may be quietly setting the stage for a powerful recovery. This support level looks like a gift for those with patience and vision. DCA smartly, monitor dips, and don’t panic, because when this pattern breaks out, you’ll wish you had loaded up earlier.

This isn't about hype...it’s about positioning. Stay disciplined. Stick to your plan. SHIB might just surprise everyone again.

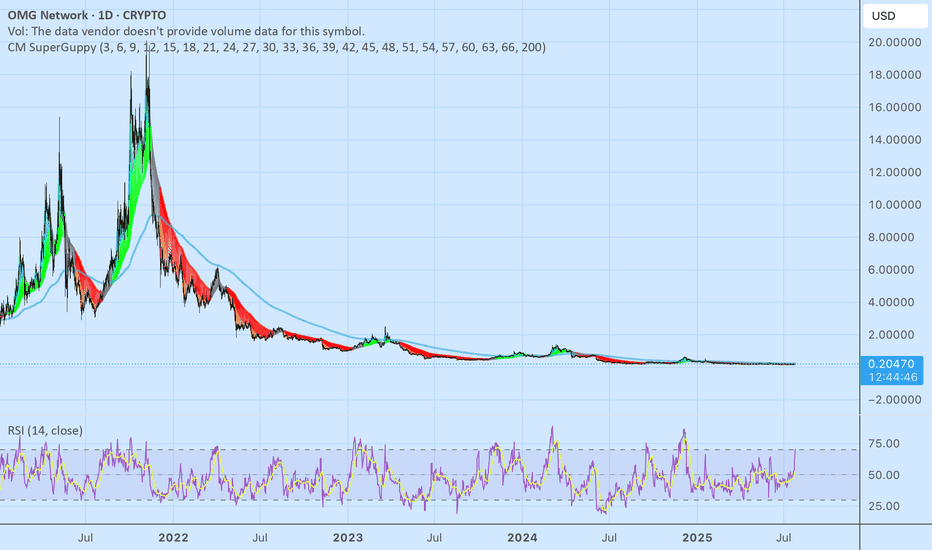

We might be changing the trend in the coming months!I found this indicator extremely accurate for the past tops. We are focusing on the histogram today and looking once that green candles starts growing momentum taking BTC down the hill. If this idea proves right we might be bottoming around 400 days perhaps August 2026 ~45k

BTCUSDT: Elliot Wave AnalysisAs you can see in the chart, the fourth wave has ended and there is a possibility of an increase in the next stage to the level between 128,000 and 131,000, followed by a correction for a larger fourth wave and finally the last leg of the increase to the fifth wave, which has the possibility of reaching 139,000 to 140,000.

CRV SHORT Update Hello.

CRV Update

💁♂️ TP1 🔥

You can see this analysis in the analyses I posted before. It has now reached its first target. Please don't forget to like, share, and boost so that I can analyze it for you with more enthusiasm. Thank you. 💖😍

✅ TP1: 0.93$ Accessible (done)🔥

TP2: 0.82$ Possible

TP3: 0.73$ Possible

ADA, long term dubious speculationWARNING: This idea is highly dubious!

This is a logarithmic estimate of potential targets, in case Cardano moves in long logarithmic measures.

The real potential of this idea is strongly linked to the fundamentals evolution on time, i.e.: FED reducing the interest rate, for instance, but not only.

The plot features top and bottom limits drown by hand!, these are not perfect logarithmic measures, thus they certainly lacks of math accuracy. Beware.

There are zones in red and green, as transparent boxes, which depicts potential zones of buy and sell interest, of course, everything is in a log scale.

Everyone wish these kind of scenarios to be true. Only time and reality will show us the true face of it. In any case, in the total chaos of uncertainty that this market is, we try to make a sense of it.

Best of the lucks for everyone.

T.

DISCLAIMER: Do your own research! This idea is not a financial advice. All the information presented is highly speculative and cannot be taken as a reference in any circumstance.

STELLAR LUMENS - DOLLAR COST AVERAGE FOR LONG TERM GAINSSTELLAR LUMENS (XLM) has taken off late 2024 from under .10 cents and now trading at .40 cents for a 400% Gain in 6 months so far, and there is much more upside to come potentially. It hit all time highs around .50 cents and now the token seems to want to test those highs in the near term 2025, we can easily see XLM approach $1.00 towards 2026 for a 100% gain and even higher longer term. Overall, XLM moves with XRP and we all know XRP is a blue chip project, it has all the funds and institutional backing, and so does XLM.

Both projects share a common creator in Jed McCaleb, however they have different focuses. Ripple, and its native token XRP, was initially designed to facilitate cross-border payments for financial institutions. Stellar, on the other hand, focuses on financial inclusion and aims to provide accessible financial services for individuals, including remittances and access to banking services.

CAN WE SAY BULLISH?! TO THE MOON!!!

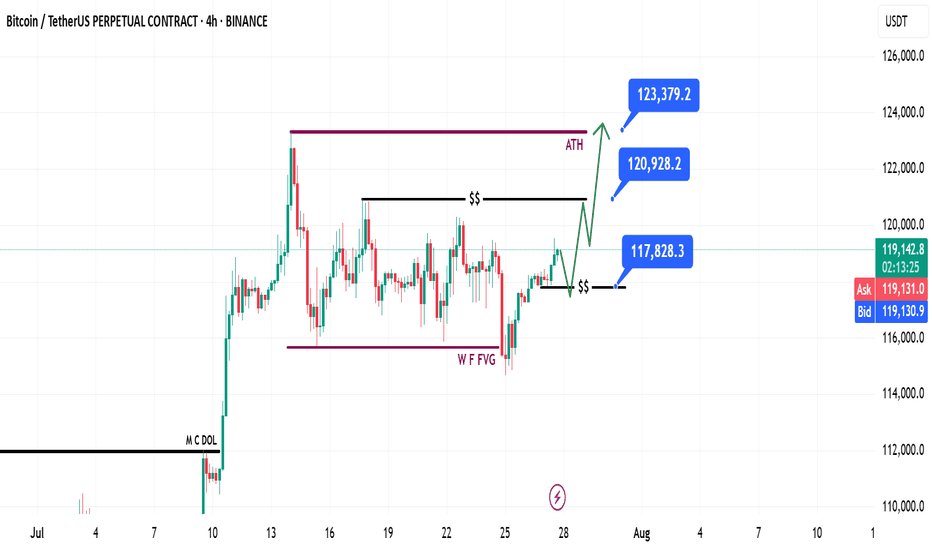

Bitcoin Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop.

Last week’s gameplan played out well — solid profits were captured (see linked chart below).

🧾 Weekly Recap:

• Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post.

• From here, I expect continuation toward new all-time highs.

📌 Technical Outlook:

→ First, I expect a short retracement and a 4H swing liquidity grab at 117,828$.

→ Then, a strong continuation move toward ATH targets.

🎯 Setup Trigger:

Watch for:

✅ 4H liquidity sweep

✅ 15M–30M bullish break of structure (BOS)

This is the confirmation zone for potential long setups.

📋 Trade Management:

• Stoploss: Below confirmation swing low

• Targets:

– 120,938$

– 123,400$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

BTCUSD 4HOUR TIME FRAME ANALYSISOverall Structure & Trend

Over the past several 4-hour candles, BTCUSD has carved out a series of higher lows around 116,500–117,000 and higher highs around 120,000–120,500, defining a gentle up-sloping channel.

The current price (118,758) sits just above the middle of that channel, suggesting there’s still room toward the upper trendline before meeting heavy supply.

Key Support & Entry Zone

Primary support lies at 117,200–117,500 (the former swing high from three bars ago), which also aligns with the 50% retracement of the move up from 114,500 to 120,500. That zone offers confluence for the 118,758 entry.

A secondary buffer sits at 116,849 (your stop-loss), just below the channel’s lower boundary—if price breaches here, the bullish structure would be invalidated.

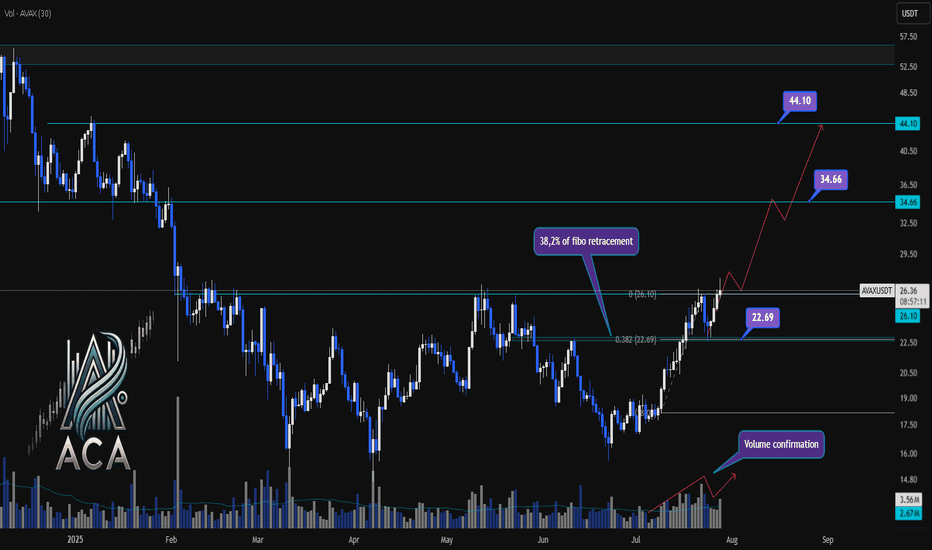

AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?

🔍 Let’s break down the AVAX/USDT setup, examining its technical structure and mapping out key opportunities as it gears up for a decisive move.

⏳ Daily Overview

AVAXUSDT has been exhibiting a bullish structure, recently reacting to the 0.382 Fibonacci retracement level (around 22.69USDT) where price paused for a correction. This correction was technically healthy, as it occurred with declining volume, while upward impulses were marked by notable volume surges—signaling strong bullish participation and confirming accumulation phases.

🔺 Bullish Scenario:

The next area to watch is the resistance at 26.10USDT, which has acted as a major barrier in recent trading sessions. A decisive daily close above this level—preferably supported by a clear uptick in volume—would confirm breakout momentum and set the stage for further advances.

Upon confirmation, the chart points to medium- and long-term targets at 34.66USDT and eventually 44.10USDT. These levels are derived from key Fibonacci extensions and historic price reactions, offering logical take-profit zones for trend-following strategies.

📊 Key Highlights:

- 0.382 Fibonacci level (22.69USDT) acted as a reaction zone and healthy correction point.

- Volume profile validates trend: increased buying volume during upswings, decreased volume on dips.

- 26.10USDT is the next crucial resistance for confirmation.

- Breakout (with volume) opens path to 34.66USDT and 44.10USDT targets.

- Failure to clear 26.10USDT could result in consolidation or another retest lower.

🚨 Conclusion:

All eyes are on the 26.10USDT resistance. Wait for a clear daily close and volume confirmation before considering entries. A breakout above this level could propel AVAXUSDT towards higher Fibonacci targets, while a rejection may prompt another retest of prior supports or consolidation.

Stay sharp and plan your trades with discipline!

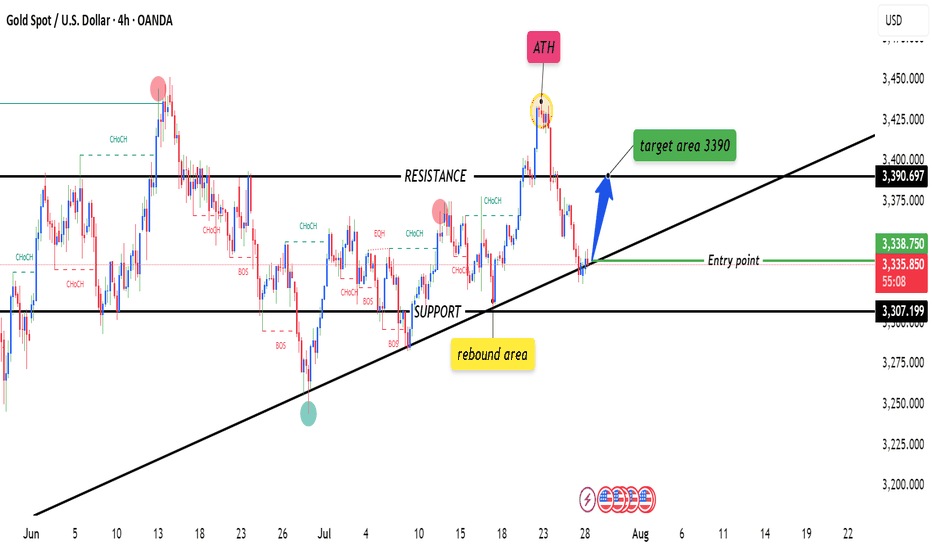

XAUUSD 4HOUR TIME FRAME ANALYSISOn the 4-hour chart, XAUUSD has recently pulled back into a well‐defined demand zone just above 3 330, offering a low-risk entry around 3 338. Here’s how the setup looks:

Trend Context

• Over the past week, gold has carved out a gentle up-slope, tracing higher highs and higher lows from 3 300 up toward 3 395.

• Price dipped back to test the rising 50-period moving average.

Key Levels

• Entry (3 338): Aligns with the confluence of the 50-period MA and a horizontal support zone (3 330–3 340), where buyers staged a rally earlier in the week.

• Stop-Loss (3 307): Placed just beneath the swing low at 3 315 and below the trendline connecting the last two higher lows—giving room for noise while protecting against a deeper reversal.

Momentum & Oscillators

• RSI (14): Currently around 45, rising from the 40 region. This suggests bearish exhaustion is waning and room remains before overbought conditions.

TON/USDT - Bullish Channel in H4 (27.07.2025)The TON/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3.770

2nd Resistance – 3.989

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

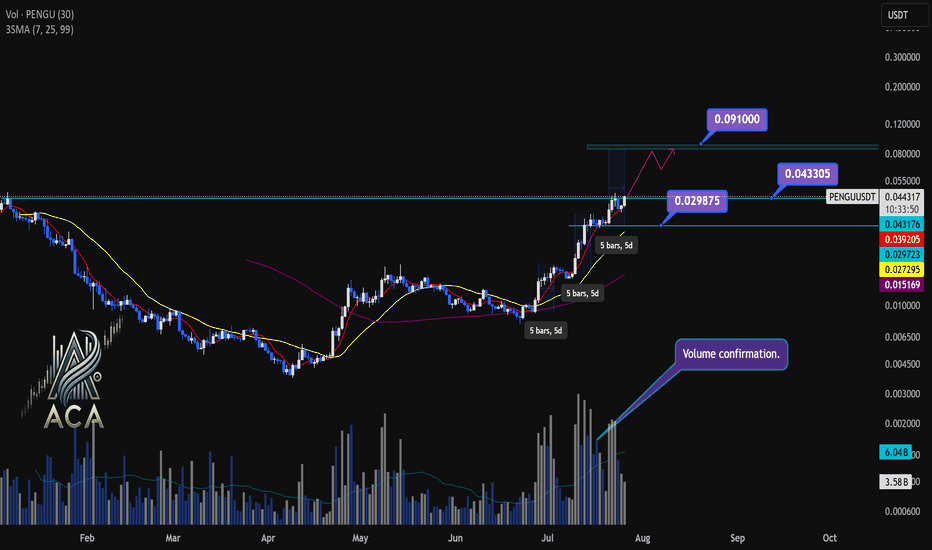

PENGUUSDT Daily Chart Analysis | Powerful Uptrend in PlayPENGUUSDT Daily Chart Analysis | Powerful Uptrend in Play

🔍 Let’s dissect the current PENGU/USDT daily chart, highlighting the unmistakable bullish structure and mapping potential targets as this trend matures.

⏳ Daily Overview

PENGUUSDT is riding a strong upward trend, with all three daily SMAs (7, 25, and 99) lined up in bullish sequence—clear confirmation of momentum. Recent rallies are also supported by textbook volume behavior: volume consistently surges during price climbs and tapers off during minor corrections, reflecting the classic signature of a robust uptrend.

🔺 Bullish Setup and Price Targets:

The next major upside target sits at $0.0910, almost 85% above the current level. For bulls, a daily candle closing above $0.043305 with convincing volume should act as a confirmation for fresh highs—though, as it’s Saturday, even moderate volume could suffice for a valid breakout.

📊 Key Highlights:

- All SMAs (7, 25, 99) confirming the uptrend on daily timeframe.

- Volume spikes on upward moves, fades on corrections—classic bullish confirmation.

- Historical trend velocity: Each time a new high (HH) is set, it’s preceded by around 5 days of advance; first leg was +83%, second +124%, the next (projected) is +160%, aligning with the $0.0910 target.

- Corrections: After each rally, pullbacks have measured about 15% and 20%. Should the first target be reached, expect a correction up to 25%—a healthy reset for further continuation.

🚨 Conclusion:

With all signals aligned—moving averages, volume dynamics, and historic price structure—the path remains bullish. A decisive close above $0.043305, especially with solid volume, could be the catalyst for the next major leg higher. As always, monitor for typical correction ranges post-breakout in line with the prior trend.

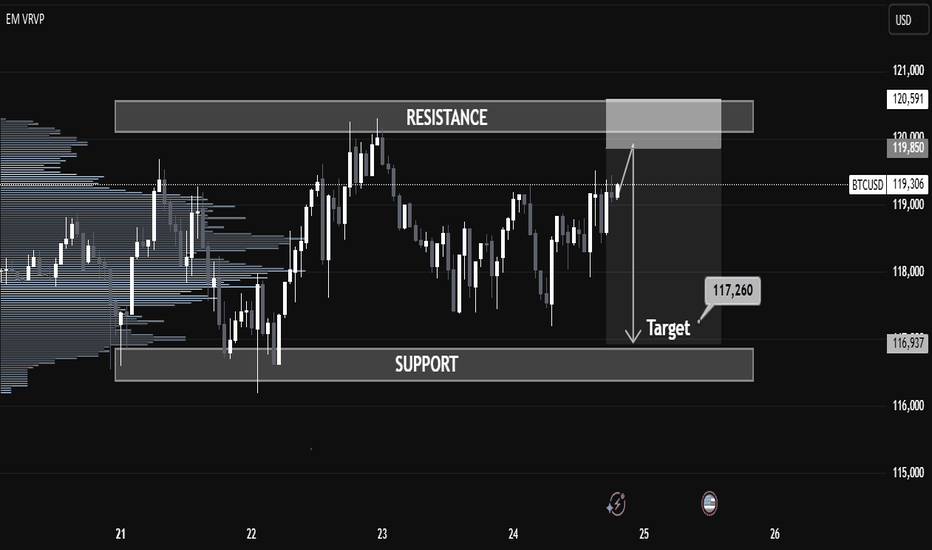

BTCUSD Key Supply Zone Rejection – Bearish Target Mapped BTCUSD Key Supply Zone Rejection – Bearish Target Mapped (Educational Breakdown)

⸻

🧠 Technical Analysis (1H Chart):

• Range Structure: BTCUSD is currently trading within a well-defined consolidation range between the Resistance Zone ($119,850–$120,591) and the Support Zone ($116,937).

• Volume Profile (VRVP): Volume is noticeably thick near the mid-range, suggesting accumulation/distribution behavior. Price is struggling to break above the value area high near $120K.

• Resistance Rejection: After testing the upper supply zone, price failed to sustain bullish momentum and is showing signs of exhaustion – a possible sign of institutional selling.

• Target Zone: If price rejects this resistance again, a strong move toward the target level of $117,260 is expected. This aligns with:

• Mid-range liquidity sweep

• Low-volume node (LVN) below current price

• Fair Value Gap fill near $117,200–$116,900

⸻

🧩 Key Concepts Highlighted:

• Support & Resistance Mapping

• Volume Profile Readings

• Institutional Order Flow Bias

• Target Projection using Smart Money Concepts

⸻

⚠ Educational Insight:

This setup is a perfect example of how to combine Volume Profile + Price Action to identify liquidity traps and smart entries. Always wait for confirmation near key zones — not every level breaks!

⸻

✅ Trade Plan (Not Financial Advice):

• Watch for bearish engulfing/rejection wick at resistance

• Short entry below $119,000 with SL above $120,600

• Target: $117,260 / Final TP: $116,937 zone

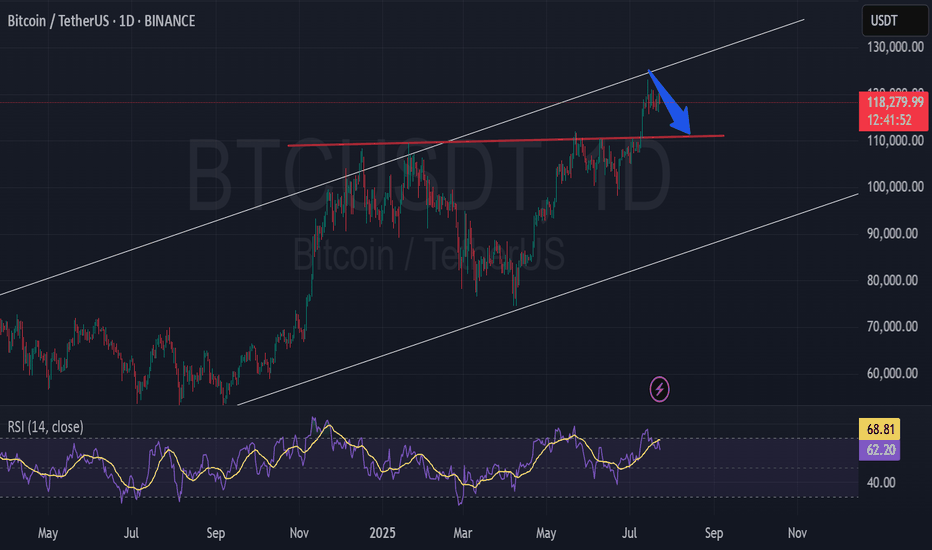

BTC correction august/septemberBTC has reached overbought territory, there is also bearisch divergence. It also didnt go above 123k anymore. i expect a correction in august/september.

dont chase FOMO, be prepared. Nothing goes in a straight line. there are always corrections.

CRYPTO:BTCUSD BINANCE:BTCUSD CME:BTC1! BINANCE:BTCUSDU2025

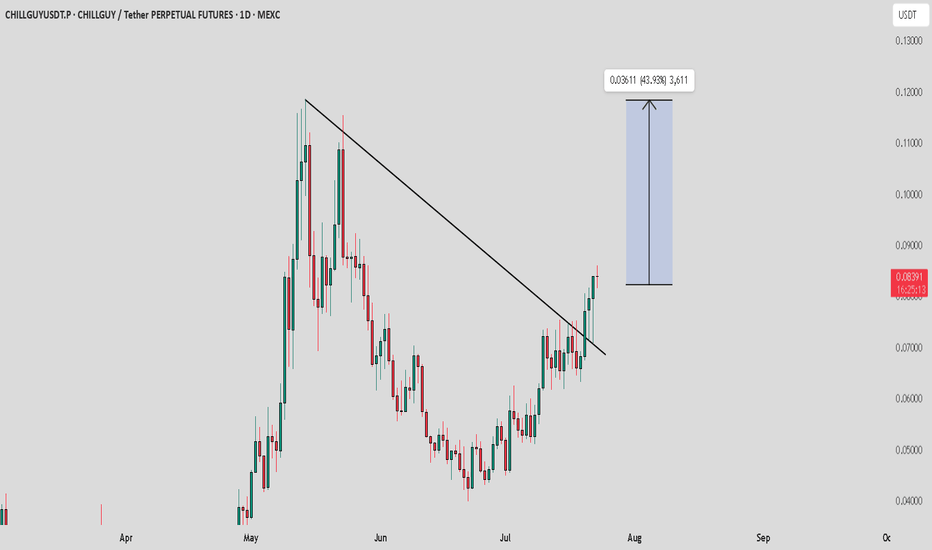

CHILLGUY / USDT : Trend shift and Retest confirmedChillGuy/USDT - Trend Shift & Retest

ChillGuy/USDT has fully shifted its trend, and after a successful retest, we expect a strong pump towards $0.10 - $0.12 soon.

Bullish Scenario:

Successful retest confirms the trend shift, leading to a potential move towards $0.10 - $0.12.

Pro Tip:

Keep a close watch for any signs of weakness or reversal before entering.