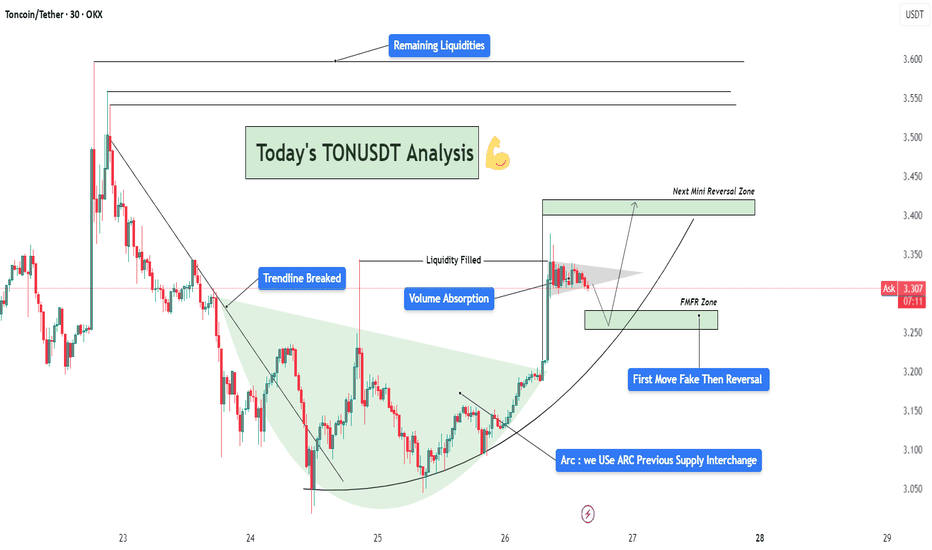

TONUSDT Analysis – Trendline Breakout | Liquidity| Arc + Target📈 Chart Summary:

The TONUSDT 30-minute chart presents a clean smart-money setup after a trendline breakout, volume absorption, and liquidity fill, supported by a beautifully formed ARC accumulation pattern. This structure hints at institutional involvement and a strategic roadmap for the next probable moves.

🔎 Technical Components Breakdown

1️⃣ Trendline Breakout – Shift in Structure

Price had been following a descending trendline with multiple touches, establishing bearish market structure.

Eventually, that trendline was violently broken to the upside, signaling a change in character (CHOCH) – one of the first signs of a potential bullish reversal.

The breakout candle was strong, with a wide body and notable bullish volume. This often indicates institutional interest or engineered breakout via a stop-hunt.

2️⃣ Volume Absorption – Smart Money Accumulation

After the breakout, the price didn't immediately rally. Instead, it consolidated with wicks on both sides – a sign of volume absorption.

This is where smart money absorbs opposing orders, typically absorbing sellers before a larger directional move.

This consolidation confirmed the idea of liquidity engineering – they trap liquidity (shorts) and use it as fuel.

3️⃣ Liquidity Filled – Stop Hunt Behavior

A sharp wick into previous highs grabbed resting liquidity, filling orders and sweeping stop losses.

This action invalidated weak resistance, setting up the platform for a larger move.

🧠 Conceptual Structure – ARC Play & Reversal Dynamics

✅ ARC Formation – Rounded Accumulation Base

The light green arc highlights the rounded bottom, a common technical pattern representing accumulation over time.

This kind of base often indicates that smart money is building positions silently, especially after a significant downtrend.

In this context, the ARC acts as a dynamic support, and the structure mimics the reversal of market sentiment from bearish to bullish.

🌀 FMFR Zone – “First Move Fake, Then Reversal”

Labeled FMFR zone between 3.22–3.26 signifies a potential trap setup.

The expectation is a manipulated downward move (fakeout) that will be quickly reversed, catching breakout sellers off-guard.

Smart traders can use this as a high-probability re-entry zone by waiting for wick rejection, engulfing candles, or bullish divergences.

📍 Short-Term Targets & Zones

🟩 Next Mini Reversal Zone – 3.38 to 3.42

This is a probable area for minor pullback or distribution, especially for scalpers or short-term trades.

Price may stall here due to earlier supply and psychological round levels.

🟦 Remaining Liquidity Zones – 3.55 to 3.63

Higher timeframe liquidity remains uncollected above.

If bullish momentum continues with support from volume and structure, expect price to sweep these levels next.

These zones are ideal for medium-term swing targets.

🧾 Trade Setup Idea (Not Financial Advice)

Item Details

Entry On rejection/confirmation within FMFR zone (3.22–3.26)

Stop-Loss Below arc support or structural low (3.18 area)

TP1 3.38 (Mini reversal zone)

TP2 3.55 (Liquidity target 1)

TP3 3.63+ (Extended target)

📘 Market Psychology in Action

Fear/Greed Play: Initial selloff invited fear, smart money accumulates quietly via the arc. Fakeout traps greed and late shorts.

Trap-Reversal Model: FMFR zones exploit retail stops, offering entries for institutional players.

Liquidity Mapping: The chart clearly maps how price is attracted to uncollected liquidity zones – a classic order flow approach.

Cryptosetup

C98/USDT 15M ANALYSISHey Traders! 👋

I'm tracking a potential impulsive Elliott Wave structure on C98/USDT.

📈 Wave Count So Far:

- We completed a clean 5-wave impulsive move up — labeled i through v.

- This was followed by a classic zigzag (ABC) correction, forming what looks like a textbook

Wave 2.

- The corrective structure appears complete, and price is now holding above key support.

🔍 Current Expectation:

I'm now looking for Wave 3 to unfold, which typically brings the strongest momentum in the Elliott Wave sequence.

Trade Setup:

🟢 Entry Zone: 0.06 – 0.0615

🔴 Stop Loss: 0.05923

🎯 Target Price: 0.0652

💡 Note: Always manage your risk and confirm with your own analysis before entering any trade.

BTCUSD 1H | Liquidity Grab + FVG Play Before Bullish Expansion📊 BTC/USD 1-Hour Smart Money Outlook — May 15, 2025

Bitcoin is setting up for a classic SMC combo move — targeting sell-side liquidity before flipping bullish and running for the buy-side liquidity at ~$106K.

Let’s break it down 👇

🧠 1. The Setup

Price broke structure to the downside ✅

Heading into a liquidity sweep of the recent lows around $100,000

Major Fair Value Gap lies between $98,100–$96,800

This gap aligns with the 61.8–70.5% fib zone — a premium rebalance area for smart money

🔍 2. Expectations

Short-Term Bearish into FVG → Sell-side liquidity gets swept

Then strong bullish reversal targeting:

🔹 First target: $103,000

🔹 Final target: $105,787 (Buy-side liquidity + Weak High)

Trade Idea: Long after FVG rejection confirmation

SL below $96,800, TP up to $106K — insane RRR of 1:4+

⚠️ 3. Risk Management

Wait for a bullish reaction inside the FVG zone

Protect capital if price closes below $96,800 → setup invalid

Look out for NY session volatility and CPI/FOMC-driven fakeouts

This is textbook Smart Money behavior: draw liquidity, rebalance price, and expand into inefficient price zones. If you're not trading with liquidity in mind — you're the liquidity. 🧠💸

💬 Comment “🚀” if you're long from the Fair Value Gap zone!

🎯 Follow @ChartNinjas88 for daily sniper setups and smart money breakdowns!

BTCUSD – 30m Precision Entry from FVG & Fib Discount Zone🚀 BTCUSD BUY SETUP | May 8, 2025 | Smart Money Precision Execution

This 30-minute chart screams Smart Money accumulation with a golden entry aligned at the 70.5–78.6% Fib levels AND a bullish Fair Value Gap (FVG) just below.

Here’s the confluence breakdown you need to study:

🔍 KEY CONFLUENCES:

🟣 Fair Value Gap (FVG) between $97,800 and $98,550 – prime liquidity zone

📉 Deep Discount Entry at 70.5%–78.6% Fib retracement ($97,797 – $97,200)

🔁 Breaker Block + Internal BOS confirming upside intent

📈 Target: -27% Extension Zone around $100,920

✅ RR: 1:4+ with tight risk below swing low

🧠 Execution Strategy:

Enter near $97,797 – inside the FVG

SL: Below 100% Fib (~$96,800)

TP: -27% Fib (~$100,920) or scale partials at 0% / -10%

Break-even management once price closes above $99,500

📊 Setup Summary:

Timeframe: 30m

Bias: Bullish

Entry: FVG + Deep Discount

TP: -27% extension

SL: Below 100% Fib

RR: 1:4

Structure: Smart Money Reversal

💡 Chart Ninja Insight:

“Smart money enters where retail panic sells. The FVG is the highway—they’re just waiting to get on.”

Back to the Box — Classic Range Play on ATOMATOM has been moving within a well-defined sideways range between $4.03 and $5.08 for over two months now. Every time price touches the lower boundary, we’ve seen strong bullish reactions — and right now, we’re sitting right at that key support zone again.

I'm entering a long position around $4.281

💡 The idea here is simple: classic range trading setup with a clean invalidation point and an R:R close to 1:4.

📍 Entry: $4.281

🎯 Targets:

→ $4.325

→ $4.369

→ $4.426

→ $4.497

→ $4.569

❌ Stop: $4.029

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

BITCOIN BREAKDOWNHave a nice day dear traders, we are here with Bitcoin

Bitcoin resumed its sharp move on Sunday evening early in the Asian session as I have been writing for the past two weeks. But currently I see less change, usually these moves determine the whole weekly trend but in this situation I would say the market went for liquidity at $16975 - $16920 and this is where the whales are taking long positions into swing trades. The last 40 years in the stock market, December has been 90% in the green which is currently indicated by the Fed's dovish policy

We are currently at the vPOC ( point of control ) of the Asian session for BTC which means that if we hold this level on the 30m chart and do not close at least 3 candles below $16930 then I see the current swing trend breaking out to the levels indicated on the chart around $17,500

SAND - Trade setupDownward breakout through the descending triangle pattern, Looking at the market conditions there will be retest towards the breakout point which is my entry range. It needed to be observed that the retest must take place with low volume therefore indicating weak retracement so that we can enter short side. I'll update once my trade entry got triggered in the update section.

Disclaimer : Anything provided here is not a financial advice.

ADA Trade SetupIt's awesome right, from past few hours market moving pretty upside !!

Hey Welcome back - I have something to say

First let me start with overbought condition, after good rally most of the crypto's are reflecting overbought conditions. How bad it is ?

Let's just say for short term may be it's better if we look for shorts and so MACD added much more confirmation to those overbought conditions, Not only me no one knows how far this trend change will go but one thing for in trading we need to focus each and every key price points, no one knows when market sentiment gonna change. So my advice is stop predicting start reading the market.

THIS IS MY ADA TRADE SETUP :

Entry Range : 0.6581 - 0.6470

Target : 0.6192

Stop Loss : 0.6707

Note : My trade conditions hasn't triggered yet even it's in my entry range, I'll update when the conditions triggered in update section.

Disclaimer : Anything provided here is not a financial advice.

KNC Long term Halloween Spot trade for you profit goblins!Hello Traders,

I have put together this trade set up and information for you to help you in your research. Please see chart for details and be mindful of your stop losses along the way moving them beneath the pullbacks to stay in profit the whole trade.

KNC Price Live Data

The live #Kyber Network Crystal v2 price today is $1.73 USD with a 24-hour trading volume of $48,869,324 USD. We update our KNC to USD price in real-time. Kyber Network Crystal v2 is up 6.77% in the last 24 hours. The current #CoinMarketCap ranking is #256, with a live market cap of $307,680,364 USD. It has a circulating supply of 177,809,350 KNC coins and the max. supply is not available.

If you would like to know where to buy Kyber Network Crystal v2, the top exchanges for trading in Kyber Network Crystal v2 are currently #Binance, #Mandala Exchange ,#OKEx, #Huobi Global. You can find others listed on our crypto exchanges page.

What Is Kyber Network (KNC)?

Kyber Network is a hub of liquidity protocols that aggregates liquidity from various sources to provide secure and instant transactions on any decentralized application (#DApp). The main goal of Kyber Network is to enable #DeFi DApps, #decentralized exchanges (DEXs) and other users easy access to #liquidity pools that provide the best rates.

All transactions on Kyber are on-chain, which means they can be easily verified using any Ethereum block explorer. Projects can build on top of Kyber to utilize all the services offered by the protocol, such as the instant settlement of tokens, liquidity aggregation, and a customizable business model.

Kyber looks to solve the liquidity issue in the decentralized finance (DeFi) industry by allowing developers to build products and services without having to worry about liquidity for different needs.

The Kyber Network Crystal (KNC) token is a utility token that is the "glue that connects different stakeholders in Kyber's ecosystem." KNC holders can stake their tokens in the KyberDAO to help govern the platform and vote on important proposals --- and earn staking rewards in Ethereum (ETH) that come from trading fees.

Who Are the Founders of Kyber Network?

Kyber Network began its development in 2017 and is built on top of the Ethereum blockchain. The project was founded by Loi Luu, Victor Tran and Yaron Velner, and currently has its headquarters in Singapore.

Loi Luu is a blockchain researcher and an advisor for various blockchain projects. He developed #Oyente, the first open-source security analyzer for Ethereum smart contracts, and co-founded SmartPool, among other decentralized projects.

Victor Tran is a senior backend engineer and Linux system administrator. He was the CTO at Clixy and 24/7 Digital Group as well as a developer for several projects in Vietnam.

Yaron Velner is the current CEO of B.Protocol, a decentralized backstop liquidity protocol, and was a postdoctoral researcher. Velner stepped down from his CTO position at Kyber in October 2019 but remains as an advisor.

The Kyber team is also composed of several executive advisors, engineers and designers. According to the official Kyber Network LinkedIn page, the company has over 50 employees --- most of which are based in Vietnam or Singapore.

What Makes Kyber Network Unique?

Kyber Network is the first tool that allows anyone to instantly swap tokens without the need of a third-party, like a centralized exchange. The unique architecture of Kyber is designed to be developer-friendly, which enables the protocol to be easily integrated with apps and other blockchain-based protocols.

DeFi has many use cases and possibilities. Therefore, no single liquidity protocol can fit the needs of all liquidity providers, takers, and other market participants. Kyber's liquidity hub architecture allows developers and the Kyber team to rapidly innovate and integrate new protocols into the overall Kyber Network to cater to different liquidity needs.

In April 2021, Kyber launched the Kyber DMM, the world's first dynamic market maker protocol (DMM). Kyber DMM is a next-generation AMM designed to react to market conditions to optimise fees, maximise earnings, and enable extremely high capital efficiency for liquidity providers, especially for stable pairs with low variability in price range (like USDC/USDT, #ETH/SETH). They will be able to support pools with extremely high amplification factors, which means given the same liquidity pool and trade size, slippage can be 100x (or more) better than typical AMMs. Depending on their amplification strategy, liquidity providers can maximise the use of their capital and have the opportunity to earn much more fees relative to their contribution size, while takers can enjoy extremely low slippage on their trades.

Kyber DMM is the first of many new liquidity protocols that will be launched on the Kyber 3.0 Liquidity Hub.

In the Kyber #ecosystem, KNC token holders play an important role in deciding new #growth and value-capture opportunities and incentive mechanisms. Through KyberDAO, KNC holders can participate in the #governance of the network by voting on important proposals. Kyber's #community is sizable and made up of a wide range of developers, in addition to other members of the blossoming DeFi industry.

Kyber's fully on-chain design enables the protocol to maintain full transparency and verifiability. The platform claims to be the most used liquidity hub in the world.

How Many Kyber Network (KNC) Coins Are There in Circulation?

As of May 2021, Kyber Network has a total supply of 210 million KNC tokens. Out of this, just over 200 million tokens are in circulation. The KNC token is dynamic, with the KyberDAO having the ability to vote to increase or decrease the supply in order to drive innovation, bootstrap liquidity, and reward early adopters of new protocols such as the Kyber DMM.

Kyber concluded its initial coin offering (ICO) on September 15, 2017, raising $52 million by selling each KNC token at a price of 0.00166 ETH. According to the official token distribution paper, 61.06% of tokens were sold in the ICO, 19.47% were saved for the founders, advisors and seed investors, and the remaining 19.47% was reserved for the company.

How Is the Kyber Network Secured?

As an ERC-20 token, Kyber is built on top of and secured by the Ethereum blockchain. In addition, Kyber uses an extensive trust and security model that protects users from misbehaving administrators or exchanges, thanks to security measures built in both at the protocol and smart contract level.

The platform has been audited by several third-party security firms and researchers, including #Chainsecurity, which have determined that the protocol is secure and hence free of vulnerabilities.

Where Can You Buy Kyber Network (KNC)?

KNC tokens can be purchased and traded on a variety of exchange platforms, including prominent names like Binance, Coinbase Pro, Huobi Global and Kraken. The token is currently listed on more than 20 exchanges and has more than a dozen trading pairs, including #stablecoins like #Tether (USDT) and Binance USD (BUSD).

If you are looking for a guide on how to buy KNC tokens or other cryptocurrencies using fiat, check out our detailed guide to get started.

Have a green week,

Savvy

ETH Trade Setups 2020/12/22Daily ETH Trade Setups

There are two potential trade setups that could develop and we can wait patiently to see if either setup gives us a good trade entry

Scenario 1: False Breakdown at Horizontal Support

In this first scenario, we are waiting for price to hit the horizontal support @~$595 and then bounce back up.

Confirmation criteria for entering a long position:

1. Candlestick: A breakdown candlestick (candle close below support @~$595) followed by a reclaiming candlestick (candle close above $595), ideally breakdown and reclaiming candlesticks are consecutive candles, but also have a few candles in between.

2. Volume: Above average volume (volume above the average volume line) on both breakdown candle and reclaiming candle, ideally the reclaiming candle's volume is a local high

3. MACD: MACD histogram bottoming out, as indicated by the histogram becoming less negative (color changing from red to pink)

Ideally we get all three confirmations above for an entry, but sometimes we might only get 1 or 2 confirmations. The more confirmations, the higher the win probability.

Scenario 2: Rejection at 200MAs

In the second scenario, we are waiting for price to go up to the dynamic resistance zone of the 200MAs and then fall back down. This zone is currently projected to be $630-$635, but could be slightly different once we get to that level based on price action.

Confirmation criteria for entering a short position:

1. Candlestick: A bearish candlestick pattern such as a bearish engulfing candle or a multiple candlestick breakdown (a large green candle followed by multiple red candles that eventually close below the open/low of the large green candle)

2. Volume: Above average volume on the bearish engulfing candle / on any of the multiple red candles that eventually break the green candle (ideally on the candle that breaks)

3. MACD: MACD histogram topping out (changing from dark green to light green

Ideally we get all three confirmations above for an entry, but sometimes we might only get 1 or 2 confirmations. The more confirmations, the higher the win probability.

Please follow for daily trading levels and potential trade setups on Bitcoin and Ethereum. I will be posting trade setups at about this time every day.