On a year on Year basis Bitcoin is where it was in early 2017

I have been talking about Bitcoin following the 2013 - 2017 Fractal and this chart shows us, in a different way, how this is still Valid.

The vertical lines on this chart are January of each year.

You can see from the Arrow on the left and right, where we are in relation to 2017.

Things to note

When we first touched the dotted line on both occasions, it led to a GREEN RED GREEN candle, however, in 2024, we got there earlier than we should have maybe and so we have had to "Wait" to fall back into date sequence.

Why ?

If we look back at 2017, we remained below that dotted line till end of April - Statistically MAY is a great month for Big moves

In my monthly candle analysis, I have also mentioned that using monthly candle close patterns, May is likely to be the better month for PA to rise higher

We seem to be playing this out BUT we need to notice how PA is Below that Dotted line.

PA is under pressure and yet in a great position though the trading volume is Low and consequentially, the candle sizes are not that impressive.

We are half way through April . Things will change and Fast......

Hang on

Cryptotrading

#CHR Ready For Another Leg Down? Key Levels to Watch Yello, Paradisers! #CHR is showing upside probability, but this is just a setup before the next brutal leg down? Here’s why the current move by #Chromia could be the calm before the storm:

💎#CHRUSDT is trading around $0.0819, and on the 4H chart, the price is developing within a potential Leading Diagonal Formation. But here's the catch: for the diagonal to be valid, Wave 5 must exceed Wave 3, which hasn’t happened yet. So, the structure remains incomplete and vulnerable.

💎As of now, the 5th wave is still in play, but momentum is fading fast. A Bearish Divergence on the MACD histogram is flashing early warnings. If it intensifies, it could drag #CHRUSD down before Wave 5 completes, leading to a premature breakdown and invalidation of the pattern.

💎The resistance zone between $0.089-$0.97 remains key. A break and sustained hold above this level would invalidate the bearish scenario, potentially triggering a short squeeze up toward $0.1000+. But unless that happens, bears are still in control of the structure.

💎On the downside, a confirmed breakdown below the $0.0740 support will signal the failure of the diagonal and likely accelerate the drop toward the next major support at $0.0610, where we anticipate the next Swing Low. A valid bearish breakout below needs to be backed by increasing selling pressure and market weakness.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

ETHUSDT: No Bottom yet, Bears still in control?Hey Realistic Traders, is ETHUSDT just a dead cat bounce, or are we looking at an actual reversal? Let’s dive in...

Since March 26, 2025, ETHUSDT has struggled to break above the EMA100 line, signaling a bearish trend. Additionally, a symmetrical triangle pattern has broken to the downside, further confirming bearish momentum.

The Stochastic indicator has crossed and is moving downward within the neutral zone, confirming that selling pressure may continue.

These signals indicate that Ethereum could drop toward our first target at $1,403. After hitting this level, a short pullback is likely as traders take profits, before the price potentially continues its descent toward a new low around $1,239.

These targets were identified using a combination of Fibonacci ratios and classic support/resistance levels, as shown in the chart.

This outlook remains valid as long as the price moves below the stop-loss level at 1,754.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Ethereum.

DOGE Trade Setup – Structure Shift in Progress?DOGE just swept the $0.13 liquidity, shaking out weak hands, but price is still holding strong above the $0.15 key support zone. If we get a daily close above $0.18, that could lock in a bullish structure shift and kickstart the next leg up.

📌 Trade Details:

Entry: Around $0.16

Take Profit Targets:

🥇 $0.23

🥈 $0.30

Stop Loss: Daily close below $0.14

Potential Bullish Reversal Setup in LINK/USDTThe LINK/USDT pair recently experienced a false breakdown below the March low, followed by a strong recovery. This move appeared to be a liquidity grab beneath the psychological support level at 10.00, after which the market quickly reversed direction.

In addition, the price action broke and closed above a descending trendline, which had previously signalled a corrective phase. Notably, the market also revisited a demand zone—an area where a major price rally originated in November 2024.

If the price retraces back toward the support level near the trendline, historical behaviour suggests the potential for another upward move. This confluence of a false breakdown, a trendline breakout, and a revisit to a key demand zone points to a possible bullish reversal, provided the support continues to hold. The next significant resistance level is identified around 14.80

ETH/USDT Breaks Uptrend – Key Retracement Zone in PlayETH/USDT has broken its recent uptrend and is now entering a correction phase, approaching a key retracement zone around the $1,630 level. This area has acted as strong support in the past and could become a critical decision point for price action. If the level holds, it may trigger a continuation of the broader bullish trend. However, a breakdown below this zone could open the door for a deeper pullback. Monitoring closely for confirmation and market reaction.

Trade safe, Joe.

ETHUSD: Prepare to buy if this trendline breaks.Ethereum remains bearish on its 1D technical outlook (RSI = 41.779, MACD = -115.050, ADX = 39.213) despite an encouraging start to the day as the 4 month Channel Down is intact. The 1D RSI is supported and is trading sideways and ETH itself is back to historic buy levels. We are willing to buy only after a break over the 1D MA50 validates the trend change technically. If that happens we will aim for the 2.0 Fibonacci extension (TP = 2,800). You can use as an extra validation condition a potential break of the 1D RSI above the R1 level.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XLM/USD Main trend. Timeframe 1 week. Channel. Radiant Star of 2218) One of the most “silent” cryptocurrencies. Unlike its fellow clone, pumped up by the community on the ears of pseudo-esoterics (although 589 is not going anywhere, which is, that is, it is not price))))....

Note that past secondary trend reversals are shrinking after significant dips. We are now in the lower zone of the channel, but not at the lowest potential values. Never “catch” the lows and highs, but work most of your position near those values, and you will be happy and relaxed.

I advise you to combine pyramiding (up) + martingale (down), and you won't care where the price goes, because you'll be happy with either direction. It is also rational to protect your profits with stops, but not near intraday volatility.

It is also natural for your peace of mind to forget about two things if you have a mind:

1) Forget margin trading. Work only on spot.

2) Forget the 1 “world's most reliable exchange” (diversification of trading and storage).

Coinmarket: XLM

About the enlightenment: .

1) Instant (less than 3 sec) transactions,

2) Conditionally free transactions $0.000001 (0.00001 XLM micro payments),

3) No network congestion (30 sec refund in case of failed transaction (not to be confused with exchange),

4) Smart contacts and NFT (2022),

5) "Transaction rollback" (this is an advantage, not a disadvantage for real use, not speculation),

6) Support for multi-currency transactions.

7) Interest in XLM blockchain by states.

And much more...

Roughly speaking, all the best worked out solutions from thousands of temporary “faith cryptocurrencies” over the last 10+ years.

Incidentally, many states will be making “transitional” fiat currencies on this blockchain. For example, the long-suffering Ukraine. But then when there will be “total sadness”. Creating a problem—presenting a ready-made solution.

Here's what this important zone looks like on the 1-day timeframe. Key reversal or trend continuation zone.

Breakout of the local symmetrical triangle +10% to the mirror resistance level of 0.2022.

Can #AAVE Bulls Sustain the Current Momentum? Key Levels Yello, Paradisers! #AAVE looks bullish on the surface—but is this setup quietly setting up for a brutal dump? Here's the key level that will trigger the next big move:

💎#AAVEUSD is currently trading around $143.66, holding inside a clear ascending channel on the 4H timeframe. The price action of #AAVE has been respecting both the ascending support and resistance trendlines, forming higher lows and higher highs—but momentum is fading.

💎A bearish divergence on the momentum oscillator is signaling early weakness despite the price climbing higher. This divergence usually marks the beginning of a bull trap, where the price appears strong just before a sharp reversal.

💎The immediate resistance to watch is in the $156. This is where price was recently rejected, near the upper channel trendline. Above that, $156 remains the key Bearish Setup Invalidation level. A breakout and hold above this would invalidate any bearish structure and could lead to a push toward $170+.

💎However, if AAVE breaks below the ascending support, currently near $140, it opens the door for a sharp drop. The first target is the $126.10 support zone, followed by the $114.35 level, which aligns with a strong historical demand area.

Play it safe, respect the structure, and let the market come to you. Discipline, patience, and strategy are what separate long-term winners from short-term gamblers

MyCryptoParadise

iFeel the success🌴

Breakout in Aergo (AERGOUSDC)...Chart is self explanatory. Levels of breakout, possible up-moves (where crypto may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. Please consult your financial advisor before taking any trade.

ZRO Bullish Setup | Time to Buy? (4H)Since the red arrow was marked on the chart, ZRO has shown signs of entering a bullish phase.

Wave A appears to have completed, and the price is now developing into wave B, which is unfolding as a diagonal (diametric) structure. At the current stage, we are likely in the early movement of wave g, a corrective bearish leg within this larger structure.

Key Buy Opportunity:

We’re closely watching the green support zone as a potential bullish reaction area. If price action confirms, this level may offer a prime long/buy setup with a favorable risk-reward ratio.

Invalidation Level:

A daily candle close below the invalidation level will invalidate this bullish scenario.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

FARTCOIN/USDT – HIGH PROBABILITY SHORT FROM PREMIUM ZONEMarket structure shift confirmed with CHoCH, signaling bearish intent.

Price is retracing to fill the Fair Value Gap (FVG) — a premium zone where institutions are likely to re-enter shorts.

Entry: 0.8971 – 0.9010

Target: 0.8571 – 0.8264 – 0.7689

Stop: 0.9254

This is a high-RR setup with clean structure, imbalance, and trend alignment.

Entry in FVG with confirmation = sniper entry.

Targeting downside liquidity zones with ~1:3.5 RR.

Always do your own research, manage your risk, and use proper confirmation before entering any position. Trade responsibly.

TRXUSDT – Bullish System Trigger (3D Chart)

📅 April 13, 2025

Today’s 3D bar close offers a strong bullish signal, aligning multiple system indicators in favor of a long entry.

Here’s what the system confirms:

✅ Price closed above the 50 MA – bullish structure

✅ MLR > SMA > BB Center – solid confluence

✅ Price > PSAR – trend shift confirmed

✅ Above the 200 MA – long-term trend support

Entry Strategy

- Open long at the 3D bar close

- Stop-loss below the latest PSAR dot for system integrity

📌 Note: This is a system-based entry — not a prediction.

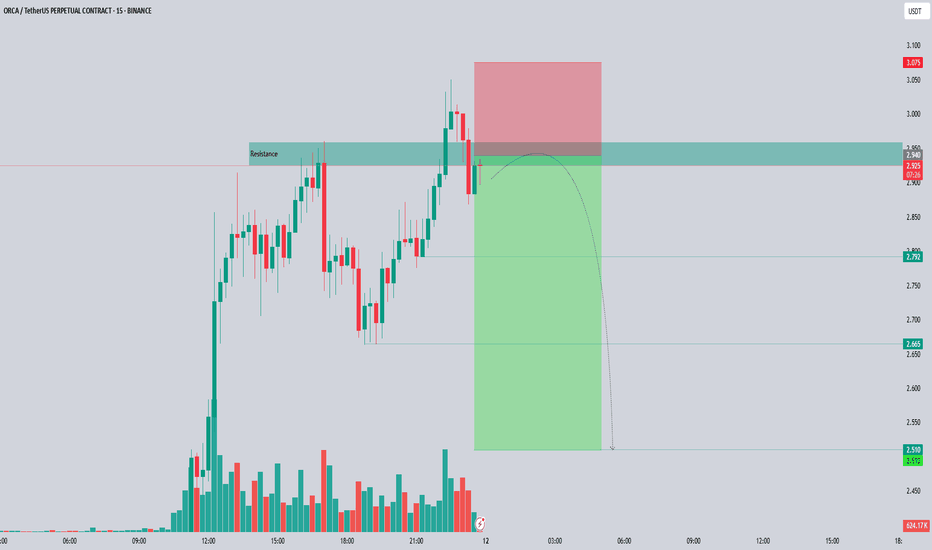

ORCA/USDT – Futures Setup: Potential Short OpportunityORCA is currently testing a resistance zone at 2.940 USDT, an area where selling pressure has historically emerged. Price action indicates a potential rejection, setting up a possible short trade targeting lower support levels.

📌 Futures Trading Levels:

Entry Zone: 2.920 - 2.940 – short positions could be considered upon confirmation of rejection.

Stop-Loss: 3.075 – placed above resistance to limit risk exposure.

Take-Profit Targets:

First TP: 2.79

Second TP: 2.665

Third TP: 2.51

This structure aligns with futures trading principles while maintaining risk management. Let me know if you’d like further refinements! 🚀📊

RNDR/USDT – Double Bottom Formation Signals Reversal PotentialRender (RNDR) is currently forming a Double Bottom pattern, signaling a potential bullish reversal from recent lows. The pattern is validated if the price breaks above the Resistance Neckline at 4.200, confirming strength from buyers.

📌 Key Technical Levels:

Key Support: 3.235 – a critical level where price previously found buying interest.

Order Block (OB) Zone: 3.400 - 3.484 – potential demand area for renewed bullish momentum.

Strong Resistance Zone: 5.800 - 6.200 – historical selling pressure likely to be met if price continues upward.

A decisive break above the neckline could trigger a rally toward the Strong Resistance Zone, aligning with prior structural reactions. However, failure to sustain momentum might see retests of Key Support and the OB zone for liquidity gathering. Traders should monitor volume confirmation and price reaction at these critical levels.

TAO/USDT – Bullish Reversal Setup Taking Shape#TAOUSDT is showing early signs of a potential trend reversal following a prolonged downtrend. Price has recently rebounded from a key major support zone between $164 and $192, where a bullish divergence with the RSI has emerged—indicating a possible shift in momentum.

A well-defined descending trendline has been acting as dynamic resistance since the November 2024 high. Currently, price is approaching a critical resistance level around $284.7. A confirmed breakout above this area would be a strong signal that the market structure is beginning to shift in favor of the bulls.

If price breaks and holds above this resistance, the next upside targets are:

$468

$480

$495.9, in line with previous supply zones and structural highs.

Momentum is also improving, with RSI crossing back above the 50 level, supporting the bullish case. However, a clean breakout with sustained volume will be key to validating this setup.

Levels to Watch:

Support: $192.8 and $164.1

Resistance: $284.7, followed by $468–$495.9

Until we see a confirmed breakout, caution is warranted. Failure to clear the trendline may lead to another retest of support.

Summary:

#TAO is setting up for a potential bullish reversal, but confirmation above $284.7 is critical. A move beyond that level could open the door for a significant upside continuation. As always, manage risk accordingly and wait for confirmation.

ALTS may be starting an explosive rally.This chart shows the Crypto Total Market Cap (excluding top 10) dominance trading inside a Megaphone pattern that just bottomed. The bearish wave is identical to the first that made a double bottom LL on August 5th and kickstarted an altcoin surge that peaked on December 7th 2024. The first target of this setup is 9.20%.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

FLUX About to Explode or Break Your Portfolio? Yello Paradisers — are you ready for the next breakout play, or are you blindly walking into a trap? FLUXUSDT is showing signs of a major decision point, and it could catch most traders off guard if they're not prepared. Here's exactly how we're planning it.

💎#FLUXUSD is currently trading within a wedge formation, and we're seeing a high probability of an upside breakout, especially if price is able to surpass the key resistance at $0.2291. In such a case, the next magnet is the internal supply zone at $0.2650 this is where we’ll start monitoring for potential trade setups.

💎This internal supply is a critical reaction zone. If price respects it and starts pulling back, we expect a retracement toward the support level at $0.1646. The high time frame structure remains bearish, which adds more weight to this retracement scenario being likely after tagging the internal supply.

💎Also, Flux is trading below both the 50 EMA and 200 EMA, confirming broader weakness in trend structure and making any short-term breakout more of a reactive move inside the macro bearish bias.If price doesn’t reject at the internal supply zone and breaks through it cleanly, we’ll be looking for a strong reversal from the Ultra TF supply zone at $0.3115. That’s the higher level of confluence we trust more in the bigger picture.

💎At this level, we’ll wait patiently as always and look for clear bearish reversal patterns like an Evening Star or a Shooting Star. Only a confirmed breakout above $0.3115 would change the game entirely by shifting the overall market structure and invalidating this current bearish setup.

Stay focused, Paradisers. Be the hunter, not the hunted.

MyCryptoParadise

iFeel the success🌴

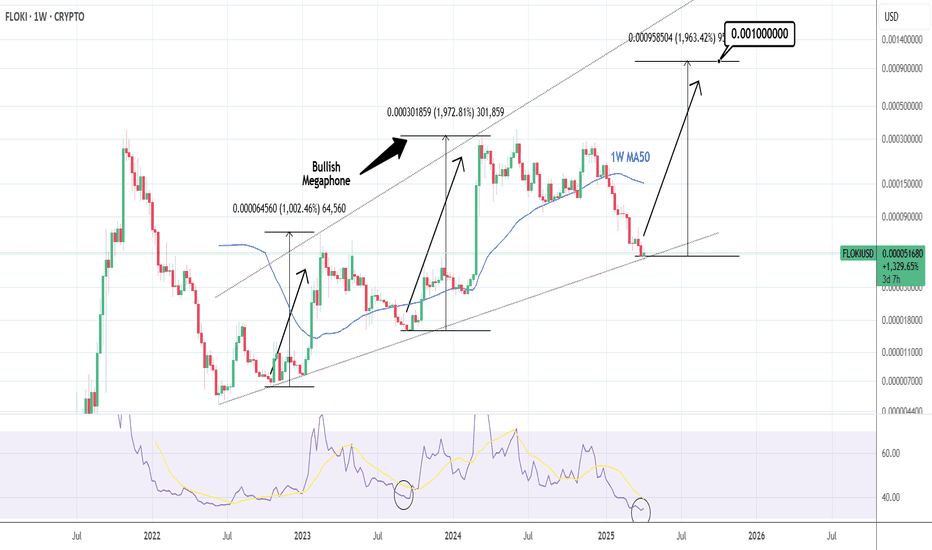

FLOKIUSD: The buy opportunity of the year.FLOKI is bearish on its 1W technical outlook (RSI = 34.609, MACD = 0.000, ADX = 19.895) hitting this week the bottom of the 3 year Bullish Megaphone. The 1W RSI is posting a sequence similar to the previous bottom on September 11th 2023. Technically a rally of identical proportions should begin to price the Cycle Top. TP = 0.0010.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

JUP Long Spot Trade Setup – Oversold and Approaching Key SupportJUP is showing strong signs of oversold conditions and is now approaching a major support zone ($0.22 – $0.30). This area offers a favorable risk-to-reward opportunity for a bounce if buyers step in.

📌 Trade Setup:

Entry Zone: $0.22 – $0.30

Take Profit Targets:

🥇 $0.4050

🥈 $0.4467

Stop Loss: Just below $0.20

BTCUSD: We haven't seen the real Bull yet.Bitcoin is under heavy volatility and yesterday's gains from the moment of the tariff pause announcement are almost all wiped out, which is reflected on its 1D technical outlook which turned bearish (RSI = 42.714, MACD = -1766.300, ADX = 26.356). Nonetheless, it is still holding its 1W MA50, the key support of this Bull Cycle, which might have not shown its strongest rally yet.

And the reason is a pure look at the 2015-2017 Bull Cycle, which is on a similar Channel Up and 3W RSI pattern. 11 weeks between the Channel's last two corrections, same level with the RSI bottoms. This indicates that this April could be similar to April 2017 that started the strongest rally of the Cycle.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##