CS

CS Credit Suisse Group to $0.27 on Monday??UBS Group AG has made an offer to acquire Credit Suisse for as much as $1 billion.

The Swiss government is planning to change the country's laws to bypass the need for a shareholder vote on the deal, as they seek to restore confidence in the banking sector following Credit Suisse's outflow of 10 billion Swiss francs in just one week.

The proposed agreement, which is an all-share deal between Switzerland's two largest banks, is expected to be signed as early as Sunday evening.

The deal is priced at a fraction of Credit Suisse's closing price on Friday.

According to insiders, the offer was made on Sunday morning at a price of 0.25 Swiss francs ($0.27) per share, payable in UBS stock.

On Friday, Credit Suisse's shares closed at $2.01 Swiss francs.

I think we are about to see more bidders and the price go up from $0.27.

Looking forward to read your opinion about it.

Credit Suisse Woes Threat to ECB Rate Hike and EUR TradeAfter a brief period of calm following the collapse of Silicon Valley Bank, Credit Suisse disclosed "material weaknesses" in their financial reporting controls and ongoing customer outflows, setting off another bout of instability across global assets. Credit Suisse's biggest investor, Saudi National Bank, also noted that it could not offer more financial support to the troubled Swiss Bank leading to shares in Credit Suisse falling more than 20%. Switzerland’s central bank has come to the rescue though, saying it is ready to provide financial support to Credit Suisse, if necessary, helping the shares to recover about half of its losses on Wednesday, and rising from its record low under $2.00.

There is now growing concern over wider instability in the banking sector. This led to expectations that the Federal Reserve might slow down or pause hiking rates. Although, on Wednesday, the dollar rose due to safe haven buying, while European currencies sharply declined. The Euro, which had seen a 0.02% gain over a month, fell 1.4%, and the market is pricing in a 60% chance of a 25-basis-point hike in euro zone rates on Thursday, compared to a previous 90% chance of a 50-bps hike. The ECB’s interest rate decision is due on Thursday at 9:15am EDT.

Elsewhere, the dollar rose 1.8% against the Swiss franc, while sterling traded down 0.8%. The Japanese yen strengthened 0.58%. As investors sought safe havens, gold prices continued their recent rally, with gold up 0.8% and silver up 0.3%. Conversely, oil prices fell by more than $5 a barrel.

Maximum Pain in The Future CS Credit SuisseBanks restructure the debt of stressed corporations every day, not out of philanthropy but out of enlightened self-interest.

But the problem was that, now that we had accepted the EU–IMF bailout, we were no longer dealing with banks but with politicians who had lied to their parliaments to convince them to relieve the banks of Greece’s debt and take it on themselves.

A debt restructuring would require them to go back to their parliaments and confess their earlier sin, something they would never do voluntarily, fearful of the repercussions.

Credit Suisse is A Mess, This won't be good R-R for a reversal until late 2023. There are hundreds of significantly better opportunities available

Growth potential for CSGrowth potential for Credit Suisse, that is currently trading at the lowest ever reached.

CS quite likely hit bottom and is slowly crawling out of the hole.

Mismanagement hit the company in the recent years and the recent (few days ago) reshuffle at the top of its Investment Banking division is yet another step for the company to seek a way out of the current situation.

Two important levels are to be monitored in my opinion.

3.40 and 3.80 are two levels to keep in mind as strong resistances to break in order to see a real bull run.

*** This Content is for educational and informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. ***

AXA has turned negative.Axa - 30d expiry - We look to Sell a break of 25.89 (stop at 26.71)

We are trading at overbought extremes.

Short term bias has turned negative.

Short term MACD has turned negative.

The bearish engulfing candle on the daily chart is negative for sentiment.

There is no clear indication that the downward move is coming to an end.

A break of the recent low at 25.93 should result in a further move lower.

Our profit targets will be 23.92 and 23.12

Resistance: 26.70 / 27.00 / 27.68

Support: 25.93 / 25.00 / 24.30

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

AXA to correct lower.Axa - Intraday - We look to Sell a break of 26.19 (stop at 27.11)

We are trading at overbought extremes.

Posted a Double Top formation.

Bearish divergence is expected to cap gains.

A higher correction is expected.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Our profit targets will be 24.02 and 23.22

Resistance: 26.77 / 27.00 / 27.50

Support: 26.25 / 25.80 / 25.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Axa getting cut down? Axa

Short Term - We look to Sell at 25.34 (stop at 26.01)

Levels close to the 78.6% pullback level of 27.36 found sellers. Further downside is expected and we prefer to set shorts in early trade. The move higher is mixed and volatile, common in corrective sequences. The bias is still for lower levels and we look for any gains to be limited.

Our profit targets will be 21.04 and 20.10

Resistance: 26.00 / 27.50 / 29.00

Support: 24.00 / 21.00 / 20.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Axa Heading Back to Highs? Axa - Short Term - We look to Buy at 26.38 (stop at 25.61)

Preferred trade is to buy on dips. The medium term bias remains bullish. Prices expected to stall near trend line support. Previous support located at 26.20.

Our profit targets will be 28.63 and 29.45

Resistance: 28.00 / 29.00 / 30.00

Support: 26.20 / 25.00 / 24.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

CS can reach 2600 sts?Good time to buy in CS after the 1st correction.

2700 sts is expected price in long term, but 850 is entry price.

Dip BuyCredit Suisse is one of the most credible investment banks with various arms of business that has given them a phenomenal balance sheet. The recent Archegos implosion may put some clients on edge and although the bank has had to sell some hefty positions, it is expected that such a strong company will return. RSI has reset and bounced showing a reversal may be imminent. The stock should follow as buyers step in to buy the dip. Long over 10.4, Short under, PT back to fair value at $21, phenomenal risk return.

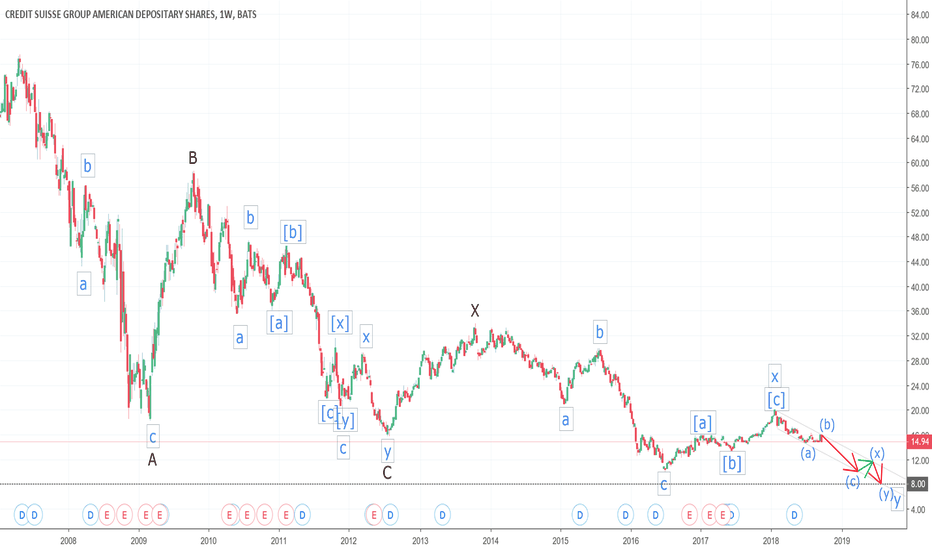

CS – Spiraling Around the DrainGee, Imagine that, another European Insolvent Bank Walking…

Short Term, Credit Sleaze looks like it is working its way down to $8.

Long Term, Credit Fleas is projecting a massively negative valuations, complements of the massive pile of derivatives they like to play with…

CS: Short term bulling movement spottedI believe that successful trading strategies rely heavily upon identifying consolidation zones. Consolidation zones provide us the right direction of the market. Consolidation happens when a market move sharply upside or downside. Later, a trader can use these consolidation zones to identify patterns, whether it be a continuation or reversal.

It requires attention and care. Rather than turning out to be a factory of producing signals, it is better to sit down and look for a setup. Setups are important because we are planning a trade and execute them on time. If you fail to plan a setup, then you are planning to fail.

Another advantage of trade setup is that we know where to get out and the right time to go in. Know the market. Study the price movements and make your trades.

My charts use price movements, patterns, structures and indicators such as moving averages and oscillators. Trading intelligence is combining multiple knowledge to produce a favorable trade setup and plans.

In the case of CS Two other important profitability ratios for investors to know are both returns-based ratios that measure a company’s ability to create wealth for shareholders. They are return on equity and return on assets.

GBPUSD bounce from weekly high - CSS Bearish #GBPUSD | USD very strong versus very weak GBP on daily time frame. Currently the price has hit the weekly high and bounced from this level>

Momentum as such is good to seek for possible GBPUSD on sell side based on the weekly CSS trend.

Don't miss the next FREE Analysis, join the Telegram Channel:

telegram.me