VRT : Long Position Vertiv Holdings is trading above the 50 and 200-period moving averages.

It has overcome the resistances one by one without being exposed to a very high IV.

It has started to draw a cup.

However, it is much better to focus on the big gap rather than the cup formation because with good chances it can encounter a big resistance there.

Targeting the 50-period ema and the 0.5 level of the short-term Fibonacci retracement levels as a stop point gives us the opportunity to try trading at a not bad risk/reward ratio.

With a small position size or small portfolio percent :

Risk/Reward Ratio : 2.54

Stop-Loss : 103.77

Take-Profit : 145.32

CUP

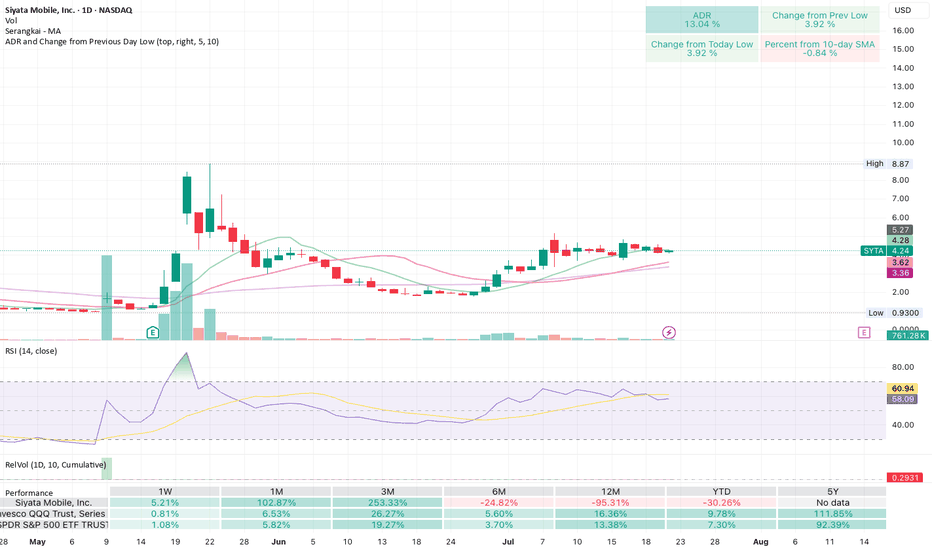

Getting ready to blow! Cup and handle after positive surprisesSiyata makes 2-way telecoms for things like first responders, miltary, construction crews.

Had big earnings and revenue surprises a few weeks ago, and now looks to be forming a cup and handle. Low volume yesterday shows a squeeze pattern like it's getting ready to go.

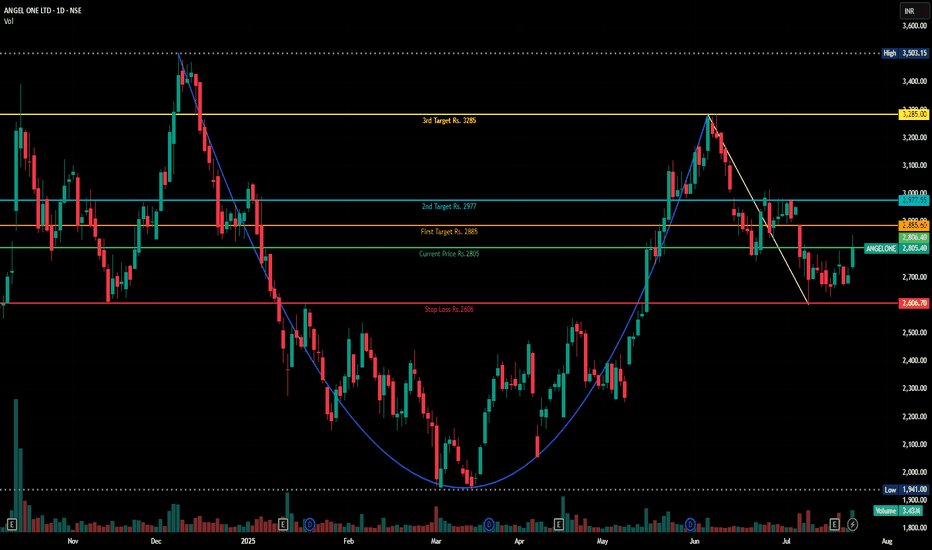

Cup and Handle Formation in Angelone ChartDisclaimer : Do your own research before investing. This is just a chart analysis for education purpose only. No recommendation to buy and sell.

In Dec 2024, AngelOne made high of Rs.3500 and pull back to level of Rs.1941 in March 2025.

After touching level of Rs. 3288 , its now trading at Rs. 2805.

I can see a cup and handle chart pattern formation in this stock. to me , it will be bullish in near to long term.

I have mentioned my targets along with stop loss.

Bandhan Bank - first major trend reversal! Upside to ₹215–230Thesis:

Bandhan Bank has broken out above the ₹185 zone after constructing a multi-month rounded base between ₹130 and ₹185. This marks the first major structural reversal after a multi-year downtrend. The breakout is backed by above-average volume and positive momentum.

Technical Structure:

Breakout Level: ₹180

Current Price: ₹189.64

Volume Surge: 11.4M (above 20-day average)

RSI (14): 67.5 — trending strong, near breakout zone

Targets:

₹215 ( 13.8% upside ) — measured move of near-term range

₹259 ( 25% upside ) — major horizontal resistance from 2022

Disclaimer:

Not a recommendation. For educational use only. Position already held from earlier. This post reflects personal strategy execution in a structured portfolio.

PLTR 1D — When the tea is brewed and the handle’s in placePalantir’s daily chart is shaping up a textbook cup with handle pattern — one of the most reliable continuation setups in technical analysis. The cup base was formed over several months and transitioned into a consolidation phase, building a rectangle structure where smart money likely accumulated positions before a breakout.

Now here’s the key: price has not only broken out — it’s settled above all major moving averages, including EMA 20/50/100/200 and MA 50/200. The breakout candle was supported by surging volume, signaling strong participation from institutional buyers. When all the averages start bending upwards, it's usually not by accident.

The breakout above the $121 resistance zone unlocked a pathway toward a target at $187 , derived by projecting the height of the cup upward from the breakout level. This kind of structure, once confirmed, often fuels aggressive continuation — and this one’s got the setup locked in.

From a fundamental perspective, Palantir is holding solid ground: strong earnings reports, expanding government and commercial contracts, and aggressive development in AI services. Institutional interest is rising steadily, and that momentum is visibly reflected in price action.

To sum it up: price has launched cleanly out of the consolidation zone, pierced all critical MAs and EMAs, and continues to gain momentum. While the market sips its tea, this cup is boiling hot. Just don’t forget your stop loss — this is a trading desk, not a tea party.

If you enjoy posts like this, drop a like, share it around, and let’s hear your thoughts below. It keeps ideas moving and the content flowing — free, sharp, and relevant.

Lemonade Inc.: Breakout in Motion — Cup, Flag, and No BrakesLemonade Inc. (LMND) is accelerating after a clean breakout from a textbook cup with handle pattern, where the handle formed as a tight bullish flag. The breakout occurred around $32, and since then, price action has been sharp, controlled, and uncorrected — currently trading at $42.42 with buyers clearly in charge.

On the fundamental side, LMND is moving through a recovery phase: operational losses are narrowing, revenue is stabilizing, and the company is aggressively leveraging AI to automate its insurance processes. Expansion into Europe continues, and institutional interest is visibly rising — confirmed by volume building alongside price. Within the insuretech sector, LMND is starting to look like a comeback story rather than a cautionary tale.

Technically, the setup remains strong:

– Golden Cross confirmed (EMA50 crossing EMA200)

– EMA50/100/200 all below price — bullish structure firmly intact

– Volume expanding on up-days — healthy confirmation

– RSI hovering in the 60–65 range — momentum is intact, no signs of exhaustion

Targets remain aligned with the structure:

– tp1 = $64 — measured move from the flag

– tp2 = $94 — full realization of the cup pattern

Tactically, this is no longer a “wait and see” setup — the move is in progress. No correction so far, only continuation. Momentum traders may consider entries into strength. Above $45, the move could accelerate further as more participants recognize the structure.

LMND is showing technical and fundamental alignment — confirmed breakout, improving narrative, and strong trend structure. While the impulse holds, this chart favors continuation, not hesitation.

Arkham (ARKM) Structure Analysis (1D)Interesting chart for BINANCE:ARKMUSDT

Apologies for the trendlines mess, but they're all potentially relevant.

Watch for

• Bounce at ~$0.49 (0.786 Fib)

• Break above the yellow and orange resistance trendlines (~$0.57)

These conditions could form a Cup & Handle pattern and lead to a retest of the $0.80-$0.85 supply zone.

If that it broken, it could set the next target to ~$1.25.

ApeCoin (APE) Cup Pattern (1D)After a deviation below demand, BINANCE:APEUSDT formed a clean rounded bottom, reclaimed the zone, briefly consolidated, and it's now attempting to break above resistance.

Key Levels

• $0.79: Current resistance

• ~$0.65: Current support, breaking it might lead to the formation of a handle

• $0.50-$0.60: Main demand zone and logical pullback target in case of a handle

• $1.20: Measured breakout target, and previous swing high

Worth watching it closely for a daily close above $0.79 with good volume to activate the target.

Alternatively, look at the $0.50-$0.60 area for a reversal in case of a rejection here.

ANGEL ONE - Potential Cup Pattern Breakout!Timeframe: Daily (1D)

Pattern: Cup Formation (shown with arc)

Setup:

Price is forming a classic cup pattern.

The neckline (arc resistance) is near 2538.40.

Price has recently approached but faced resistance around the neckline.

Once the price breaks above the arc line with strong volume, a bullish breakout could be confirmed!

Targets After Breakout:

🎯 Target 1: 2800

🎯 Target 2: 3000

Stop-loss suggestion: As per your risk management.

Notes:

Price is currently below the 200 EMA. For a strong confirmation, look for a close above the arc and the 200 EMA with volume spike.

Disclaimer

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a qualified financial advisor before making any investment decisions. Trading involves substantial risk.

Curve (CRV) Structure Analysis (1D)BINANCE:CRVUSDT formed a rounded bottom (cup) and a minor rectangle, and it's currently attempting to break above the local $0.83 resistance.

Key Levels to Watch

• $0.64: Current support and minor rectangle lower boundary

• $0.83: Current resistance, cup and rectangle upper boundary

• $1.00: Measured target from the minor rectangle pattern

• $1.30: Measured target from the cup pattern (within a key supply zone)

Other Important Levels

• $0.20: Key demand zone, and 2024 low

• $0.40-$0.50: Key S/R dating back to November 2022, aligned with the cup bottom

• $1.20-$1.30: Main supply zone, dating back to February 2023

A daily close above $0.83 with volume would confirm the breakout and trigger the targets.

Solana (SOL) Cup & Handle (1W Log)BINANCE:SOLUSDT has formed a Cup & Handle pattern on the weekly chart, and arguably already broke out of the handle.

The measured move target based on the linear depth of the cup is ~$510.

Key Levels to Watch

• ~$100: Local low and 0.618 Fib of the cup depth, a typical handle retracement in a Cup & Handle pattern.

• $260: Cup & Handle neckline and key horizontal resistance. A decisive weekly close with strong volume above this level would confirm the pattern and activate the measured move target.

• $510: Measured move target based on the depth of the cup from the neckline.

Considerations

Volume confirmation remains key. A breakout above $260 with strong volume could validate the pattern and open the path to $510.

AGL - Bowl chart with a Golden cross- AGL is in a long-term uptrend.

- AGL made a golden cross on 04.08.2025 (MA50 & MA200).

- The price chart is forming a bowl of patterns.

- Price now (05.01.2025): $3.93.

- Price target: $7.62.

If the bowl pattern fails, cut loss when the intraday price is below $3.66.

IMO, amateur trader.

Silver-led profit-taking weighing on goldGold reached a fresh record high above USD 3,050 an ounce before some end-of-week profit-taking, led by silver and platinum, helped trigger another, so far shallow, correction. The recent rally has pushed the price of a standard 400-ounce (12.4 kg) gold bar—held by central banks globally—above USD 1,200,000, a tenfold increase since the start of the 21st century. Beyond reinforcing gold’s status as a long-term buy-and-hold asset, this surge reflects growing global instability, which has fueled strong demand for safe havens like gold and, to some extent, also silver.

Since the November 2022 low, gold has rallied by around 80%—a phenomenal performance by an asset often criticized by Warren Buffett, famously calling it an unproductive asset, with his argument being that gold does not generate income, unlike stocks, bonds, or real estate, which can produce dividends, interest, or rental income.

While managed money accounts have been net sellers during the past seven weeks, reducing their net long by 5.2 million ounces to 18.2 million, potentially signalling a short-term peak, asset managers and other more long-term-focused investors have increased total holdings across exchange-traded funds by 2.9 million ounces to 86.2 million—still a far cry from the pre-US rate hike peak at 106.8 million ounces—highlighting plenty of room for additional demand should the underlying trends continue to support. Read more in our latest gold update here.

Technical analysis suggests that gold’s short-term peak is around USD 3,100, potentially followed by a period of consolidation before a renewed attempt toward our year-end target of USD 3,300 per ounce. After three failed attempts, last year’s breakout above USD 2,074 confirmed the completion of a cup and handle formation, developed over a 13-year period (2011–2024). Using the distance from the cup’s bottom (large box) to the handle’s top (small box), the technical target is USD 3,100.

XCN beautiful 2000% gainWith XCN popping off and everyone now wanting a piece of the action. XCN is not finished. I entered XCn on the 3 vertical orange lines. Every entry and exit was more beautiful than the last first 125% then 230% or so then 2000%. We are now at $0.012 roughly and holding above the 200EMA

Forming a clear cup and handle, (if your new to the game check out DIMO, the cup and handle formed right before multiple major take offs)

Bitcoin is showing support, and we all know what happens when that happens. Now is a better entry than ever, we could se a bit lower but I doubt past $0.01

However looking at June 15th 2022 we see a major push down followed by an immediate rejection, this is still possible but overall I believe this will hit its ATH and more being $0.10, $0.18, $0.35, $0.50 potential

Not financial advice but if your kicking yourself for missing a very very easy 2000%

It’s not over.

Good luck and have fun with it

Not Financial Advice

The handle is now forming on a massive cup & handle on SOL.SOL is now forming the handle of a massive cup-and-handle pattern that has taken over three years to develop. If SOL breaks out of this pattern in the coming months, we could very well see a four-digit price moving forward.

Keep your eyes on this.

Good luck, and always use a stop-loss!

TOTAL CRYPTO MARKET CAP is back-testing the cup & handle patternIt's no mystery that the crypto market has been getting hit pretty hard since mid-December. However, the total market cap—which had previously broken out of a nice cup-and-handle pattern—is now backtesting the rim line and looks to be setting up for what could be an incredible move upward over the next 6 to 9 months, with the potential for a double within that timeframe.

Good luck, and always use a stop loss!

Bullish on Daily TF.Bullish on Daily TF.

Beautiful Cup & Handle Formation

on Shorter Time Frame.

Crossing & Sustaining 174 will lead

it towards 180 & then around 185-186.

170 - 170.80 may act as Immediate Support level.

However, it should not break 160, otherwise we

may witness further Selling pressure uptill 153 - 155

ONDO appears to have a bright future ahead!ONDO is a favorite cryptocurrency of many investors and traders alike. The entire crypto market has been dragged down since December after the massive gains from the "Trump election pump" caused many cryptos to go ballistic. However, the future looks bright for ONDO, as the current weekly chart suggests it's setting up for another leg up.

Good luck, and always use a stop-loss!

Salesforce (CRM) – Bullish Setup AnalysisWeekly Chart – Cup and Handle Formation

• The stock has formed a classic cup and handle pattern on the weekly timeframe.

• Moving Averages (20 & 150) are trending upwards, supporting bullish momentum.

• After breaking out, CRM retested the breakout level as support and is now showing signs of continuation.

• The potential long-term target stands at +60% upside, aligning with the measured move projection.

Daily Chart – Consolidation & Breakout Retest

• The stock is currently trading within a converging channel, stabilizing near the breakout level.

• A wick rejection at the breakout price suggests strong demand at this level.

• Stochastic oscillator is turning upwards, indicating the start of a potential bullish cycle.

Final Thoughts

If momentum continues, CRM has the potential for a strong bullish move. Watching for confirmation and volume increase on continuation.

What’s your take on this setup? Let me know in the comments!

SILVER | The longest timeframe cup & handle in history!SILVER has been forming a cup-and-handle pattern for the past 45 years. And even though SILVER has made some incredible moves during that time, its price has been blatantly manipulated by the LBMA (London Bullion Market Association), central banks around the world, and a completely fraudulent derivatives market that circulates fake paper silver at hundreds of times greater than the underlying asset. Prices have been artificially suppressed for decades to prop up the global fake fiat currency Ponzi scheme and tighten the grip of control over nearly every asset and human being—making these fake currencies appear legitimate when they are clearly instruments of debt and deception.

This artificial suppression of SILVER and many other commodities is coming to an end as the debt-and-death paradigm unravels before our very eyes.

The day is rapidly approaching when SILVER will enter true price discovery, and people will not believe the price points it will reach in the very near future. Silver is one of the most—if not the most—undervalued physical assets of all time.

Good luck, and always use a stop-loss!