Currencytrading

EURUSD well expectation !!!my expectation gone well, we see now the eurusd after a retracement and a price rejection when he touched the uptrend line price goes up again to reach our target (1.06300), you can now take your profit and waiting for another retracement or you can trailing you SL

FOLLOW, LIKE and COMMENT to get more right expectations.

Setting Pending Orders and Breakeven TradesHi Purpose Traders. In this video, I will be showing you how to set a sell limit and how to move a trade to breakeven. Both of these are vital to being a profitable trader because there may be times you cannot set manual orders due to time or distractions. There will come a time when you in good profit and you don't want to risk giving it back.

I pray you find value in this video and if you do like the video.

Characteristics of Currency PairsHey Guys!

Here are some characteristics of currency pairs that I noticed over the years. Perhaps it'll help you find the pairs that best fit your trading style, or perhaps you can use this information as an add-on to your current strategy.

Gbp/Usd - Tends to overshoot key levels.

- Can use to get better risk/reward. Both on entries and targets.

- Can expect many fake breakouts; where key higher time frame levels may be broken on the lower time frames but fail to break out on the higher time frames.

Eur/Usd- Tends to accurately respond to key levels.

- Can be used for tight stop loss placements for there is no need to add a couple pips for wiggle room on this pair.

- Especially on this pair, remember to enter/exit without being greedy or scared. Due to the response accuracy at key levels, price will not give you a second chance to enter a trade or take profits.

Usd/Jpy-Tends to have huge moves without price confirmation.In other words, price gets forced up or down by a higher power for months at a time.

- Can use to ultimately enter counter the initial direction of the forced move; expecting price to return to fair value.

- Can use this characteristic to ride this forced move while not requiring price confirmation for your entry.

Usd/Chf- Tends to have false break outs.

- Especially on this pair, remember to watch the lower time frame's price action to make sure the break out is legitimate.

Eur/Jpy, Aud/Jpy, Gbp/Jpy tend to form trade set ups simultaneously.

- If you notice a strong move occuring on the eur/jpy, pay attention to the aud/jpy and gbp/jpy for possible trade opportunities and visa versa.

That's it!

I hope this helps!

Ken

EURUSD continue higher again !!!!yesterday expectation gone well, but our target is 1.06300, if you already in long position you can still trailing your SL, if not you can wait for a price rejection at an area of value (ex : uptrend line) and after that go long

FOLLOW, LIKE and COMMENT to discuss the expectations

4 Steps To Become A Confident TraderIf you lack confidence in ability as a trader I am here to encourage you. Being a forex trader can be hard, but when you learn the steps it takes to become confident in your abilities it can become more simple. In this video, I am going to give you the 4 steps I give to my clients who work with me for 6 weeks in our 1 on 1 sessions.

I'd love to know if you've been struggling in this area and what questions you may have to help you overcome your struggles. Write them below and let's chat.

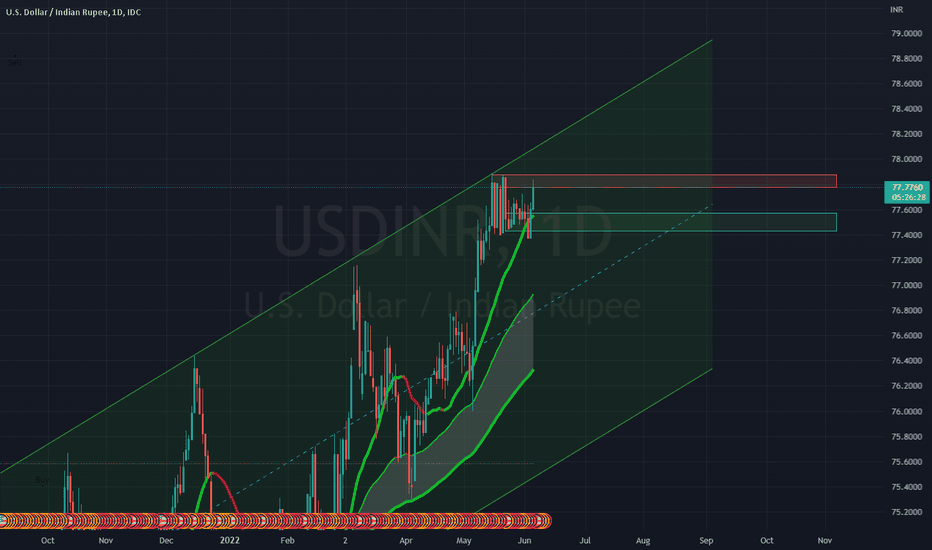

USDINR looks strong on Daily & Weekly timeframe, heading to 77.8USDINR is rising on rising sharply due rising crude oil prices this week, as European nations has said No to Russian Oil.

USDINR is looking strong and can head to levels of 77.8 where it can face huge resistance.

If USDINR manages to trade above 77.8 levels on daily and weekly timeframes, then it is heading towards 78.5 levels.

If BEARS managed to hold USDINR further upward movement or if RBI intervenes, then it can fall back to retest 77.4 levels.

P.S. Most of this movement in USDINR this week would be dependent on how CRUDE OIL performs in global markets.

How to analyze a counter-trend trade Do you know if you are a counter-trend trader and if it fits your trading style? We will need to analyze what a counter-trend trader is appropriate to answer these questions.

Counter - to move against

Trend - the latest direction in which something is moving

Trade - to exchange

If you put all of these terms together, a counter-trend trade is an exchange that goes against the direction.

Let's take into account EURCAD. On the daily timeframe, the price in April was bearish. You can see the visual evidence based on the daily lower lows and lower highs that formed.

On May 10, 2022, the buyers pushed the price up past the last lower high at 1.37599, representing the previous highest exchange rate price sellers sold, causing the price to decline again to new lows at 1.33903.

This signals a reversal in price. Here is the true question:

Would it be wise to become the buyer, and what would that look like?

It is wise, but you'd have to understand which market cycle you'd be trading in.

There are three market cycles.

1. Trend continuation (a.k.a impulse)

2. Retracement (a.k.a the correction or counter-trend or pullback)

3. Reversal

When the price passed 1.37599 to make new highs at 1.37695, that signaled a reversal. It would have been wise to wait for a pullback before buying back up to ensure a better risk to reward. If this trade were taken above 1.33903 back up to the new highs, you would have had a decent risk to reward.

But, what about now. Could the same results be produced? Let's go deeper.

Does this qualify as a counter-trend trade?

If you scale up to the higher timeframe, you will see the weekly timeframe is in a downtrend. It is making lower lows and lower highs. So any buy you enter on the lower timeframe at this point will be categorized as a counter-trend trade.

Here is what this means:

1. Do not expect to hold counter-trend trades as long as you would a trend trade. Choosing which timeframes you enter counter-trend trades will help determine where you take profits, and your rules should play a big part in this.

2. Sometimes, you won't know if you're entering a counter-trend trade unless you become aware of which cycle you are trading.

If it's not clear, try going up one timeframe.

As far as this potential trade here goes, this would be considered a daily timeframe counter-trend trade because the weekly is in a strong downtrend.

Something to remember:

The best traders go with the trend. They may counter-trend trade occasionally, but their systems work best when they trend trade.

When choosing if you are the counter-trend trader, make sure your timeframes align, and you have sufficient visual evidence you are trading with the trend before entering a counter-trend trade.

Also, consider lowering your risk so you do not give back profits you may have just earned.

Lastly, consider if counter-trend trading may not be your thing. It's ok if it's not. Not all great traders trade the same. It's ok to be in your lane.

I pray this quick analysis and note were helpful. I'd love to converse with you if you have any questions or thoughts. So comment below, and let's chat there.

-Shaquan

The Next Big Move For Euro and DollarHey Purpose traders. Did you know the Euro and Dollar are negatively correlated currency pairs in the market. What this means is the EURUSD moves opposite of the dollar index (ticker symbol DXY).

In this video, I will show you the supply and demand technicals behind the currency pair and index. Please understand this is not a signal, but an educational video. If a trade can be taken, please use your own knowledge and trade at your own risk.

USDCAD, could a new push lower be on the cards? Looking at the USDCAD on the daily chart TradingView community, could we see a new move lower if sellers can reverse today's rally and break last Friday's low?

We are looking for that low break as it will back up a break of the fast trend and confirm the current bearish CCI. Risk markets look to be back in vogue on the short term, but this could be a short term move as overall inflation has not gone anywhere.

Oil is another factor for this pair, and for now, buyers are trimming earlier losses. So we will continue to watch this pair's price action, and if we do see a new break below last Friday's low, we will look to see if it can turn into a new leg lower.

Good trading

Pending Orders Changed The Way I TradeIf you feel like you're missing trades due to a busy work schedule or because you're afraid to hit the button when a great trading opportunity comes along, pending orders may be the thing you need.

In this video, I will teach you the difference between market orders vs. pending orders.

Thank you for watching the video and comment below your thoughts. I'd love to read them ( please be kind and happy trading).

Buying This Again. Will Join Me? What I love about USDJPY is she has been showing clear signs of an uptrend. She has been creating higher highs and higher lows for the past few months and it has been a joy to watch.

I've not been able to catch all of the opportunities she has presented because she doesn't fit each of my 3 three rules, but 'm hoping she can meet it this week.

If she can pullback to my estimation zone( my personal name for my strategy) and prove she can stay above 128.617 I'll buy her again.

This is a tight pullback which is known as a narrow trend. Here is what this tells me and I'm happy to share it with you. It tells me 3 things:

1. My risk to reward will be close to a 1:1.

2. The trade may can take less than 3 days to give profit. If my rules are met she could give profit in less than 24 hours if no fundamentals impact her movement,

3. I could enter this trade no later than tomorrow pending on her candle closures.

At this moment I do not have a 1:1 trade so if price can pull back a little deeper past my zone, but still stay above 128.617 I can happily buy JPY at a great price.

Does your analysis resemble the same buying sentiment? Let's talk about it below. Share your thoughts or questions and let us chat.

No hateful or unkind words please.

EUR/USD Daily Chart Analysis For May 6, 2022Technical Analysis and Outlook:

The rebound to Mean Res 1.065 is completed as specified Daily Chart Analysis For April 29, 2022. The next down move is marked as Next Inner Currency Dip 1.031, and the future Outer Currency Dip 0.9765. Bullish movements are possible within the current downtrend - trade appropriately.

Bitcoin: Liquidity and Order blocks!This is an educational post! I have tried to combine the concept of liquidity with that of supply and demand to show you one of the most efficient trade setups in financial markets!

You basically have a descending trendline in 30m chart of bitcoin! Price reaches a confluence area in higher time frame analysis (let's not be concerned about that now) then it jumps a bit to create a range! We know range bounds are liquidity nests!

So price first grabs the upper range liquidity, breaking the market structure at the same time and hence confirming the long bias! Then it comes down to the demand zone, grabbing the lower range liquidity at the same time and then boom! It goes to the target!

How To Analyze Charts On The Monthly, Weekly, and Daily TFOOH multiple timeframes analysis can be hard for beginner traders. It took me a few years to understand how to pair the right timeframes together and what to plot on my each timeframe to help me find my entry.

In this video, I am sharing a trade idea on CADCHF. It's just an idea until I receive my entry, but it can be a good setup if it works well. You'll get to view how I am analyzing the monthly, weekly, and daily timeframe to find my entry price.

I pray you have a safe trading week and if you have questions or comments please share them in the comment section below.

How To Trade USDJPY & EURJPY| Detailed AnalysisThe Japanese Yen pairs are one of my quote pairs to swing trade. USDJPY and EURJPY tend to move the same from time to time because they share the Japanese Yen Currency.

In this video, I'm sharing my view of the analysis step by step. So, take your pen and pencil, well mouse and keyboard out and let's analyze the pairs.

A Quick Trade Setup On AUDUSD CompletedAUDUSD was a great setup. I won't be taking as many of these in the future after this week so I'm enjoying these 4 hour setups while I can. I'm going back to my roots as a long term swing trader who holds trades between a week to a few months.

It's more relaxing to me and improves my mental health. Remember, to do what you love and not what everyone expects you to do!!!