CVX

CVX/USDT Weekly Analysis — Strong Reversal Zone CouldTechnical Analysis:

1. Strong Demand Zone (Key Reversal Area)

CVX price has repeatedly tested a strong support zone around $1.43 – $2.20 (highlighted in yellow). This area has acted as a major accumulation zone, showing strong buyer interest and serving as a critical base support.

2. Potential Double Bottom Formation (Bullish Reversal Pattern)

A potential Double Bottom or Adam & Eve pattern is forming within this demand zone — a classic bullish reversal structure, indicating a possible trend shift to the upside.

3. Key Resistance Levels (Bullish Targets):

$2.90 – Minor resistance, likely to be tested in the short term.

$3.46 – Significant psychological and technical resistance.

$4.98 – Major resistance and neckline of the double bottom pattern.

$6.76 – Strong weekly resistance, a potential medium-term target.

$15.77 & $47.97 – Long-term targets if a macro bullish trend emerges.

Bullish Scenario:

If the price holds above the $2.20 support zone:

Gradual upward movement expected toward $2.90 → $3.46 → $4.98.

A confirmed breakout above $4.98 could trigger a rally toward $6.76.

Full bullish confirmation would occur if the price breaks and holds above $6.76, indicating a longer-term trend reversal.

Bearish Scenario:

If price breaks down below the $1.43 support level with a weekly close:

The double bottom structure would be invalidated.

Price could enter new price discovery territory, potentially heading below $1.00.

Market sentiment would turn significantly bearish.

Strategic Conclusion:

CVX/USDT is currently at a critical decision point. A strong historical support zone suggests a high potential for bullish reversal. Confirmation of the bullish structure requires a breakout above $4.98. However, caution is needed if price breaks below $1.43, as it may indicate structural failure.

#CVXUSDT #ConvexFinance #CryptoAnalysis #DoubleBottom #ReversalPattern #BullishSetup #AltcoinAnalysis #SupportResistance #CryptoBreakout #TechnicalAnalysis

#CVX best zone for make some money SOON ?#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a bounce from the lower boundary of the descending channel. This support is at 2.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 2.23, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 2.41

First target: 2.46

Second target: 2.55

Third target: 2.65

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

RIG Mega Profits SecuredRIG is a high beta oil stock. We secured profits today and looking for another entry.

With the recent breakout and upside momentum in oil, this name caught a massive bid.

Crude oil has seen a sharp rise in just the last week and shaping up for a continuation move higher.

If this breakout holds energy stocks should continue to fly.

WTI has its first major resistance level coming up within 1% from current price.

Look for pullback buys in energy if oil continue to hold the inverse head & shoulder breakout.

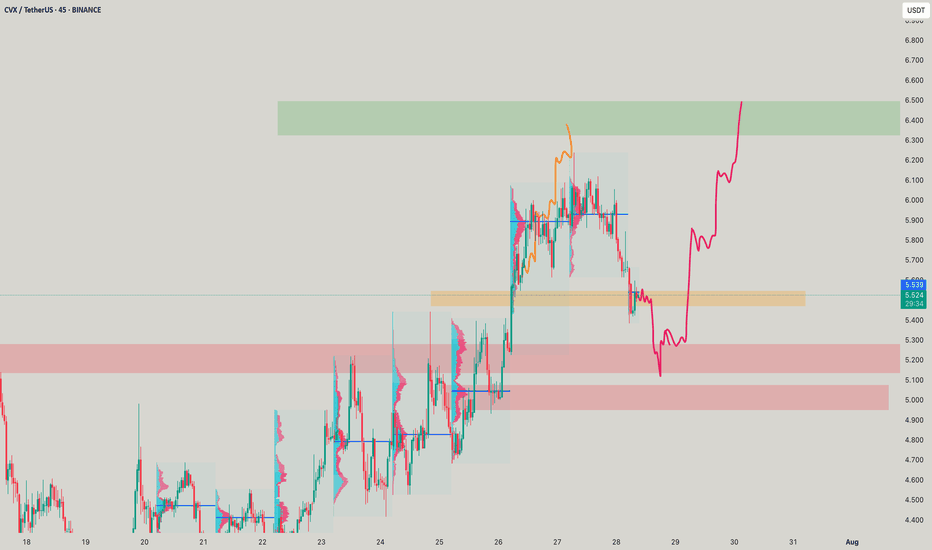

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.644.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 2.730

First target: 2.800

Second target: 2.860

Third target: 2.924

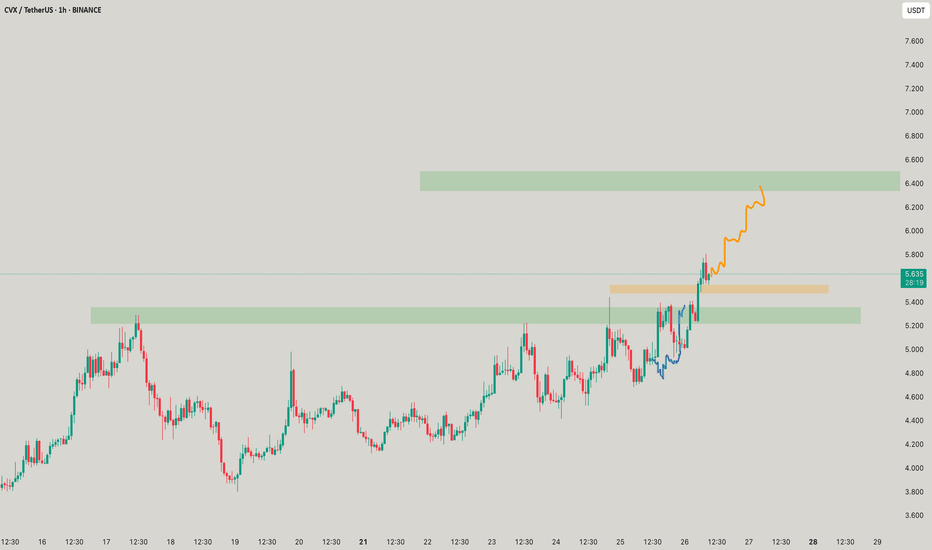

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.97.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.43

Second target: 3.59

Third target: 3.77

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 3.00, which acts as strong support from which the price can rebound.

Entry price: 3.14

First target: 3.26

Second target: 3.42

Third target: 3.58

Convex Finance (CVX) Rectangle (1W)BINANCE:CVXUSDT has been trading in a rectangle with well-defined boundaries since January 2023, and it has recently reclaimed the 1-year EMA, potentially shifting the bias to bullish.

Key Levels to Watch

• $1.5-$2.0: Main demand zone and invalidation point for any bullish TA if broken

• $3.0: 1-year EMA, successfully reclaimed and retested as support

• $4.4: Rectangle midline, previously relevant as a S/R

• $6.1-$7.2: Main supply zone and upper boundary of the rectangle

• $13.0: Previous swing high and rectangle breakout target, which would be confirmed by a weekly close above $7.2 with good volume

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.98.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.05

First target: 3.14

Second target: 3.24

Third target: 3.36

CVX demand zone!OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.72, which acts as strong support from which the price can rebound.

Entry price: 2.83

First target: 2.90

Second target: 2.97

Third target: 3.06

CVX Chevron Corporation Options Ahead of EarningsIf you haven`t sold CVX before the retracement:

Now analyzing the options chain and the chart patterns of CVX Chevron Corporation prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Chevron: The Chart’s Reaching a Critical PointChevron is starting to look very interesting again — but let’s be clear from the start: Chevron, like every oil giant, lives and dies by the price of oil. If oil rips higher or collapses due to global politics, supply shocks, or economic chaos, Chevron NYSE:CVX follows. No exceptions.

That said, what we’re seeing on the chart right now is increasingly pointing toward a deeper correction — specifically down to the $113–$100 zone. That would make sense structurally as a Wave 4 retracement.

But there’s a technical nuance here. Wave 1’s high sits at $103 — and depending on how strict your Elliott Wave rules are, Wave 4 dipping into Wave 1 is bad territory. Personally, I’m okay with a brief touch into that range, but I don’t want to see price hanging around below $103 for long.

From a trend perspective, we’re clearly in a downward channel. We just saw a textbook bull trap:

Chevron broke out with a solid +7% move over two weeks,

Followed immediately by a massive 22% drop,

One of the sharpest two-week declines since — yeah — March 2020, pandemic levels.

Now, price is hovering around $130, and the setup is simple:

If this level holds, great — maybe we’re bottoming.

If it breaks, I’m looking to buy between $113 and $100. That’s where the structure aligns, the volume kicks in, and risk/reward starts to make sense again.

So here’s the real question:

Do we see $200 first — or $100?

I’m leaning $100 first.

Not because I’m bearish long-term— but because that level would clean up the chart, shake out the noise, and give us a real shot at riding the next strong leg higher with conviction.

Would love to hear what you think — where’s your bet?

CVXUSDT | Critical Resistance Zones – Precision Trading Required🚨 High-Importance Levels Identified – Stay Ahead of the Crowd

The red box and red line represent key resistance zones where sellers are likely to be aggressive. Blindly longing into resistance is how most traders lose money, but we trade with precision and confirmations.

🔴 Short Scenario (Rejection from Red Zones):

✔️ If price rejects from these levels with clear LTF breakdowns, I will look for shorts.

✔️ Volume & CDV Confluences – We need confirmation that selling pressure is increasing before entering a position.

✔️ No Confirmation = No Trade – We don’t chase, we execute with discipline.

🟢 Long Scenario (Break & Retest Above Red Line):

✔️ If price breaks above the red line with volume and successfully retests it as support, I will look for long opportunities.

✔️ Confirmation on LTFs is crucial – Without it, there’s no reason to go long.

Why This Analysis Matters

Most traders are lost, making impulsive decisions with no strategy. That’s why my high success rate stands out. I identify the key levels before anyone else, giving you the edge needed to dominate the market.

Trading isn’t about hope—it’s about execution. If you’re serious about winning, follow the right approach.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Chevron (CVX) – Strong Growth & Cash Flow ExpansionCompany Overview:

Chevron NYSE:CVX continues to demonstrate strong operational efficiency, strategic expansion, and record-breaking U.S. production.

Key Catalysts:

Production Growth & Profitability 🚀

Global production up 7% in 2024.

U.S. output surged 19% to record levels.

Permian Basin nearing 1M bpd, reinforcing cash flow strength.

Strategic Expansion & Sustainability 🌍

Gulf of Mexico projects targeting a boost from 200K to 300K bpd.

Future Growth Project in Kazakhstan enhances long-term production & ESG alignment.

Navigating Venezuelan challenges while leveraging stable U.S. policies for continued growth.

Investment Outlook:

Bullish Case: We remain bullish on CVX above $139.00-$140.00, backed by resilient production growth & execution.

Upside Potential: Our price target is $215.00-$220.00, supported by strong cash flow & expansion initiatives.

🔥 Chevron – Powering the Future with Growth & Stability. #CVX #EnergyStocks #OilAndGas

If it receives support at 2.179-2.862, it is time to buy

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(CVXUSDT 1D chart)

The key is whether it can receive support near 2.835-2.862 and rise above 3.267.

Since the StochRSI indicator is showing signs of entering the overbought zone again, if it does not receive support near 2.835-2.862,

1st: 2.472

2nd: 2.179

It is expected to fall to the 1st and 2nd levels above.

Since the HA-Low indicator of each chart is located in the 2.179-2.862 range, if it is supported within this range, it is a time to buy.

The fact that the HA-Low indicator was created means that it has moved out of the low range.

-

Since the HA-High indicator of the 1W chart is formed at the 3.267 point, if it is supported at this point, I think that a full-scale uptrend is likely to begin.

However, since the M-Signal indicator of the 1M chart is passing around 4.086, the point to watch is whether it can rise above this point and maintain the price.

-

If it falls below 2.179, you should check whether it is supported when the HA-Low indicator is created again and determine whether trading is possible.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

#CVX/USDT Ready to launch upwards#CVX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.85

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 3.15

First target 3.26

Second target 3.41

Third target 3.61

Crude Oil LongWTI's price broke through the 200-day MA. In the next few days, we should also see the breakup in the 50-day MA versus the 100-day MA.

Energy stocks will benefit from the price swing in Q1 2025. Look at XOM, BKR, CVX

The Chinese government's introduction of ultra-long special government bonds to boost infrastructure spending and consumer demand has heightened expectations for increased oil consumption.

Saudi Arabia and OPEC+ have continued their production cuts, tightening supply. Saudi Arabia raised the price of its flagship Arab Light crude for February by $0.60 per barrel.

The outlook for February 2025 is bullish for oil. We should expect continuing supply constraints. OPEC+ production cuts and sanctions on major oil producers like Iran and Russia are expected to persist, maintaining a tight supply environment.

The incoming Trump administration's potential tightening of sanctions on Iran could significantly reduce Iranian crude exports, further constraining supply.