Cypher-harmonic

Bear Rally Bull Trap or Runaway Rocketship?Bounced off 200DMA and of course FOMC coupled with missed ERs and Hopium drove it up up and away.

Broke above DT line but indicators show bearish divergence, price rising while Stoch RSI falls.

Trades at upper Bolly Band. as Bad news has had such a positive effect can hardly imagine what Good news might bring!

Fed sez another 75bp hike next month. Is it priced in? Anybody's guess.

NB: This post suggests no future path, only observing key signs.

Will it selloff to retest 200DMA? Or ignore logic and reason to bull higher in face of adversity? Stay tuned.

Would not chase this long.

NB: Close on 7/27 perfects harmonic cypher pattern. These usually sell, sooner than later.

And it has sold off after FOMC twice.

Silver is close to TL system resistance and 61.8% Title: Silver is close to TL system resistance and 61.8%

Silver

Overview (DXY):

The US Dollar (DXY) traded to the highest level in 237 months in July before taking a corrective move to the downside. This coincided with a base being put in on Silver at 18.15.

There are three downside barriers in Silver. The TL system highlights 105.00 and 104.70 as support, while the completion of an AB leg, in a large cypher BAT formation, is located at 104.91

Silver Daily Chart

We can clearly see 5-waves to the downside. Elliott Wave enthusiast will see this as the completion of a bearish count. This would suggest that the next wave higher is the complex correction consisting of five and three wave counts

TL system highlights resistance at 20.83

Silver eight-hour chart

We can see a 5-wave count to the upside. The TL system highlights resistance at 20.83. A 61.8% Fibonacci resistance level is located at 20.83 (from 22.51-18.11).

Conclusion:

I am looking for limited upside, selling at 20.83, for a move lower in the BC leg towards 18.50

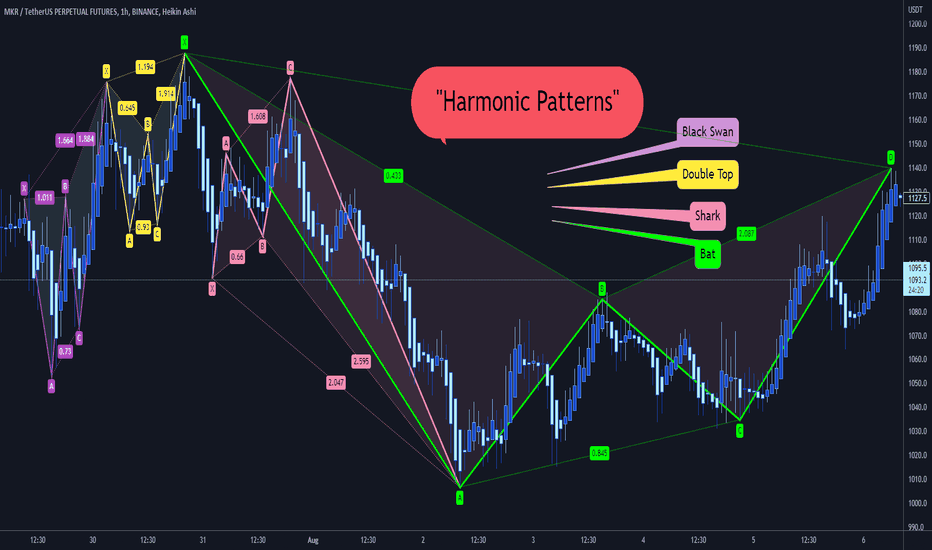

Harmonic PatternsHarmonic Patterns

we have so many kinds of “Harmonic Pattern”:

Black Swan

Bat

Crab

Butterfly

Gartly

White Swan

Shark

Zero_Five

Cypher

Double Top

Double Bottom

📚👌🏻 Each one of them has its unique Fibonacci levels.

⚡️ Do you want to know them?

😍 Happy to see what you find in the charts, please share yours with us

Cypher Nearing CompletionJuly has been a crazy month for BTC, first we started out with a very clear head and shoulders pattern, but as well know, that was rejected, and we soared upwards.

That was a clue to me that we were entering potential bullish cypher, as such I drew one on the chart and waited to see what happened. I have noted my entry points so as you can see that I did not enter for most of the month, while I waited for a clear direction to form.

Once I saw the cypher pattern validate itself, I entered.

The only question remains, will the pattern complete 'textbook' taking to 28k and then back down to 20k before entering a parabolic rise breaking this lower range?

Or will we see something bizarre happen?

My money is on the pattern holding true, market makers will want to ride the volatility as long as possible; they see the same chart I'm show likely; they know whats up.

Get ready to close longs over this weekend.

NAS100 Daily Bullish TradePEPPERSTONE:NAS100

Trade Plan

Date: 19 July 2022

Instrument: NAS100

Timeframe: Daily

Description

NAS100 (US Tech 100) appears to have completed a correction sequence that started on 22 November 2022.

Apparently price is sitting at a range price (support zone) of Monthly and Weekly Pivots at11820 and 11860 respectively. If this support zone holds, price is likely to visit 15550 area for a completion of CD of Bearish Cypher Pattern on Daily Timeframe.

Bullish Trade of potential CD Leg is depicted on the chart.

Disclaimer:

Charts are EDUCATIONAL purpose, not INVESTMENT recommendation.

Banknifty - Cypher PRZ at Wolfewave TargetBanknifty had wolfewave and near to its target , interesting thing is wolfewave target and cypher prz are at same level. Current supply is tested thrice (including current attempt to break) Looks like it will trap bulls by giving breakout ... Upside a significant supply with left shoulder is waiting to pull price down. Previous quasimodo failed to break low hence we can say strong low has formed. and also two flag limits below (one with FTR) shows strong demand and which is hard to break .

*Cypher might turn into shark so next potential reversal zone will be at 886

CHAMBAL FERTILIZERHello and welcome to this analysis

The stock is at the PRZ of a Bullish Harmonic Cypher formed in Weekly time frame.

A bounce/reversal till 340 to 375 is probable as long as it does not break 250.

Risk Reward for the trade is v good at 1:3

Harmonic Trading Patterns consolidate and then give strong follow through of trends. Since this is based on weekly time frame, trading it via derivatives could be risky as it will be a time consuming one with pullbacks and sideway along the path till its target, hence, cash based entry is advisable.

A Few Possible Buy-In Spots for $SUSHI I'm long on SUSHI & have been the last few weeks, after all the inverse fibonacci's had bottomed out & the price became pressed against that massive diagonal trend line. This chart is a 4hr chart, & I believe we're just essentially in consolidation before a move up. These are some possible targets where the price might dip to, barring a big sudden move up without further consolidation. We've got a cypher pattern in play & a couple fibonacci retracement possibilities.

*Not trading advice.

RUNEUSDT Cypher HarmonicThe information contained herein has been prepared for general information purposes only. The comments and recommendations contained herein are based on the personal opinions of commenters and recommenders. It should not be interpreted as a buy-sell recommendation or a promise of return on any investment instrument. These views may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained herein may not yield results that meet your expectations.

Common features of all bullish harmonic patterns.www.tradingview.com

By combing all bullish harmonic patterns together, we can observe the following:

1. The Bat, Cypher , Gartley and Shark pattern point D is (0.786 - 0.886) XA without breaking the low.

2. The Butterfly, Nenstar , Crab and Deep Crab point D is (1.272 - 1.618) XA after breaking the low.

3. Point C band is common for all patterns (0.382 - 0.886) AB

4. Pint B band is common for three patterns ( 0.382 -0.618) : Bat (upto 0.5) , Gartley and Crab, with the Gartley pattern point B fixed at 0.618 XA

5. Patterns breaking out of Point A high have a band ( 1.13 - 1.61 )AB

USDCHF - short from the cypher pattern Cypher pattern completion at bespoke resistance has resulted in a short USDCHF trade. We are looking for a move down to 0.9400 offering a nice risk set up with a stop above the swing high

It should also be note that the swing trades was also accompanied by our scalp set up

$BOXD Next Target PTs 3.25-3.40 and higherBoxed, Inc. operates as an e-commerce retailer and an e-commerce enabler in the continental United States. The company through its e-commerce retail service provides branded and private labelled bulk pantry consumables, such as paper products, snacks, beverages, cleaning supplies, etc. to B2C and B2B customers, vendors, and enterprise retailers, as well as household customers. It also provides Boxed IQ, a content management suite, programmatic cost-per-click ad-platform, and vendor portal data suite, that offers vendors, suppliers, and CPG manufacturers the ability to advertise their products to customers, and access customer data and feedback in real-time; on-demand grocery services; and an enterprise-level e-commerce platform. Boxed, Inc. was founded in 2013 and is headquartered in New York, New York.

BTCUSDT - CYPHER HARMONIC "BEAR" MARKET - 19 June 2022 Blue lines recent daily support. Dashed lines historic daily support. Put some time pressure on myself here not to over analyse. Just for fun but ultimately would have responsible risk management at key levels. Absolutely not accurate if specification should require technical. A rough idea. I like it.

BTCUSD - Bearish ContinuationBITSTAMP:BTCUSD has been trading in downtrend and recently pulled back but looks week on daily and might not carry the momentum longer. It also formed potential Cypher/Shark harmonic patterns and possible targets are at 21578(target#1) and 16040(target#2). 200 SMA is also around target#1 so it might bounce from there. It is also forming narrow TTM Squeeze. Momentum is negative so it's very likely that it will fire downside.