Czk

ridethepig | The ElementsFor this exercise we are going to use PLNCZK as an example and allow a live swing to be setup. The banquet is over for bulls in this case after sellers capped the highs on three separate occasions each time driving the price out. Next came the spike down in thin markets, algos on the sell side helping itself to clean the board. But then came this breakdown yesterday and the retrace banquet was over. The technical damage now ruefully done, with nothing left to defend for bulls as strong seasonal factors enter into play for CZK .

The correct method on this board is to punish buyers for losing the break and sweeping the lows at 5.825. All is going according to play; the ladder can easily be cleared. The advance lower is an illustration of how to spot a breakdown miles ahead of the crowd.

As soon as bulls shamefully abandon the highs in yellow, their fellow comrades begin to lose confidence. Yes, it is true as in life the same case with markets....whenever a retailer gets "delusions of grandeur", they then forget all about their fellow comrades and go overboard .

Smart money is spotting the change in direction, opening fire each time and pinging the price back down. Sellers now have the task of marching towards the recent lows while keeping an eye on any further rallies to add on pullbacks. This breakdown can hardly be more obvious as sellers have the immunity to attack by being "protected" from the 5.968x, 5.989x and 6.00x highs.

Good luck all those on the sell side here over the coming sessions, a well developed swing in play and highly recommend tracking if not trading it with live accounts.

Hope it helps.

EURCZK: Buy opportunity (long term).The pair is trading within a multi month Rectangle with 25.4100 being the 1M Support. This month 1D has succeeded at pricing a bottom on this support as it stopped the previous downtrend and consolidated (neutral RSI = 44.755, ADX = 16.849, CCI = -10.1188, highs/Lows = 0.0000).

We are taking this as a strong long term buy signal with 25.8300 - 25.9000 as our Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDCZK: Structured Long term Buy opportunity.The pair is trading within a +1.5years Channel Up (1M RSI = 52.074, MACD = -0.009, Highs/Lows = 0.0000, ADX = 35.324). This month it extended the rebound of the last Higher Low and also held the 1D MA200 (orange line). Even though the 1D MA50 is applying Resistance at the moment, we are expecting a steady uptrend within the blue shaded area, in the same manner as the previous time. Our Target Zone is 23.6900 - 23.8350.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURCZK: Sell opportunity on the Descending Triangle.The pair is trading on a year long 1W Descending Triangle with clear Lower Highs that provided optimal sell entries throughout 2019. We are currently on such a Lower High and with 1W neutral (RSI = 52.272, STOCH = 45.628, Williams = -46.569, Highs/Lows = 0.0000) we are targeting the top of the 1D Support zone (TP = 25.62400). Notice how a 1D Higher High sequence (curves) precedes every Lower High rejection on 1W. Similar formation printed in April.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

CHF/CZK 1:3.44 Risk Reward (LONG BIAS)CHF Quant Score

- The current score is 0, but showed a positive shift from -25 previously... this gives an early sign of strength.

CZK Quant Score

- The current score is -25, and shifted from -8 last week, showing a continuation of weakness.

Technicals

- 4HR engulfing and support area.

- 4HR Buy zone

- High break on the previous break out.

- Higher low

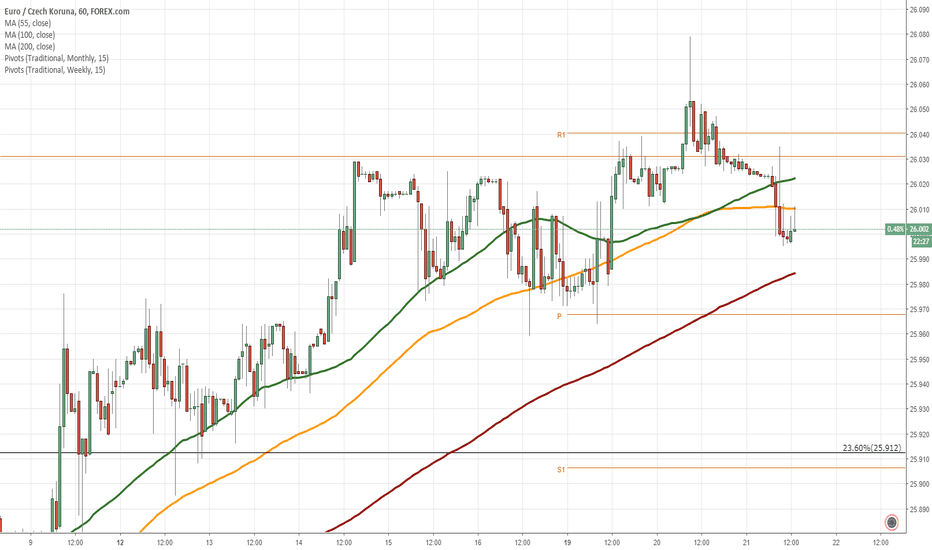

EUR/CZK 1H Chart: Upside potentialThe Euro has been appreciating against the Czech Koruna since the currency pair reversed from the lower boundary of a long-term ascending channel near the 25.40 mark.

Given that the exchange rate is being supported by the 55-, 100– and 200-period SMAs (4H), it is expected that the rate targets the Fibonacci 0.00% retracement at 26.16. Technical indicators for the short run also support bullish scenario.

The general price movement is expected to be upside within the following weeks until the upper channel line near 26.35 is reached.

EUR/CZK 1H Chart: Rising wedge in sightThe Euro has been appreciating against the Czech Koruna after the currency pair reversed from the lower boundary of a long-term ascending channel at 25.43.

As apparent on the chart, the rate has been trading in a rising wedge since the end of September. The pair's neat movement in this pattern suggests that its next move should be north towards the Fibonacci 23.60% retracement at 25.94.

The general price movement is expected to be upside within the following weeks until the 2018 high is reached at 26.14.

EUR/CZK 1H Chart: Trades in falling wedgeThe Czech Koruna has been appreciating against the Euro since the beginning of August after the pair reversed from the 2018 high at 26.14. This movement is bounded in a falling wedge.

As apparent on the chart, the exchange rate reversed from the lower pattern line at 25.43. From the theoretical point of view, it is likely that a surge towards the upper boundary of the wedge at 25.63 could happen within following trading sessions.

However, technical indicators suggest this advance might not be immediate. The pair could go down to the weekly R1 at 25.55 during next trading hours.

EUR/CZK 1H Chart: Begins expected surgeThe previous review of the EUR/CZK currency pair was concentrating on the fact that the pair was about to break the upper trend line of a junior descending pattern. It occurred on August 1 and the rate traded sideways in the aftermath of the breaking.

On Thursday, the currency rate stopped the sideways movements and broke past the SMAs, which kept it lower for the past two trading sessions. Namely, the previously expected surge has begun.

Most likely in the future the rate will form an ascending pattern of the same scale as the just broken channel down pattern.

EUR/CZK 1H Chart: Pair remains squeezed The EUR/CZK exchange rate has been trading in a channel-like formation since early 2018. The upper boundary of this pattern was tested on May 1 when the Euro reversed from the 25.75 mark. The pair’s subsequent movement has been downwards until 25.55 where the pair was located at the time of this analysis.

Technical indicators are generally neutral, thus demonstrating that the current movement sideways which has prevailed during the previous two weeks could still dominate the market for a couple of sessions. Technical signals on the daily time-frame, however, are more bearish, thus suggesting that the rate could eventually resume moving lower down to the senior channel around 25.30. The monthly S1 is likewise located near this area.

In case the dashed trend-line and the weekly R1 circa 25.60 are breached to the upside today, traders might see a surge to the opposite channel boundary and the monthly R1 at 25.75.