ETH — Still Lagging Behind. Two Levels That MatterETH continues to underperform the market — and it's not just about Ethereum. Most alts showed weakness after yesterday’s front-running impulse ended in today’s fade-out.

Let’s see how they behave on BTC’s next leg up.

As for ETH — only two levels matter for now:

1689 to the upside, and 1485.7 to the downside.

I’ll take action only after a confirmed breakout and hold above or below one of these zones. Until then — just observing.

D-ETH

ETHEREUM Does it still have fuel in the tank?Ethereum / ETHUSD hit rock bottom as it entered the Support Zone of the 3 year Channel Up.

The only times it made contact with this Zone was in June-July 2022 and November 2022.

The 1week RSI is on the oversold line and technically there is no better level to buy long term than this.

Technically it should reach $4000 at least by the end of the year.

Target 1200.

Follow us, like the idea and leave a comment below!!

ETH | Ethereum Hits 2 YEAR LOW - What's Next?Could it be that ETH bottoms out here?

Low from March 2023:

Interestingly enough, it could be said that it was the previous cycle's accumulation zone. Considering the previous cycle's price action, this isn't a ad zone to load up - for the longer term.

From here, although the price bounced high, and low, it was the 8-month price action before the next bullish cycle started. This gives us perspective in terms of time

___________________

BINANCE:ETHUSDT

Opportunity for a Profitable Ethereum Long Position (30M)Before anything else, you must stick to the entry zone and stop-loss.

Otherwise, the risk-to-reward ratio gets ruined and the trade loses its value.

There's a bullish QM pattern on the chart.

We're looking for a Buy/Long opportunity around the support zone.

Take partial profit at the first target and move the stop to break-even

If the stop-loss gets hit, the position will be closed.

ETH - LOWER LOWS incoming - SELL OFF CONTINUESETH - Lower Lows possibly ahead given current BEARISH MARKET STRUCTURE.

From the break out below the channel, to the RETEST & CONTINUATION of BEARISH MOMENTUM / SELLS - there is a high chance these Red Candles will extend to the next PYSHC LEVEL OF 1,250

1,000 &

POSSIBLY TOUCH 750.

From there I'd prefer not to predict but I would not be surprised of a massive Bull Run off of those KEY LEVELS.

SAFE SL - ABOVE 2,000

TP1 - 1,674 - HIT

TP2 - 1,250

TP 3 - 800

ETH Long Term Prediction - Ethereum Game Plan ETH broke the bullish weekly structure and is currently retracing lower. I don’t see any signs of strength on the chart yet.

I expect the price to first hit $1250 and see a rejection there a possible bounce.

However, the real target is $870 (2022 low). That level holds significant liquidity, so I expect it to be taken out, triggering a potential capitulation. I’ll be looking for spot buys and long-term long setups in anticipation of another possible bull run.

Litecoin LTCUSD Completing Final Leg Down Before LaunchAs you can see Litecoin is forming a very similar pattern. I think the rest of March will be corrective. Litecoin will likely come down and bounce off the trend line which coincidental also is a major support level. April will be slightly bullish, May and June will be majorly bullish which I believe Bitcoin will also fly up to 140k as well in this time. I believe Litecoin will outperform the majority of the market. Major hyperinflation will begin this summer which will be very positive for crypto. Many cryptos will die in this hyperinflation period. Only some will survive. Dollar is going to crash. Get ready for a wild ride into 2026. People calling for a bear market are ill informed and will kick themselves for selling. This is the beginning of the biggest run in some cryptos, we've ever seen. Buckle up. Good luck. Not financial advice.

Ethereum has been highly volatile and is rapidly losing value.Ethereum has been highly volatile and is rapidly losing value. This is not only due to actions taken by Trump but also because of the looming recession that many analysts are predicting. But will this recession truly materialize, and if so, will it also impact the crypto market?

The recession is most likely to continue affecting traditional markets, especially financial firms. Tech companies have already suffered significantly and may face an additional decline of up to 20%. Ethereum will also be affected, as it is not classified as a digital currency but rather as an asset—primarily due to U.S. regulatory policies.

This means Ethereum is tied to recessionary trends. Since the crypto market hasn't yet entered its own growth cycle, which is still expected to come, we may still see a short-term drop in price down to around $831. After that, our mid-term price targets are up to $2,460.

Ethereum - Short Term Sell Trade Update!!!Hi Traders, on April 8th I shared this idea "Ethereum - Expecting Retraces Before Prior Continuation Lower"

I expected retraces and further continuation lower until the two Fibonacci resistance zones hold. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ethereum (ETH) Forecast with NEoWave1M Cash Data Chart

Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times.

Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C -failure. However, if the price breaks strongly through the 1000–1200 range and consolidates below this level, wave-C might extend to the 700–807 range.

ETHEREUM BEARISH BREAKOUT|SHORT|

✅ETHEREUM keeps falling

Down and the price made a

Bearish breakout of the

Key horizontal level of 1600$

And the breakout is confirmed

So we are bearish biased

And we will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

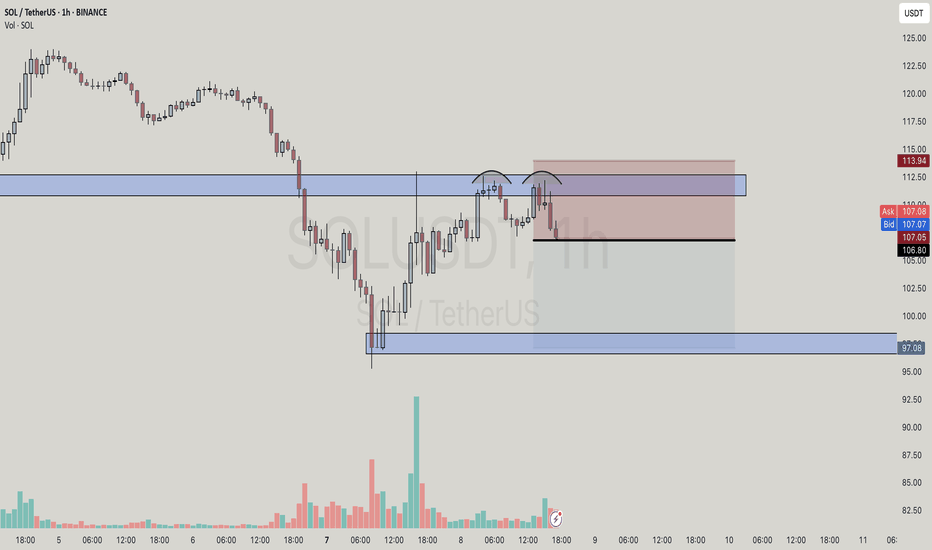

Solana vs. Ethereum: Why Investors Are Turning to Solana in 2025In recent months, a growing shift in sentiment has been observed among crypto investors: many are increasingly eyeing Solana (SOL) as a strong alternative to Ethereum (ETH). The comparison chart above, plotting Solana’s price action alongside Ethereum's, reveals that despite ETH retracing back to October 2023 levels, SOL is still holding higher support zones—a sign of relative strength and growing market confidence.

But why exactly is Solana capturing investor attention more than Ethereum in 2025? Let’s dive into the technical, fundamental, and sentiment-driven reasons behind this evolving preference.

___________________

📊 Technical Outlook: Solana Holding Strong

Ethereum (red line) has dropped back to its October 2023 price levels (~$1500), reflecting a broader altcoin weakness.

Solana, on the other hand, is still trading above $100, even though the macro market has turned bearish.

SOL has tested and respected the long-term ascending trendline that began in early 2023, while holding above a key horizontal support near $68–$82.

This divergence in structure suggests stronger buy-side interest and support zones forming on Solana, while Ethereum appears to be losing momentum.

___________________

🧬 Fundamental Comparison: Solana vs. Ethereum

Solana’s technical design gives it a speed and cost edge that appeals to users and developers building consumer-facing applications like NFTs, GameFi, and micro-transactions. Ethereum remains the institutional and DeFi heavyweight, but it’s starting to feel the pressure of competition in usability and scalability.

___________________

💬 Investor Sentiment: What’s Driving the Shift?

User Experience

Solana offers near-instant confirmation and negligible fees, making it ideal for gaming, NFTs, and mainstream use cases. Ethereum's scaling solution rollouts are still clunky and fragmented (Layer 2s like Arbitrum, Optimism, etc.), creating friction.

Vibrant Ecosystem Growth

Solana’s ecosystem is experiencing a boom in dApps, especially with high-profile launches like Jupiter, Marinade, and Phantom wallet integration. The mobile-first approach (Saga phone initiative) and deeper ties with consumer apps are also pushing adoption.

Performance During Market Pullbacks

As seen in the chart, SOL is showing relative strength during market corrections, indicating long-term accumulation rather than panic selling.

Narrative Momentum

The "ETH killer" narrative has found new life with Solana's resurgence. While Ethereum focuses on L2 scaling and abstract complexity, Solana is betting on a simpler, high-performance monolithic chain.

Were To Buy BITCOINMartyBoots here , I have been trading for 17 years and sharing my thoughts on COINBASE:BTCUSD here.

.

BTC is very interesting chart for now that it has dipped 30% and trying to find support.

Do not miss out on BTC at the important levels as this will be a great opportunity

Watch video for more details

$ETH why is it cancelled? Things you porobably need to know.There are several reasons why CRYPTOCAP:ETH is being sidelined—some obvious, others you may not have considered. Here's my analysis.

Let’s be clear: something is wrong in this cycle, and the ETF providers are at the heart of the problem.

The famous line, *"there is no second best"*, rings true—because they ensure no one overshadows their main asset: $BTC.

They’ve already tried to destroy crypto outright—really hard—and failed. The elites are 100% devoted to the USD; it’s their lifeblood. Crypto, especially stablecoins like USDT or USDC, became a competitor, and they did everything possible to wreck the market. When direct attacks didn’t work, they turned to a new strategy: controlling it from the inside.

They embraced crypto, and now they’re making billions off crypto enthusiasts who mistakenly believe these players are here for their benefit. This won’t last forever, but that’s a topic for another day.

Now, let’s address why Ethereum is underperforming—and why it’s likely to continue.

### 1. **Corruption in the Proof-of-Stake System**

All PoS systems rely on staking: the more you stake, the more rewards you earn. Typical staking rewards in crypto average about 10% APR, significantly higher than traditional bank interest rates.

But here’s the catch: these rewards are minted, creating inflation because more coins are constantly being dumped into the market. This results in a class of "retired" investors who stake massive amounts, live off their staking rewards, and sell them without ever touching their capital. This creates constant sell pressure on PoS coins.

The Ethereum Foundation controls how much staking is rewarded. Because it’s run by the same people staking, their vested interest is to keep APRs high, even though this fuels inflation. Ironically, Ethereum’s inflation rivals the USD—a troubling reality for a crypto meant to outperform traditional finance.

### 2. **Ethereum’s Ripple Effect on the Market**

Most altcoins rely on Solidity smart contracts, meaning Ethereum’s performance directly impacts the broader altcoin market. When Ethereum underperforms, it drags down Layer 2 solutions, DeFi projects, and the entire altcoin ecosystem.

Knowing this, why did ETF providers rush to approve ETH ETFs? Simple: *“There is no second best.”*

By taming Ethereum, ETF providers manipulate the market to keep Bitcoin afloat, cancel bear markets, and kill any chance of an altseason. On-chain data shows their strategy: when they buy Bitcoin, they sell Ethereum. This frustrates altcoin holders, pushing them to dump their bags and pivot toward—guess what—Bitcoin.

### 3. **The ETF Trojan Horse**

Ethereum, with its corrupt foundation, is the perfect tool for entities like BlackRock to maintain Bitcoin dominance. By doing so, they effectively prevent bear markets and suppress altseasons.

But this strategy has an endpoint. ETFs will milk the crypto space for as much profit as possible. Once they’ve extracted enough, they’ll dump their holdings, funneling all that capital back into USD. This has been their plan all along.

When that happens, the crypto market—including Bitcoin—will crash. Ethereum’s role has essentially been to funnel cash into Bitcoin, making it easier for institutions to accumulate wealth before transferring it all back into USD.

---

In short, Ethereum is being used as a tool in the ETF providers' larger scheme. It’s not about creating a thriving ecosystem but about maintaining dominance, controlling markets, and ultimately cashing out into the USD.

Ethereum - Expecting Retraces Before Prior Continuation LowerH1 - Bearish trend pattern in the form of lower highs, lower lows structure.

Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH Outlook after the Dip. What to expect NOW?Finally, the price broke the wedge, and the price experienced a significant drop. I think now is the time for ETH to rise again to 1900 . STRONG SUPPORT 1400 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

eth buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"