Bitcoin CME Gap at $77,930 Filled! Now, can $BTC push to $150K?Bitcoin CME Gap at $77,930 Filled! Now, can CRYPTOCAP:BTC push to $150K? 🚀

🔹 Support Level: $75,000 – If it holds, #BTC may target $100K+

🔻 If support breaks, my spot bids: $72K | $69K | $66K (Already filled at $77K ✅)

This drop was a liquidity flush to shake out high leverage traders. Stay prepared!

📢 Where’s your next buy order? Share below! 👇

#Bitcoin

D-ETH

AMERICA'S BITCOIN MINER: CLEANSPARKThe chart for Ethereum Futures is showing a promising inverse head and shoulders pattern. This indicates a potential turnaround for the struggling bitcoin mining industry. It appears that miners are behaving more like altcoin investors rather than taking a leveraged stance on Bitcoin. This shift suggests that their fortunes are more closely tied to the performance of Ethereum rather than Bitcoin itself.

Here’s what you should be aware of: CleanSpark (#CLSK), is set to be added to the S&P SmallCap 600 index on March 24.

This index features smaller publicly traded companies in the U.S. that have a market cap exceeding $1 billion and fulfil certain financial requirements.

Being included in this index may enhance CleanSpark’s visibility, boost its trading volume and liquidity, and draw in more institutional investors.

CleanSpark is the second crypto miner to be added to the index after peer Marathon Digital was added to the list last year.

Companies in the index typically benefit from increased trading volume and improved liquidity, making their shares more accessible to a broader pool of investors.

"CleanSpark's inclusion enhances visibility within the investment community," CEO Zach Bradford said in the announcement. “Our inclusion enhances visibility within the investment community and gives us an opportunity to demonstrate the value of being a pure play, vertically integrated Bitcoin mining company and making exposure to our model more broadly available."

CleanSpark operates bitcoin mining facilities across the U.S., focusing on energy efficiency and cost-effective power sources. The company has expanded its operations over the past year with the acquisition of peer GRIID Infrastructure.

Crypto Total Market Cap (CRYPTOCAP:TOTAL) As of March 12, 2025, the Total Crypto Market Cap sits at 2.63T USD.

Let’s dive into the monthly chart for a technical breakdown:

Since 2016, price has been moving within a long-term ascending channel. Right now, we’re testing the lower trendline support zone (2.4T - 2.5T).

This level has historically acted as a strong base – both the 2017 and 2021 bull runs kicked off from similar support zones.

Volume profile shows a 15-20% increase over the past 3 months, indicating growing buyer interest and improving market liquidity.

RSI is at 40 (neutral zone), not yet in oversold territory but signaling a potential base for a recovery.

Bullish Scenario: If the 2.5T support holds, we could see a move toward the channel’s midline (3T - 3.5T range), potentially retesting the 2021 highs above 3T.

Bearish Risk: A break below 2.5T could lead to a deeper pullback toward 2T, so keep this level on your radar.

💡 My Take: I believe we’re either at the bottom or just a few weeks away from the start of a new uptrend. April could mark the beginning of a bull run, signaling the end of the bloodbath – at least based on the technicals of the Total Market Cap.

What’s your view? Will the 2.5T support hold, or are we in for another correction?

OTHERS DOMINANCE ANALYSEThe Crypto Total Market Cap (excluding top 10) dominance is showing interesting action around the key 8.30% level. Historically, this level has acted as strong support/resistance (see 2017, 2020, 2022).

After breaking below 8.30% in late 2023, we’re now seeing a retest from the downside.

The price has bounced off this level with a decent volume spike, suggesting potential for an upward move.

If this support holds, we could see a push toward the next resistance around 11%-12% in the coming months.

Keep an eye on volume – sustained buying pressure will confirm the breakout.

💡 Trading Idea: Watch for a weekly close above 8.30% for confirmation of bullish momentum. On the flip side, a rejection here could lead to a retest of lower supports around 7%.

What do you think?

ETH/USD 1D Chart ReviewHey everyone, let's look at the 1D ETH to USD chart, in this situation we can see how the price has reverted back to the long-standing uptrend, and here we can see a significant decline below the uptrend line.

In the event that the trend reverses and growth begins again, it is worth setting targets for the near future that the price must face:

T1 = 2246 USD

T2 = 2533 USD

Т3 = 2785 USD

Т4 = 3010 USD

Т5 = 3365 USD

However, here we can see how the current decline has been maintained by the support zone from $ 1904 to $ 1686, however, if the zone is broken further, we can see a decline to the level of $ 1338, and then again we can have the price go down to the area of $ 921

The RSI indicator shows a continuing downward trend, and here we can see a decline to the lower part of the range, but there is still room for the price to go lower to the lower limit.

Ethereum: I expect it to reach $1,800-$2,243.Current situation with Ethereum: I expect it to reach $1,800-$2,243 based on Coinbase data.

Not going into too much detail, but in short: the stock market will drop, and Bitcoin and Ethereum will follow.

➖ Please avoid using leverage—the market is highly volatile right now.

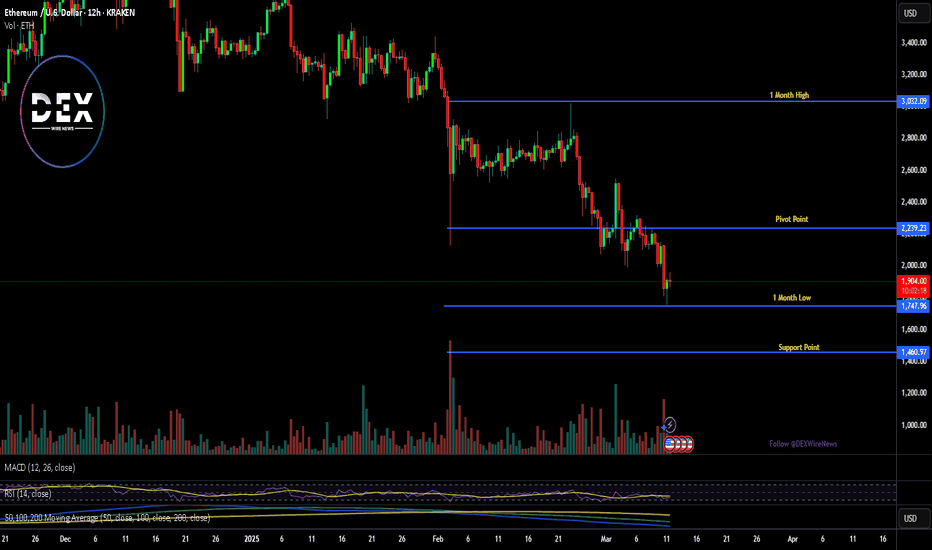

Breaking: Ethereum Dips 9% Today losing the $2k Price LevelEthereum today saw a noteworthy downtick with the asset dipping below the $2000 pivot zone. currently trading around the $1900 - $1700 price zones.

Ethereum is currently oversold as depicted by the Relative Strength Index (RSI) at 36. The 1-month low is acting as support point for Ethereum. Should selling pressure continue, CRYPTOCAP:ETH might tanked to $1000- 1400 price levels.

However, in the case of a price reversal, a break above the 65% Fibonacci retracement level could placed CRYPTOCAP:ETH on the cusp of a bullish spree.

Despite the bloodbath facing Ethereum albeit the general crypto landscape facing same, data from DefiLlama hints at a growing Defi landscape in the Ethereum blockchain with about $45.43 billion locked in Total Value Lock (TVL) and the volume growing in tandem with the TVL locked.

Presently up 2% trading at $1905 price point all eyes are set on the major pivots we mentioned above.

Ethereum at Critical Levels – Breakout or Breakdown for ETH?Ethereum (ETH) is looking heavily overextended right now 📊, with price action pressing into key support zones on the daily and weekly charts ⏳. The market is at a critical juncture, and a sharp pullback 📉 could be on the cards.

This could present a short-term counter-trend buying opportunity on the lower timeframes 💰, but if ETH pushes higher, it may offer a prime short setup 🎯.

⚠️ Not financial advice – trade smart and manage risk accordingly! 🚀

Ethereum's Potential Bottom: Could $5000 Be Next?Ethereum has experienced a significant 56% drop over the last 84 days. Has ETH found its bottom, or is more downside ahead? Let's break it down.

🔹 Fibonacci Retracement from October Low (2023) to December High (2024)

Starting with the Fibonacci retracement from the low of $1520.85 on 12th October 2023 to the high of $4109 on 16th December 2024, ETH recently hit the 0.886 Fib retracement at $1815.9 and saw a bounce. This area aligns with the Point of Control (POC) from previous price action, a potential signal that this could be a major support zone.

However, the real question is whether this is the final bottom, or if ETH will retest lower levels.

🔹 Further Fibonacci Retracement Analysis

Next, we take a larger Fibonacci retracement, from the low of $879.8 on 18th June 2022 to the high of $4109. The 0.786 Fib retracement at $1570.85 appears to be a critical support zone, as it also coincides with the POC in the volume profile of the entire market structure. This indicates that the $1570-$1600 region is a significant area of interest for buyers to step in.

🔹 Log Scale Fibonacci Confluence

To further strengthen this analysis, applying the same Fibonacci retracement on a log scale shows the 0.618 Fib retracement at $1585.17, very close to the POC and 0.786 Fib level, reinforcing this region as a major support zone.

🔹 High-Probability Long Setup

If ETH revisits the $1570-$1600 zone, this forms an ideal high-probability long setup with excellent risk/reward potential. A potential R:R ratio of more than 20:1 could materialise if this setup plays out and price targets $5000 as a take-profit level. The stop loss placement will determine the exact risk-to-reward, but the reward could be massive if this level holds.

💬 What are your thoughts? Will Ethereum find its bottom around these key levels? Excited to see how this develops! 🚀

Biggest support at ETHBTC, the end of the fall? Will Ethereum end its downtrend? Ethereum has been quite weak for a long time and is currently at an important support level. If it breaks down further, a sharp decline may continue, but if it holds the support, the upcoming period could be more positive.

2018 and 2021 crypto rally started from this support. Will be again?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

OTHERS.D at important support, crypto rally coming?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

TOTAL Marketcap at important support?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

BTC trend support?Will BTC end its downtrend? Bitcoin coming to an important support level. If it breaks down further, a sharp decline may continue to other support, but if it holds at support (77500), the upcoming period could be more positive.

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

ONDObeen looking at this for a while... a strong and must to be added on spot portfolio

structures across most of alts are invalidated... BTC and ETH are taking their key levels and we are in the final stage of capitulation

will reupdate all the charts (I'm holding) after the dust settles

Bull Run isn't over... wait for consolidation and we can have our alts rally in a few weeks

(ETH) ethereum "nft land"I was recently looking into NFTs on Opensea and while doing so I noticed there are far more NFTs from people based on the Ethereum blockchain compared to the other offerings on Opensea. Even though Solana (SOL) is on the forefront of popularity with Meme projects Opensea does not offer an exclusive Solana chain to provide NFT ideas. Hence, there is not an easy way to compare to amount of Solana projects to Ethereum projects being built, developed and/or offered. It would be interesting to see the comparison of NFTs on Solana versus Ethereum. Ethereum reduced their transactions with a transition to Proof-Of-Stake and since then the number of Ethereum NFTs must be growing. While the news is on a constant watch for new meme projects, tokens, the Opensea network for many other blockchains is not growing as nearly rapidly as Ethereum.

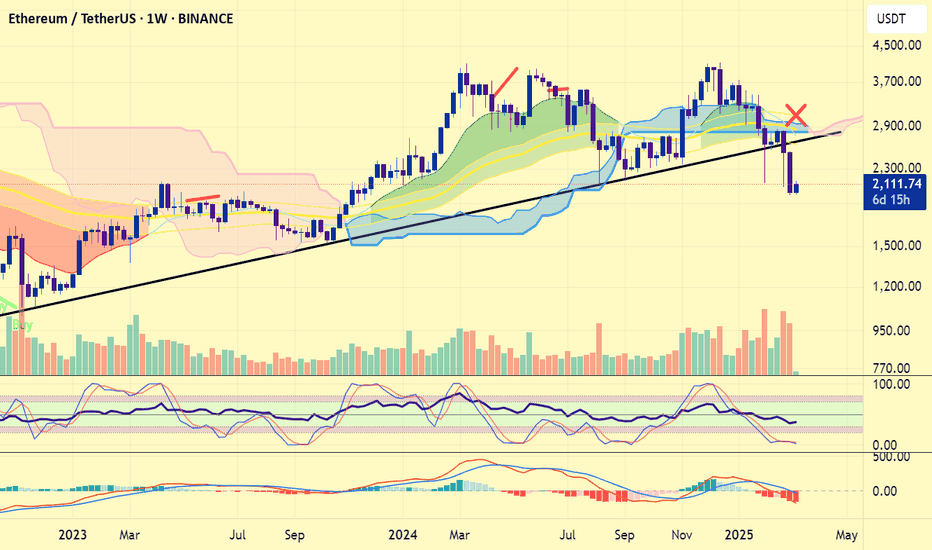

ETHEREUM price is alarming...#ethereum price has closed a weekly candle below 3 years of trendline for the first time!.. This is the one negative only. The other fact is, #eth price has already declined from the weekly ichimoku cloud and lost support. These must not be underestimated. I' ve warned you about CRYPTOCAP:ETH price structure weakness weeks ago.

What' ll be next? Allrigt. ETH has took support this zone and is now testing 2000 usd support zone. To avoid this sign of "major weakness", #eth price must immediately reclaim 3000 usd and above with monthly candle close. With this weekly close, it' s now getting harder to shelter the trend reversal. For now 2000 usd moderate and 1450 usd are now strong support zones for #ethusd .Otherwise, things will get more serious in mid term. Not financial advice. DYOR.

Bitcoin will make a Breakout Chart Analysis:

1. Timeframe and Price Context

Timeframe: 4-hour chart (each candlestick represents 4 hours of trading).

Price Levels:

The current price is $92,812.72, with a slight decrease of 0.23% as of the latest data point.

The price range on the chart spans from approximately $80,000 to $108,255 (the recent peak).

Trend Overview:

Late 2024: Bitcoin experienced a strong uptrend, peaking near $108,255.

Early 2025: The price has corrected downward, forming a descending triangle pattern, with the current level at $92,812.72.

2. Key Patterns and Annotations

Descending Triangle:

The chart features a descending triangle pattern, a common consolidation pattern that can signal either a continuation of a downtrend or a reversal.

Upper Resistance: A horizontal resistance line around $108,255 (the recent peak where the price failed to sustain higher levels).

Lower Support: A descending trendline (sloping downward) that the price has been testing, currently near $92,000-$93,000.

The price is nearing the apex of the triangle, suggesting an imminent breakout (upward or downward).

Accumulation Zone:

The chart labels an "Accumulation Zone" near the $80,000-$85,000 range, indicating a potential area where large players (e.g., whales) may have been buying during the correction.

The current price ($92,812.72) is above this zone, suggesting a bounce or stabilization after reaching this support.

Breakout Prediction:

An upward arrow with a Bitcoin symbol points toward $120,000 or higher, indicating a potential bullish breakout targeting a new all-time high.

3. Support and Resistance Levels

Support:

The $92,000-$93,000 level is acting as immediate support, aligning with the lower boundary of the descending triangle.

The $80,000-$85,000 accumulation zone is a stronger support level, likely a key area of buying interest during the correction.

If this support fails, the next level could be around $75,000 (a psychological and historical support).

Resistance:

The $108,255 level is a major resistance, marking the recent high.

The next significant resistance could be around $120,000 (as suggested by the arrow), a psychological level and a potential new all-time high.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely peaked during the rally to $108,255 and decreased during the correction as selling pressure eased.

A breakout would require a volume spike to confirm, especially if the price breaks above the descending trendline (around $100,000-$105,000).

Momentum indicators (e.g., RSI or MACD) could indicate if Bitcoin is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If Bitcoin breaks above the descending trendline (around $100,000-$105,000) with strong volume, it could confirm the breakout.

The target of $120,000 (a ~29% move from $92,812.72) is plausible, especially if whale accumulation in the $80,000-$85,000 zone drives momentum.

This aligns with the upward arrow and suggests a resumption of the prior uptrend.

Bearish Breakdown:

If the price fails to hold the $92,000-$93,000 support and breaks below, it could signal a bearish continuation.

The next support at $80,000-$85,000 would be tested, potentially leading to further downside toward $75,000.

Consolidation:

If the price remains within the triangle (between $92,000 and the descending trendline), it might continue to consolidate until a catalyst (e.g., market news, volume surge) triggers a move.

6. Market Context

Whale Activity: The accumulation zone at $80,000-$85,000 supports your earlier narrative of whales accumulating during corrections to set up a breakout. This could indicate strategic buying by large players.

Market Sentiment: As the leading cryptocurrency, Bitcoin’s price heavily influences altcoins like Ethereum and UNISWAP (from your previous charts). A bullish breakout in BTC could trigger similar moves in the broader market.

Timing: The chart’s position near the triangle’s apex suggests a breakout could occur within days to a week on a 4-hour timeframe, depending on market conditions.