Dash RocketDash has been in a bearish trend for some time now, but it has stood the test of time being one of the OG coins of the market with this double bottom within this descending channel on the daily and a retest of demand I believe this coin will see $50 soon.

It’s master node runners and minors have kept the chain going, and we should be breaking its bearishness very soon.

Dash

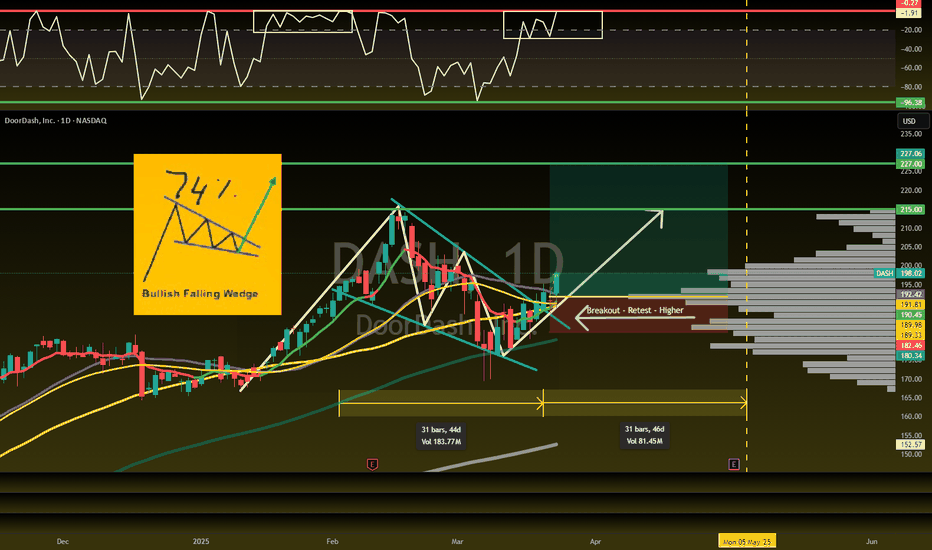

DASH Weekly Options Trade — June 15, 2025📈 DASH Weekly Options Trade — June 15, 2025

💡 Ticker: DASH

🎯 Strategy: Bullish Swing — Call Option

📅 Expiry: June 20, 2025

⏱ Entry Timing: Market Open (only if breakout confirmed)

📈 Confidence: 70%

🔍 Analysis Summary

All four models (Grok, Llama, Gemini, DeepSeek) point to short-term bullish momentum with DASH currently trading:

🔼 Above key EMAs on the 5-min and daily charts

🧭 MACD & RSI in bullish alignment

💬 Supported by strong volume and market sentiment

While there is caution due to overbought RSI and a wide gap between price and max pain ($187.50), the models favor a breakout scenario if DASH clears resistance at $219–$220.

✅ Trade Recommendation

🛒 Trade Type: Long CALL (Naked)

🎯 Strike: $230.00

💵 Entry Price: ~$0.67

📅 Expiration: June 20, 2025 (weekly)

📈 Profit Target: ~$1.34 (100% gain)

🛑 Stop Loss: ~$0.33 (50% loss)

🔎 Entry Note: Only enter if price confirms breakout above $219–$220 zone at open

🧠 Key Risks to Monitor

❗ Overbought signals could lead to a pullback before continuation

⚖️ Max pain at $187.50 may pressure price toward expiration

📉 Avoid entry if DASH fails to hold above $219 at open

🔄 Wider bid/ask spreads due to volatility—manage slippage carefully

🚨 Watchlist Trade: This setup is conditional. Enter only on breakout confirmation above $220.

Let’s see if DASH delivers another leg up—or stalls at resistance.

DASHBreak the floors one by one

In the short term, if the blue one is not lost, it will go to the red box, and if it fails, the first step is the orange lines

But if it fails, it should come to the green ones

If you read it, you can make sharp moves, they can grow between 60 and 240 percent. But entry is important

DOORDASH ($DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSEDOORDASH ( NASDAQ:DASH ) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33/share—the second profitable quarter since going public! 💰

• Net revenue margin: 13.5%, inching up from last quarter.

• Plus, a SEED_TVCODER77_ETHBTCDATA:5B share repurchase plan signals management’s confidence in future earnings. 💎

(3/7) – SECTOR COMPARISON

• Market cap ~$80.2B, with the buyback at ~5% of that.

• Analysts (e.g., Oppenheimer) raising price targets → suggests undervaluation vs. Uber Eats & Grubhub. 🤔

• Strong performance in new verticals & international markets = diversification & growth advantage. 🌐

(4/7) – RISK FACTORS

• Market saturation: Competitors might lower prices or offer bigger discounts. 🛍️

• Regulatory: Gig worker laws could drive up costs. ⚖️

• Economic sensitivity: Consumer spending on delivery can be fickle during downturns. 💸

• Restaurant health: If restaurants stumble, so does DoorDash. 🍽️

(5/7) – SWOT HIGHLIGHTS

Strengths:

• Leading U.S. food delivery market share 🍔

• Expanding into grocery & retail → less restaurant dependence 🛒

• Solid international growth 🌍

Weaknesses:

• High operational costs to maintain delivery network 🚚

• Customer loyalty can be promo-driven vs. brand-driven 💳

Opportunities:

• Enter underpenetrated regions → more global share 🌐

• Expand non-restaurant deliveries → bigger wallet share 🏪

• AI-driven efficiency → streamlined ops 🤖

Threats:

• Heavy competition (direct & from self-delivery restaurants) ⚔️

• Consumer shift back to in-person dining if economy improves 🍴

(6/7) – BULL OR BEAR?

With 25% growth and a second profitable quarter, is DoorDash set to dominate? Or are looming regulatory and market saturation risks a speed bump? 🏁

(7/7) Where do you stand on DoorDash?

1️⃣ Bullish—They’ll keep delivering the goods! 🚀

2️⃣ Neutral—Impressed, but risks loom 🤔

3️⃣ Bearish—Competition & costs will weigh them down 🐻

Vote below! 🗳️👇

The DASH train has ALREADY LEFT the station!I'm going to link to my previous DASH idea where I was patiently awaiting DASH to leave the bullish falling wedge, re-test it from the top, and then fly off. But it turns out I was WRONG. DASH has already left the station for its next parabolic move.

Here's a slightly different way of charting the falling wedge. It's valid too! The difference is that the B wave has a price action overthrow. Why is it an overthrow? B typically retraces to 50% of wave A but here it's retraced to more than 65%. That's where I concluded there's an overthrow. It means the top of the wedge needs to come slightly down towards the real price action. What does this all mean?!? It means that right now we're not dealing with a rejection at the top of A re-test from the top down. In other words, we're well past the construct of the falling wedge and DASH is about to go parabolic starting this month!

DASHUSDT: Is a Big Move Brewing? Yello, Paradisers! Are we on the brink of a significant breakout or another leg down for DASH? Let’s dive into the chart and uncover what’s next for this coin. Stay sharp this analysis could save you from making the wrong move at the wrong time.

💎#DASHUSDT is currently approaching a key support level around $30.87, a zone that has consistently acted as a springboard for bullish momentum in the past. This level has been tested previously, showing signs of strength. However, if the support fails to hold, it could spark a cascade of selling pressure, potentially dragging the price down to the next lower demand at $25–$26.

💎Currently, the price is under the influence of a descending trendline, with repeated rejections clearly visible. This pattern has kept the bearish structure intact, making a breakout above this trendline a crucial signal for any shift in momentum.

💎A failure to hold the demand zone at $25–$26 could trigger a sharp move downward, leading to bullish invalidation with bearish targets around $16–$20. This would bring #DASH to an untested historical support level and possibly lead to a liquidation event, clearing out weak hands from the market.

💎The RSI, currently in a neutral range, will be critical to watch. A move above 50 on the RSI could support a bullish breakout, while a drop below 40 would reinforce bearish sentiment.

The market is at a tipping point, and taking action without confirmation at this stage could lead to unnecessary losses. Stay patient, disciplined, and wait for clear signals before taking action.

MyCryptoParadise

iFeel the success🌴

XRP ShortThe last two shorts I've taken on this coin have given me profit to walk away with before stopping me from taking the bigger swing I am looking for. I am happy to keep shorting until my target is met. This coin may have a future, but not right now IMO.

In short, I haven't lost yet.

This is just chop. Dubai isn't sending this to the moon and more adoption pumps are coming on the way down

I will stick to my narrative until the market says otherwise

Stay safe in this bear market and enjoy it. We won't get one like this for a very long time, if ever.

PS. Leave your immaturity to yourself, you won't get a response from me just because you don't agree or you're upset that I'm speaking the truth and won't be invested like you want to so I can lose along with 90% of the market.

DASH/USDT - (25-12-2024) G-Money's short version analysis basedDASH/USDT G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

DASH/USDT still kinda on the "move" waiting for a signal to TP. Trade was open with 10X leverage & should bring *2 account size...Who did enter this trade congratulations! Who missed it... See you all next time! ;)

What do you think?

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

Merry Christmas to ALL !

DASH is heading for $72A logical target price, if your Elliott wave and Fibonacci projections play out, would be in the vicinity of the key Fibonacci retracement levels—particularly around the 61.8% ($65 area) or as high as the 78.6% ($72 area) retracement of the prior decline. If the bullish Elliott wave structure is confirmed and momentum is strong, an eventual retest of the swing high near $80 could be possible. However, these should be treated as potential targets, not guarantees.

More Detailed Reasoning:

Identifying Wave Targets with Fibonacci:

Elliott wave practitioners often use Fibonacci extensions and retracements to project potential price targets for each wave. Assuming your scenario of a new 5-wave impulse forming off the recent low is correct, the two key levels to watch would be:

61.8% Retracement (~$65): This is a common target for a robust Wave (3) or as an initial resistance level if price is reclaiming ground lost in the correction.

78.6% Retracement (~$72): This level often comes into play if the trend is especially strong. If Wave (3) surpasses the 61.8% level decisively and doesn’t encounter heavy selling, the 78.6% is the next logical checkpoint.

Wave-by-Wave Considerations:

Wave (3) Target: Typically, Wave (3) is the most dynamic and might push price to or beyond the 61.8% retracement. If momentum and volume confirm the bullish move, $65 could be an initial target. Surpassing that, $72 becomes the next serious test.

Wave (5) Potential: If the structure unfolds in textbook fashion and there’s enough bullish sentiment, Wave (5) could aim to retest the previous swing high near $80, or even exceed it. This final push often comes with weaker RSI momentum and possible divergence, signaling caution.

Market Confirmation:

It’s important to note that these are projected targets based on an Elliott wave scenario and assume the market follows a recognizable pattern. Before making trading decisions, look for confirming evidence:

Momentum (RSI): RSI should trend upwards as the price moves into Wave (3). Weak RSI as price approaches $65 or $72 would be a warning sign.

Volume Patterns: Increasing volume on moves higher supports the bullish scenario. If volume declines as price approaches key fib levels, you might encounter resistance or a failing rally.

Risk Management:

Always remember that no Elliott wave or Fibonacci level guarantees a certain price outcome. Unexpected market developments, news events, or changes in sentiment can derail even the clearest pattern. Plan your trades with stop-loss orders, monitor market conditions closely, and be ready to adjust your targets as real-time data evolves.

Conclusion:

Based on the given Elliott wave and Fibonacci framework, a reasonable bullish target would first be the 61.8% retracement ($65), followed by the 78.6% ($72) if momentum remains strong. A more optimistic scenario might see price retest the previous highs near $80. Use these levels as guides rather than absolutes, and monitor volume and RSI for confirmation as the trend unfolds.

Bought from the Green BoxThe green box on the chart represents a significant buyer zone, and I executed a long position after observing price action within this area. This analysis will break down why the green box was identified as a demand zone and my expectations for DASHUSDT's movement.

1. The Significance of the Green Box

The green box marks a strong demand area where buyers have previously stepped in, making it a high-probability zone for a bounce.

Key Support Zone: This area aligns with historical support levels and technical confluences, reinforcing its strength.

Market Structure: Price has maintained higher lows above this zone, signaling a bullish continuation pattern.

Volume Confirmation: Increased buying volume near the green box suggests active demand.

2. Why I Bought Here

The decision to buy was based on the following confirmations:

Price Action Signals: A bullish reversal pattern formed within the green box, confirming buyer interest.

Fibonacci Retracement: This zone aligns with the 0.618–0.786 retracement of the previous upward swing, a classic area for reversals.

Oversold Conditions: Momentum indicators like RSI showed oversold conditions, adding confidence to the buy decision.

3. Current Expectations

Based on the price action and market structure, I anticipate the following scenarios:

Primary Target: The first target is set at the nearest resistance level, which aligns with previous highs around $XX.XX.

Secondary Target: If momentum continues, the second target is the $XX.XX level, corresponding to a Fibonacci extension level.

Stop-Loss Placement: My stop-loss is set just below the green box to minimize risk in case of invalidation.

4. Strategy and Risk Management

Risk management is a crucial part of any trade, and here’s how I’m handling it:

Risk-to-Reward Ratio: The trade offers a 1:3 risk-to-reward ratio, balancing potential gains against downside risk.

Monitoring Key Levels: I’ll be closely watching for volume spikes and resistance breakouts to validate the bullish momentum.

Adjusting Stops: As the price moves toward the target, I plan to trail the stop-loss to secure profits.

5. Final Notes

The green box represents a well-defined buyer zone backed by multiple technical factors. I’ll remain patient and let the trade develop while managing risk effectively.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

Dash filling out right shoulder after burj khaifa moveBy correcting here after dash’s big golden cross vertical slingshot in price action it is in the perfect zone to form a right shoulder to a newly materializing inverse head and shoulders pattern. The common theme for many inverse head and shoulders patterns this alt season has been very tiny right shoulders so there’s a decent chance it breaks above the neckline of the inverse head and shoulders before where the hypothetical right shoulder I have drawn on the chart reached it’s end. Always a chance it bucks the trend and ends up being even wider than what I drew too as the width of the shoulder would traditionally be. We will know soon enough As always dash and zcash see to be having some similar chart patterns. Nice to see privacy coins still matter enough to have a chance to make big gains this bull run and perhaps even surpass the previous all time highs if it keeps this up long enough *not financial advice*

Dash breaking up from double bottom on same day as goldencrossI’m starting to think my hypothesis has been proven at this point as yet another alt coin has its massive breakout pump on the exact same day pill candle it has its golden cross on. Dash now joins the countless other alt coins who have also broken up from the chart patterns with a big pum the day fo their golden cross. *not financial advice*

DASH - an old-timer set to growDash has been around the block for pretty long time. I remember when it had multiple ambassadors and they promoted Dash as a new digital cash.

Of course when the main altcoins were litecoin, dash, ethereum and a couple of others, they've gained a lot of attention and growth (look at 2017). But they've lost marketing points to DeFi, Smart chains, and even memecoins. So it is highly doubted that Dash will reach previous levels but a pump to ~$200 zone is almost imminient during this altcoin season.

DASHDash (digital cash) was launched in January 2014 as a fork of Litecoin is an open-source blockchain and cryptocurrency focused on offering a fast, cheap global payments network that is decentralized in nature. According to the project's white paper, Dash seeks to improve upon Bitcoin (BTC) by providing stronger privacy and faster transactions.

Anyway, DASH chart is straightforward: an upward phase followed by a correction phase which unfolded in a big descending triangle pattern. Recently, DASH started an upward wave when broke the minor downtrend line, and is going up toward the big descending triangle's upper line. If DASH breaks the triangle, reaching ATH is possible, or even higher. Let's see what happens.

DASHUSDT Breaks Channel: Bullish Surge Ahead!BINANCE:DASHUSDT Technical analysis update

DASHUSDT has formed a descending channel pattern on the daily chart, breaking above the channel's resistance line. The price is currently trading above the 100 and 200 EMAs. A strong bullish move can be expected once the breakout is confirmed on the daily chart.